19.1: Measuring Output Using GDP

19.1.1: Defining GDP

Gross domestic product is the market value of all final goods and services produced within the national borders of a country for a given period of time.

Learning Objective

Distinguish between the income and expenditure approaches of assessing GDP

Key Points

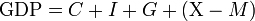

- GDP can be measured using the expenditure approach: Y = C + I + G + (X – M).

- GDP can be determined by summing up national income and adjusting for depreciation, taxes, and subsidies.

- GDP can be determined in two ways, both of which, in principle, give the same result.

Key Term

- GDP

-

Gross domestic product (GDP) is the market value of all officially recognized final goods and services produced within a country in a given period of time.

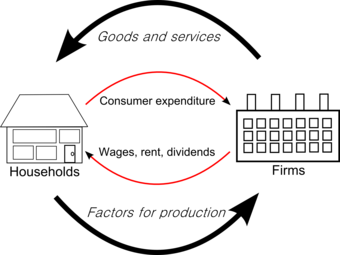

Gross domestic product (GDP) is the market value of all final goods and services produced within the national borders of a country for a given period of time. GDP can be determined in multiple ways. The income approach and the expenditure approach highlighted below should yield the same final GDP number .

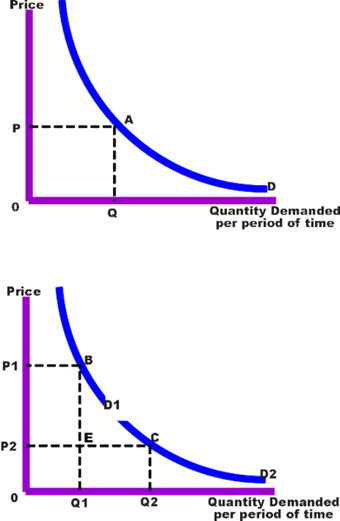

Simple view of expenditures

In an economy, households receive wages that they then use to purchase final goods and services. Since wages eventually are used in consumption (C), the expenditure approach to calculating GDP focuses on the end consumption expenditure to avoid double counting. The income approach, alternatively, would focus on the income made by households as one of its components to derive GDP.

Expenditure Approach

The expenditure approach attempts to calculate GDP by evaluating the sum of all final good and services purchased in an economy. The components of U.S. GDP identified as “Y” in equation form, include Consumption (C), Investment (I), Government Spending (G) and Net Exports (X – M).

Y = C + I + G + (X − M) is the standard equational (expenditure) representation of GDP.

- “C” (consumption) is normally the largest GDP component in the economy, consisting of private expenditures (household final consumption expenditure) in the economy. Personal expenditures fall under one of the following categories: durable goods, non-durable goods, and services.

- “I” (investment) includes, for instance, business investment in equipment, but does not include exchanges of existing assets. Spending by households (not government) on new houses is also included in Investment. “Investment” in GDP does not mean purchases of financial products. It is important to note that buying financial products is classed as ‘saving,’ as opposed to investment.

- “G” (government spending) is the sum of government expenditures on final goods and services. It includes salaries of public servants, purchase of weapons for the military, and any investment expenditure by a government. However, since GDP is a measure of productivity, transfer payments made by the government are not counted because these payment do not reflect a purchase by the government, rather a movement of income. They are captured in “C” when the payments are spent.

- “X” (exports) represents gross exports. GDP captures the amount a country produces, including goods and services produced for other nations’ consumption, therefore exports are added.

- “M” (imports) represents gross imports. Imports are subtracted since imported goods will be included in the terms “G”, “I”, or “C”, and must be deducted to avoid counting foreign supply as domestic.

Income Approach

The income approach looks at the final income in the country, these include the following categories taken from the U.S. “National Income and Expenditure Accounts”: wages, salaries, and supplementary labor income; corporate profits interest and miscellaneous investment income; farmers’ income; and income from non-farm unincorporated businesses. Two non-income adjustments are made to the sum of these categories to arrive at GDP:

- Indirect taxes minus subsidies are added to get from factor cost to market prices.

- Depreciation (or Capital Consumption Allowance) is added to get from net domestic product to gross domestic product.

19.1.2: Learning from GDP

GDP is a measure of national income and output that can be used as a comparison tool.

Learning Objective

Explain how GDP is calculated.

Key Points

- The output approach focuses on finding the total output of a nation by directly finding the total value of all goods and services a nation produces.

- The income approach equates the total output of a nation to the total factor income received by residents or citizens of the nation.

- The expenditure approach is basically an output accounting method. It focuses on finding the total output of a nation by finding the total amount of money spent.

Key Terms

- gross national product

-

The total market value of all the goods and services produced by a nation (citizens of a country, whether living at home or abroad) during a specified period.

- gross domestic product

-

A measure of the economic production of a particular territory in financial capital terms over a specific time period.

There are two commonly used measures of national income and output in economics, these include gross domestic product (GDP) and gross national product (GNP). These measures are focused on counting the total amount of goods and services produced within some “boundary” where the boundary is defined by either geography or citizenship.

Since GDP measures income and output, it can be used to compare two countries. The country with higher GDP is often regarded as wealthier, but, when using GDP to compare countries, it is important to remember to adjust for population.

GDP

GDP limits its focus to the value of goods or services in an actual geographic boundary of a country, where GNP is focused on the value of goods or services specifically attributable to citizens or nationality, regardless of where the production takes place. Over time GDP has become the standard metric used in national income reporting and most national income reporting and country comparisons are conducted using GDP.

GDP can be evaluated by using an output approach, income approach, or expenditure approach.

Output Approach

The output approach focuses on finding the total output of a nation by directly finding the total value of all goods and services a nation produces. Because of the complication of the multiple stages in the production of a good or service, only the final value of a good or service is included in the total output. This avoids an issue referred to as double counting, where the total value of a good is included several times in national output, by counting it repeatedly in several stages of production.

For example, in meat production, the value of the good from the farm may be $10, then $30 from the butchers, and then $60 from the supermarket. The value that should be included in final national output should be $60, not the sum of all those numbers, $90.

Formula: GDP (gross domestic product) at market price = value of output in an economy in the particular year – intermediate consumption at factor cost = GDP at market price – depreciation + NFIA (net factor income from abroad) – net indirect taxes.

Income Approach

The income approach equates the total output of a nation to the total factor income received by residents or citizens of the nation. The main types of factor income are:

- Employee compensation (cost of fringe benefits, including unemployment, health, and retirement benefits);

- Interest received net of interest paid;

- Rental income (mainly for the use of real estate) net of expenses of landlords;

- Royalties paid for the use of intellectual property and extractable natural resources.

All remaining value added generated by firms is called the residual or profit or business cash flow.

Formula: GDI (gross domestic income, which should equate to gross domestic product) = Compensation of employees + Net interest + Rental & royalty income + Business cash flow

Expenditure Approach

The expenditure approach is basically an output accounting method. It focuses on finding the total output of a nation by finding the total amount of money spent. This is acceptable, because like income, the total value of all goods is equal to the total amount of money spent on goods. The basic formula for domestic output takes all the different areas in which money is spent within the region, and then combines them to find the total output .

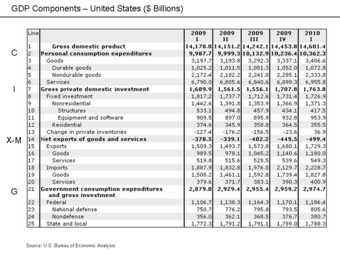

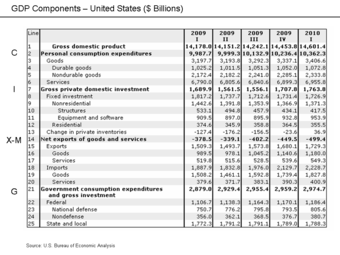

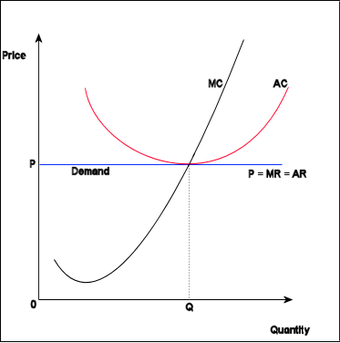

U.S. GDP Components

The components of GDP include consumption, investment, government spending, and net exports (exports minus imports).

Formula: Y = C + I + G + (X – M) ; where: C = household consumption expenditures / personal consumption expenditures, I = gross private domestic investment, G = government consumption and gross investment expenditures, X = gross exports of goods and services, and M = gross imports of goods and services.

19.1.3: The Circular Flow and GDP

In economics, the “circular flow” diagram is a simple explanatory tool of how the major elements in an economy interact with one another.

Learning Objective

Evaluate the effect of the circular flow on GDP

Key Points

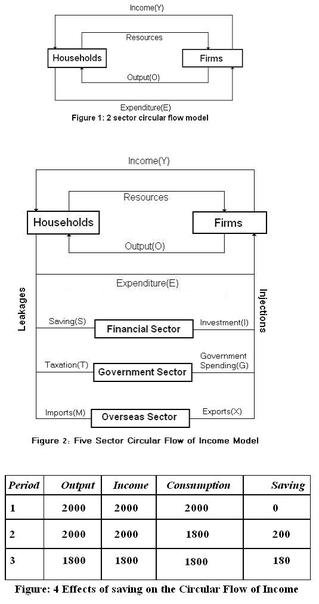

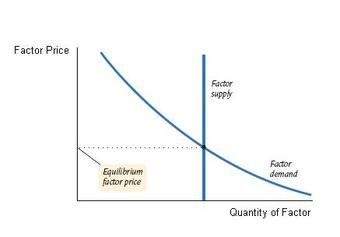

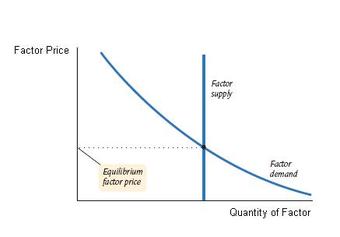

- In the circular flow model, the household sector, provides various factors of production such as labor and capital, to producers who in turn produce goods and services.

- Firms provide consumers with goods and services in exchange for consumer expenditure and “factors of production” from households.

- Investment is equal to savings and is the income not spent but available to both consumers and firms for the purchase of capital investments, such as buildings, factories and homes.

- A portion of income is also allocated to taxes (income is taxed and the remaining is either consumed and or saved); government spending, G, is based on the tax revenue, T.

- The continuous flow of production, income and expenditure is known as circular flow of income; it is circular because it has neither any beginning nor an end.

Key Terms

- Factors of production

-

In economics, factors of production are inputs. They may also refer specifically to the primary factors, which are stocks including land, labor, and capital goods applied to production.

- circular flow

-

A model of market economy that shows the flow of dollars between households and firms.

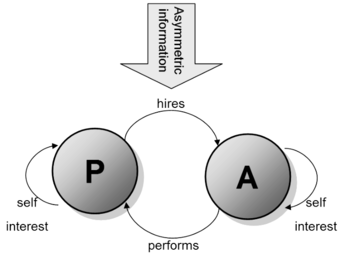

In economics, the “circular flow” diagram is a simple explanatory tool of how the major elements as defined by the equation Y = Consumption + Investment + Government Spending + (Exports – Imports). interact with one another. Circular flow is basically a continuous loop that for any point and time yields the value “Y” otherwise defined as the sum of final good and services in an economy, or gross domestic product (GDP) .

Circular flow

The circular flow is a simplified view of the economy that provides an ability to assess GDP at a specific point in time.

In the circular flow model, the household sector, provides various factors of production such as labor and capital, to producers who in turn produce goods and services. Firms compensate households for resource utilized and households pay for goods and services purchased from firms. This portion of the circular flow contributes to expenditures on consumption, C and generates income, which is the basis for savings (equal to investment) and government spending (tax revenue generated from income).

Investment, I, is equal to savings and is the income not spent but available to both consumers and firms for the purchase of capital investments, such as buildings, factories and homes. I represents an expenditure on investment capital.

Income generated in the relationship between firms and households is taxed and the remaining is either consumed and or saved. Government spending, G, is based on the tax revenue, T. G can be equal to taxes, less than or more than the tax revenue and represents government expenditure in the economy.

Finally, exports minus imports, X – M, references whether an economy is a net importer or exporter (or potentially trade neutral (X – M = 0)) and the impact of this component on overall GDP. Note that if the country is a net importer the value of X – M will be negative and will have a downward impact to overall GDP; if the country is a net exporter, the opposite will be true.

Circular flow

The continuous flow of production, income and expenditure is known as circular flow of income. It is circular because it has neither any beginning nor an end. The circular flow involves two basic assumptions:

1. In any exchange process, the seller or producer receives what the buyer or consumer spends.

2. Goods and services flow in one direction and money payment flow in the opposite or return direction, causing a circular flow.

19.1.4: GDP Equation in Depth (C+I+G+X)

GDP is the sum of Consumption (C), Investment (I), Government Spending (G) and Net Exports (X – M): Y = C + I + G + (X – M).

Learning Objective

Identify the variables that make up GDP

Key Points

- C (consumption) is normally the largest GDP component in the economy, consisting of private (household final consumption expenditure) in the economy.

- I (investment) includes, for instance, business investment in equipment, but does not include exchanges of existing assets.

- G (government spending) is the sum of government expenditures on final goods and services. It includes salaries of public servants, purchase of weapons for the military, and any investment expenditure by a government.

- X (exports) represents gross exports. GDP captures the amount a country produces, including goods and services produced for other nations’ consumption, therefore exports are added.

- M (imports) represents gross imports.

Key Terms

- government spending

-

Includes all government consumption, investment but excludes transfer payments made by a state.

- consumption

-

In the expenditure approach, the amount of goods and services purchased for consumption by individuals.

- export

-

Any good or commodity, transported from one country to another country in a legitimate fashion, typically for use in trade.

- import

-

To bring (something) in from a foreign country, especially for sale or trade.

- investment

-

A placement of capital in expectation of deriving income or profit from its use.

Gross domestic product (GDP) is defined as the sum of all goods and services that are produced within a nation’s borders over a specific time interval, typically one calendar year.

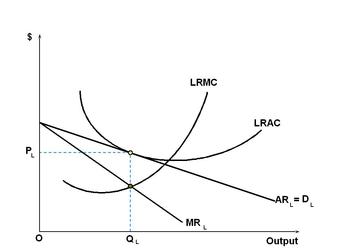

Components of GDP

GDP (Y) is a sum of Consumption (C), Investment (I), Government Spending (G) and Net Exports (X – M):

()

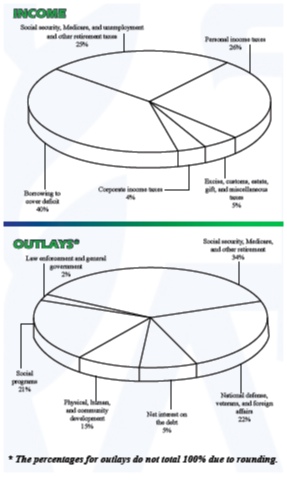

Expenditure accounts

Components of the expenditure approach to calculating GDP as presented in the National Income Accounts (U.S. Bureau of Economic Analysis).

Defining the components

Consumption

Consumption (C) is normally the largest GDP component in the economy, consisting of private (household final consumption expenditure) in the economy. These personal expenditures fall under one of the following categories: durable goods, non-durable goods, and services. Examples include food, rent, jewelry, gasoline, and medical expenses but does not include the purchase of new housing. Also, it is important to note that goods such as hand-knit sweaters are not counted as part of GDP if they are gifted and not sold. Only expenditure based consumption is counted.

Investment

Investment (I) includes, for instance, business investment in equipment, but does not include exchanges of existing assets. Examples include construction of a new mine, purchase of software, or purchase of machinery and equipment for a factory. Spending by households (not government) on new houses is also included in Investment. In contrast to common usage, ‘Investment’ in GDP does not mean purchases of financial products. Buying financial products is classified as ‘saving’, as opposed to investment. This avoids double-counting: if one buys shares in a company, and the company uses the money received to buy plant, equipment, etc., the amount will be counted toward GDP when the company spends the money on those things. To count it when one gives it to the company would be to count two times an amount that only corresponds to one group of products. Note that buying bonds or stocks is a swapping of deeds, a transfer of claims on future production, not directly an expenditure on products.

Government Spending

Government spending (G) is the sum of government expenditures on final goods and services. It includes salaries of public servants, purchase of weapons for the military, and any investment expenditure by a government. It does not include any transfer payments, such as social security or unemployment benefits.

Net Exports

Exports (X) represents gross exports. GDP captures the amount a country produces, including goods and services produced for other nations’ consumption, therefore exports are added.

Imports (M) represents gross imports. Imports are subtracted since imported goods will be included in the terms G, I, or C, and must be deducted to avoid counting foreign supply as domestic.

Sometimes, net exports is simply written as NX, but is the same thing as X-M.

Note that C, G, and I are expenditures on final goods and services; expenditures on intermediate goods and services do not count.

19.1.5: Calculating GDP

GDP can be calculated through the expenditures, income, or output approach.

Learning Objective

Identify the output approach to calculating GDP

Key Points

- The expenditures approach says GDP= consumption + investment + government expenditure + exports – imports.

- The income approach sums the factor incomes to the factors of production.

- The output approach is also called the “net product” or “value added” approach.

Key Terms

- expenditure approach

-

The total spending on all final goods and services (Consumption goods and services (C) + Gross Investments (I) + Government Purchases (G) + (Exports (X) – Imports (M)) GDP = C + I + G + (X-M).

- income approach

-

GDP based on the income approach is calculated by adding up the factor incomes to the factors of production in the society.

- output approach

-

GDP is calculated using the output approach by summing the value of sales of goods and adjusting (subtracting) for the purchase of intermediate goods to produce the goods sold.

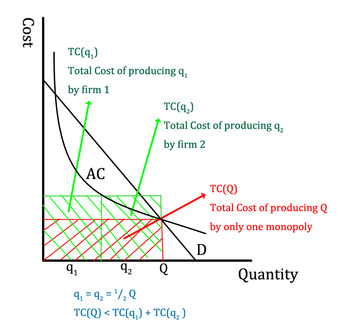

Gross Domestic Product

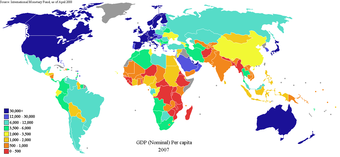

Gross domestic product is one method of understanding a country’s income and allows for comparison to other countries .

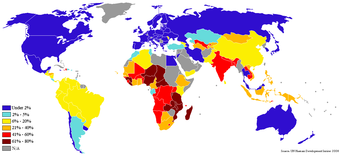

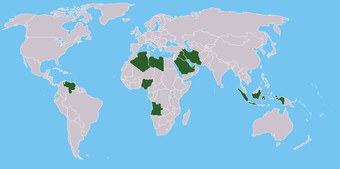

Global GDP

GDP is a common measure for both inter-country comparisons and intra-country comparisons. The metric is one method of understanding economic growth within a country’s borders.

By calculating the value of goods and services produced in a country, GDP provides a useful metric for understanding the economic momentum between the major factors of an economy: consumers, firms, and the government. There are a few methods used for calculating GDP, the most commonly presented are the expenditure and the income approach. Both of these methods calculate GDP by evaluating the final stage of sales (expenditure) or income (income). However, another approach referred to as the “output approach” calculates GDP by evaluating the value of all sales and adjusting for the purchase of intermediate goods (to remove double counting).

Expenditures Approach

The most well known approach to calculating GDP, the expenditures approach is characterized by the following formula:

GDP = C + I + G + (X-M)

where C is the level of consumption of goods and services, I is gross investment, G is government purchases, X is exports, and M is imports.

Income Approach

The income approach adds up the factor incomes to the factors of production in the society. It can be expressed as:

GDP = National Income (NY) + Indirect Business Taxes (IBT) + Capital Consumption Allowance and Depreciation (CCA) + Net Factor Payments to the rest of the world (NFP)

Output Approach

The output approach is also called “net product” or “value added” method. This method consists of three stages:

- Estimating the gross value of domestic output;

- Determining the intermediate consumption, i.e., the cost of material, supplies, and services used to produce final goods or services;

- Deducting intermediate consumption from gross value to obtain the net value of domestic output.

Net value added = Gross value of output – Value of intermediate consumption.

Gross value of output = Value of the total sales of goods and services + Value of changes in the inventories.

The sum of net value added in various economic activities is known as GDP at factor cost. GDP at factor cost plus indirect taxes less subsidies on products is GDP at producer price. GDP at producer price theoretically should be equal to GDP calculated based on the expenditure approach. However, discrepancies do arise because there are instances where the price that a consumer may pay for a good or service is not completely reflected in the amount received by the producer and the tax and subsidy adjustments mentioned above may not adequately adjust for the variation in payment and receipt.

19.1.6: Other Approaches to Calculating GDP

The income approach evaluates GDP from the perspective of the final income to economic participants.

Learning Objective

Explain the income approach to calculating GDP.

Key Points

- The sum of COE, GOS, and GMI is called total factor income; it is the income of all of the factors of production in society. It measures the value of GDP at factor (basic) prices.

- Adding taxes less subsidies on production and imports converts GDP at factor cost (as noted, a net domestic product) to GDP.

- By definition, the income approach to calculating GDP should be equatable to the expenditure approach; however, measurement errors will make the two figures slightly off when reported by national statistical agencies.

Key Terms

- expenditure approach

-

The total spending on all final goods and services (Consumption goods and services (C) + Gross Investments (I) + Government Purchases (G) + (Exports (X) – Imports (M)) GDP = C + I + G + (X-M).

- income approach

-

GDP based on the income approach is calculated by adding up the factor incomes to the factors of production in the society.

- depreciation

-

The measurement of the decline in value of assets. Not to be confused with impairment, which is the measurement of the unplanned, extraordinary decline in value of assets.

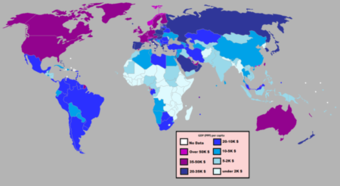

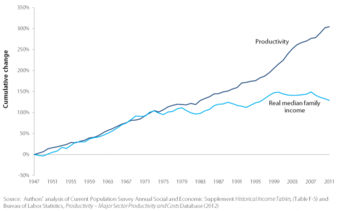

Gross domestic product provides a measure of the productivity of an economy specific to the national borders of a country . It can be measured a few different ways and the most commonly used metric is the expenditure approach; however, the second most commonly used measure is the income approach. The income approach unlike the expenditure approach, which sums the spending on final goods and services across economic agents (consumers, businesses and the government), evaluates GDP from the perspective of the final income to economic participants. GDP calculated in this manner is sometimes referenced as “Gross Domestic Income” (GDI).

GDP over time

GDP is measured over consecutive periods to enable policymakers and economic agents to evaluate the state of the economy to set expectations and make decisions.

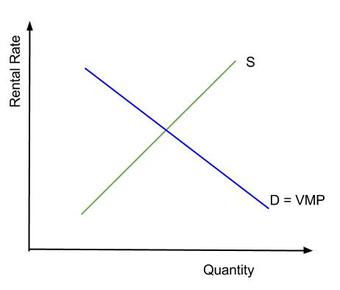

This method measures GDP by adding incomes that firms pay households for factors of production they hire- wages for labor, interest for capital, rent for land, and profits for entrepreneurship. The U.S. “National Income and Expenditure Accounts” divide incomes into five categories:

- Wages, salaries, and supplementary labor income

- Corporate profits

- Interest and miscellaneous investment income

- Farmers’ income

- Income from non-farm unincorporated businesses

Two adjustments must be made to get the GDP: Indirect taxes minus subsidies are added to get from factor cost to market prices. Depreciation (or Capital Consumption Allowance) is added to get from net domestic product to gross domestic product.

Income Approach Formula

GDP = compensation of employees + gross operating surplus + gross mixed income + taxes less subsidies on production and imports. Alternatively, this can be expressed as:

GDP = COE + GOS + GMI + TP & M – SP & M

- Compensation of employees (COE) measures the total remuneration to employees for work done.

- Gross operating surplus (GOS) is the surplus due to owners of incorporated businesses.

- Gross mixed income (GMI) is the same measure as GOS, but for unincorporated businesses. This often includes most small businesses.

- TP & M is taxes on production and imports.

- SP&M is subsidies on production and imports.

The sum of COE, GOS, and GMI is called total factor income; it is the income of all of the factors of production in society. It measures the value of GDP at factor (basic) prices. The difference between basic prices and final prices (those used in the expenditure calculation) is the total taxes and subsidies that the government has levied or paid on that production. So, adding taxes less subsidies on production and imports converts GDP at factor cost (as noted, a net domestic product) to GDP.

By definition, the income approach to calculating GDP should be equatable to the expenditure approach (Y = C + I+ G + (X – M)). In practice, however, measurement errors will make the two figures slightly off when reported by national statistical agencies.

19.1.7: Evaluating GDP as a Measure of the Economy

The value of GDP as a measure of the quality of life for a given country may be limited.

Learning Objective

Assess the uses and limitations of GDP as a measure of the economy

Key Points

- The sensitivities related to social welfare has continued the argument specific to the use of GDP as a economic growth or progress metric.

- A country with wide disparities in income could appear to be economically stronger, strictly using GDP, than a country where the income disparities were significantly lower (standard of living).

- Therefore, GDP has a tremendous big-picture value but policymakers would be better served using other metrics in combination with the aggregate measure if and when social welfare is being addressed.

Key Terms

- qualitative

-

Based on descriptions or distinctions rather than on some quantity.

- welfare

-

Health, safety, happiness and prosperity; well-being in any respect.

- quantitative

-

Of a measurement based on some number rather than on some quality.

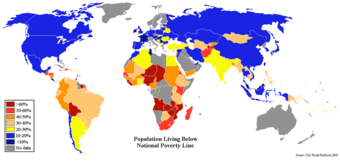

Gross domestic product (GDP) due to its relative ease of calculation and definition, has become a standard metric in the discussion of economic welfare, growth and prosperity. However, the value of GDP as a measure of the quality of life for a given country may be quite poor given that the metric only provides the total value of production for a specific time interval and provides no insight with respect to the source of growth or the beneficiaries of growth. Therefore, growth could be misinterpreted by looking at GDP values in isolation.

Limitations of GDP

Simon Kuznets, the economist who developed the first comprehensive set of measures of national income, stated in his first report to the US Congress in 1934, in a section titled “Uses and Abuses of National Income Measurements”:

“Economic welfare cannot be adequately measured unless the personal distribution of income is known. And no income measurement undertakes to estimate the reverse side of income, that is, the intensity and unpleasantness of effort going into the earning of income. The welfare of a nation can, therefore, scarcely be inferred from a measurement of national income. “

Following on his caution with respect to economic extrapolations from GDP, in 1962, Kuznets stated: “Distinctions must be kept in mind between quantity and quality of growth, between costs and returns, and between the short and long run. Goals for more growth should specify more growth of what and for what. “

The sensitivities related to social welfare has continued the argument specific to the use of GDP as a economic growth or progress metric.

Austrian School economist Frank Shostak has noted: “The GDP framework cannot tell us whether final goods and services that were produced during a particular period of time are a reflection of real wealth expansion, or a reflection of capital consumption. For instance, if a government embarks on the building of a pyramid, which adds absolutely nothing to the well-being of individuals, the GDP framework will regard this as economic growth. In reality, however, the building of the pyramid will divert real funding from wealth-generating activities, thereby stifling the production of wealth. “

GDP as an Evaluation Metric

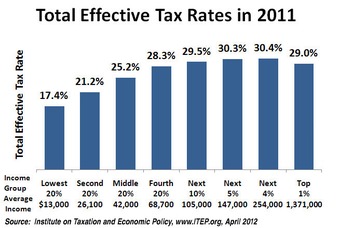

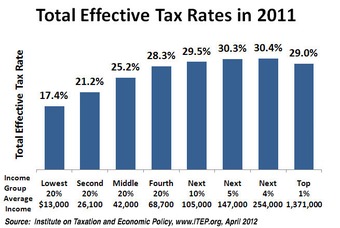

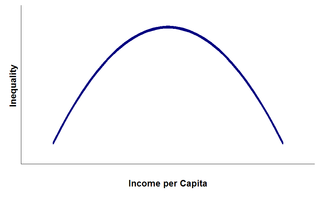

Although GDP provides a single quantitative metric by which comparisons can be made across countries, the aggregation of elements that create the single value of GDP provide limitations in evaluating a country and its economic agents. Given the calculation of the metric, a country with wide disparities in income could appear to be economically stronger than a country where the income disparities were significantly lower (standard of living). However, a qualitative assessment would likely value the latter country compared to the former on a welfare or quality of life basis .

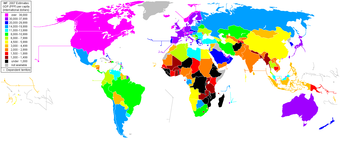

GDP across the globe

GDP can be adjusted to compare the purchasing power across countries but cannot be adjusted to provide a view of the economic disparities within a country.

Therefore, GDP has a tremendous big-picture value but policymakers would be better served using other metrics in combination with the aggregate measure if and when social welfare is being addressed.

19.2: Other Measures of Output

19.2.1: National Income

A variety of measures of national income and output are used in economics to estimate total economic activity in a country or region.

Learning Objective

Explain the importance of calculating national income.

Key Points

- Arriving at a figure for the total production of goods and services in a large region like a country entails a large amount of data-collection and calculation.

- In order to count a good or service, it is necessary to assign value to it.

- Three strategies have been used to obtain the market values of all the goods and services produced: the product (or output) method, the expenditure method, and the income method.

Key Term

- national income

-

The total amount of goods and services produced within some “boundary. ” The boundary is usually defined by geography or citizenship, and may also restrict the goods and services that are counted.

A variety of measures of national income and output are used in economics to estimate total economic activity in a country or region, including gross domestic product (GDP), gross national product (GNP), net national income (NNI), and adjusted national income (NNI* adjusted for natural resource depletion). All of the measures are especially concerned with counting the total amount of goods and services produced within some boundary. The boundary is usually defined by geography or citizenship, and may also restrict the goods and services that are counted. For instance, some measures count only goods and services that are exchanged for money, excluding bartered goods, while other measures may attempt to include bartered goods by imputing monetary values to them.

Arriving at a figure for the total production of goods and services in a large region like a country entails a large amount of data-collection and calculation. Although some attempts were made to estimate national incomes as long ago as the 17th century, the systematic keeping of national accounts, of which these figures are a part, only began in the 1930s, in the United States and some European countries. The impetus for that major statistical effort was the Great Depression and the rise of Keynesian economics, which prescribed a greater role for the government in managing an economy, and made it necessary for governments to obtain accurate information so that their interventions into the economy could proceed as well-informed as possible .

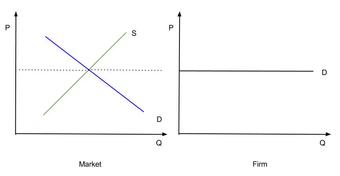

Expenditure approach

The expenditure approach is a common method for evaluating the value of an economy at a given point in time.

Measuring National Income

In order to count a good or service, it is necessary to assign value to it. The value that the measures of national income and output assign to a good or service is its market value – the price when bought or sold. The actual usefulness of a product (its use-value) is not measured – assuming the use-value to be any different from its market value. Three strategies have been used to obtain the market values of all the goods and services produced: the product or output method, the expenditure method, and the income method.

Product or Output Method

The output approach focuses on finding the total output of a nation by directly finding the total value of all goods and services a nation produces:

At factor cost = GDP at market price – depreciation + NFIA (net factor income from abroad) – net indirect taxes

Income Method

The income approach equates the total output of a nation to the total factor income received by residents or citizens of the nation:

NDP at factor cost = compensation of employees + net interest + rental and royalty income + profit of incorporated and unincorporated NDP at factor cost

Expenditure Method

The expenditure approach focuses on finding the total output of a nation by finding the total amount of money spent and is the most commonly used equational form:

GDP = C + I + G + ( X – M ); where C = household consumption expenditures / personal consumption expenditures, I = gross private domestic investment, G = government consumption and gross investment expenditures, X = gross exports of goods and services, and M = gross imports of goods and services.

19.2.2: Personal Income

Personal income is an individual’s total earnings from wages, investment interest, and other sources.

Learning Objective

Explain personal income

Key Points

- In the United States the most widely cited personal income statistics are the Bureau of Economic Analysis’s (BEA) personal income and the Census Bureau’s per capita money income.

- BEA’s personal income measures the income received by persons from participation in production, from government and business transfers, and from holding interest-bearing securities and corporate stocks.

- The Census Bureau also produces alternative estimates of income and poverty based on broadened definitions of income that include many of these income components that are not included in money income.

Key Term

- personal income

-

An individual’s total earnings from wages, investment enterprises, and other ventures.

Personal income is an individual’s total earnings from wages, investment interest, and other sources.

In the United States the most widely cited personal income statistics are the Bureau of Economic Analysis’s (BEA) personal income and the Census Bureau’s per capita money income. The two statistics spring from different traditions of measurement: personal income from national economic accounts and money income from household surveys.

BEA’s personal income measures the income received by persons from participation in production, from government and business transfers, and from holding interest-bearing securities and corporate stocks. Personal income also includes income received by nonprofit institutions serving households, by private non-insured welfare funds, and by private trust funds. BEA publishes disposable personal income, which measures the income available to households after paying federal and state and local government income taxes. Income from production is generated both by the labor of individuals (for example, in the form of wages and salaries and of proprietors’ income) and by the capital that they own (in the form of rental income of persons). Income that is not earned from production in the current period—such as capital gains, which relate to changes in the price of assets over time—is excluded. BEA’s monthly personal income estimates are one of several key macroeconomic indicators that the National Bureau of Economic Research considers when dating the business cycle. Personal income and disposable personal income are provided both as aggregate and as per capita statistics. BEA produces monthly estimates of personal income for the nation, quarterly estimates of state personal income, and annual estimates of local-area personal income .

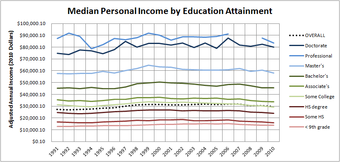

Historical personal income by educational attainment

Personal income data can provide governments with useful information in the formulation of public policy to combat income inequality.

The Census Bureau also produces alternative estimates of income and poverty based on broadened definitions of income that include many of these income components that are not included in money income. The Census Bureau releases estimates of household money income as medians, percent distributions by income categories, and on a per capita basis. Estimates are available by demographic characteristics of householders and by the composition of households.

19.2.3: Disposable Income

Disposable income is the income left after paying taxes.

Learning Objective

Define disposable income

Key Points

- Disposable income is total personal income minus personal current taxes.

- Discretionary income is disposable income minus all payments that are necessary to meet current bills.

- Disposable income is often incorrectly used to denote discretionary income.

Key Terms

- disposable income

-

Income left after taxes.

- Discretionary Income

-

Disposable income (after-tax income) minus all payments that are necessary to meet current bills.

Income left after paying taxes is referred to as disposable income. Disposable income is thus total personal income minus personal current taxes . In national accounts definitions:

Disposable income

Disposable income can be spent on essential or nonessential items. Alternatively, it can also be saved. It is whatever income is left after taxes.

Personal income – personal current taxes = disposable personal income

This can be restated as: consumption expenditure + savings = disposable income

For the purposes of calculating the amount of income subject to garnishment, United States federal law defines disposable income as an individual’s compensation (including salary, overtime, bonuses, commission, and paid leave) after the deduction of health insurance premiums and any amounts required to be deducted by law. Amounts required to be deducted by law include federal, state, and local taxes, state unemployment and disability taxes, social security taxes, and other garnishments or levies, but does not include such deductions as voluntary retirement contributions and transportation deductions.

Discretionary income is disposable income minus all payments that are necessary to meet current bills. It is total personal income after subtracting taxes and typical expenses (such as rent or mortgage, utilities, insurance, medical fees, transportation, property maintenance, child support, food and sundries, etc.) needed to maintain a certain standard of living. In other words, it is the amount of an individual’s income available for spending after the essentials (such as food, clothing, and shelter) have been taken care of.

Discretionary income = Gross income – taxes – all compelled payments (bills)

Disposable income is often incorrectly used to denote discretionary income. The meaning should therefore be interpreted from context. Commonly, disposable income is the amount of “play money” left to spend or save.

19.2.4: GDP per capita

Gross domestic product (GDP) per capita is the mean income of people in an economic unit.

Learning Objective

Define GDP per capita and assess its usefulness as a metric.

Key Points

- GDP per capita is often used as average income, a measure of the wealth of the population of a nation, particularly when making comparisons among nations.

- Per capita income is often used to measure a country’s standard of living.

- It is usually expressed in terms of a commonly used international currency such as the Euro or United States dollar, and can be easily calculated from readily-available GDP and population estimates.

Key Term

- per capita

-

per person

Gross domestic product (GDP) per capita is also known as income per person. It is the mean income of the people in an economic unit such as a country or city. GDP per capita is calculated by dividing GDP by the total population of the country.

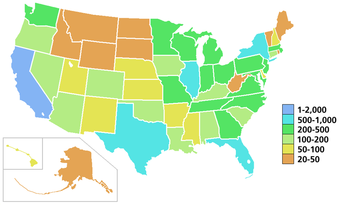

GDP per capita income as a measure of prosperity

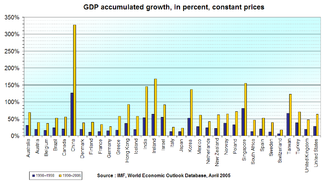

GDP per capita is often used as average income, a measure of the wealth of the population of a nation, particularly when making comparisons to other nations . It is useful because GDP is expected to increase with population, so it may be misleading to simply compare the GDPs of two countries. GDP per capita accounts for population size.

Comparisons of GDP per capita

GDP per capita varies across countries and is highest among developed countries. However, GDP per capita is not an indicator of income distribution in a given country. For this reason GDP per capita may not necessarily be a barometer for the quality of life in a given country.

Per capita income is often used to measure a country’s standard of living. It is usually expressed in terms of a commonly used international currency such as the Euro or United States dollar. It is easily calculated from readily-available GDP and population estimates, and produces a useful statistic for comparison of wealth between sovereign territories. This helps countries know their development status.

However, critics contend that per capita income has several weaknesses as a measure of prosperity, including:

- Comparisons of GDP per capita over time need to take into account changes in prices. Without using measures of income adjusted for inflation, they will tend to overstate the effects of economic growth.

- International comparisons can be distorted by differences in the cost of living between countries that are not reflected in exchange rates. When looking at differences in living standards between countries, using a measure of GDP per capita adjusted for differences in purchasing power parity more accurately reflects the differences in what people are actually able to buy with their money.

- As it is a mean value, it does not reflect income distribution. If the distribution of income within a country is skewed, a small wealthy class can increase GDP per capita far above that of the majority of the population. Median income is a more useful measure of prosperity than GDP per capita because it is less influenced by outliers.

19.3: Comparing Real and Nominal GDP

19.3.1: Calculating Real GDP

Real GDP growth is the value of all goods produced in a given year; nominal GDP is value of all the goods taking price changes into account.

Learning Objective

Calculate real and nominal GDP growth

Key Points

- The following equation is used to calculate the GDP: GDP = C + I + G + (X – M) or GDP = private consumption + gross investment + government investment + government spending + (exports – imports).

- Nominal value changes due to shifts in quantity and price.

- In economics, real value is not influenced by changes in price, it is only impacted by changes in quantity. Real values measure the purchasing power net of any price changes over time.

- Real GDP accounts for inflation and deflation. It transforms the money-value measure, nominal GDP, into an index for quantity of total output.

Key Terms

- nominal

-

Without adjustment to remove the effects of inflation (in contrast to real).

- gross domestic product

-

Known also as GDP, this is a measure of the economic production of a particular territory in financial capital terms over a specific time period.

Example

- Imagine a country with a GDP of $100 in a given year. In the next year the GDP rises to $105 and the inflation rate is %3. Roughly, we can say that real GDP rises to only $102 as the inflation rate accounted for.

Gross Domestic Product

The Gross domestic Product (GDP) is the market value of all final goods and services produced within a country in a given period of time. The GDP is the officially recognized totals. The following equation is used to calculate the GDP:

Written out, the equation for calculating GDP is:

GDP = private consumption + gross investment + government investment + government spending + (exports – imports).

For the gross domestic product, “gross” means that the GDP measures production regardless of the various uses to which the product can be put. Production can be used for immediate consumption, for investment into fixed assets or inventories, or for replacing fixed assets that have depreciated. “Domestic” means that the measurement of GDP contains only products from within its borders.

Nominal GDP

The nominal GDP is the value of all the final goods and services that an economy produced during a given year. It is calculated by using the prices that are current in the year in which the output is produced . In economics, a nominal value is expressed in monetary terms. For example, a nominal value can change due to shifts in quantity and price. The nominal GDP takes into account all of the changes that occurred for all goods and services produced during a given year. If prices change from one period to the next and the output does not change, the nominal GDP would change even though the output remained constant.

Nominal GDP

This image shows the nominal GDP for a given year in the United States.

Real GDP

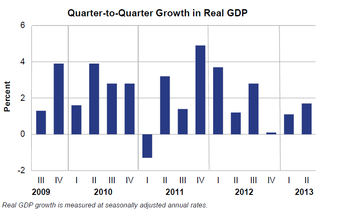

The real GDP is the total value of all of the final goods and services that an economy produces during a given year, accounting for inflation . It is calculated using the prices of a selected base year. To calculate Real GDP, you must determine how much GDP has been changed by inflation since the base year, and divide out the inflation each year. Real GDP, therefore, accounts for the fact that if prices change but output doesn’t, nominal GDP would change.

Real GDP Growth

This graph shows the real GDP growth over a specific period of time.

In economics, real value is not influenced by changes in price, it is only impacted by changes in quantity. Real values measure the purchasing power net of any price changes over time. The real GDP determines the purchasing power net of price changes for a given year. Real GDP accounts for inflation and deflation. It transforms the money-value measure, nominal GDP, into an index for quantity of total output.

19.3.2: The GDP Deflator

The GDP deflator is a price index that measures inflation or deflation in an economy by calculating a ratio of nominal GDP to real GDP.

Learning Objective

Explain how the calculation of the GDP deflator can measure inflation

Key Points

- The GDP deflator is a measure of price inflation. It is calculated by dividing Nominal GDP by Real GDP and then multiplying by 100. (Based on the formula).

- Nominal GDP is the market value of goods and services produced in an economy, unadjusted for inflation. Real GDP is nominal GDP, adjusted for inflation to reflect changes in real output.

- Trends in the GDP deflator are similar to changes in the Consumer Price Index, which is a different way of measuring inflation.

Key Terms

- GDP deflator

-

A measure of the level of prices of all new, domestically produced, final goods and services in an economy. It is calculated by computing the ratio of nominal GDP to the real measure of GDP.

- real GDP

-

A macroeconomic measure of the value of the economy’s output adjusted for price changes (inflation or deflation).

- nominal gdp

-

A macroeconomic measure of the value of the economy’s output that is not adjusted for inflation.

The GDP deflator (implicit price deflator for GDP) is a measure of the level of prices of all new, domestically produced, final goods and services in an economy. It is a price index that measures price inflation or deflation, and is calculated using nominal GDP and real GDP.

Nominal GDP versus Real GDP

Nominal GDP, or unadjusted GDP, is the market value of all final goods produced in a geographical region, usually a country. That market value depends on the quantities of goods and services produced and their respective prices. Therefore, if prices change from one period to the next but actual output does not, nominal GDP would also change even though output remained constant.

In contrast, real gross domestic product accounts for price changes that may have occurred due to inflation. In other words, real GDP is nominal GDP adjusted for inflation. If prices change from one period to the next but actual output does not, real GDP would be remain the same. Real GDP reflects changes in real production. If there is no inflation or deflation, nominal GDP will be the same as real GDP.

Calculating the GDP Deflator

The GDP deflator is calculated by dividing nominal GDP by real GDP and multiplying by 100 .

GDP Deflator Equation

The GDP deflator measures price inflation in an economy. It is calculated by dividing nominal GDP by real GDP and multiplying by 100.

Consider a numeric example: if nominal GDP is $100,000, and real GDP is $45,000, then the GDP deflator will be 222 (GDP deflator = $100,000/$45,000 * 100 = 222.22).

In the U.S., GDP and GDP deflator are calculated by the U.S. Bureau of Economic Analysis.

Relationship between GDP Deflator and CPI

Like the Consumer Price Index (CPI), the GDP deflator is a measure of price inflation/deflation with respect to a specific base year. Similar to the CPI, the GDP deflator of the base year itself is equal to 100. Unlike the CPI, the GDP deflator is not based on a fixed basket of goods and services; the “basket” for the GDP deflator is allowed to change from year to year with people’s consumption and investment patterns. However, trends in the GDP deflator will be similar to trends in the CPI.

19.4: Cost of Living

19.4.1: Introduction to Inflation

Inflation is a persistent increase in the general price level, and has three varieties: demand-pull, cost-push, and built-in.

Learning Objective

Distinguish between demand-pull and cost-push inflation

Key Points

- Inflation is an increase in price levels, which decreases the real value, or purchasing power, of money.

- Demand-pull inflation is an increase in price levels due to an increase in aggregate demand when the employment level is full or close to full.

- Cost-push inflation is an increase in price levels due to a decrease in aggregate supply. Generally, this occurs due to supply shocks, or an increase in the price of production inputs.

Key Terms

- inflation

-

An increase in the general level of prices or in the cost of living.

- demand-pull inflation

-

A rise in the price level for goods and services in an economy due to greater demand than the economy’s ability to produce those goods and services.

- cost-push inflation

-

A rise in the price level for goods and services in an economy due to increases in the costs of production.

In economics, inflation is a persistent increase in the general price level of goods and services in an economy over a period of time. When the general price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money; it is a loss of real value, as a single dollar is able to purchase fewer goods than it previously could.

Types of Inflation

The reasons for inflation depend on supply and demand. Depending on the type of inflation, changes in either supply or demand can create an increase in the price level of goods and services. In Keynesian economics, there are three types of inflation.

Demand-Pull Inflation

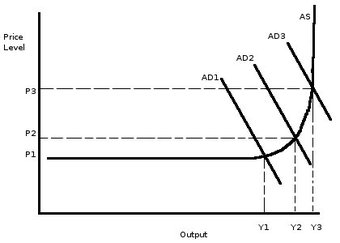

Demand-pull inflation is inflation that occurs when total demand for goods and services exceeds the economy’s capacity to produce those goods. Put another way, there is “too much money chasing too few goods. ” Typically, demand-pull inflation occurs when unemployment is low or falling. The increases in employment raise aggregate demand, which leads to increased hiring to expand the level of production. Eventually, production cannot keep pace with aggregate demand because of capacity constraints, so prices rise .

Demand-Pull Inflation

Demand-pull inflation is caused by an increase in aggregate demand. As demand increases, so does the price level.

Cost-Push Inflation

Cost-push inflation occurs when there is an increase in the costs of production. Unlike demand-pull inflation, cost-push inflation is not “too much money chasing too few goods,” but rather, a decrease in the supply of goods, which raises prices .

Cost-Push Inflation

As the costs of production inputs rises, aggregate supply can decrease, which increases price levels.

The reason for decreases in supply are usually related to increases in the prices of inputs. One major reason for cost-push inflation are supply shocks. A supply shock is an event that suddenly changes the price of a commodity or service. (sudden supply decrease) will raise prices and shift the aggregate supply curve to the left. One historical example of this is the oil crisis of the 1970’s, when the price of oil in the U.S. surged. Because oil is integral to many industries, the price increase led to large increases in the costs of production, which translated to higher price levels.

Built-In Inflation

Built-in inflation is the result of adaptive expectations. If workers expect there to be inflation, they will negotiate for wages increasing at or above the rate of inflation (so as to avoid losing purchasing power). Their employers then pass the higher labor costs on to customers through higher prices, which actually reflects inflation. Thus, there is a cycle of expectations and inflation driving one another.

19.4.2: Defining and Calculating CPI

The consumer price index (CPI) is a statistical estimate of the change in prices of goods and services bought for consumption.

Learning Objective

Assess the uses and limitations of the Consumer Price Index

Key Points

- The CPI is calculated by collecting the prices of a sample of representative items over a specific period of time.

- The CPI can be used to index the real value of wages, salaries, pensions, and price regulation. It is one of the most closely watched national economic statistics.

- The equation to calculate a price index using a single item is:

. - The equation for calculating the CPI for multiple items is:

.

Key Terms

- market basket

-

A list of items used specifically to track the progress of inflation in an economy or specific market.

- consumer price index

-

A statistical estimate of the level of prices of goods and services bought for consumption purposes by households.

Consumer Price Index

The consumer price index (CPI) is a statistical estimate of the level of prices of goods and services bought for consumption by households. It measures changes in the price level of a market basket of goods and services used by households. The CPI is calculated by collecting the prices of a sample of representative items over a specific period of time. Goods and services are divided into categories, sub categories, and sub indexes. All of the information is combined to produce the overall index of consumer expenditures. The annual percentage change in a CPI is used to measure inflation. The CPI can be used to index the real value of wages, salaries, pensions, and price regulation. It is one of the most closely watched national economic statistics.

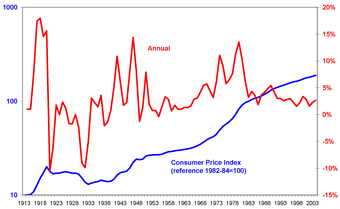

Consumer Price Index

The graph shows the consumer price index in the United States from 1913 – 2004. The x-axis indicates year, the left y-axis indicates the Consumer Price Index, and the right y-axis indicates annual percentage change in Consumer Price Index, which can be used to measure inflation.

Calculating CPI using a Single Item

In order to calculate the CPI using a single item the following equation is used:

Calculating the CPI for Multiple Items

When calculating the CPI for multiple items, it must be noted that many but not all price indices are weighted averages using weights that sum to 1 or 100. When calculating the average for a large number of products, the price is given a weighted average between 1 and 100 to simplify calculation. The weighting determines the importance of the quantity of the product on average. The equation for calculating the CPI for multiple items is:

For example, imagine you buy five sandwiches, two magazines, and two pairs of jeans. In the first period, sandwiches are $6 each, magazines are $4 each, and jeans are $35 each. This will be our base period. In the second period, sandwiches are $7, magazines are $6, and jeans are $45.

Market basket at base period prices = 5(6.00) + 2(4.00) + 2(35.00) = 108.00.

Market basket at current period prices = 5(7.00) + 2(6.00) + 2(45.00) = 137.00.

The CPI based on consumption is 127.

CPI Limitations

The CPI is a convenient way to calculate the cost of living and price level for a certain period of time. However, the CPI does not provide a completely accurate estimate for the cost of living. Issues that impede the accuracy of the CPI include substitution bias (consumers substituting goods for others), introducing new products, and changes in quality. The CPI can also overstate inflation because it does not always account for quality improvements or new goods and services.

GDP Deflator vs. CPI

The GDP deflator is a measure of the level of prices of all new, domestically produced, final goods and services in an economy. Unlike the CPI, the GDP deflator is a measure of price inflation or deflation for a specific base year. The GDP deflator differs from the CPI because it is not based on a fixed basket of goods and services. The GDP deflator “basket” changes from year to year depending on people’s consumption and investment patterns. Unlike the CPI, the GDP deflator is not impacted by substitution biases. Despite the GDP being more flexible, the CPI is a more accurate reflection of the changes in the cost of living.

Chapter 18: Introduction to Macroeconomics

18.1: Key Topics in Macroeconomics

18.1.1: Defining Macroeconomics

Macroeconomics is a branch of economics that focuses on the behavior and decision-making of an economy as a whole.

Learning Objective

Define Macroeconomics.

Key Points

- Macroeconomists study aggregated indicators such as GDP, unemployment rates, and price indices to understand how the whole economy functions.

- Macroeconomists develop models that explain the relationship between such factors as national income, output, consumption, unemployment, inflation, savings, investment, government spending and international trade.

- Though macroeconomics encompasses a variety of concepts and variables, but there are three central topics for macroeconomic research on the national level: output, unemployment, and inflation.

Key Terms

- microeconomics

-

That field that deals with the small-scale activities such as that of the individual or company.

- Macroeconomics

-

The study of the entire economy in terms of the total amount of goods and services produced, total income earned, the level of employment of productive resources, and the general behavior of prices.

Economics is comprised of many specializations; however, the two broad sub-groupings for economics are microeconomics and macroeconomics.

Macroeconomics

Macroeconomics is a branch of economics that focuses on the behavior and decision-making of an economy as a whole . In this manner it differs from the field of microeconomics, which evaluates the motivations of and relationships between individual economic agents.

Macroeconomics: Circular Flow of the Economy

Macroeconomics simplifies the complexities of the trading activities in an economy by distilling actions to primary participants and tracing the circular flow of activity between them.

Indicators

Macroeconomists study aggregated indicators such as GDP, unemployment rates, and price indices to understand how the whole economy functions and develop models that explain the relationship between such factors as national income, output, consumption, unemployment, inflation, savings, investment, government spending, and international trade. These variables taken as a whole comprise a grouping of variables that are referred to as economic indicators. These indicators, which are classified as leading, lagging and coincident relative to their predictive capability, in combination with one another provide economists with a directional attribution for the economy.

Macroeconomic Study

While macroeconomics is a broad field of study, there are two areas of research that are especially well publicized in the media: the evaluation of the business cycle and the growth rate of the economy. As a result, macroeconomics tends to be widely cited in discussions related to government intervention in economic expansion and contraction, as well as, with respect to the evaluation of economic policy.

Though macroeconomics encompasses a variety of concepts and variables, but there are three central topics for macroeconomic research on a national level: output, unemployment, and inflation. Outside of macroeconomic theory, these topics are also extremely important to all economic agents including workers, consumers, and producers.

18.1.2: The Importance of Aggregate Decisions about Consumption versus Saving and Investment

Money can either be consumed, invested, or saved (deferred consumption or investment).

Learning Objective

Explain the relationship between consumption, savings, and investment.

Key Points

- Aggregate demand is downward sloping as a result of three consumption sensitivities: wealth effect, interest rate effect and foreign exchange effect.

- Spending is related to income: Income – Spending = Net Savings.

- For the economy as a whole, aggregate savings is equal to investment, which is usually in the form of borrowed funds available as a result of savings.

Key Term

- aggregate demand

-

The the total demand for final goods and services in the economy at a given time and price level.

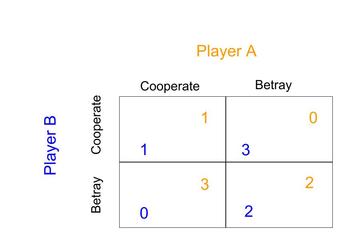

There are three choices that market actors can make with their money. They can consume it by spending it on goods and services. For example, buying a movie ticket is spending money on consumption. They can also invest money by lending it to a company or project with the hope of getting back more money in the future. Finally, they can save it by putting it in a bank account (or keeping cash under the bed). Savings is essentially deferred consumption or investment; it is intended for use in the future.

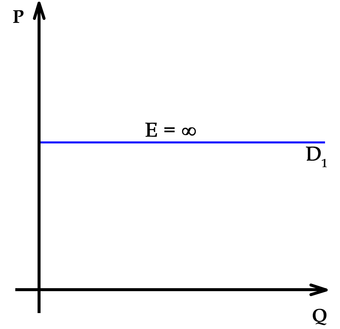

In order to understand the effects of aggregate decisions of consumption, savings, and investment, we must look at aggregate demand (AD). AD is the total demand for final goods and services in the economy at a given time and price level. It specifies the amounts of goods and services that will be purchased at all possible price levels and is the demand for the gross domestic product of a country.

Components of Aggregate Demand

It is often cited that the aggregate demand curve is downward sloping because at lower price levels a greater quantity is demanded. While this is correct at the microeconomic, single good level, at the aggregate level this is incorrect. The aggregate demand curve is downward sloping but in variation with microeconomics, this is as a result of three distinct effects: the wealth effect, the interest rate effect and the exchange-rate effect.

Basically individuals will consume or purchase more when they feel wealthier or have access to inexpensive funding.

The wealth effect is specifically related to the value of assets; market participants will adjust consumption in-line with their perception of the appreciation or depreciation of held assets (a home; equity investments, etc.). The interest rate effect has to do with access to inexpensive funding, which provides an incentive to increase current period expenditures; while the exchange-rate effect has to do with expenditure decisions related to imports or foreign related expenditures, as the exchange rate is perceived to be favorable to the domestic currency, expenditures on foreign items or imports will increase.

Consumption, Savings, and Investment

Aggregate demand met by the market is spending, be it on consumption, investment, or other categories.

Spending is related to income:

Income – Spending = Net Savings

Rearranging:

Spending = Income – Net Savings = Income + Net Increase in Debt

In words: what you spend is what you earn, plus what you borrow: if you spend $110 and earned $100, then you must have net borrowed $10; conversely if you spend $90 and earn $100, then you have net savings of $10, or have reduced debt by $10, for net change in debt of –$10.

For the economy as a whole, aggregate savings is greater than or equal to investment, which is usually in the form of borrowed funds available as a result of savings. Through investment spending, savings influences aggregate demand.

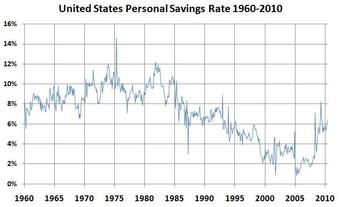

Furthermore, since consumption and investment are components of GDP but saving is not, increased savings indirectly reduces GDP .

US Savings Rate

Savings have declined in the US on aggregate since the 1980s, which means that the proportion of income spent on consumption and investment increased.

18.1.3: The Role of the Financial System

A financial market or system is a market in which people and entities can trade financial securities, commodities, and other fungible items.

Learning Objective

Explain the importance of the financial system

Key Points

- An economy which relies primarily on interactions between buyers and sellers to allocate resources is known as a market economy.

- Markets work by placing many interested buyers and sellers, including households, firms, and government agencies, in one “place,” thus making it easier for them to find each other.

- Healthy financial systems are associated with the accelerated development of an economy.

Key Terms

- entrepreneurship

-

The art or science of innovation and risk-taking for profit in business.

- investment

-

A placement of capital in expectation of deriving income or profit from its use.

- saving

-

the act of storing for future use

Financial System

A financial market or system is a market in which people and entities can trade financial securities, commodities, and other fungible items . Securities include stocks and bonds, and commodities include precious metals or agricultural goods.

Equity Markets

Equity markets are the most closely followed of the financial markets. They provide transparent and active trading platforms that promote liquidity and access to funds to on a global scale.

There are both general markets (where many commodities are traded) and specialized markets (where only one commodity is traded). Markets work by placing many interested buyers and sellers, including households, firms, and government agencies, in one place, thus making it easier for them to find each other.

An economy that relies primarily on interactions between buyers and sellers to allocate resources is known as a market economy, in contrast either to a command economy or to a non-market economy such as a gift economy.

Role of the Financial System

Financial markets are associated with the accelerated growth of an economy. A financial market helps to achieve the following non-comprehensive list of goals:

- Saving mobilization: Obtaining funds from the savers or surplus units such as household individuals, business firms, public sector units, central government, state governments, etc. is an important role played by financial markets. Borrowers (e.g. bond issuers) are connected with lenders (e.g. bond buyers) in financial markets.

- Investment: Financial markets play a crucial role in arranging to invest funds. Both firms and individuals can invest in companies through financial markets (e.g. by buying stock).

- National Growth: An important role played by financial market is that, they contribute to a nation’s growth by ensuring unfettered flow of surplus funds to deficit units. In other words, financial markets help shift money from industry to industry or firm to firm based on the supply and demand for their products.

- Entrepreneurship growth: Financial markets allow entrepreneurs (and established firms) to access the funds needed to invest in projects or companies.

18.1.4: The Business Cycle: Definition and Phases

The term business cycle refers to economy-wide fluctuations in production, trade, and general economic activity.

Learning Objective

Identify features of the economic business cycle

Key Points

- Business cycles are identified as having four distinct phases: expansion, peak, contraction, and trough.

- Business cycle fluctuations occur around a long-term growth trend and are usually measured by considering the growth rate of real gross domestic product.

- In the United States, it is generally accepted that the National Bureau of Economic Research (NBER) is the final arbiter of the dates of the peaks and troughs of the business cycle.

Key Terms

- contraction

-

A period of economic decline or negative growth.

- peak

-

The highest value reached by some quantity in a time period.

- trough

-

The lowest turning point of a business cycle

- expansion

-

The act or process of expanding.

The Business Cycle

The term “business cycle” (or economic cycle or boom-bust cycle) refers to economy-wide fluctuations in production, trade, and general economic activity. From a conceptual perspective, the business cycle is the upward and downward movements of levels of GDP (gross domestic product) and refers to the period of expansions and contractions in the level of economic activities (business fluctuations) around a long-term growth trend .

Business Cycles

The phases of a business cycle follow a wave-like pattern over time with regard to GDP, with expansion leading to a peak and then followed by contraction leading to a trough.

Business Cycle Phases

Business cycles are identified as having four distinct phases: expansion, peak, contraction, and trough.

An expansion is characterized by increasing employment, economic growth, and upward pressure on prices. A peak is realized when the economy is producing at its maximum allowable output, employment is at or above full employment, and inflationary pressures on prices are evident. Following a peak an economy, typically enters into a correction which is characterized by a contraction, growth slows, employment declines (unemployment increases), and pricing pressures subside. The slowing ceases at the trough and at this point the economy has hit a bottom from which the next phase of expansion and contraction will emerge.

Business Cycle Fluctuations

Business cycle fluctuations occur around a long-term growth trend and are usually measured by considering the growth rate of real gross domestic product.

In the United States, it is generally accepted that the National Bureau of Economic Research (NBER) is the final arbiter of the dates of the peaks and troughs of the business cycle. An expansion is the period from a trough to a peak, and a recession as the period from a peak to a trough. The NBER identifies a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production. ” This is significantly different from the commonly cited definition of a recession being signaled by two consecutive quarters of decline in real GDP.

18.1.5: Recessions

A recession is a business cycle contraction; a general slowdown in economic activity.

Learning Objective

Explain the connection between a recession and other macroeconomic variables

Key Points

- Macroeconomic indicators such as GDP (Gross Domestic Product), employment, investment spending, capacity utilization, household income, business profits, and inflation fall, while bankruptcies and the unemployment rate rise.

- Most mainstream economists believe that recessions are caused by inadequate aggregate demand in the economy, and favor the use of expansionary macroeconomic policy during recessions.

- Strategies favored for moving an economy out of a recession vary depending on which economic school the policymakers follow.

Key Term

- recession

-

A period of reduced economic activity

In economics, a recession is a business cycle contraction; a general slowdown in economic activity. Macroeconomic indicators such as GDP (Gross Domestic Product), employment, investment spending, capacity utilization, household income, business profits, and inflation fall, while bankruptcies and the unemployment rate rise. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, or the bursting of an economic bubble .

Recessions and panic

Recessions are characterized as periods of fear and uncertainty; historically they also were a time of widespread panic. However, as confidence in the central bank and federal government increased, though fear and uncertainty remain, panic-conditioned “runs” as depicted in the photo above have become an element of the past.

Attributes of Recession

A recession has many attributes that can occur simultaneously, these include declines in component measures (economic indicators) of economic activity (GDP) such as consumption, investment, government spending, and net export activity. These indicators in turn, reflect underlying drivers such as employment levels and skills, household savings rates, corporate investment decisions, interest rates, demographics, and government policies.

Causes of Recession

Under ideal conditions, a country’s economy should have the household sector as net savers and the corporate sector as net borrowers, with the government budget nearly balanced and net exports near zero. When these relationships become imbalanced, recession can develop within a country or create pressure for recession in another country. Policy responses are often designed to drive the economy back towards this ideal state of balance.

Most mainstream economists believe that recessions are caused by inadequate aggregate demand in the economy, and favor the use of expansionary macroeconomic policy during recessions.

Policy Responses to Recession

Strategies favored for moving an economy out of a recession vary depending on which economic school the policymakers follow. Monetarists would favor the use of expansionary monetary policy, while Keynesian economists may advocate increased government spending to spark economic growth. Supply-side economists may suggest tax cuts to promote business capital investment. When interest rates reach the boundary of an interest rate of zero percent (zero interest-rate policy) conventional monetary policy can no longer be used and government must use other measures to stimulate recovery.

A severe (GDP down by 10%) or prolonged (three or four years) recession is referred to as an economic depression, although some argue that their causes and cures can be different. As an informal shorthand, economists sometimes refer to different recession shapes, such as V-shaped, U-shaped, L-shaped, and W-shaped recessions.

18.1.6: Managing the Business Cycle

When the economy is not at a steady state, the government and monetary authorities have policy mechanisms to move the economy back to consistent growth.

Learning Objective

Identify how changes in monetary and fiscal policy can manage the business cycle, and why that is desirable

Key Points

- If the economy needs to be slowed, enacted policies are referred to as being contractionary and if the economy needs to be stimulated the policy prescription is expansionary.

- Central banks use monetary policy measures to facilitate consistent economic growth, while the government uses fiscal policy.

- The government policy measures are referred to as fiscal policy.

Key Terms

- fiscal policy

-

Government policy that attempts to influence the direction of the economy through changes in government spending or taxes.

- monetary policy

-

The process by which the central bank, or monetary authority manages the supply of money, or trading in foreign exchange markets.