9.1: The Production Function

9.1.1: Defining the Production Function

The production function relates the maximum amount of output that can be obtained from a given number of inputs.

Learning Objective

Define the production function

Key Points

- The production function describes a boundary or frontier representing the limit of output obtainable from each feasible combination of inputs.

- Firms use the production function to determine how much output they should produce given the price of a good, and what combination of inputs they should use to produce given the price of capital and labor.

- The production function also gives information about increasing or decreasing returns to scale and the marginal products of labor and capital.

Key Terms

- marginal cost

-

The increase in cost that accompanies a unit increase in output; the partial derivative of the cost function with respect to output. Additional cost associated with producing one more unit of output.

- Production function

-

Relates physical output of a production process to physical inputs or factors of production.

- output

-

Production; quantity produced, created, or completed.

In economics, a production function relates physical output of a production process to physical inputs or factors of production. It is a mathematical function that relates the maximum amount of output that can be obtained from a given number of inputs – generally capital and labor. The production function, therefore, describes a boundary or frontier representing the limit of output obtainable from each feasible combination of inputs.

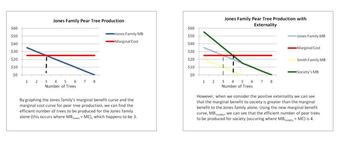

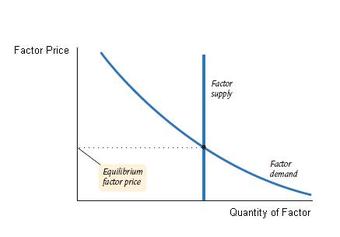

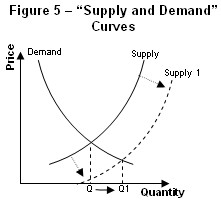

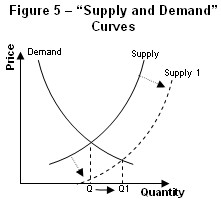

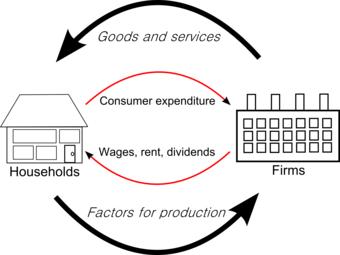

Firms use the production function to determine how much output they should produce given the price of a good, and what combination of inputs they should use to produce given the price of capital and labor (). When firms are deciding how much to produce they typically find that at high levels of production, their marginal costs begin increasing. This is also known as diminishing returns to scale – increasing the quantity of inputs creates a less-than-proportional increase in the quantity of output. If it weren’t for diminishing returns to scale, supply could expand without limits without increasing the price of a good.

Factory Production

Manufacturing companies use their production function to determine the optimal combination of labor and capital to produce a certain amount of output.

Increasing marginal costs can be identified using the production function. If a firm has a production function Q=F(K,L) (that is, the quantity of output (Q) is some function of capital (K) and labor (L)), then if 2Q<F(2K,2L), the production function has increasing marginal costs and diminishing returns to scale. Similarly, if 2Q>F(2K,2L), there are increasing returns to scale, and if 2Q=F(2K,2L), there are constant returns to scale.

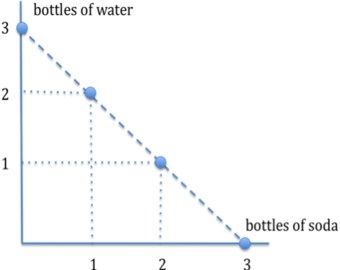

Examples of Common Production Functions

One very simple example of a production function might be Q=K+L, where Q is the quantity of output, K is the amount of capital, and L is the amount of labor used in production. This production function says that a firm can produce one unit of output for every unit of capital or labor it employs. From this production function we can see that this industry has constant returns to scale – that is, the amount of output will increase proportionally to any increase in the amount of inputs.

Another common production function is the Cobb-Douglas production function. One example of this type of function is Q=K0.5L0.5. This describes a firm that requires the least total number of inputs when the combination of inputs is relatively equal. For example, the firm could produce 25 units of output by using 25 units of capital and 25 of labor, or it could produce the same 25 units of output with 125 units of labor and only one unit of capital.

Finally, the Leontief production function applies to situations in which inputs must be used in fixed proportions; starting from those proportions, if usage of one input is increased without another being increased, output will not change. This production function is given by Q=Min(K,L). For example, a firm with five employees will produce five units of output as long as it has at least five units of capital.

9.1.2: The Law of Diminishing Returns

The law of diminishing returns states that adding more of one factor of production will at some point yield lower per-unit returns.

Learning Objective

Explain the Law of Diminishing Returns

Key Points

- One consequence of the law of diminishing returns is that producing one more unit of output will eventually cost increasingly more, due to inputs being used less and less effectively.

- The marginal cost curve will initially be downward sloping, representing added efficiency as production increases. If the law of diminishing returns holds, however, the marginal cost curve will eventually slope upward and continue to rise.

- The SRAC is typically U-shaped with its minimum at the point where it intersect the marginal cost curve. This is caused by the first increasing, and then decreasing, marginal returns to labor.

- The typical LRAC curve is also U-shaped, reflecting increasing returns of scale where negatively-sloped, constant returns to scale where horizontal and decreasing returns where positively sloped.

Key Terms

- returns to scale

-

A term referring to changes in output resulting from a proportional change in all inputs (where all inputs increase by a constant factor).

- marginal cost

-

The increase in cost that accompanies a unit increase in output; the partial derivative of the cost function with respect to output. Additional cost associated with producing one more unit of output.

In economics, diminishing returns (also called diminishing marginal returns) is the decrease in the marginal output of a production process as the amount of a single factor of production is increased, while the amounts of all other factors of production stay constant. The law of diminishing returns states that in all productive processes, adding more of one factor of production, while holding all others constant (“ceteris paribus”), will at some point yield lower per-unit returns . The law of diminishing returns does not imply that adding more of a factor will decrease the total production, a condition known as negative returns, though in fact this is common.

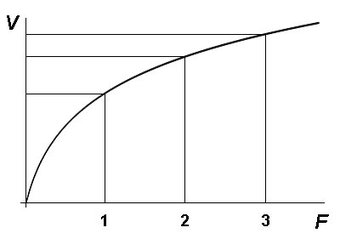

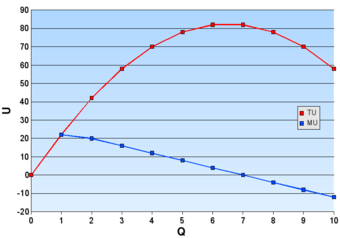

Diminishing Returns

As a factor of production (F) increases, the resulting gain in the volume of output (V) gets smaller and smaller.

For example, the use of fertilizer improves crop production on farms and in gardens; but at some point, adding more and more fertilizer improves the yield less per unit of fertilizer, and excessive quantities can even reduce the yield. A common sort of example is adding more workers to a job, such as assembling a car on a factory floor. At some point, adding more workers causes problems such as workers getting in each other’s way or frequently finding themselves waiting for access to a part. In all of these processes, producing one more unit of output will eventually cost increasingly more, due to inputs being used less and less effectively.

This increase in the marginal cost of output as production increases can be graphed as the marginal cost curve, with quantity of output on the x axis and marginal cost on the y axis. For many firms, the marginal cost curve will initially be downward sloping, representing added efficiency as production increases. If the law of diminishing returns holds, however, the marginal cost curve will eventually slope upward and continue to rise, representing the higher and higher marginal costs associated with additional output.

The Law of Diminishing Returns and Average Cost

The average total cost of production is the total cost of producing all output divided by the number of units produced. For example, if the car factory can produce 20 cars at a total cost of $200,000, the average cost of production is $10,000. Average total cost is interpreted as the the cost of a typical unit of production. So in our example each of the 20 cars produced had a typical cost per unit of $10,000. Average total cost can also be graphed with quantity of output on the x axis and average cost on the y-axis.

What will this average total cost curve look like? In the short run, a firm has a set amount of capital and can only increase or decrease production by hiring more or less labor. The fixed costs of capital are high, but the variable costs of labor are low, so costs increase more slowly than output as production increases. As long as the marginal cost of production is lower than the average total cost of production, the average cost is decreasing. However, as marginal costs increase due to the law of diminishing returns, the marginal cost of production will eventually be higher than the average total cost and the average cost will begin to increase. The short run average total cost curve (SRAC) will therefore be U-shaped for most firms .

Cost Curves in the Short Run

Both marginal cost and average cost are U-shaped due to first increasing, and then diminishing, returns. Average cost begins to increase where it intersects the marginal cost curve.

The long-run average cost curve (LRAC) depicts the cost per unit of output in the long run—that is, when all productive inputs’ usage levels can be varied. The typical LRAC curve is also U-shaped but for different reasons: it reflects increasing returns to scale where negatively-sloped, constant returns to scale where horizontal, and decreasing returns (due to increases in factor prices) where positively sloped.

9.1.3: Inputs and Outputs of the Function

In the basic production function, inputs are typically capital and labor and output is whatever good the firm produces.

Learning Objective

Describe the inputs and outputs in a generalized production function

Key Points

- Capital refers to the material objects necessary for production. In the short run, economists assume that the level of capital is fixed.

- Labor refers to the human work that goes into production. Typically economists assume that labor is a variable factor of production.

- The marginal product of an input is the amount of output that is gained by using one additional unit of that input. It can be found by taking the derivative of the production function in terms of the relevant input.

Key Terms

- rental rate

-

The price of capital.

- capital

-

Already-produced durable goods available for use as a factor of production, such as steam shovels (equipment) and office buildings (structures).

- marginal product

-

The extra output that can be produced by using one more unit of the input.

A production function relates the input of factors of production to the output of goods. In the basic production function inputs are typically capital and labor, though more expansive and complex production functions may include other variables such as land or natural resources. Output may be any consumer good produced by a firm. Cars, clothing, sandwiches, and toys are all examples of output.

Capital refers to the material objects necessary for production. Machinery, factory space, and tools are all types of capital. In the short run, economists assume that the level of capital is fixed – firms can’t sell machinery the moment it’s no longer needed, nor can they build a new factory and start producing goods there immediately. When looking at the production function in the short run, therefore, capital will be a constant rather than a variable. Although in reality a firm may own the capital that it uses, economists typically refer to the ongoing cost of employing capital as the rental rate because the opportunity cost of employing capital is the income that a firm could receive by renting it out. Thus, the price of capital is the rental rate.

Capital Goods

Capital equipment, like these motor graders, can vary in the long run but are fixed in the short run.

Labor refers to the human work that goes into production. Typically economists assume that labor is a variable factor of production; it can be increased or decreased in the short run in order to produce more or less output. The price of labor is the prevailing wage rate, since wages are the cost of hiring an additional unit of capital.

The marginal product of an input is the amount of output that is gained by using one additional unit of that input. It can be found by taking the derivative of the production function in terms of the relevant input. For example, if the production function is Q=3K+2L (where K represents units of capital and L represents units of labor), then the marginal product of capital is simply three; every additional unit of capital will produce an additional three units of output. Inputs are typically subject to the law of diminishing returns: as the amount of one factor of production increases, after a certain point the marginal product of that factor declines.

9.2: Production Cost

9.2.1: Types of Costs

Variable costs change according to the quantity of goods produced; fixed costs are independent of the quantity of goods being produced.

Learning Objective

Differentiate fixed costs and variable costs

Key Points

- Total cost is the sum of fixed and variable costs.

- Variable costs change according to the quantity of a good or service being produced. The amount of materials and labor that is needed for to make a good increases in direct proportion to the number of goods produced. The cost “varies” according to production.

- Fixed costs are independent of the quality of goods or services produced. Fixed costs (also referred to as overhead costs) tend to be time related costs including salaries or monthly rental fees.

- Fixed costs are only short term and do change over time. The long run is sufficient time of all short-run inputs that are fixed to become variable.

Key Terms

- fixed cost

-

Business expenses that are not dependent on the level of goods or services produced by the business.

- variable cost

-

A cost that changes with the change in volume of activity of an organization.

Total Cost

In economics, the total cost (TC) is the total economic cost of production. It consists of variable costs and fixed costs. Total cost is the total opportunity cost of each factor of production as part of its fixed or variable costs .

Calculating total cost

This graphs shows the relationship between fixed cost and variable cost. The sum of the two equal the total cost.

Variable Costs

Variable cost (VC) changes according to the quantity of a good or service being produced. It includes inputs like labor and raw materials. Variable costs are also the sum of marginal costs over all of the units produced (referred to as normal costs). For example, in the case of a clothing manufacturer, the variable costs would be the cost of the direct material (cloth) and the direct labor. The amount of materials and labor that is needed for each shirt increases in direct proportion to the number of shirts produced. The cost “varies” according to production.

Fixed Costs

Fixed costs (FC) are incurred independent of the quality of goods or services produced. They include inputs (capital) that cannot be adjusted in the short term, such as buildings and machinery. Fixed costs (also referred to as overhead costs) tend to be time related costs, including salaries or monthly rental fees. An example of a fixed cost would be the cost of renting a warehouse for a specific lease period. However, fixed costs are not permanent. They are only fixed in relation to the quantity of production for a certain time period. In the long run, the cost of all inputs is variable.

Economic Cost

The economic cost of a decision that a firm makes depends on the cost of the alternative chosen and the benefit that the best alternative would have provided if chosen. Economic cost is the sum of all the variable and fixed costs (also called accounting cost) plus opportunity costs.

9.2.2: Average and Marginal Cost

Marginal cost is the change in total cost when another unit is produced; average cost is the total cost divided by the number of goods produced.

Learning Objective

Distinguish between marginal and average costs

Key Points

- The marginal cost is the cost of producing one more unit of a good.

- Marginal cost includes all of the costs that vary with the level of production. For example, if a company needs to build a new factory in order to produce more goods, the cost of building the factory is a marginal cost.

- Economists analyze both short run and long run average cost. Short run average costs vary in relation to the quantity of goods being produced. Long run average cost includes the variation of quantities used for all inputs necessary for production.

- When the average cost declines, the marginal cost is less than the average cost. When the average cost increases, the marginal cost is greater than the average cost. When the average cost stays the same (is at a minimum or maximum), the marginal cost equals the average cost.

Key Terms

- marginal cost

-

The increase in cost that accompanies a unit increase in output; the partial derivative of the cost function with respect to output. Additional cost associated with producing one more unit of output.

- average cost

-

In economics, average cost or unit cost is equal to total cost divided by the number of goods produced.

Marginal Cost

In economics, marginal cost is the change in the total cost when the quantity produced changes by one unit. It is the cost of producing one more unit of a good. Marginal cost includes all of the costs that vary with the level of production. For example, if a company needs to build a new factory in order to produce more goods, the cost of building the factory is a marginal cost. The amount of marginal cost varies according to the volume of the good being produced. Economic factors that impact the marginal cost include information asymmetries, positive and negative externalities, transaction costs, and price discrimination. Marginal cost is not related to fixed costs. An example of calculating marginal cost is: the production of one pair of shoes is $30. The total cost for making two pairs of shoes is $40. The marginal cost of producing the second pair of shoes is $10.

Average Cost

The average cost is the total cost divided by the number of goods produced. It is also equal to the sum of average variable costs and average fixed costs. Average cost can be influenced by the time period for production (increasing production may be expensive or impossible in the short run). Average costs are the driving factor of supply and demand within a market. Economists analyze both short run and long run average cost. Short run average costs vary in relation to the quantity of goods being produced. Long run average cost includes the variation of quantities used for all inputs necessary for production.

Relationship Between Average and Marginal Cost

Average cost and marginal cost impact one another as production fluctuate :

Cost curve

This graph is a cost curve that shows the average total cost, marginal cost, and marginal revenue. The curves show how each cost changes with an increase in product price and quantity produced.

- When the average cost declines, the marginal cost is less than the average cost.

- When the average cost increases, the marginal cost is greater than the average cost.

- When the average cost stays the same (is at a minimum or maximum), the marginal cost equals the average cost.

9.2.3: Short Run and Long Run Costs

Long run costs have no fixed factors of production, while short run costs have fixed factors and variables that impact production.

Learning Objective

Explain the differences between short and long run costs

Key Points

- In the short run, there are both fixed and variable costs.

- In the long run, there are no fixed costs.

- Efficient long run costs are sustained when the combination of outputs that a firm produces results in the desired quantity of the goods at the lowest possible cost.

- Variable costs change with the output. Examples of variable costs include employee wages and costs of raw materials.

- The short run costs increase or decrease based on variable cost as well as the rate of production. If a firm manages its short run costs well over time, it will be more likely to succeed in reaching the desired long run costs and goals.

Key Terms

- fixed cost

-

Business expenses that are not dependent on the level of goods or services produced by the business.

- variable cost

-

A cost that changes with the change in volume of activity of an organization.

In economics, “short run” and “long run” are not broadly defined as a rest of time. Rather, they are unique to each firm.

Long Run Costs

Long run costs are accumulated when firms change production levels over time in response to expected economic profits or losses. In the long run there are no fixed factors of production. The land, labor, capital goods, and entrepreneurship all vary to reach the the long run cost of producing a good or service. The long run is a planning and implementation stage for producers. They analyze the current and projected state of the market in order to make production decisions. Efficient long run costs are sustained when the combination of outputs that a firm produces results in the desired quantity of the goods at the lowest possible cost. Examples of long run decisions that impact a firm’s costs include changing the quantity of production, decreasing or expanding a company, and entering or leaving a market.

Short Run Costs

Short run costs are accumulated in real time throughout the production process. Fixed costs have no impact of short run costs, only variable costs and revenues affect the short run production. Variable costs change with the output. Examples of variable costs include employee wages and costs of raw materials. The short run costs increase or decrease based on variable cost as well as the rate of production. If a firm manages its short run costs well over time, it will be more likely to succeed in reaching the desired long run costs and goals.

Differences

The main difference between long run and short run costs is that there are no fixed factors in the long run; there are both fixed and variable factors in the short run . In the long run the general price level, contractual wages, and expectations adjust fully to the state of the economy. In the short run these variables do not always adjust due to the condensed time period. In order to be successful a firm must set realistic long run cost expectations. How the short run costs are handled determines whether the firm will meet its future production and financial goals.

Cost curve

This graph shows the relationship between long run and short run costs.

9.2.4: Economies and Diseconomies of Scale

Increasing, constant, and diminishing returns to scale describe how quickly output rises as inputs increase.

Learning Objective

Identify the three types of returns to scale and describe how they occur

Key Points

- In economics, returns to scale describes what happens when the scale of production increases over the long run when all input levels are variable (chosen by the firm).

- Increasing returns to scale (IRS) refers to a production process where an increase in the number of units produced causes a decrease in the average cost of each unit.

- Constant returns to scale (CRS) refers to a production process where an increase in the number of units produced causes no change in the average cost of each unit.

- Diminishing returns to scale (DRS) refers to production where the costs for production do not decrease as a result of increased production. The DRS is the opposite of the IRS.

Key Terms

- average cost

-

In economics, average cost or unit cost is equal to total cost divided by the number of goods produced.

- return to scale

-

A term referring to changes in output resulting from a proportional change in all inputs (where all inputs increase by a constant factor).

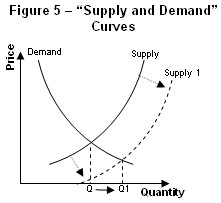

In economics, returns to scale describes what happens when the scale of production increases over the long run when all input levels are variable (chosen by the firm). Returns to scale explains how the rate of increase in production is related to the increase in inputs in the long run. There are three stages in the returns to scale: increasing returns to scale (IRS), constant returns to scale (CRS), and diminishing returns to scale (DRS). Returns to scale vary between industries, but typically a firm will have increasing returns to scale at low levels of production, decreasing returns to scale at high levels of production, and constant returns to scale at some point in the middle .

Long Run ATC Curves

This graph shows that as the output (production) increases, long run average total cost curve decreases in economies of scale, constant in constant returns to scale, and increases in diseconomies of scale.

Increasing Returns to Scale

The first stage, increasing returns to scale (IRS) refers to a production process where an increase in the number of units produced causes a decrease in the average cost of each unit. In other words, a firm is experiencing IRS when the cost of producing an additional unit of output decreases as the volume of its production increases. IRS may take place, for example, if the cost of production of a manufactured good would decrease with the increase in quantity produced due to the production materials being obtained at a cheaper price.

Constant Return to Scale

The second stage, constant returns to scale (CRS) refers to a production process where an increase in the number of units produced causes no change in the average cost of each unit. If output changes proportionally with all the inputs, then there are constant returns to scale.

Diminishing Return to Scale

The final stage, diminishing returns to scale (DRS) refers to production for which the average costs of output increase as the level of production increases. The DRS is the opposite of the IRS. DRS might occur if, for example, a furniture company was forced to import wood from further and further away as its operations increased.

9.2.5: Economic Costs

The economic cost is based on the cost of the alternative chosen and the benefit that the best alternative would have provided if chosen.

Learning Objective

Break down the components of a firm’s economic costs

Key Points

- Economic cost takes into account costs attributed to the alternative chosen and costs specific to the forgone opportunity.

- Components of economic cost include total cost, variable cost, fixed cost, average cost, and marginal cost.

- Cost curves – a graph of the costs of production as a function of total quantity produced. In a free market economy, firms use cost curves to find the optimal point of production (to minimize cost). Maximizing firms use the curves to decide output quantities to achieve production goals.

- Average cost (AC) – total costs divided by output (AC = TFC/q + TVC/q).

- Marginal cost (MC) – the change in the total cost when the quantity produced changes by one unit.

- Cost curves – a graph of the costs of production as a function of total quantity produced. In a free market economy, firms use cost curves to find the optimal point of production (to minimize cost). Maximizing firms use the curves to decide output quantities to achieve production goals.

Key Terms

- economic cost

-

The accounting cost plus opportunity cost.

- cost

-

A negative consequence or loss that occurs or is required to occur.

- Opportunity cost

-

The cost of any activity measured in terms of the value of the next best alternative forgone (that is not chosen).

Example

- An example of economic cost would be the cost of attending college. The accounting cost includes all charges such as tuition, books, food, housing, and other expenditures. The opportunity cost includes the salary or wage the individual could be earning if he was employed during his college years instead of being in school. So, the economic cost of college is the accounting cost plus the opportunity cost.

Economic Cost

Throughout the production of a good or service, a firm must make decisions based on economic cost. The economic cost of a decision is based on both the cost of the alternative chosen and the benefit that the best alternative would have provided if chosen. Economic cost includes opportunity cost when analyzing economic decisions.

An example of economic cost would be the cost of attending college. The accounting cost includes all charges such as tuition, books, food, housing, and other expenditures. The opportunity cost includes the salary or wage the individual could be earning if he was employed during his college years instead of being in school. So, the economic cost of college is the accounting cost plus the opportunity cost.

Components of Economic Costs

Economic cost takes into account costs attributed to the alternative chosen and costs specific to the forgone opportunity. Before making economic decisions, there are a series of components of economic costs that a firm will take into consideration. These components include:

- Total cost (TC): total cost equals total fixed cost plus total variable costs (TC = TFC + TVC) .

- Variable cost (VC): the cost paid to the variable input. Inputs include labor, capital, materials, power, land, and buildings. Variable input is traditionally assumed to be labor.

- Total variable cost (TVC): same as variable costs.

- Fixed cost (FC): the costs of the fixed assets (those that do not vary with production).

- Total fixed cost (TFC): same as fixed cost.

- Average cost (AC): total costs divided by output (AC = TFC/q + TVC/q).

- Average fixed cost (AFC): the fixed costs divided by output (AFC = TFC/q). The average fixed cost function continuously declines as production increases.

- Average variable cost (AVC): variable costs divided by output (AVC = TVC/q). The average variable cost curve is normally U-shaped. It lies below the average cost curve, starting to the right of the y axis.

- Marginal cost (MC): the change in the total cost when the quantity produced changes by one unit.

- Cost curves: a graph of the costs of production as a function of total quantity produced. In a free market economy, firms use cost curves to find the optimal point of production (to minimize cost). Maximizing firms use the curves to decide output quantities to achieve production goals.

9.3: Economic Profit

9.3.1: Difference Between Economic and Accounting Profit

Economic profit consists of revenue minus implicit (opportunity) and explicit (monetary) costs; accounting profit consists of revenue minus explicit costs.

Learning Objective

Distinguish between economic profit and accounting profit

Key Points

- Explicit costs are monetary costs a firm has. Implicit costs are the opportunity costs of a firm’s resources.

- Accounting profit is the monetary costs a firm pays out and the revenue a firm receives. It is the bookkeeping profit, and it is higher than economic profit. Accounting profit = total monetary revenue- total costs.

- Economic profit is the monetary costs and opportunity costs a firm pays and the revenue a firm receives. Economic profit = total revenue – (explicit costs + implicit costs).

Key Terms

- explicit cost

-

A direct payment made to others in the course of running a business, such as wages, rent, and materials, as opposed to implicit costs, which are those where no actual payment is made.

- implicit cost

-

The opportunity cost equal to what a firm must give up in order to use factors which it neither purchases nor hires.

- economic profit

-

The difference between the total revenue received by the firm from its sales and the total opportunity costs of all the resources used by the firm.

- accounting profit

-

The total revenue minus costs, properly chargeable against goods sold.

Example

- Consider a simplified example of a firm. In one year, it cost $60,000 to maintain production, but earned $100,000 in revenue. The accounting profit would be $40,000 ($100,000 in revenue – $60,000 in explicit costs). However, if the firm could have made $50,000 by renting its land and capital, its economic profit would be a loss of $10,000 ($100,000 in revenue – $60,000 in explicit costs – $50,000 in opportunity costs).

The term “profit” may bring images of money to mind, but to economists, profit encompasses more than just cash. In general, profit is the difference between costs and revenue, but there is a difference between accounting profit and economic profit. The biggest difference between accounting and economic profit is that economic profit reflects explicit and implicit costs, while accounting profit considers only explicit costs.

Explicit and Implicit Costs

Explicit costs are costs that involve direct monetary payment. Wages paid to workers, rent paid to a landowner, and material costs paid to a supplier are all examples of explicit costs.

In contrast, implicit costs are the opportunity costs of factors of production that a producer already owns. The implicit cost is what the firm must give up in order to use its resources; in other words, an implicit cost is any cost that results from using an asset instead of renting, selling, or lending it. For example, a paper production firm may own a grove of trees. The implicit cost of that natural resource is the potential market price the firm could receive if it sold it as lumber instead of using it for paper production.

Accounting Profit

Accounting profit is the difference between total monetary revenue and total monetary costs, and is computed by using generally accepted accounting principles (GAAP). Put another way, accounting profit is the same as bookkeeping costs and consists of credits and debits on a firm’s balance sheet. These consist of the explicit costs a firm has to maintain production (for example, wages, rent, and material costs). The monetary revenue is what a firm receives after selling its product in the market.

Accounting profit is also limited in its time scope; generally, accounting profit only considers the costs and revenue of a single period of time, such as a fiscal quarter or year.

Economic Profit

Economic profit is the difference between total monetary revenue and total costs, but total costs include both explicit and implicit costs. Economic profit includes the opportunity costs associated with production and is therefore lower than accounting profit. Economic profit also accounts for a longer span of time than accounting profit. Economists often consider long-term economic profit to decide if a firm should enter or exit a market.

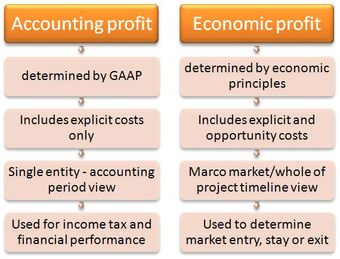

Economic vs. Accounting Profit

The biggest difference between economic and accounting profit is that economic profit takes implicit, or opportunity, costs into consideration.

9.3.2: Sources and Determinants of Profit

Whether economic profit exists or not depends how competitive the market is, and the time horizon that is being considered.

Learning Objective

Describe sources of economic profit

Key Points

- Economic profit = total revenue – (explicit costs + implicit costs). Accounting profit = total revenue – explicit costs.

- Economic profit can be positive, negative, or zero. If economic profit is positive, there is incentive for firms to enter the market. If profit is negative, there is incentive for firms to exit the market. If profit is zero, there is no incentive to enter or exit.

- For a competitive market, economic profit can be positive in the short run. In the long run, economic profit must be zero, which is also known as normal profit. Economic profit is zero in the long run because of the entry of new firms, which drives down the market price.

- For an uncompetitive market, economic profit can be positive. Uncompetitive markets can earn positive profits due to barriers to entry, market power of the firms, and a general lack of competition.

Key Term

- normal profit

-

The opportunity cost of an entrepreneur to operate a firm; the next best amount the entrepreneur could earn doing another job.

Example

- Consider a shoe production firm that is in a competitive market. In one year, the firm earns a total revenue of $50,000, while spending $15,000 on production (explicit costs) and having $10,000 in foregone wages, rent, and interest (opportunity costs). Consequently, the firm earns $25,000 in economic profit. Attracted by the potential to earn profit, other firms enter the market. Eventually, the firm’s revenue will fall as market price decreases, until the total revenue just covers production costs and opportunity costs, and economic profit equals zero.

Economic profit is total revenue minus explicit and implicit (opportunity) costs. In contrast, accounting profit is the difference between total revenue and explicit costs- it does not take opportunity costs into consideration, and is generally higher than economic profit.

Economic profits may be positive, zero, or negative. If economic profit is positive, other firms have an incentive to enter the market. If profit is zero, other firms have no incentive to enter or exit. When economic profit is zero, a firm is earning the same as it would if its resources were employed in the next best alternative. If the economic profit is negative, firms have the incentive to leave the market because their resources would be more profitable elsewhere. The amount of economic profit a firm earns is largely dependent on the degree of market competition and the time span under consideration.

Competitive Markets

In competitive markets, where there are many firms and no single firm can affect the price of a good or service, economic profit can differ in the short-run and in the long-run.

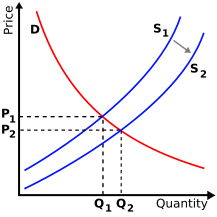

In the short run, a firm can make an economic profit. However, if there is economic profit, other firms will want to enter the market. If the market has no barriers to entry, new firms will enter, increase the supply of the commodity, and decrease the price. This decrease in price leads to a decrease in the firm’s revenue, so in the long-run, economic profit is zero . An economic profit of zero is also known as a normal profit. Despite earning an economic profit of zero, the firm may still be earning a positive accounting profit.

Long-Run Profit for Perfect Competition

In the long run for a firm in a competitive market, there is zero economic profit. Graphically, this is seen at the intersection of the price level with the minimum point of the average total cost (ATC) curve. If the price level were set above ATC’s minimum point, there would be positive economic profit; if the price level were set below ATC’s minimum, there would be negative economic profit.

Uncompetitive Markets

Unlike competitive markets, uncompetitive markets – characterized by firms with market power or barriers to entry – can make positive economic profits. The reasons for the positive economic profit are barriers to entry, market power, and a lack of competition.

- Barriers to entry prevent new firms from easily entering the market, and sapping short-run economic profits.

- Market power, or the ability to affect market prices, allows firms to set a price that is higher than the equilibrium price of a competitive market. This allows them to make profits in the short run and in the long run. This situation can occur if the market is dominated by a monopoly (a single firm), oligopoly (a few firms with significant market control), or monopolistic competition (firms have market power due to having differentiated products). .

- Lack of competition keeps prices higher than the competitive market equilibrium price. For example, firms can collude and work together to restrict supply to artificially keep prices high.

Long-Run Profit for Monopoly

In the long run, a monopoly, because of its market power, can set a price above the competitive equilibrium and earn economic profit. If price were set equal to the minimum point of the average total cost (ATC) curve, the monopoly would earn zero economic profit. If the price were set lower than the minimum of ATC, the firm would earn negative economic profit.

Chapter 8: Market Failure: Public Goods and Common Resources

8.1: Public Goods

8.1.1: Defining a Good

There are four types of goods in economics, which are defined based on excludability and rivalrousness in consumption.

Learning Objective

Define a good

Key Points

- Private goods are excludable and rival. Examples of private goods include food and clothes.

- Common goods are non-excludable and rival. A classic example is fish stocks in international waters.

- Club goods are excludable but non-rival. Cable television is an example.

- Public goods are non-excludable and non-rival. They include public parks and the air we breathe.

Key Terms

- Rival

-

A good whose consumption by one consumer prevents simultaneous consumption by other consumers

- Excludable

-

A good for which it is possible to prevent consumers who have not paid for it from having access to it.

There are four categories of goods in economics, which are defined based on two attributes. The first attribute is excludability, or whether people can be prevented from using the good. The second is whether a good is rival in consumption: whether one person’s use of the good reduces another person’s ability to use it.

National defense provides an example of a good that is non-excludable. America’s national defense establishment offers protection to everyone in the country. Items on sale in a store, on the other hand, are excludable. The store owner can prevent a customer from obtaining a good unless the customer pays for it. National defense also provides an example of a good that is non-rivalrous. One person’s protection does not prevent another person from receiving protection. In contrast, shoes are rivalrous. Only one person can wear a pair of shoes at a time.

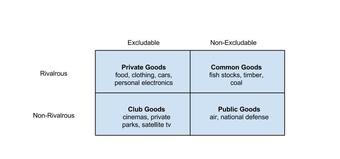

Combinations of these two attributes create four categories of goods :

Four Types of Goods

There are four categories of goods in economics, based on whether the goods are excludable and/or rivalrous in consumption.

- Private goods: Private goods are excludable and rival. Examples of private goods include food, clothes, and flowers. There are usually limited quantities of these goods, and owners or sellers can prevent other individuals from enjoying their benefits. Because of their relative scarcity, many private goods are exchanged for payment.

- Common goods: Common goods are non-excludable and rival. Because of these traits, common goods are easily over-consumed, leading to a phenomenon called “tragedy of the commons. ” In this situation, people withdraw resources to secure short-term gains without regard for the long-term consequences. A classic example of a common good are fish stocks in international waters. No one is excluded from fishing, but as people withdraw fish without limits being imposed, the stocks for later fishermen are depleted.

- Club goods: Club goods are excludable but non-rival. This type of good often requires a “membership” payment in order to enjoy the benefits of the goods. Non-payers can be prevented from access to the goods. Cable television is a classic example. It requires a monthly fee, but is non-rival after the payment.

- Public goods: Public goods are non-excludable and non-rival. Individuals cannot be effectively excluded from using them, and use by one individual does not reduce the good’s availability to others. Examples of public goods include the air we breathe, public parks, and street lights. Public goods may give rise to the “free rider problem. ” A free-rider is a person who receives the benefit of a good without paying for it. This may lead to the under-provision of certain goods or services.

8.1.2: Private Goods

A private good is both excludable and rivalrous.

Learning Objective

Define a private good

Key Points

- The owners or sellers of private goods exercise private property rights over them.

- A consumer generally has to pay for a private good.

- Generally, the market will efficiently allocate resources for the production of private goods.

Key Terms

- Excludable

-

A good for which it is possible to prevent consumers who have not paid for it from having access to it.

- Rivalrous

-

A good whose consumption by one consumer prevents simultaneous consumption by other consumers.

In economics, a private good is defined as an asset that is both excludable and rivalrous. It is excludable in that it is possible to exercise private property rights over it, preventing those who have not paid from using the good or consuming its benefits. For example, person A may have the means and will to pay $20 for a t-shirt. Person B may not wish to pay $20 or may not be able to do so. Person B would not be able to purchase the t-shirt. Additionally, the private good is rivalrous in that its consumption by one person necessarily prevents consumption by another. When person A purchases and drinks a bottle of water, the same bottle of water is not available for person B to purchase and consume.

A private good is a scare economic resource, which causes competition for it. Generally, people have to pay to enjoy the benefits of a private good. Because people have to pay to obtain it, private goods are much less likely to encounter a free-rider problem than public goods. Thus, generally, the market will efficiently allocate resources to produce private goods.

In daily life, examples of private goods abound, including food, clothing, and most other goods that can be purchased in a store. Take an example of an ice cream cone . It is both excludable and rivalrous. It is possible to prevent someone from consuming the ice cream by simply refusing to sell it to them. Additionally, it can be consumed only once, so its consumption by one individual would definitely reduce others’ ability to consume it.

Ice Cream Cone

An ice cream cone is an example of a private good. It is excludable and rival.

8.1.3: Public Goods

Individuals cannot be excluded from using a public good, and one individual’s use of it does not limit its availability to others.

Learning Objective

Define a public good

Key Points

- A public good is both non-excludable and non-rivalrous.

- Pure public goods are perfectly non-rival in consumption and non-excludable. Impure public goods satisfy those conditions to some extent, but not perfectly.

- Public goods provide an example of market failure. Because of the free-rider problem, they may be underpoduced.

Key Terms

- free rider

-

Someone who enjoys the benefits of a good without paying for it

- Non-excludable

-

Non-paying consumers cannot be prevented from accessing a good

- Non-rivalrous

-

A good whose consumption by one consumer does not prevent simultaneous consumption by other consumers

A public good is a good that is both non-excludable and non-rivalrous. This means that individuals cannot be effectively excluded from its use, and use by one individual does not reduce its availability to others. Examples of public goods include fresh air, knowledge, lighthouses, national defense, flood control systems, and street lighting .

Streetlight

A streetlight is an example of a public good. It is non-excludable and non-rival in consumption.

Public goods can be pure or impure. Pure public goods are those that are perfectly non-rivalrous in consumption and non-excludable. Impure public goods are those that satisfy the two conditions to some extent, but not fully.

The production of public goods results in positive externalities for which producers don’t receive full payment. Consumers can take advantage of public goods without paying for them. This is called the “free-rider problem. ” If too many consumers decide to “free-ride,” private costs to producers will exceed private benefits, and the incentive to provide the good or service through the market will disappear. The market will thus fail to provide enough of the good or service for which there is a need.

For example, a local public radio station relies on support from listeners to operate. The station holds pledge drives several times a year, asking listeners to make contributions or face possible reduction in programming. Yet only a small percentage of the audience makes contributions. Some audience members may even listen to the station for years without ever making a payment. Those listeners who do not make a contribution are “free-riders. ” If the station relies solely on funds contributed by listeners, it would under-produce programming. It must obtain additional funding from other sources (such as the government) in order to continue to operate.

8.1.4: Optimal Quantity of a Public Good

The government is providing an efficient quantity of a public good when its marginal benefit equals its marginal cost.

Learning Objective

Explain the optimal quantity of a public good

Key Points

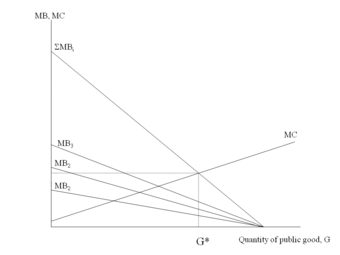

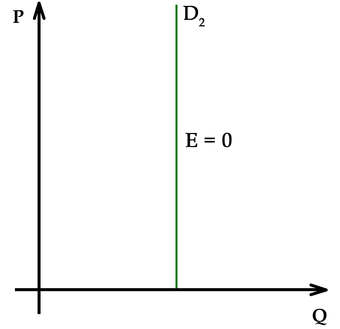

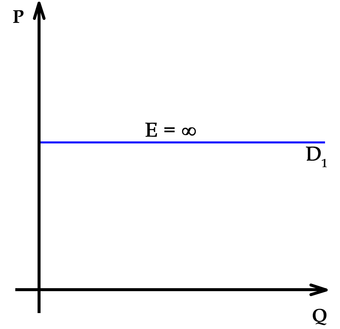

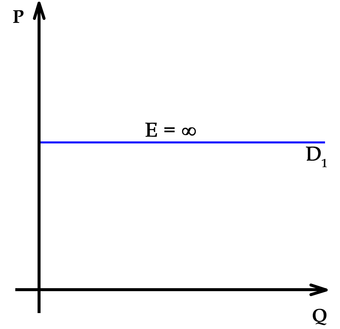

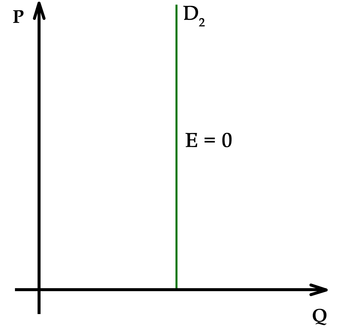

- Collective demand for a public good is the vertical summation of individual demand curves. It shows the price society is willing to pay for a given quantity of a public good.

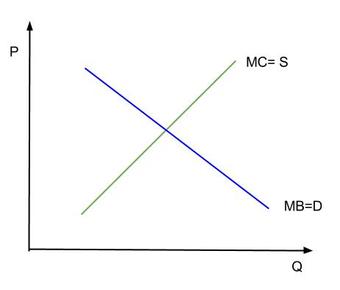

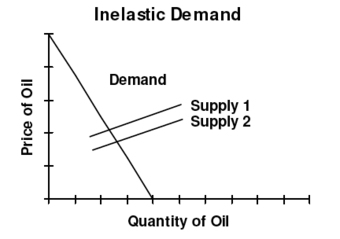

- The demand curve for a public good is downward sloping, due to the law of diminishing marginal utility. The supply curve is upward sloping, due to the law of diminishing returns.

- The optimal quantity of a public good occurs where the demand (marginal benefit) curve intersects the supply (marginal cost) curve.

- The government uses cost-benefit analysis to decide whether to provide a particular good. If MB is greater than MC there is an underallocation of a public good. If MC is greater than MB there is an overallocation of a public good. When MC = MB then there is an optimal allocation of public goods.

Key Term

- Cost-benefit analysis

-

A systematic process for calculating and comparing the marginal benefits and marginal costs of a project or activity.

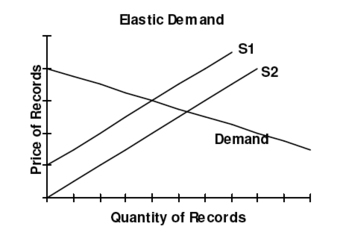

To determine the optimal quantity of a public good, it is necessary to first determine the demand for it. Demand for public goods is represented through price-quantity schedules, which show the price someone is willing to pay for the extra unit of each possible quantity. Unlike the market demand curve for private goods, where individual demand curves are summed horizontally, individual demand curves for public goods are summed vertically to get the market demand curve. As a result, the market demand curve for public goods gives the price society is willing to pay for a given quantity. It is equal to the marginal benefit curve. Due to the law of diminishing marginal utility, the demand curve is downward sloping.

Often, the government supplies the public good. The supply curve for a public good is equal to its marginal cost curve. Because of the law of diminishing returns, the marginal cost increases as the quantity of the good produced increases. The supply curve therefore has an upward slope.

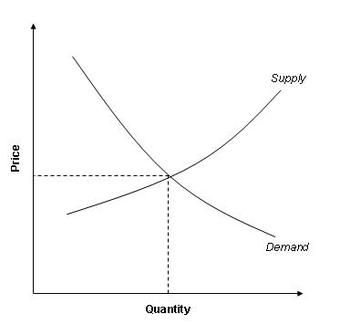

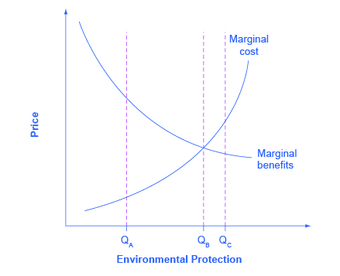

As already noted, the demand curve is equal to the marginal benefit curve, while the supply curve is equal to the marginal cost curve. The optimal quantity of the public good occurs where MB (society’s marginal benefit) equals MC (provider’s marginal cost), or where the two curves intersect . When MB = MC, resources have been allocated efficiently.

Optimal Quantity of a Public Good

The optimal quantity of public good occurs where MB = MC.

The public good provider uses cost-benefit analysis to decide whether to provide a particular good by comparing marginal costs and marginal benefits. Cost-benefit analysis can also help the provider decide the extent to which a project should be pursued. Output activity should be increased as long as the marginal benefit exceeds the marginal cost. An activity should not be pursued when the marginal benefit is less than the marginal cost. An activity should be stopped at the point where MB equals MC. This is the MC=MB rule, by which the provider of the public good can determine which plan, will give society maximum net benefit.

8.1.5: Demand for Public Goods

The aggregate demand curve for a public good is the vertical summation of individual demand curves.

Learning Objective

Analyze the demand for a public good.

Key Points

- For public goods, aggregate demand is the sum of marginal benefits to each person at each quantity of the good provided.

- As for private goods, the individual demand curves show the price someone is willing to pay for an extra unit of each possible quantity of a good.

- The efficient quantity of a public good is the quantity at which marginal benefit equals marginal cost.

- The efficient quantity of a public good is the quantity at which marginal benefit equals marginal cost.

Key Term

- public good

-

A good that is non-rivalrous and non-excludable.

The aggregate demand for a public good is derived differently from the aggregate demand for private goods.

To an individual consumer, the total benefit of a public good is the dollar value that he or she places on a given level of provision of the good. The marginal benefit for an individual is the increase in the total benefit that results from a one-unit increase in the quantity provided. The marginal benefit of a public good diminishes as the level of the good provided increases.

Public goods are non-rivalrous, so everyone can consume each unit of a public good. They also have a fixed market quantity: everyone in society must agree on consuming the same amount of the good. However, each individual’s willingness to pay for the quantity provided may be different. The individual demand curves show the price someone is willing to pay for an extra unit of each possible quantity of the public good.

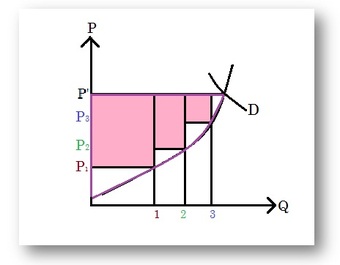

The aggregate demand for a public good is the sum of marginal benefits to each person at each quantity of the good provided . The economy’s marginal benefit curve (demand curve) for a public good is thus the vertical sum all individual’s marginal benefit curves. The vertical summation of individual demand curves for public goods also gives the aggregate willingness to pay for a given quantity of the good.

Demand for a Public Good

The sum of the individual marginal benefit curves (MB) represent the aggregate willingness to pay or aggregate demand (∑MB). The intersection of the aggregate demand and the marginal cost curve (MC) determines the amount of the good provided.

This is in contrast to the aggregate demand curve for a private good, which is the horizontal sum of the individual demand curves at each price. Unlike public goods, society does not have to agree on a given quantity of a private good, and any one person can consume more of the private good than another at a given price.

The efficient quantity of a public good is the quantity that maximizes net benefit (total benefit minus total cost), which is the same as the quantity at which marginal benefit equals marginal cost.

8.1.6: Cost-Benefit Analysis

The government uses cost-benefit analysis to decide whether to provide a public good.

Learning Objective

Explain how to determine the net cost/benefit of providing a public good

Key Points

- Cost-benefit analysis is a systematic way of calculating the costs and benefits of a project to society as a whole.

- Benefits and costs are expressed in monetary terms and are adjusted for the time-value of money.

- Financial costs are much easier to capture in the analysis than non-financial welfare impacts, such as impacts on human life or the environment.

- The government should provide a public good if the benefits to society outweigh the costs.

Key Term

- net present value

-

The present value of a project determined by summing the discounted incoming and outgoing future cash flows resulting from the decision.

The government uses cost-benefit analysis to decide whether to provide a particular public good and how much of it to provide. Cost-benefit analysis, which is also sometimes called benefit-cost analysis, is a systematic process for calculating the benefits and costs of a project to society as a whole.

The positive and negative effects captured by cost-benefit analysis may include effects on consumers, effects on non-consumers, externality effects, or other social benefits or costs. The guiding principle is to list all parties affected by a project and add a negative or positive value that they ascribe to the project’s effect on their welfare. Benefits and costs are expressed in monetary terms, and are adjusted for the time value of money, so that all flows of benefits and costs over time are expressed on a common basis in terms of their net present value. Financial costs tend to be most thoroughly represented in cost-benefit analyses due to relatively abundant market data. It is much more difficult to capture non-financial welfare impacts. For example, it is very difficult to place a dollar value on human life, consumers’ time, or environmental impact.

Imagine that the government is considering a project to widen a highway . The benefits side of the analysis might include time savings for passengers who can now avoid traffic, an increase in the number of passenger trips (as more people could now use the road), and lives saved by dint of fewer car accidents. The cost side of the analysis would include the cost of land that must be acquired prior to construction, construction, and maintenance. These costs and benefits will need to be translated into monetary terms for the sake of analysis.

The Highway as a Public Good

The benefits of a highway expansion project might include time savings for passengers, additional passenger trips, and saved lives. Costs might include construction and maintenance.

The procedure for conducting cost-benefit analysis is as follows:

- Identify project(s) to be analyzed.

- Estimate all costs and benefits to society associated with the project(s) over a relevant time horizon.

- Assign a monetary value to all costs and benefits.

- Calculate the net benefit of the project (total benefit minus total cost).

- Adjust for inflation and apply the discount rate to calculate present value of the project.

- Calculate the net present value for the project(s).

- Make recommendation about project(s). If the benefit outweighs the cost, then the government should proceed with the project.

8.2: Common Resources

8.2.1: The Tragedy of the Commons

The tragedy of the commons is the overexploitation of a common good by individual, rational actors.

Learning Objective

Describe the tragedy of the commons

Key Points

- Common goods are non-excludable and rivalrous.

- When individuals act independently and rationally, they may collectively trade long-term benefit for short-term gain.

- Enlightened self-interest and government intervention are two ways that the tragedy of the commons may be avoided.

Key Terms

- Common good

-

Goods which are rivalrous and non-excludable.

- Enlightened Self-Interest

-

The ability for individuals to realize when their actions, collectively, will trade long-term benefit for short-term gain.

Example

- The population of tuna may be depleted if fishermen are allowed to catch as much as they want. To make more profit, fishermen must catch more fish, which leads to overfishing. To prevent the tragedy of the commons, governments may implement market-based solutions.

Common Goods

Common goods are goods that are rivalrous and non-excludable. This means that anyone has access to the good, but that the use of the good by one person reduces the ability of someone else to use it. A classic example of a common good are fish stocks in international waters; no one is excluded from fishing, but as people withdraw fish without limits being imposed, the stocks for later fishermen are potentially depleted.

Tragedy of Commons

The tragedy of the commons is the depletion of a common good by individuals who are acting independently and rationally according to each one’s self-interest. Consider, the example of fish in international waters. Each individual fisherman, acting independently, will rationally choose to catch some of the fish to sell. This makes sense: there is a resource that the fisherman is able to use to generate a profit. However, when a lot of fishermen, all thinking this way, catch the fish, the total stock of fish may be depleted. When the stock of fish is depleted, none of the fishermen are able to continue fishing, even though, in the long run, each fisherman would have preferred that the fish not be depleted. The tragedy of the commons describes such situations in which people withdraw resources to secure short-term gains without regard for the long-term consequences.

Not all common goods, however, suffer from the tragedy of the commons. If individuals have enlightened self-interest, they will realize the negative long-term effects of their short-term decisions. This would be the same as the fishermen realizing that they should limit their fishing to preserve the stock of fish in the long-term.

In the absence of enlightened self-interest, the government may step in and impose regulations or taxes to discourage the behavior that leads to the tragedy of the commons. This would be like the government imposing limits on the amount of fish that can be caught.

Bluefin Tuna Caught in Net

Fish populations are at risk of becoming fully extinct due to overfishing. The Food and Agriculture Association estimated 70% of the world’s fish species are either fully exploited or depleted.

8.2.2: The Free-Rider Problem

The free-rider problem is when individuals benefit from a public good without paying their share of the cost.

Learning Objective

Describe the Free-Rider Problem

Key Points

- Public goods are non-excludable, but have a cost, so those who don’t pay their share of the cost can still easily benefit from the good.

- Free-riders have an incentive to free ride because they can benefit from a good at a reduced personal cost.

- The providers of public goods often create enforcement mechanisms to mitigate the free-rider problem.

Key Term

- public good

-

A good that is non-rivalrous and non-excludable.

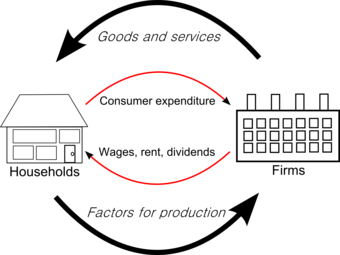

It is easy to think about public goods as free. In your everyday life, you benefit from public goods such as roads and bridges even though no transaction occurs when you use them. However, even public goods need to be paid for. In the case of roads and bridges, everyone pays taxes to the government, who then uses the taxes to pay for public goods .

Roads

Free riders are able to use roads without paying their taxes because roads are a non-excludable public good.

Public goods, as you may recall, are both non-rivalrous and non-excludable. It is the second trait- the non-excludability- that leads to what is called the free-rider problem. The free-rider problem is that some people may benefit from a public good without paying their share of the cost.

Since public goods are non-excludable, free-riders not only can’t be prevented from using the good, but actually have an incentive to continue to free-ride. If they will be able to use the public good whether they pay their share of the costs, they might as well not pay.

Take the military, for example. National security is a public good: it is both non-rivalrous and non-excludable. In order to have such a public good, everyone pays taxes which are then used by the government to finance the military. However, there are undoubtedly people who have not paid their taxes. These people, without having paid their share of the cost of having a military, still benefit from the protection the military provides. They are free-riders.

Of course, there are commonly regulations that attempt to discourage free-riding. For government-provided public goods, the government makes sure that everyone pays their share of the costs by enforcing tax laws. The threat of fines or jail time are enough of a threat that most people find it more appealing (in the US, at least) to pay their share of public goods via taxes than to free-ride.

Chapter 7: Market Failure: Externalities

7.1: Introducing Market Failure

7.1.1: Defining Market Failure

Market failure occurs when the price mechanism fails to account for all of the costs and benefits necessary to provide and consume a good.

Learning Objective

Identify common market failures and governmental responses

Key Points

- Prior to market failure, the supply and demand within the market do not produce quantities of the goods where the price reflects the marginal benefit of consumption.

- The structure of market systems contributes to market failure. In the real world, it is not possible for markets to be perfect due to inefficient producers, externalities, environmental concerns, and lack of public goods.

- Government responses to market failure include legislation, direct provision of merit goods and public goods, taxation, subsidies, tradable permits, extension of property rights, advertising, and international cooperation among governments.

Key Terms

- merit good

-

A commodity which is judged that an individual or society should have on the basis of some concept of need, rather than ability and willingness to pay.

- public good

-

A good that is both non-excludable and non-rivalrous in that individuals cannot be effectively excluded from use and where use by one individual does not reduce availability to others.

- externality

-

An impact, positive or negative, on any party not involved in a given economic transaction or act.

Market failure occurs when the price mechanism fails to account for all of the costs and benefits necessary to provide and consume a good. The market will fail by not supplying the socially optimal amount of the good.

Prior to market failure, the supply and demand within the market do not produce quantities of the goods where the price reflects the marginal benefit of consumption. The imbalance causes allocative inefficiency, which is the over- or under-consumption of the good.

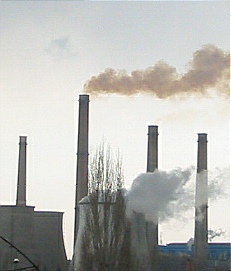

The structure of market systems contributes to market failure. In the real world, it is not possible for markets to be perfect due to inefficient producers, externalities, environmental concerns, and lack of public goods. An externality is an effect on a third party which is caused by the production or consumption of a good or service .

Air pollution

Air pollution is an example of a negative externality. Governments may enact tradable permits to try and reduce industrial pollution.

During market failures the government usually responds to varying degrees. Possible government responses include:

- legislation – enacting specific laws. For example, banning smoking in restaurants, or making high school attendance mandatory.

- direct provision of merit and public goods – governments control the supply of goods that have positive externalities. For example, by supplying high amounts of education, parks, or libraries.

- taxation – placing taxes on certain goods to discourage use and internalize external costs. For example, placing a ‘sin-tax’ on tobacco products, and subsequently increasing the cost of tobacco consumption.

- subsidies – reducing the price of a good based on the public benefit that is gained. For example, lowering college tuition because society benefits from more educated workers. Subsidies are most appropriate to encourage behavior that has positive externalities.

- tradable permits – permits that allow firms to produce a certain amount of something, commonly pollution. Firms can trade permits with other firms to increase or decrease what they can produce. This is the basis behind cap-and-trade, an attempt to reduce of pollution.

- extension of property rights – creates privatization for certain non-private goods like lakes, rivers, and beaches to create a market for pollution. Then, individuals get fined for polluting certain areas.

- advertising – encourages or discourages consumption.

- international cooperation among governments – governments work together on issues that affect the future of the environment.

7.1.2: Causes of Market Failure

Market failure occurs due to inefficiency in the allocation of goods and services.

Learning Objective

Explain some common causes of market failure

Key Points

- A price mechanism fails to account for all of the costs and benefits involved when providing or consuming a specific good. When this happens, the market will not produce the supply of the good that is socially optimal – it will be over or under produced.

- Due to the structure of markets, it may be impossible for them to be perfect.

- Reasons for market failure include: positive and negative externalities, environmental concerns, lack of public goods, underprovision of merit goods, overprovision of demerit goods, and abuse of monopoly power.

Key Terms

- free rider

-

One who obtains benefit from a public good without paying for it directly.

- public good

-

A good that is both non-excludable and non-rivalrous in that individuals cannot be effectively excluded from use and where use by one individual does not reduce availability to others.

- monopoly

-

A market where one company is the sole supplier.

Market failure occurs due to inefficiency in the allocation of goods and services. A price mechanism fails to account for all of the costs and benefits involved when providing or consuming a specific good. When this happens, the market will not produce the supply of the good that is socially optimal – it will be over or under produced.

In order to fully understand market failure, it is important to recognize the reasons why a market can fail. Due to the structure of markets, it is impossible for them to be perfect. As a result, most markets are not successful and require forms of intervention.

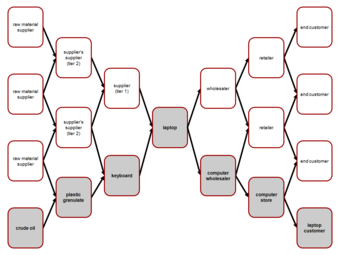

Reasons for market failure include:

- Positive and negative externalities: an externality is an effect on a third party that is caused by the consumption or production of a good or service . A positive externality is a positive spillover that results from the consumption or production of a good or service. For example, although public education may only directly affect students and schools, an educated population may provide positive effects on society as a whole. A negative externality is a negative spillover effect on third parties. For example, secondhand smoke may negatively impact the health of people, even if they do not directly engage in smoking.

- Environmental concerns: effects on the environment as important considerations as well as sustainable development.

- Lack of public goods: public goods are goods where the total cost of production does not increase with the number of consumers. As an example of a public good, a lighthouse has a fixed cost of production that is the same, whether one ship or one hundred ships use its light. Public goods can be underproduced; there is little incentive, from a private standpoint, to provide a lighthouse because one can wait for someone else to provide it, and then use its light without incurring a cost. This problem – someone benefiting from resources or goods and services without paying for the cost of the benefit – is known as the free rider problem.

- Underproduction of merit goods: a merit good is a private good that society believes is under consumed, often with positive externalities. For example, education, healthcare, and sports centers are considered merit goods.

- Overprovision of demerit goods: a demerit good is a private good that society believes is over consumed, often with negative externalities. For example, cigarettes, alcohol, and prostitution are considered demerit goods.

- Abuse of monopoly power: imperfect markets restrict output in an attempt to maximize profit.

When a market fails, the government usually intervenes depending on the reason for the failure.

7.1.3: Introducing Externalities

An externality is a cost or benefit that affects an otherwise uninvolved party who did not choose to be subject to the cost or benefit.

Learning Objective

Give examples of externalities that exist in different parts of socity

Key Points

- In regards to externalities, the cost and benefit to society is the sum of the benefits and costs for all parties involved.

- Market failure occurs when the price mechanism fails to consider all of the costs and benefits necessary for providing and consuming a good.

- In regards to externalities, one way to correct the issue is to internalize the third party costs and benefits. However, in many cases, internalizing the costs is not feasible. When externalities exist, it is possible that the particular industry will experience market failure.

- In many cases, the government intervenes when there is market failure.

Key Terms

- externality

-

An impact, positive or negative, on any party not involved in a given economic transaction or act.

- intervene

-

To interpose; as, to intervene to settle a quarrel; get involved, so as to alter or hinder an action.

In economics, an externality is a cost or benefit resulting from an activity or transaction, that affects an otherwise uninvolved party who did not choose to be subject to the cost or benefit . An example of an externality is pollution. Health and clean-up costs from pollution impact all of society, not just individuals within the manufacturing industries. In regards to externalities, the cost and benefit to society is the sum of the value of the benefits and costs for all parties involved.

Externality

An externality is a cost or benefit that results from an activity or transaction and that affects an otherwise uninvolved party who did not choose to incur that cost or benefit.

Negative vs. Positive

A negative externality is an result of a product that inflicts a negative effect on a third party . In contrast, positive externality is an action of a product that provides a positive effect on a third party.

Negative Externality

Air pollution caused by motor vehicles is an example of a negative externality.

Externalities originate within voluntary exchanges. Although the parties directly involved benefit from the exchange, third parties can experience additional effects. For those involuntarily impacted, the effects can be negative (pollution from a factory) or positive (domestic bees kept for honey production, pollinate the neighboring crops).

Economic Strain

Neoclassical welfare economics explains that under plausible conditions, externalities cause economic results that are not ideal for society. The third parties who experience external costs from a negative externality do so without consent, while the individuals who receive external benefits do not pay a cost. The existence of externalities can cause ethical and political problems within society.

In regards to externalities, one way to correct the issue is to internalize the third party costs and benefits. However, in many cases, internalizing the costs is not financially possible. Governments may step in to correct such market failures.

7.1.4: Externality Impacts on Efficiency

Economic efficiency is the use resources to maximize the production of goods; externalities are imperfections that limit efficiency.

Learning Objective

Analyze the effects of externalities on efficiency

Key Points

- An economically efficient society can produce more goods or services than another society without using more resources.

- An externality is a cost or benefit that results from an activity or transaction and affects a third party who did not choose to incur the cost or benefit. Externalities are either positive or negative depending on the nature of the impact on the third party.

- Neoclassical welfare economics states that the existence of externalities results in outcomes that are not ideal for society as a whole.

- In order to maximize economic efficiency, regulations are needed to reduce market failures and imperfections, like internalizing externalities. When market imperfections exist, the efficiency of the market declines.

- In order for economic efficiency to be achieved, one defining rule is that no one can be made better off without making someone else worse off. When externalities are present, not everyone benefits from the production of the good or service.

Key Terms

- efficient

-

Making good, thorough, or careful use of resources; not consuming extra. Especially, making good use of time or energy.

- externality

-

An impact, positive or negative, on any party not involved in a given economic transaction or act.

Economic Efficiency

In economics, the term “economic efficiency” is defined as the use of resources in order to maximize the production of goods and services. An economically efficient society can produce more goods or services than another society without using more resources.

A market is said to be economically efficient if:

- No one can be made better off without making someone else worse off.