1.1: Introducing Finance

1.1.1: Defining Finance

Finance is the study of fund management and asset allocation over time.

Learning Objective

Explain the importance of time to the discipline of finance

Key Points

- The two main drivers of finance are the time value of money and risk.

- Since the value of assets changes over time, finance seeks to ensure the change is beneficial for the organization or individual.

- Financial professionals generally operate in an environment of uncertainty where they must make forecasts about future events.

Key Terms

- debtor

-

A person or firm that owes money, one in debt, or one who owes a debt.

- asset

-

Something or someone of any value; any portion of one’s property or effects so considered.

- investment

-

A placement of capital in expectation of deriving income or profit from its use.

Overview

Finance is the study of fund management and asset allocation over time. Funds consist of money and other assets. There are many different types of finance, but all are fundamentally concerned with studying how best to allocate assets in different conditions over time.

Importance of Time

The underlying driver behind all of finance is time. There are two reasons why time is so important to finance:

- Time value of money: For a number of reasons, money today is worth more than the same amount of money in the future. For example, you would rather have $100 today than $100 in 10 years – the money is worth more to you now than it would be in the distant future. We will explore this concept in greater depth later on.

- Risk: Making an investment does not guarantee a return. When a bank makes a loan, they’re not sure the debtor will pay it back. There is a risk that the person will just take the money and run, the debtor will file for bankruptcy, or, for dozens of other reasons, the bank will not get the money they lent back.

The field of finance, however, embraces time. Finance says, “Since I know assets change value over time, how do I use that to cause my assets to change value in the direction I want? How do I manage assets so that they’re worth more in the future than they are today? “

Challenges in Finance

Figuring out what to do with assets is sometimes easy: all of the variables are known, and there is clearly an option that is better than all the others. However, most of the time, this is not the case. Finance generally operates with a lot of uncertainty. As a result, companies hire entire departments of people to help them figure out which option is best .

Walmart CFO

Charles Holley, the Chief Financial Officer (CFO) of Wal-Mart, is in charge of making sure all of Wal-Mart’s assets are allocated as optimally as possible.

1.1.2: Comparing the Fields of Finance, Economics, and Accounting

Finance, economics, and accounting are business subjects with many similarities and differences; each is a distinct field of study.

Learning Objective

Recognize how finance, economics and accounting overlap.

Key Points

- Finance is the study of how to optimally allocate assets. Finance is fundamentally a forward looking field, concerned with what an asset will be worth in the future.

- Economics is the social science that analyzes the production, distribution, and consumption of goods and services.

- Accounting is the process of communicating financial information about a business. Accounting is fundamentally a backward-looking field.

Key Term

- return

-

Gain or loss from an investment.

Finance, economics, and accounting are business subjects with many similarities and differences. While they influence each other, each is a distinct field of study.

Finance

Finance is the study of how to optimally allocate assets—how individuals and organizations should invest assets in order to get the highest possible return given changing conditions over time. Finance is fundamentally a forward looking field, concerned with what an asset will be worth in the future.

Economics

Economics is a social science that analyzes the production, distribution, and consumption of goods and services. It focuses on how economic agents (people, businesses, and government) interact and make decisions. Economics is fundamentally the study of cause and effect. It tries to figure out how one variable affects economic agents or the economy as a whole.

Accounting

Accounting focuses on communicating a businesses’ financial information. Accounting is fundamentally a backward-looking field, concerned with what has already happened financially and what position that leaves the company in today.

If accounting is called the language of business, then the financial statements that accountants prepare are the words . Statements are created under a standardized set of accounting laws, which allows one to easily compare and contrast companies. This indicates how financially healthy a company is.

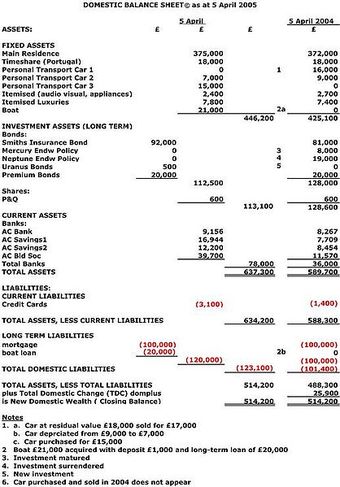

Balance Sheet

The balance sheet is one of the three main financial statements. The other two are the cash flow statement and the income statement.

Overlap

Finance, economics, and accounting overlap in a lot of areas. For example, an investor will use accounting to see whether a company has shown past financial success and to predict what the company will look like in the future. Part of that prediction incorporates economics. The investor wants to know what the overall economy will look like in the future and wants to know how the company will interact with its competitors. The investor can use finance to figure out what his or her investment will be worth in the future.

There are few strong delineators between finance, economics and accounting. All three fields intermingle and influence one another. It is almost impossible to have a strong grasp of one without at least a basic understanding of the other two.

1.1.3: Role of Finance in an Organization

The primary role of corporate finance is to determine how best to maximize shareholder value.

Learning Objective

Define the role of finance in an organization

Key Points

- Maximizing shareholder value can be done over the long-term or the short-term, so the job of the finance department is to determine how best to do both. Sometimes, the goals may appear to contradict each other.

- The finance department is devoted to the task of figuring out how to allocate assets for the overarching goal of maximizing shareholder value. They must ensure that the right assets are in the right place at the right time.

- The finance department must also manage the company’s liabilities so that all projects are financed in an optimal way without taking on too much risk.

Key Terms

- liability

-

An obligation, debt or responsibility owed to someone.

- asset

-

Something or someone of any value; any portion of one’s property or effects so considered.

- shareholder

-

One who owns shares of stock.

Corporate finance is the area of finance dealing with monetary decisions that business enterprises make. When finance is talked about in the context of business decisions, it is called corporate finance (technically, corporate finance deals only with corporations, while managerial finance deals with all types of companies, but we will use the terms interchangeably). There are other branches of finance such as personal finance (individuals taking care of their money) and public finance (the finances of the government).

The primary goal of corporate finance is to maximize shareholder value. Maximizing shareholder value can be done over the long-term or the short-term, so the job of the finance department is to determine how best to do both. Sometimes, the goals may appear to be in competition with one another. For example, a company can choose to pay dividends (a small payment to each person who owns a stock of a company), which increases short-term shareholder wealth. However, paying dividends means that the money is not being invested in long-term investments, which may cause the stock price to increase more in the future, and thereby increasing long-term shareholder wealth.

The technique behind maximizing shareholder value is the management of assets. This means that the finance department figures out how to best invest its money.

For example, a company could have two proposals from the R&D department to develop different products, but only enough money to fund one . The finance department will project out the future revenues and costs of each product and figure out which one, if either, is worth the money.

iPod Touch

Apple used financial analysis to decide to fund the development of the iPod. The money allocated development could not be used for another project, but the finance department determined the iPod was the best option.

Also, the finance department will determine when a company should take on a liability. For example, suppose both projects are absolute home-runs, but the company still only has enough money to fund one. The finance department will figure out if the company should borrow money so that it can fund both.

The role of finance in an organization is to make sure that money is at the right place at the right time. A company wants to have enough money to pay its bills, but also wants to invest so that it can grow in the future. The finance department is devoted to the task of figuring out how to allocate assets to do so, for the overarching goal of maximizing shareholder value.

1.1.4: Types of Financial Decisions: Investment and Financing

Investment and financing decisions boil down to how to spend money and how to borrow money.

Learning Objective

Identify the criteria a corporation must use when making a financial decision

Key Points

- The primary goal of both investment and financing decisions is to maximize shareholder value.

- Investment decisions revolve around how to best allocate capital to maximize their value.

- Financing decisions revolve around how to pay for investments and expenses. Companies can use existing capital, borrow, or sell equity.

Key Terms

- equity

-

Ownership, especially in terms of net monetary value, of a business.

- expected return

-

Considering the magnitude and likelihood of exogenous events, the yield that an investor predicts s/he will earn on average.

- financing

-

A transaction that provides funds for a business.

There are two fundamental types of financial decisions that the finance team needs to make in a business: investment and financing. The two decisions boil down to how to spend money and how to borrow money. Recall that the overall goal of financial decisions is to maximize shareholder value, so every decision must be put in that context.

Investment

An investment decision revolves around spending capital on assets that will yield the highest return for the company over a desired time period. In other words, the decision is about what to buy so that the company will gain the most value.

To do so, the company needs to find a balance between its short-term and long-term goals. In the very short-term, a company needs money to pay its bills, but keeping all of its cash means that it isn’t investing in things that will help it grow in the future. On the other end of the spectrum is a purely long-term view. A company that invests all of its money will maximize its long-term growth prospects, but if it doesn’t hold enough cash, it can’t pay its bills and will go out of business soon. Companies thus need to find the right mix between long-term and short-term investment.

The investment decision also concerns what specific investments to make. Since there is no guarantee of a return for most investments, the finance department must determine an expected return. This return is not guaranteed, but is the average return on an investment if it were to be made many times.

The investments must meet three main criteria:

- It must maximize the value of the firm, after considering the amount of risk the company is comfortable with (risk aversion).

- It must be financed appropriately (we will talk more about this shortly).

- If there is no investment opportunity that fills (1) and (2), the cash must be returned to shareholder in order to maximize shareholder value.

Financing

All functions of a company need to be paid for one way or another. It is up to the finance department to figure out how to pay for them through the process of financing.

There are two ways to finance an investment: using a company’s own money or by raising money from external funders. Each has its advantages and disadvantages.

There are two ways to raise money from external funders: by taking on debt or selling equity. Taking on debt is the same as taking on a loan. The loan has to be paid back with interest, which is the cost of borrowing. Selling equity is essentially selling part of your company . When a company goes public, for example, they decide to sell their company to the public instead of to private investors. Going public entails selling stocks which represent owning a small part of the company. The company is selling itself to the public in return for money.

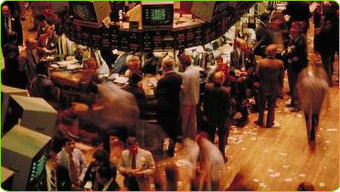

NYSE

If a company chooses to finance an investment by selling equity, they may issue stocks on an exchange like the New York Stock Exchange

Every investment can be financed through company money or from external funders. It is the financing decision process that determines the optimal way to finance the investment.

1.1.5: Functions of Corporate Finance

Corporate finance utilizes tools and analysis to make sound financial business decisions.

Learning Objective

Describe the role of finance in corporation

Key Points

- The finance group is in charge of budgeting. It will look for the optimal allocation of assets across all business functions.

- Corporate finance decides how best to finance projects. The department can either use existing internal funds, borrow money, or sell equity.

- The finance group must balance both short- and long-term company goals, though the overarching goal is to maximize shareholder value.

Key Terms

- investment

-

A placement of capital in expectation of deriving income or profit from its use.

- finance

-

To provide or obtain funding for a transaction or undertaking; to back; to support.

Corporate finance deals with monetary decisions that business enterprises make and the tools and analysis utilized to make the decisions. Corporate finance is concerned primarily with making investment and financing decisions; that is, making sure that money is being used in the best way.

The corporate finance department of a company is in charge of budgeting. Management must allocate limited resources between competing opportunities; since a dollar cannot be used for more than one project at once, it is a challenge to determine how much money should be allocated to each part of the business.

In determining how to allocate money, the finance group must also figure out where the money will be best utilized. This requires valuing projects and business functions. A large element of finance is deciding how exactly to value a project. There are a number of variables – inflation, expected revenues, expected costs, length of time required – that are all incorporated into the valuation process. Finding the true value of a project is often wrought with uncertainty, but without an accurate valuation, a company may allocate its resources sub-optimally.

The corporate finance department must also determine how to finance projects. A company can finance a project by using either internal funds (money the company already has), borrowing, or selling equity. Each option carries a certain cost that can be quantified. It is the job of the finance department to make sure that the overall cost isn’t too high and that the company has an optimal mix of all three strategies.

One public job function of corporate finance is determining whether or not the company pays a dividend, and if so, how much. The company has a responsibility to maximize shareholder value, but that can be achieved in multiple ways. Paying a dividend puts cash directly in the hands of shareholders, increasing shareholder value. However, paying a dividend means that money is not being reinvested in the company. If a company doesn’t pay a dividend and instead chooses to reinvest the money, the value of the company will presumably increase, in turn increasing shareholder value. The finance department determines which option maximizes shareholder value.

Lastly, the finance department must also ensure that there is a good balance between long- and short-term goals. The company must have enough assets to cover short-term costs, referred to as working capital management, and enough invested to ensure the company has long-term growth .

Factory

Purchasing new machinery requires a valuation of all equipment, an accurate idea of the total cost over time, and a way to finance the purchase while leaving enough cash for other upcoming costs.

1.1.6: Overview of the Role of Financial Manager

The financial manager is responsible for budgeting, projecting cash flows, and determining how to invest and finance projects.

Learning Objective

Describe the role and skills of a financial manager

Key Points

- The finance manager is responsible for knowing how much the product is expected to cost and how much revenue it is expected to earn so that s/he can invest the appropriate amount in the product.

- The finance manager uses a number of tools, such as setting the cost of capital (the cost of money over time, which will be explored in further depth later on) to determine the cost of financing.

- The financial manager must not just be an expert at financial projections; s/he also must have a grasp of the accounting systems in place and the strategy of the business over the coming years.

- The head of the financial department is the chief financial officer (CFO) who is responsible for all financial decisions and reporting done in the company.

Key Term

- capital

-

Money and wealth; the means to acquire goods and services, especially in a non-barter system.

The Role of the Financial Manager

The role of a financial manager is a complex one, requiring both an understanding of how the business functions as a whole and specialized financial knowledge. The head of the financial operations is called the chief financial officer (CFO).

The structure of the company varies, but a financial manager is responsible for the same general things across the board. The manager is responsible for managing the budget. This involves allocating money to different projects and segments so that the business can continue operating, but the best projects get the necessary funding.

The manager is responsible for figuring out the financial projections for the business. The development of a new product, for example, requires an investment of capital over time. The finance manager is responsible for knowing how much the product is expected to cost and how much revenue it is expected to earn so that s/he can invest the appropriate amount in the product. This is a lot tougher than it sounds because there is no accurate financial data for the future. The finance manager will use data analyses and educated guesses to approximate the value, but it’s extremely rare that s/he can be 100% sure of the future cash flows.

Figuring out the value of an operation is one thing, but it is another thing to figure out if it’s worth financing. There is a cost to investing money, either the opportunity cost of not investing it elsewhere, the cost of borrowing money, or the cost of selling equity. The finance manager uses a number of tools, such as setting the cost of capital (the cost of money over time, which will be explored in further depth later on) to determine the cost of financing.

At the same time that this is going on, the financial manager must also ensure that the business has enough cash to pay upcoming financial obligations without hoarding assets that could otherwise be invested. This is a delicate dance between short-term and long-term responsibilities.

The CFO is the head of the financial department and is responsible for all of the same things as his/her subordinates, but is also the person who has to sign off that all of the company’s financial statements are accurate. S/he is also responsible for financial planning and record-keeping, as well as financial reporting to higher management.

The financial manager is not just an expert at financial projections, s/he must also have a grasp of the accounting systems in place and the strategy of the business over the coming years .

Collaboration

The finance manager must collaborate across business functions in order to determine how to best allocate and manage assets.

1.1.7: Reasons to Study Finance

Finance is relevant to all business functions, the macroeconomy, and personal finances.

Learning Objective

List the reasons why a person would want to study finance

Key Points

- Finance plays an involved role in the health of the overall economy, which impacts everyone, regardless of whether or not they have studied finance.

- Like companies, individuals are faced with investment and financing decisions. Having a firm grasp of finance will help individuals make those decisions.

- All businesses functions deal with finance because they need to be able to make the financial argument for the funding of their projects and to manage their budgets.

Key Term

- leverage

-

The use of borrowed funds with a contractually determined return to increase the ability of a business to invest and earn an expected higher return (usually at high risk).

The study of finance often feels a lot narrower than it really is. There is a lot of talk of issuing bonds or pricing projects which belies how relevant finance is to everyday life, regardless of whether or not you have any desire of working in finance.

Understanding the Economic Environment

Finance plays an involved role in the health of the overall economy, which impacts everyone, regardless of whether or not they have studied finance. The field of finance explains why the 2008 recession occurred; it is the reason why people care about how the stock market is doing each day ; and it articulates why businesses and governments make some of the decisions they do.

Random Walk

Stock market cannot be predicted.

Finance plays a role in many of the stories in the news every day, which means that those who understand finance have a better grasp on how the events of the world affect them.

Personal Finances

Each person will also have to manage his or her own personal finances. Like corporations, individuals are faced with investment and financing decisions. In order to invest, individuals must be able to do the same projections and valuations as companies in order to determine the best investment for their needs. Individuals cannot sell equity like corporations, but they can choose to either dip into their savings or take out loans. Many take on debt in the form of student loans, mortgages, or through their credit cards; being able to properly compare options to leverage is just as important for individuals as it is for companies.

Application to Business

Of course, finance is an important field of study for those who have a desire of working in finance or accounting. Finance is heavily used in jobs ranging from investment banker to CFO to venture capitalist.

However, finance is not segmented from the other functions in business. Every job from marketing to engineering has to be able to manage a budget and make a business case that it should get funding for a project.

This is especially true higher up in the organizational hierarchy: managers, directors, and vice presidents need to be able to articulate why their departments should get financial support from the company.

Finance is a field of both hard analytical skill and personal judgement. There are set processes and theories for determining which financial option is best, but in the real world, it is rare to have all of the information needed to be absolutely certain about what to do. Finance develops strong analytical skills, but also the degree of finesse required to operate in an environment of uncertainty.

Silver Bid Chart

Finance helps explain what trends in silver bids mean, but more importantly, why people care about them (even those not trading silver).

1.2: Goals of Financial Management

1.2.1: Valuation

Valuation, a goal of financial management, often relies on fundamental analysis of financial statements.

Learning Objective

Describe the valuation process

Key Points

- In finance, valuation is the process of estimating what something is worth. Valuation is used to for a variety of purposes: the purchase or sale of a business, appraisal to resolve disputes, managerial decisions of how to allocate business resources, and many other business and legal purposes.

- Valuation often relies on fundamental financial statement analysis using tools such as discounted cash flow or net present value. As such, an accurate valuation, especially of privately owned companies, largely depends on the reliability of the firm’s historic financial information.

- Not only do managers want to keep reliable financial statements so that they can know the value of their own businesses, but they also want to manage finances well to enhance the value of their businesses to potential buyers, creditors, or investors.

Key Terms

- financial statement

-

A formal record of all relevant financial information of a business, person, or other entity, presented in a structured and standardized manner to allow easy understanding.

- fundamental analysis

-

An analysis of a business with the goal of financial projections in terms of income statement, financial statements and health, management and competitive advantages, and competitors and markets.

- valuation

-

The process of estimating the market value of a financial asset or liability.

Introduction

Financial management focuses on the practical significance of financial numbers. It asks: what do the figures mean? Sound financial management creates value and organizational agility through the allocation of scarce resources among competing business opportunities. It is an aid to the implementation and monitoring of business strategies and helps achieve business objectives. There are several goals of financial management, one of which is valuation .

Valuation

Valuation is, for some, one of the goals of financial management.

Valuation

In finance, valuation is the process of estimating what something is worth. Valuation often relies on fundamental analysis (of financial statements) of the project, business, or firm, using tools such as discounted cash flow or net present value. As such, an accurate valuation, especially of privately owned companies, largely depends on the reliability of the firm’s historic financial information. Items that are usually valued are a financial asset or liability. Valuations can be done on assets (for example, investments in marketable securities such as stocks, options, business enterprises, or intangible assets such as patents and trademarks) or on liabilities (e.g., bonds issued by a company).

Valuation is used to determine the price financial market participants are willing to pay or receive to buy or sell a business. In addition to estimating the selling price of a business, the same valuation tools are often used by business appraisers to resolve disputes related to estate and gift taxation, divorce litigation, allocate business purchase price among business assets, establishing a formula for estimating the value of partners’ ownership interest for buy-sell agreements, and many other business and legal purposes. Therefore, not only do managers want to keep reliable financial statements so that they can know the value of their own businesses, but they also want to manage finances well to enhance the value of their businesses to potential buyers, creditors, or investors.

1.2.2: Maximizing Shareholder and Market Value

A goal of financial management can be to maximize shareholder wealth by paying dividends and/or causing the market value to increase.

Learning Objective

Describe the relationship between shareholder value and market value

Key Points

- One interpretation of proper financial management is that the agents are oriented toward the benefit of the principals, shareholders, and in increasing their wealth by paying dividends and/or causing the stock price or market value to increase.

- The idea of maximizing market value is related to the idea of maximizing shareholder value, as market value is the price at which an asset would trade in a competitive auction setting; for example, returning value to the shareholders if they decide to sell shares or if the firm decides to sell.

- There are many different models of corporate governance around the world. These differ according to the variety of capitalism in which they are embedded. The Anglo-American (US and UK) “model” tends to emphasize the interests of shareholders.

- The sole concentration on shareholder value has been criticized, for concern that a management decision can maximize shareholder value while lowering the welfare of other stakeholders. Additionally, short-term focus on shareholder value can be detrimental to long-term shareholder value.

Key Terms

- shareholder

-

One who owns shares of stock.

- market value

-

The total value of the company as traded in the market. Calculated by multiplying the number of shares outstanding by the price per share.

- principal

-

One who directs another (the agent) to act on one′s behalf.

Introduction

Financial management is concerned with financial matters for the practical significance of the numbers, asking: what do the figures mean? There are several goals of financial management, one of which is maximizing shareholder and market value .

Money to Shareholders

Maximizing shareholder and market value is, for some, one of the goals of financial management.

Maximizing Shareholder Value

The idea of maximizing shareholder value comes from interpretations of the role of corporate governance. Corporate governance involves regulatory and market mechanisms and the roles and relationships between a company’s management, its board, its shareholders, other stakeholders, and the goals by which the corporation is governed.

In large firms where there is a separation of ownership and management and no controlling shareholder, the principal–agent issue arises between upper-management (the “agent”) and shareholders (the “principals”). The danger arises that, rather than overseeing management on behalf of shareholders, the board of directors may become insulated from shareholders and beholden to management.

Thus, one interpretation of proper financial management is that the agents are oriented toward the benefit of the principals – shareholders – in increasing their wealth by paying dividends and/or causing the stock price or market value to increase.

Maximizing Market Value

The idea of maximizing market value is related to the idea of maximizing shareholder value, as market value is the price at which an asset would trade in a competitive auction setting; for example, returning value to the shareholders if they decide to sell shares or if the firm decides to sell.

There are many different models of corporate governance around the world. These differ according to the variety of capitalism in which they are embedded. The Anglo-American (US and UK) “model” tends to emphasize the interests of shareholders.

The sole concentration on shareholder value has been widely criticized, particularly after the late-2000s financial crisis, where attention has risen to the concern that a management decision can maximize shareholder value while lowering the welfare of other stakeholders. Additionally, short-term focus on shareholder value can be detrimental to long-term shareholder value.

1.2.3: Maximizing Value Without Harming Stakeholders

A goal of financial management can be to maximize value without harming stakeholders, the diverse set of parties affected by the business.

Learning Objective

Explain how maximizing value for shareholders can harm the business’s other stakeholders

Key Points

- Stakeholders are those who are affected by an organization’s activities. The stakeholders can be internal or external to the firm and some will be involved directly in economic transactions with the business, while others will not.

- Owners, employees, customers, suppliers, trade unions, the government, local communities, and the environment can be considered stakeholders. Because of the potential breadth of the term, there are different views on whom to include in stakeholder considerations.

- Debate is ongoing about whether firms should be managed for shareholder value maximization or also with stakeholders in mind. While the Anglo-American “model” tends to emphasize shareholders, some European countries formally recognize other stakeholders in corporate governance decisions.

- Some proponents of stakeholder considerations argue that attention to other stakeholders is intimitely intertwined with market value and can enhance outcomes for all stakeholders. Others argue that value should be maximized without harming stakeholders.

Key Terms

- market value

-

The total value of the company as traded in the market. Calculated by multiplying the number of shares outstanding by the price per share.

- stakeholder

-

A person or organisation with a legitimate interest in a given situation, action or enterprise.

Introduction

Professionals in financial management are concerned with the practical significance of the numbers that appear in financial documents. Given a set of information about certain financial behavior, they ask, what do the figures mean? There are several goals of financial management, one of which is maximizing value without harming shareholders.

The Stakeholder Concept

The stakeholder concept is associated with the concept of corporate governance. Corporate governance involves regulatory and market mechanisms and the relationships that exist between a company’s management, its board, its shareholders, other stakeholders, and the goals for which the corporation is governed. Stakeholders are those who are affected by an organization’s activities. The stakeholders can be internal, like owners or employees. They can also be external, like customers, suppliers, the government, local communities, and the environment . Some stakeholders are involved directly in economic transactions with the business. Others are either affected by, or able to affect, an organization’s actions without directly engaging in an economic exchange with the business (for example, trade unions, communities, activist groups, etc). Because of the breadth of the term stakeholder, there are different views as to whom should be included in stakeholder considerations.

Environment as stakeholder

The environment can be seen as a stakeholder. Maximizing value without harming stakeholders is, for some, one of the goals of financial management.

Stakeholders vs. Shareholders

In the field of corporate governance and corporate responsibility, a major debate is currently occurring about whether a firm or company should make decisions chiefly to maximize value for shareholders, or if a company has obligations to other types of stakeholders. This increased after the financial crisis of the late 2000s, when concerns deepened about the potential of companies to lower the welfare of other stakeholders while maximizing their shareholder value. While the Anglo-American (US and UK) business “model” tends to emphasize the interests of shareholders over other implicated parties, some European countries formally recognize other stakeholders in corporate governance decisions.

Some people who argue that businesses should consider other stakeholders, like the government or the environment, argue that an attention to these types of stakeholders is intimately intwined with market value. They also argue that a holistic view can enhance general outcomes for all the stakeholders that are involved. Still others argue that stakeholders, even if they are not considered in business decisions, should at the very least not suffer harm, and that businesses should maximize value only if they can do so without generating harm.

1.3: Trends and Issues in Finance

1.3.1: Current Issues in Finance

Current issues in finance include the economic and regulatory impacts of the financial crisis and the growth of new types of finance.

Learning Objective

Discuss events and trends in finance during the early 21st century

Key Points

- The financial crisis of 2007–2008 caused the near-total collapse of many large financial institutions, the bailout of banks by national governments, and downturns in stock markets around the world.

- Following the financial crisis, various regulatory reforms were passed in the United States, and European regulators introduced Basel III regulations for banks.

- There are various growing areas of finance, including microfinance, crowdfunding, algorithmic trading, and impact investing.

Key Terms

- bailout

-

a rescue, especially a financial rescue

- crowdfunding

-

funding by many individuals pooling their money together for a common goal, usually via the Internet

Financial crisis and regulation

The financial crisis of 2007–2008 caused the near-total collapse of many large financial institutions, the bailout of banks by national governments, and downturns in stock markets around the world. The financial institution crisis hit its peak in late 2008. Several major institutions failed, were acquired under duress, or were subject to government takeover, including Lehman Brothers, Citigroup, Fannie Mae, and Freddie Mac, among several others.The crisis rapidly developed and spread into global economic shock, resulting in a number of European bank failures, economic crises in Iceland, declines in various stock indexes, and large reductions in the market value of equities and commodities. A currency crisis followed, with investors transferring vast capital resources into stronger currencies. In many areas in the United States, the housing market also suffered, resulting in significant numbers of foreclosures. The crisis played a significant role in the failure of key businesses, declines in consumer wealth, prolonged unemployment, and a downturn in economic activity in the United States. It also led to a global recession and a sovereign debt crisis in Europe.

Critics of the financial crisis have argued that the regulatory framework did not keep pace with rapid innovation in financial markets and have asked for increased regulation and enforcement. Various regulatory reforms have been passed in the United States, and European regulators introduced Basel III regulations for banks.

Growing areas of business

Microfinance is the provision of a wide range of financial services, including savings accounts, to the poor. Microcredit is a part of microfinance and involves the extension of very small loans (microloans) to impoverished borrowers, often with the goal of supporting entrepreneurship and/or alleviating poverty.

Peer-to-peer lending over the Internet is another growing development in the financial sector, to which the principles of microcredit have also been applied in attempting to address poverty as well as various non-poverty-related issues. Such efforts include crowdfunding , a term describing the collective effort of individuals who network and pool their resources to support charities initiated by other people or organizations. The rules for crowdfunding are still being developed, and the Securities Exchange Commission has yet to set rules in place for equity crowdfunding campaigns involving unaccredited investors for private companies.

Crowds

One of the newer trends in finance is “crowdfunding. “

Algorithmic trading, now widely used by pension funds, mutual funds, and other institutional traders, is the use of electronic platforms to enter trading orders with an algorithm that calculates aspects such as timing, price, and quantity. Proponents have argued that algorithmic trading substantially improves market liquidity,while critics argue that this type of trading is opaque– a “black box”– and may contribute substantially to market volatility.

The growing field of impact investing refers to investments made based on the practice of assessing not only the financial return on an investment, but also its social and environmental impacts.

1.3.2: Employment in Finance

The financial sector is a large field offering many different types of employment for a broad range of organizations that manage money.

Learning Objective

Identify jobs that require a background in finance

Key Points

- The financial sector is a large field offering many different types of employment. Financial services encompasses a broad range of organizations that manage money, including banks, credit unions, credit card companies, insurers, stock brokerages, and investment funds.

- Financial analysts may work for government investment funds, mutual fund companies, hedge funds, private equity investors, and investment banks. Similarly, credit analysts work in a variety of institutions to assess the creditworthiness of firms, governments, or individuals for loans.

- In insurance, there are insurance brokers and underwriters as well as actuaries and a host of other positions such as insurance claims investigators and agents. Intermediaries exist not just in the insurance business but also as stockbrokers that assist investors in buying and selling shares.

- Finance professionals may also work in public finance, for local or national governments, or in corporate finance. Growth in microfinance and microcredit has also opened up employment opportunities in small-unit finance both in the US and abroad.

- Sophisticated mathematical and technological developments have also advanced the field of quantitative analysis for those who work in investment management, risk management, derivatives pricing, algorithmic trading, and other area that require the application of mathematics in finance.

- Financial employees can come from a variety of backgrounds. Many financial analysis and management positions require some kind of training in finance, accounting, economics, mathematics, engineering, or another quantitative field.

Key Terms

- credit

-

A privilege of delayed payment extended to a buyer or borrower on the seller’s or lender’s belief that what is given will be repaid.

- underwriter

-

An entity which markets newly issued securities

- bank

-

An institution where one can place and borrow money and take care of financial affairs.

The financial sector is a large field offering many different types of employment. Financial services encompasses a broad range of organizations that manage money, including banks, credit unions, credit card companies, insurers, consumer finance companies, stock brokerages, investment funds, some government sponsored enterprises, and other financial institutions, including peer-to-peer lending platforms.

In banking, employees may serve the range of roles needed to run banks, from tellers to financial planners and underwriters to wealth managers. Workers may be employed in a variety of functions by credit card issuers, such as customer service, foreign exchange service, high-profile trading, and airport currency exchangers. Financial analysts may work for government investment funds, mutual fund companies, hedge funds, private equity investors, and investment banks. Credit analysts work in a variety of institutions to assess the creditworthiness of firms, governments, or individuals for loans. In insurance, there are insurance brokers and underwriters as well as actuaries and a host of other positions such as insurance claims investigators and agents.

Intermediaries exist not just in the insurance business. Stockbrokers, for instance, assist investors in buying and selling shares. There are also investors called venture capitalists and angel investors. Finance professionals may also work in public finance, for local or national governments, or in corporate finance.

Growth in microfinance and microcredit has also opened up employment opportunities in finance both in the US and abroad . Sophisticated mathematical and technological developments have also advanced the field of quantitative analysis for those who work in investment management, risk management, derivatives pricing, algorithmic trading, and other areas that require the application of mathematics in finance.

Muhammad Yunus

Muhammad Yunus is a banker who grew a field in microcredit and microfinance, opening up new types of financial employment.

Financial employees can come from a variety of backgrounds. Many financial analysis and management positions require some kind of training in finance, accounting, economics, mathematics, engineering, or another quantitative field. There are Masters degrees in Finance and Business as well as certifications such as the widely recognized Chartered Financial Analyst certification and accountancy qualifications such as the Certified Public Accountant.

1.4: Ethics: An Overview

1.4.1: Defining Ethics

Ethics are the set of moral principles that guide a person’s behavior.

Learning Objective

Define ethics and how it applies to organizations

Key Points

- Ethical behavior is based on written and unwritten codes of principles and values held in society.

- Ethics reflect beliefs about what is right, what is wrong, what is just, what is unjust, what is good, and what is bad in terms of human behavior.

- Ethical principles and values serve as a guide to behavior on a personal level, within professions, and at the organizational level.

Key Terms

- behavior

-

The way a living creature acts.

- ethics

-

The study of principles relating to right and wrong conduct.

- values

-

A collection of guiding principles; what one deems to be correct, important, and desirable in life, especially regarding personal conduct.

Ethics are the set of moral principles that guide a person’s behavior. These morals are shaped by social norms, cultural practices, and religious influences. Ethics reflect beliefs about what is right, what is wrong, what is just, what is unjust, what is good, and what is bad in terms of human behavior. They serve as a compass to direct how people should behave toward each other, understand and fulfill their obligations to society, and live their lives.

While ethical beliefs are held by individuals, they can also be reflected in the values, practices, and policies that shape the choices made by decision makers on behalf of their organizations. The phrases business ethics and corporate ethics are often used to describe the application of ethical values to business activities. Ethics applies to all aspects of conduct and is relevant to the actions of individuals, groups, and organizations.

In addition to individual ethics and corporate ethics there are professional ethics. Professionals such as managers, lawyers, and accountants are individuals who exercise specialized knowledge and skills when providing services to customers or to the public. By virtue of their profession, they have obligations to those they serve. For example, lawyers must hold client conversations confidential and accountants must display the highest levels of honest and integrity in their record keeping and financial analysis. Professional organizations, such as the American Medical Association, and licensing authorities, such as state governments, set and enforce ethical standards.

Example

The concept of corporate social responsibility emphasizes ethical behavior in that it requires organizations to understand, identify, and eliminate unethical economic, environmental, and social behaviors.

1.4.2: Ethics Training

Moral reasoning is the process in which an individual tries to determine what is right and what is wrong.

Learning Objective

Explain the role of ethical moral reasoning in the business environment

Key Points

- There are four components of moral behavior: moral sensitivity, moral judgment, moral motivation, and moral character.

- To make moral assessments, one must first know what an action is intended to accomplish and what its possible consequences will be on others.

- Studies have uncovered four skill sets that play a decisive role in the exercise of moral expertise: moral imagination, moral creativity, reasonableness, and perseverance.

Key Terms

- goodwill

-

The ability of an individual or business to exert influence within a community, club, market, or another type of group, without having to resort to the use of an asset (such as money or property).

- ethics

-

The study of principles relating to right and wrong conduct.

Moral reasoning is the process in which an individual tries to determine the difference between what is right and what is wrong in a personal situation by using logic. To make such an assessment, one must first know what an action is intended to accomplish and what its possible consequences will be on others. People use moral reasoning in an attempt to do the right thing. People are frequently faced with moral choices, such as whether to lie to avoid hurting someone’s feelings, or whether to take an action that will benefit some while harming others. Such judgements are made by considering the objective and the likely consequences of an action. Moral reasoning is the consideration of the factors relevant to making these types of assessments.

According to consultant Lynn W. Swaner, moral behavior has four components:

- Moral sensitivity, which is “the ability to see an ethical dilemma, including how our actions will affect others.”

- Moral judgment, which is “the ability to reason correctly about what ‘ought’ to be done in a specific situation.”

- Moral motivation, which is “a personal commitment to moral action, accepting responsibility for the outcome.”

- Moral character, which is a “courageous persistence in spite of fatigue or temptations to take the easy way out.”

The ability to think through moral issues and dilemmas, then, requires an awareness of a set of moral and ethical values; the capacity to think objectively and rationally about what may be an emotional issue; the willingness to take a stand for what is right, even in the face of opposition; and the fortitude and resilience to maintain one’s ethical and moral standards.

Realizing good conduct, being an effective moral agent, and bringing values into one’s work, all require skills in addition to a moral inclination. Studies have uncovered four skill sets that play a decisive role in the exercise of moral expertise.

- Moral imagination: The ability to see the situation through the eyes of others. Moral imagination achieves a balance between becoming lost in the perspectives of others and failing to leave one’s own perspective. Adam Smith terms this balance “proportionality,” which we can achieve in empathy.

- Moral creativity: Moral creativity is closely related to moral imagination, but it centers on the ability to frame a situation in different ways.

- Reasonableness: Reasonableness balances openness to the views of others with commitment to moral values and other important goals. That is, a reasonable person is open, but not to the extent where he is willing to believe just anything and/or fails to keep fundamental commitments.

- Perseverance: Perseverance is the ability to decide on a moral plan of action and then to adapt to any barriers that arise in order to continue working toward that goal.

Example

William LeMesseur designed the Citicorp Building in New York. When a student identified a critical design flaw in the building during a routine class exercise, LeMesseur responded not by shooting the messenger but by developing an intricate and effective plan for correcting the problem before it resulted in drastic real-world consequences.

1.4.3: Culture and Ethics

Culture reflects the moral values and ethical norms governing how people should behave and interact with others.

Learning Objective

Explain the role of culture in shaping moral and ethical behavior

Key Points

- Culture refers to the outlook, attitudes, values, goals, and practices shared by a group, organization, or society.

- Interpretation of what is moral is influenced by cultural norms, and different cultures can have different beliefs about what is right and wrong.

- According to the theory of cultural relativism, there is no singular truth on which to base ethical or moral behavior, as our interpretations of truths are influenced by our own culture.

Key Terms

- norms

-

Rules or laws that govern a group’s or a society’s behaviors.

- moral relativism

-

Refers to any of several philosophical positions concerned with the differences in moral judgments among different people and across different cultures.

- ethnocentric

-

Of the idea or belief that one’s own culture is more important than, or superior to, other cultures.

Culture describes a collective way of life, or way of doing things. It is the sum of attitudes, values, goals, and practices shared by individuals in a group, organization, or society. Cultures vary over time periods, between countries and geographic regions, and among groups and organizations. Culture reflects the moral and ethical beliefs and standards that speak to how people should behave and interact with others.

Cultural map of the world

This diagram attempts to plot different countries by the importance of different types of values. One axis represents traditional values to secular-rational values, while the other axis accounts for survival values and self-expression values. Different groups of countries can be grouped into certain categories, such as Catholic Europe, English speaking, and Ex-Communist.

Cultural norms are the shared, sanctioned, and integrated systems of beliefs and practices that are passed down through generations and characterize a cultural group. Norms cultivate reliable guidelines for daily living and contribute to the health and well-being of a culture. They act as prescriptions for correct and moral behavior, lend meaning and coherence to life, and provide a means of achieving a sense of integrity, safety, and belonging. These normative beliefs, together with related cultural values and rituals, impose a sense of order and control on aspects of life that might otherwise appear chaotic or unpredictable.

This is where culture intersects with ethics. Since interpretations of what is moral are influenced by cultural norms, the possibility exists that what is ethical to one group will not be considered so by someone living in a different culture. According to cultural relativists this means that there is no singular truth on which to base ethical or moral behavior for all time and geographic space, as our interpretations of truths are influenced by our own culture. This approach is in contrast to universalism, which holds the position that moral values are the same for everyone. Cultural relativists consider this to be an ethnocentric view, as the universal set of values proposed by universalists are based on their set of values. Cultural relativism is also considered more tolerant than universalism because, if there is no basis for making moral judgments between cultures, then cultures have to be tolerant of each other.

Example

The French and Americans have different views on whistle-blowing. Compared to the French, American companies consider it to be a natural part of business. So natural, in fact, that they set up anonymous hotlines. The French, on the other hand, tend to view whistle-blowing as undermining solidarity among coworkers.

1.4.4: The Manager’s Role in Ethical Conduct

Employees can more easily make ethical decisions that promote a company’s values when their personal values match the company’s norms.

Learning Objective

Explain the role of personal values in influencing behavior in organizations

Key Points

- Personal values provide an internal reference for what is good, beneficial, important, useful, beautiful, desirable, and constructive.

- Personal values take on greater meaning in adulthood as they are meant to influence how we carry out our responsibilities to others.

- To make ethical and moral choices, one needs to have a clear understanding of one’s personal values.

Key Terms

- value

-

A standard by which an individual determines what is good or desirable; a measure of relative worth or importance.

- norms

-

According to sociologists, social norms are the laws that govern society’s behaviors.

Personal values provide an internal reference for what is good, beneficial, important, useful, beautiful, desirable, and constructive. Over time, the public expression of personal values has laid the foundations of law, custom, and tradition. Personal values in this way exist in relation to cultural values, either in agreement with or divergent from prevailing norms.

Personal values are developed in many different ways:

- The most important influence on our values comes from the families we grow up with. The family is responsible for teaching children what is right and wrong long before there are other influences. It is thus said that a child is a reflection of his or her parents.

- Teachers and classmates help shape the values of children during the school years.

- Religion (or a lack thereof) also plays a role in teaching children values.

Personal values take on greater meaning in adulthood as they are meant to influence how we carry out our responsibilities to others. This is true in the workplace, especially for managers and leaders, who are charged with overseeing resources for the benefit of others. Because of their authority structures, social norms, and cultures, organizations can have a powerful influence on their employees. Employers do their best to hire individuals who match match well with the organization’s norms and values. In this way they seek to promote their standards of ethical behavior.

Conversely, conflicts can occur between an individual’s moral values and what she perceives to be those of others in their organization. Since moral judgments are based on the analysis of the consequences of behavior, they involve interpretations and assessments. One might be asked to do something that violates a personal belief but is considered appropriate by others. To make ethical and moral choices, one needs to have a clear understanding of one’s personal values. Without that awareness, it can be difficult to justify a decision on ethical or moral grounds in a way that others would find persuasive.

Example

If you value equal rights for all and you go to work for an organization that treats its managers much better than it does its workers, you may form the attitude that the company is an unfair place to work; consequently, you may not produce well or may even leave the company. It is likely that if the company had a more egalitarian policy, your attitude and behaviors would have been more positive.

1.4.5: Blurring Ethical Lines

Ethical decisions involve judgments of facts and situations that are subject to interpretation and other influences.

Learning Objective

Analyze the gray areas of ethical expectations within the context of corporate decision making and ethical business practice

Key Points

- Identifying the ethical choice can be difficult, since many situations are ambiguous and facts are subject to interpretation.

- In organizations, employees can look to the code of ethics or the statement of values for guidance about how to handle ethical gray areas.

- Individual ethical judgement can be clouded by rationalizations to justify one’s actions.

Key Terms

- business ethics

-

The branch of ethics that examines questions of moral right and wrong arising in the context of business practice or theory.

- norms

-

According to sociologists, social norms are the laws that govern society’s behaviors.

Law and ethics are not the same thing. Both exist to influence behavior, but complying with the law is mandatory, while adhering to an ethical code is voluntary. Laws define what is permissible, while ethics speak to what is right, good, and just. Lawyers and judges are responsible for clarifying the meaning of a law when there is ambiguity or when a matter is subject to interpretation. Where ethics are concerned, that responsibility lies with each individual. In organizations, employees can look to the code of ethics or the statement of values for guidance about how to handle ethical gray areas.

Even when an individual has a clear sense of right and wrong, or good and bad, it can be difficult to know what is ethical in a given situation. Ethical choices involve judgment because they involve weighing the potential consequences of one’s actions for other people. One analyzes ethical issues by asking questions such as: What could happen? How likely is it happen? What might the harm be? Who might be hurt? The answers are not always clear cut.

Individual judgments can be influenced, even clouded, by a number of factors. A study by Professor Robert Prentice suggests that self-image can influence an individual’s decision-making process, making him or her feel justified in taking shortcuts or doing things that could be seen as ethically questionable. In addition, there are times when people believe that the ends justify the means. In other words, if the result of an action is good, then it is okay if the action itself is unethical.

There is a saying that a good person is one who does good deeds when no one is looking. The same goes with ethical decisions. People who are ethical follow their beliefs even when they believe no one will find out about what they have done. In many cases of ethical breaches in organizations, those who acted unethically likely believed that they wouldn’t be discovered. Others may have thought that if the issues were discovered, the actions wouldn’t be traced back to them. They had the opportunity to be ethical but chose not to be.

Business Ethics Around the Globe

Social norms aren’t identical in different countries, and ethical standards can vary as well. A business may operate in a country that permits actions that would be considered unethical under that business’s ethical code. How will employees working in that country handle that situation, especially if something that could be considered unethical in one place is actually thought to be important to business success in the other? For instance, in some cultures it is customary for business partners and customers to be invited to weddings, with the expectation that guests will give a cash gift to the bride and groom. A company might consider the gift an unethical bribe in exchange for a customer’s business, yet it may be essential to enter a new market. Adhering to ethical standards in such instances can be difficult.

This way to ethics

Ethical decisions are not always clear-cut.

Example

American companies are often criticized for the treatment of workers who produce their products in China. However, rules concerning the rights of workers are much more relaxed in China than in the United States. Does an American company have the right to order factory owners in China to change their way of doing business? That is one example of an ethical gray area in today’s globalized economy.

1.5: Types of Business Organizations

1.5.1: Overview of Organizational Structure

Business organizations can be structured in various ways, both as legal entities and in terms of internal management processes.

Learning Objective

Select the appropriate organizational structure for a business after reviewing a its key characteristics

Key Points

- From a legal structure perspective, many business structures require a form of incorporation to register the business as a legal entity. The business entity’s type, its geographic span of operations, risk profile, and other factors are issues to consider when choosing what entity type to use.

- There are various forms of organizational structures from a corporate law perspective, including sole proprietorships, cooperatives, partnerships, limited liability companies, and corporations.

- One of the issues dividing the different organizational structures is that of liability. With sole proprietorships and some forms of partnership, owners can be personally liable for business losses, meaning their personal assets are not protected against the claims of creditors.

- Internally, organizations can also be structured differently, in terms of the groupings of organizational relationships and the characteristics of management. Some common structures are the functional, divisional, matrix, team, network, and modular structures.

- Independent from their legal and internal structures, organizations can also operate differently. For example, hybrid organizations, which may fall under various legal categories, can mix elements, value systems and logics of action from the private, public, and voluntary sectors.

Key Terms

- liability

-

An obligation, debt or responsibility owed to someone.

- incorporate

-

To form into a legal company.

- hierarchy

-

Any group of objects ranked so that every one but the topmost is subordinate to a specified one above it.

Organizational Structure

Business organizations can be structured in various ways, depending on their standing as legal entities, internal structure, and management processes .

Organizational chart

A military organizational chart

Pre-bureaucratic structures

Pre-bureaucratic (entrepreneurial) structures lack standardization of tasks. This structure is most common in smaller organizations and is best used to solve simple tasks. The structure is totally centralized and appears like a hierarchy. The strategic leader makes all key decisions and most communication is done by one-on-one conversations. It is particularly useful for new (entrepreneurial) business as it enables the founder to control growth and development.

Bureaucratic structures

Weber said that the fully developed bureaucratic mechanism compares with other organizations exactly as does the machine compare with the non-mechanical modes of production. Precision, speed, unambiguity…strict subordination, reduction of friction and of material and personal costs are raised to the optimum point in the strictly bureaucratic administration. Bureaucratic structures have a certain degree of standardization. They are better suited for more complex or larger scale organizations, usually adopting a tall structure. The tension between bureaucratic structures and non-bureaucratic is echoed in Burns and Stalker’s distinction between mechanistic and organic structures.

Functional structure

Employees within the functional divisions of an organization tend to perform a specialized set of tasks; for instance, the engineering department is staffed only with software engineers. This leads to operational efficiencies within that group. However, it could also lead to a lack of communication between the functional groups within an organization, making the organization slow and inflexible. As a whole, a functional organization is best suited as a producer of standardized goods and services at large volume and low cost.

Divisional structure

Also called a “product structure,” the divisional structure groups each organizational function into a division. Each division within a divisional structure contains all the necessary resources and functions within it. Divisions can be categorized by different points of view. One might make distinctions on a geographical basis (a US division and an EU division, for example) or on product/service basis (different products for different customers, households, or companies). In another example, an automobile company with a divisional structure might have one division for SUVs, another division for subcompact cars, and another for sedans.

Matrix structure

The matrix structure groups employees by both function and product. This structure can combine the best of both separate structures. A matrix organization frequently uses teams of employees to accomplish work, in order to take advantage of strengths and make up for weaknesses of functional and decentralized forms. An example would be a company that produces two products, “product a” and “product b. ” Using the matrix structure, this company would organize functions within the company as follows: “product a” sales department, “product a” customer service department, “product a” accounting department, “product b” sales department, “product b” customer service department, “product b” accounting department. Matrix structure is amongst the purest of organizational structures – a simple lattice emulating order and regularity demonstrated in nature.

Legal considerations

In the US and elsewhere, many business structures require a form of incorporation to register the business as a legal entity. The owner files articles of incorporation with the secretary of state’s office for the particular jurisdiction. The organization may also hold meetings, select a board of directors, adopt bylaws, and report on a regular basis. The business entity’s type, its geographic span of operations, risk profile, and other factors are issues to consider when choosing what entity type to use, in what jurisdiction to incorporate, how the articles should be drafted, and if a stock form should be used.

Business perspective

There are various forms of organizational structures from a business perspective, including sole proprietorships, cooperatives, partnerships, limited liability companies, and corporations. All of these structures are for profit, but there are also non-profit corporations and other structures. The differences in structures can depend on the number of entrepreneurs or owners involved, and the different tax treatments. One of the issues dividing forms is that of liability. With sole proprietorships and some forms of partnership, owners can be personally liable for business losses, meaning their personal assets are not protected against the claims of creditors. These organizational structures are also not separate entities from the owners/entrepreneurs, unlike a corporation.

Organizational behavior

Internally, organizations can also be structured differently, in terms of the groupings of organizational relationships and the characteristics of management. Some common structures are the functional, divisional, matrix, team, network, and modular structures.

Independent from their legal and internal structures, organizations can also behave differently. For example, hybrid organizations, which may fall under various legal categories, can mix elements, value systems, and logics of action from the private, public, and voluntary sectors.

1.5.2: Pros and Cons of Sole Proprietorship

The sole proprietorship structure has the benefit of simplicity and control but the drawback of unlimited liability.

Learning Objective

Describe the key characteristics of a sole proprietorship

Key Points

- The sole proprietorship is a type of business structure open to businesses run and owned by one entrepreneur.

- A large advantage of the sole proprietorship structure is its ease. The sole proprietorship structure does not require filing of articles of incorporation, regular meetings, or election of a board. A sole proprietor also files taxes as personal income.

- The other side of this process is the structure’s main disadvantage: there is no separation between the entrepreneur and the business. This means the sole proprietor is personally liable for business losses. Also, if the proprietor dies, the business ceases to exist.

Key Terms

- proprietor

-

An owner

- entrepreneur

-

A person who organizes and operates a business venture and assumes much of the associated risk.

Overview of Business Structures

Business organizations can be structured in two major ways, namely, in terms of their structures as legal entities and also in terms of the internal structure and management processes. The sole proprietorship is one type of business structure from a legal status perspective. It is a structure open to businesses run and owned by one entrepreneur.

Sole Proprietors

Small businesses are often structured as sole proprietorships.

Sole Proprietorship: Pros and Cons

A large advantage of the sole proprietorship structure is its ease of filing incorporation and tax documents as well as having uninterrupted control of the business. The sole proprietorship is one type of business structure in the US that does not require formal incorporation, meaning that sole proprietors do not need to formally file articles of incorporation, hold regular meetings, or elect an advising or directing board. This simplicity is also reflected in tax treatment, as a sole proprietor files taxes as personal income. Sole proprietors also have control over the aspects of their business without the involvement of elected board members.

On the flip side, the sole proprietorship has one main disadvantage: there is no separation between the entrepreneur and the business. With sole proprietorships, like some forms of partnership, owners can be personally liable for business losses, meaning their personal assets are not protected against the claims of creditors. The sole proprietorship is not a separate entity from the owner/entrepreneur, unlike a corporation. As a result, if the proprietor dies, the business ceases to exist. Because the enterprise rests exclusively on one person, it often has difficulty raising long-term capital.

1.5.3: Pros and Cons of a Partnership

The partnership structure has the benefit of simplicity and control but the drawback of personal liability for the partnership’s activities.

Learning Objective

Describe the legal pros and cons of a partnership

Key Points

- The partnership is a type of business structure open to businesses run and owned by two or more entrepreneurs.

- A large advantage of the partnership structure is its ease, in terms of filing and tax treatment. A general partnership can be started with no special formalities. The partners are taxed individually on their share of the partnership’s profits.

- The structure’s main disadvantage is that partnership owners can be personally liable for business losses. The partnership is not a separate entity from the owners/entrepreneurs, unlike a corporation.

- Types of partnership beyond the general partnership have developed to mitigate some of the disadvantages of the structure. Limited partnerships and limited liability partnerships are two examples.

Key Terms

- liability

-

An obligation, debt or responsibility owed to someone.

- partnership

-

An association of two or more people to conduct a business,

Business Organization Types

Business organizations can be structured in various ways, in terms of their structures as legal entities and also in terms of the internal structure and management processes. The partnership is one type of business structure. The partnership is the next simplest business structure after the sole proprietorship. Because sole proprietors can only have one owner, the partnership is the simplest structure open to collaborative ownership .

Partnership

The partnership is the simplest structure open to collaborative ownership.

Partnership: Pros and Cons

A large advantage of the partnership structure is its ease in filing and tax treatment. With a general partnership, two or more people can start a business as co-owners with no special formalities, directly controlling the partnership and making binding decisions with a simple majority vote. The partners are taxed individually on their share of the partnership’s profits. By default, profits are shared equally among the partners. However, a partnership agreement will almost invariably expressly provide for the manner in which profits and losses are to be shared.

The structure’s main disadvantage is similar to the sole proprietorship. Owners can be personally liable for business losses in some forms of partnership, meaning their personal assets are not protected against the claims of creditors. The partnership is not a separate entity from the owners/entrepreneurs, unlike a corporation. This means that the partnership structure is only as good as the partnership at the relational level. If the mutual consent to form a partnership breaks down, the partnership breaks down as well; partnerships are considered to be an aggregate of their partners rather than a separate entity.