19.1: Introduction to Financial Management

19.1.1: The Importance of Finance

Finance involves the evaluation, disclosure, and management of economic activity and is crucial to the successful operation of firms and markets.

Learning Objective

Differentiate between managerial finance and corporate finance

Key Points

- The primary goal of corporate finance is to maximize shareholder value and it deals with the monetary decisions that business enterprises make.

- Managerial finance is interested in the internal and external significance of a firm’s financial figures.

- The terms corporate finance and corporate financier are also associated with investment banking. The typical role of an investment bank is to evaluate a company’s financial needs and raise the appropriate type of capital that best fits those needs.

- Sound financial management creates value and organizational ability through the allocation of scarce resources.

Key Term

- dividends

-

Dividends are payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders.

The Importance of Finance

Finance involves the evaluation, disclosure, and management of economic activity and is crucial to the successful and efficient operation of firms and markets.

Managerial Finance

Managerial finance concerns itself with the managerial significance of finance. It is focused on assessment rather than technique. For instance, in reviewing an annual report, one concerned with technique would be primarily interested in measurement. They would ask: is money being assigned to the right categories? Were generally accepted accounting principles (GAAP) followed?

A person working in managerial finance would be interested in the significance of a firm’s financial figures measured against multiple targets such as internal goals and competitor figures.They may look at changes in asset balances and probe for red flags that indicate problems with bill collection or bad debt as well as analyze working capital to anticipate future cash flow problems.

Sound financial management creates value and organizational ability through the allocation of scarce resources amongst competing business opportunities. It is an aid to the implementation and monitoring of business strategies and helps achieve business objectives.

Corporate Finance

Corporate finance is the area of finance dealing with monetary decisions that business enterprises make and the tools and analysis used to make those decisions. The primary goal of corporate finance is to maximize shareholder value. Although it is in principle different from managerial finance, which studies the financial decisions of all firms, rather than corporations alone, the main concepts in the study of corporate finance are applicable to financial problems of all kinds of firms.

The discipline can be divided into long-term and short-term decisions and techniques. Capital investment decisions are long-term choices about which projects receive investment, whether to finance that investment with equity or debt, and when or whether to pay dividends to shareholders. On the other hand, short-term decisions deal with the short-term balance of current assets and current liabilities; the focus here is on managing cash, inventories, short-term borrowing, and lending (such as the terms on credit extended to customers).

The terms corporate finance and corporate financier are also associated with investment banking. The typical role of an investment bank is to evaluate the company’s financial needs and raise the appropriate type of capital that best fits those needs. Thus, the terms “corporate finance” and “corporate financier” may be associated with transactions in which capital is raised in order to create, develop, grow, or acquire businesses.

Wall St.

Wall Street is the symbol of American and global finance.

19.1.2: The Role of Financial Managers

Financial managers ensure the financial health of an organization through investment activities and long-term financing strategies.

Learning Objective

Outline the various roles played by financial managers

Key Points

- Financial managers perform data analysis and advise senior managers on profit-maximizing ideas.

- The role of the financial manager, particularly in business, is changing in response to technological advances that have significantly reduced the amount of time it takes to produce financial reports.

- Types of financial managers include controllers, treasurers, credit managers, cash managers, risk managers and insurance managers.

Key Term

- net present value

-

The present value of a project or an investment decision determined by summing the discounted incoming and outgoing future cash flows resulting from the decision.

The Role of Financial Managers

Overview

Financial managers perform data analysis and advise senior managers on profit-maximizing ideas. Financial managers are responsible for the financial health of an organization. They produce financial reports, direct investment activities, and develop strategies and plans for the long-term financial goals of their organization. Financial managers typically:

- Prepare financial statements, business activity reports, and forecasts,

- Monitor financial details to ensure that legal requirements are met,

- Supervise employees who do financial reporting and budgeting,

- Review company financial reports and seek ways to reduce costs,

- Analyze market trends to find opportunities for expansion or for acquiring other companies,

- Help management make financial decisions.

The role of the financial manager, particularly in business, is changing in response to technological advances that have significantly reduced the amount of time it takes to produce financial reports. Financial managers’ main responsibility used to be monitoring a company’s finances, but they now do more data analysis and advise senior managers on ideas to maximize profits. They often work on teams, acting as business advisors to top executives.

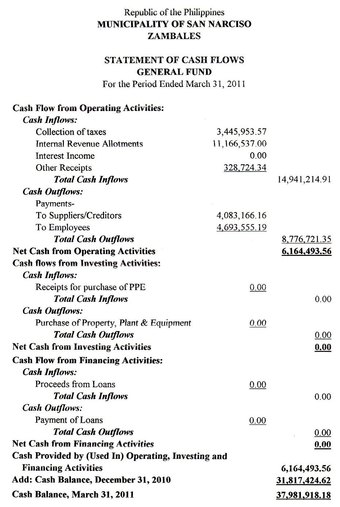

Financial Statements

This is an example of a financial statement that financial managers are responsible for preparing and interpreting.

Financial managers also do tasks that are specific to their organization or industry. For example, government financial managers must be experts on government appropriations and budgeting processes, and healthcare financial managers must know about issues in healthcare finance. Moreover, financial managers must be aware of special tax laws and regulations that affect their industry.

Capital Investment Decisions

Capital investment decisions are long-term corporate finance decisions relating to fixed assets and capital structure. Decisions are based on several inter-related criteria. Corporate management seeks to maximize the value of the firm by investing in projects which yield a positive net present value when valued using an appropriate discount rate in consideration of risk. These projects must also be financed appropriately. If no such opportunities exist, maximizing shareholder value dictates that management must return excess cash to shareholders (i.e., distribution via dividends). Capital investment decisions thus comprise an investment decision, a financing decision, and a dividend decision.

Management must allocate limited resources between competing opportunities (projects) in a process known as capital budgeting. Making this investment decision requires estimating the value of each opportunity or project, which is a function of the size, timing and predictability of future cash flows.

Achieving the goals of corporate finance requires that any corporate investment be financed appropriately. The sources of financing are, generically, capital self-generated by the firm and capital from external funders, obtained by issuing new debt or equity.

Types of Financial Managers

There are distinct types of financial managers, each focusing on a particular area of management.

Controllers direct the preparation of financial reports that summarize and forecast the organization’s financial position, such as income statements, balance sheets, and analyses of future earnings or expenses. Controllers also are in charge of preparing special reports required by governmental agencies that regulate businesses. Often, controllers oversee the accounting, audit, and budget departments. Treasurers and finance officers direct their organization’s budgets to meet its financial goals and oversee the investment of funds. They carry out strategies to raise capital and also develop financial plans for mergers and acquisitions.

Credit managers oversee the firm’s credit business. They set credit-rating criteria, determine credit ceilings, and monitor the collections of past-due accounts. Cash managers monitor and control the flow of cash that comes in and goes out of the company to meet the company’s business and investment needs. Risk managers control financial risk by using hedging and other strategies to limit or offset the probability of a financial loss or a company’s exposure to financial uncertainty. Insurance managers decide how best to limit a company’s losses by obtaining insurance against risks such as the need to make disability payments for an employee who gets hurt on the job or costs imposed by a lawsuit against the company.

Important Skills for Financial Managers

Analytical skills. Financial managers increasingly assist executives in making decisions that affect the organization, a task for which they need analytical ability.

Communication. Excellent communication skills are essential because financial managers must explain and justify complex financial transactions.

Attention to detail. In preparing and analyzing reports such as balance sheets and income statements, financial managers must pay attention to detail.

Math skills. Financial managers must be skilled in math, including algebra. An understanding of international finance and complex financial documents also is important.

Organizational skills. Financial managers deal with a range of information and documents. They must stay organized to do their jobs effectively.

19.2: Planning

19.2.1: Creating a Budget

A budget is the financial expression of an organization’s operating plan for a period of time, usually at least a year.

Learning Objective

Outline the process of budgeting

Key Points

- The budgeting process may be carried out by individuals or by companies to estimate whether the person or company can continue to operate with its projected income and expenses.

- In summary, the purpose of budgeting is to provide a forecast of revenues and expenditures; enable the actual financial operation of the business to be measured against the forecast; and establish the cost constraint for a project, program, or operation.

- The process for preparing a monthly budget includes: listing all sources of monthly income; listing all required, fixed expenses, like rent and mortgage, utilities, and phone; and listing other possible and variable expenses.

Key Term

- fixed expenses

-

In economics, fixed costs are business expenses that are not dependent on the level of goods or services produced by the business.

The Purpose of Budgeting

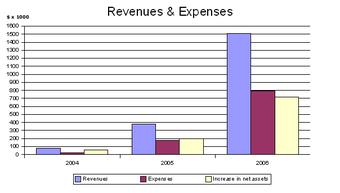

A budget is the financial expression of an organization’s operating plan for a period of time, usually at least a year . Prior to the beginning of the year, managers prepare a plan for what they hope to accomplish in the coming year in terms of revenue, expenses, and net profit.

Budget

A budget is the financial expression of an organization’s operating plan for a period of time, usually at least a year.

Budget can be more formally defined as “a financial document used to project future income and expenses. ” The budgeting process may be carried out by individuals or by companies to estimate whether the person or company can continue to operate with its projected income and expenses. A budget may be prepared simply using paper and pencil, or on computer using a spreadsheet program like Excel, or with a financial application like Quicken or QuickBooks.

In summary, the purpose of budgeting is to:

- Provide a forecast of revenues and expenditures

- Construct a model of how a business might perform financially if certain strategies, events, and plans are carried out

- Enable the actual financial operation of the business to be measured against the forecast

- Establish the cost constraint for a project, program, or operation

The Process of Preparing a Monthly Budget

The process for preparing a monthly budget includes:

- Listing all sources of monthly income

- Listing all required, fixed expenses, like rent and mortgage, utilities, and phone

- Listing other possible and variable expenses

Then, as the year unfolds, actual income and expenses are posted to the accounting records, and compared to what was budgeted, and a variance from budget for each item budgeted (e.g., sales, selling expenses, advertising costs) is calculated. Managers responsible for the various income and expense items then examine each variance and, if it is substantial, search for an explanation. For example, it is one thing if electricity costs are 20% higher than what was budgeted for one month because workmen were using power tools to repair the roof. In that case, we can expect costs to return to normal when the repair work is completed. It is quite another thing if costs are higher because the electric company raised its rates. In that case, we can expect that costs will be at least 20% higher in the future.

The Role of Budgeting in Operations

Budgeting helps aid the planning of actual operations by forcing managers to consider how the conditions might change. It thus encourages managers to consider problems before they arise and think of the steps that should be presently taken. It also helps coordinate the activities of the organization by compelling managers to examine relationships between their own operation and those of other departments. Other essential functions of budgets include:

- To control resources

- To communicate plans to various responsibility center managers

- To motivate managers to strive to achieve budget goals

- To evaluate the performance of managers

- To provide visibility into the company’s performance

The Two Approaches to Budgeting

There are two basic approaches or philosophies when it comes to budgeting. One approach is based on mathematical models, and the other on people.

The first school of thought believes that financial models, if properly constructed, can be used to predict the future. The focus is on variables, inputs and outputs, drivers and the like. Investments of time and money are devoted to perfecting these models, which are typically held in some type of financial spreadsheet application.

The other school of thought holds that it’s not about models, it’s about people. No matter how sophisticated models can get, the best information comes from the people in the business. The focus is therefore in engaging the managers in the business more fully in the budget process, and building accountability for the results. The companies that adhere to this approach have their managers develop their own budgets. While many companies would say that they do both, in reality the investment of time and money falls squarely in one approach or the other.

19.2.2: Financial Plan and Forecast

Financial planning aims to ensure that a firm is properly capitalized and makes appropriate investments.

Learning Objective

Explain how financial planners use forecasts in decision making

Key Points

- Management must identify the “optimal mix” of financing—the capital structure that results in maximum value. Equity financing is less risky with respect to cash flow commitments, but results in a dilution of share ownership, control and earnings.

- Management must attempt to match the long-term financing mix to the assets being financed as closely as possible, in terms of both timing and cash flows.

- Most organizations prepare a revised forecast for the balance of the year, taking into account earlier budgets and forecasts. This step is particularly important if material variances from the original budget exist.

Key Term

- corporate finance

-

Corporate finance is the area of finance dealing with monetary decisions that business enterprises make and the tools and analysis used to make these decisions.

Financial Planning

Financial planning is important in ensuring that corporate investment is financed appropriately, as well as seeing to it that money is spent in worthwhile investments. Achieving the goals of corporate finance requires that any corporate investment be financed appropriately. The sources of financing are capital self-generated by the firm and capital from external sources, obtained by issuing new debt and equity. The financing mix will impact the valuation of the firm (as well as the other long-term financial management decisions). There are two interrelated considerations here:

Financial planning

Financial planning is important in ensuring that corporate investment is both financed appropriately, as well as seeing to it that money is spent in worthwhile investments.

- Management must identify the “optimal mix” of financing—the capital structure that results in maximum value. Equity financing is less risky with respect to cash flow commitments, but results in a dilution of share ownership, control and earnings.

- Management must attempt to match the long-term financing mix to the assets being financed as closely as possible, in terms of both timing and cash flows.

Forecasts

Most organizations prepare a revised forecast for the balance of the year, taking into account earlier budgets and forecasts. This step is particularly important if there are variances from the original budget. For example, if sales are less than projected because market conditions are less favorable than anticipated when the budget was prepared, managers may look for ways to increase sales or reduce expenses in order to avoid a loss for the year.

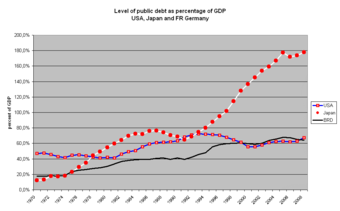

Organizations may carry out a form of economic forecasting which is the process of making predictions about the economy. Forecasts can be carried out at a high level of aggregation like gross domestic product (GDP), inflation, unemployment, or the fiscal deficit. They may also happen at a more dis-aggregated level, for specific sectors of the economy or even specific firms. Some forecasts are produced annually, but many are updated more frequently.

Scenarios

There are many other forecasts that managers ask for in order to try and anticipate what the future might hold and so that they can prepare contingency plans in case of unforeseen events. Examples of unforeseen events that may affect future outcomes are the arrival of a new competitor, a change in the overall economic outlook which could affect costs and/or revenues either positively or negatively, or even the arrival of a new company in another line of business that could raise prevailing wage rates in the region.

Managers like to develop forecasts of figures such as sales, costs, cash, profits, interest rates using different assumptions. Another word for forecasts is scenarios. For example, let us assume that a forecast of the income statement for a business at the end of the year assumes that sales will grow by 8 percent over the previous year and costs will grow by 6 percent. A manager might ask for an alternative scenario where sales increase by 12 percent and costs increase by 9 percent and another scenario where sales decrease by 3 percent and costs increase by 1 percent.

19.3: Operating Funds

19.3.1: Day-to-Day Needs

Operating cash flow refers to the daily cash inflows and outflows generated from business revenues earned, excluding certain costs.

Learning Objective

Define operating cash flow

Key Points

- The International Financial Reporting Standards (IFRS) defines operating cash flow as cash generated from operations less taxation and interest paid, investment income received and less dividends paid.

- “Cash and cash equivalents” on the balance sheet are the most liquid assets found on this statement. They are assets that are readily convertible into cash, such as money market holdings, short-term government bonds or Treasury bills, marketable securities, and commercial paper.

- Cash flow forecasting or cash flow management is a key aspect of the financial management of a business, because planning for future cash requirements can help to avoid a liquidity crisis in the business.

Key Terms

- liquidity

-

An asset’s ability to become solvent without affecting its value; the degree to which it can be easily converted into cash.

- International Financial Reporting Standards

-

International accounting standards that provide a common global language for business affairs, so that company accounts are understandable and comparable across international boundaries.

Operating Cash Needs

Operating cash flow refers to the amount of cash a company generates from the revenues it brings in, excluding costs associated with long-term investment on capital items or investment in securities. The International Financial Reporting Standards (IFRS) defines operating cash flow as cash generated from operations less taxation and interest paid, investment income received and less dividends paid. Business operations have daily cash inflows and outflows. Cash inflows come from cash sales of inventory, collection of credit sales, sales of other assets, and funds obtained through credit financing. Cash outflows occur due to cash payment of business expenses, purchase of assets, and payment on debt .

Liquidity

Liquidity is essential for businesses, because it allows them to meet daily operating needs.

Cash and Cash Equivalents

“Cash and cash equivalents” on the balance sheet are the most liquid assets found on this statement. They are assets that are readily convertible into cash, such as money market holdings, short-term government bonds or Treasury bills, marketable securities, and commercial paper. Cash equivalents are distinguished from other investments through their short-term existence; they mature within three months and have insignificant risk of change in value.

Cash and cash equivalents are also used in the contexts of payments and payment transactions and refer to currency, money orders, paper checks, and stored value products, such as gift certificates and gift cards.

Operating Cash Forecast

Cash flow forecasting or cash flow management is a key aspect of the financial management of a business, because planning for future cash requirements can help to avoid a liquidity crisis in the business. Cash flow is the life-blood of all businesses, particularly start-ups and small enterprises. As a result, it is essential that management forecast (predict) what is going to happen to cash flow to make sure the business has enough to survive.

19.3.2: Capital Expenditures

Capital costs are incurred for the purchase of land, buildings, construction of assets, and equipment, etc., used during business operations.

Learning Objective

Explain how capital expenditures are accounted for

Key Points

- Capital expenditures are needed to bring a project to a commercially operable status. Whether a particular cost is capital or not depends on many factors, such as accounting rules, tax laws, and materiality.

- Capital costs include expenses for tangible goods, such as the purchase of plants and machinery, as well as expenses for intangibles assets, such as trademarks and software development.

- A capital expenditure cannot be deducted in the year in which it is paid or incurred and must be capitalized. The general rule is that if the acquired property’s useful life is longer than the taxable year, then the cost must be capitalized.

Key Terms

- expenditure

-

Amount expended; expense; outlay.

- amortize

-

To reduce (a debt, liability, etc. ) gradually or in installments.

- Trademark

-

A word, symbol, or phrase used to identify a particular company’s product and differentiate it from other companies’ products.

Costs of Capital

Capital expenditures (“CAPEX”) are one-time expenses incurred for the purchase of land, buildings, construction of buildings and other assets, and equipment used in the production of goods or in the rendering of services. In short, capital expenditures are the total costs needed to bring a project to a commercially operable status.

Whether a particular cost is a CAPEX or not depends on many factors, such as accounting rules, tax laws, and materiality. CAPEX include expenses for tangible goods, such as the purchase of plants and machinery, as well as expenses for intangibles assets, such as trademarks and software development. CAPEX are not limited to the initial construction of a building or other asset and should include other expense items, such as interest incurred during the construction phase.

The construction of a building requires the use of capital.

The funds used to construct and put a building into use are capital expenditures.

Accounting for Capital Expenditures

A CAPEX cannot be deducted as an expense in the year in which it is paid or incurred and must be capitalized. The general rule is that if the acquired property’s useful life is longer than the taxable year, then the cost must be capitalized. The CAPEX costs are then amortized or depreciated over the life of the asset in question. The following capital expenditures are capitalized:

- Acquiring fixed and, in some cases, intangible assets

- Repairing an existing asset so as to improve its useful life

- Upgrading an existing asset, which increases its value (original cost)

- Preparing an asset to be used in business

- Restoring property or adapting it to a new or different use

- Starting or acquiring a new business

An ongoing question for the accounting of any company is whether certain expenses should be capitalized. Costs that are expensed in a particular month simply appear on the financial statement as a cost incurred that month. Costs that are capitalized, however, are amortized or depreciated over multiple years. Capitalized expenditures show up on the balance sheet. Most ordinary business expenses are clearly either expensable or capitalizable, but some expenses could be treated either way, according to the preference of the company. Capitalized interest, if applicable, is also spread out over the life of the asset.The counterpart of capital expenditure is operational expenditure (“OpEx”).

19.3.3: Alternate Sources of Funds

Funds typically originate from company sales and earning revenue; other cash sources include the sale of non-current assets and company stock.

Learning Objective

Differentiate between operating, investing and financing cash flows

Key Points

- Cash inflows and outflows can originate from three types of activities: operating, investing, and financing.

- Operating activities that generate cash flows include receipts from the sale of goods or services; receipts from the sale of loans, debt, or equity instruments in a trading portfolio; and interest received on loans.

- Cash inflows from investing activities involve non-current assets, such as sales of land, building, equipment, and marketable securities; loans from suppliers; and payments related to mergers and acquisitions.

- Financing activities include the inflow of cash from investors, such as banks and shareholders, proceeds from issuing short-term or long-term debt; sale of repurchased company shares (treasury stock); for non-profit organizations, receipts of donor-restricted cash; and sale of the company’s stock.

Key Term

- non-current assets

-

assets and property not easily converted into cash; a fixed/non-current asset can also be defined as an asset not directly sold to a firm’s consumers/end-users

Sources of Funds

Funds for business operations typically originate from company sales and earning revenue. However, a business can also generate cash funds from other sources as well, such as the sale of non-current assets and through the sale of company stock. The cash flow statement, which shows cash inflows and outflows for a specific reporting period and distinguishes between three types of activities that generate or use cash: operating, investing, and financing.

Cash Flow Statement

The cash flow statement shows cash inflows and outflows for a specific reporting period and distinguishes between three types of activities that generate or use cash: operating, investing, and financing.

Cash from Operating Activities

Operating activities include the production, sales, and delivery of the company’s product, as well as collecting payment from its customers. This could include purchasing raw materials, building inventory, advertising, and shipping the product. Operating activities that generate cash flows are:

- Receipts from the sale of goods or services

- Receipts for the sale of loans, debt, or equity instruments in a trading portfolio

- Interest received on loans

- Merchandise items which are added back to the net income figure

- Dividends received

- Revenue received from certain investing activities

Cash from Investing Activities

Cash inflows from investing activities involve cash flows associated with non-current assets:

- Sale of a non-current asset (assets, such as land, building, equipment, marketable securities, etc.)

- Loans from suppliers

- Payments related to mergers and acquisitions

Cash from Financing Activities

Financing activities include the inflow of cash from investors, such as banks and shareholders. Other activities which impact long-term liabilities and equity of the company are also listed under financing activities, such as:

- Proceeds from issuing short-term or long-term debt

- Sale of repurchased company shares (treasury stock)

- For non-profit organizations, receipts of donor-restricted cash

- Sale of the company’s stock

19.3.4: Credit Operations

Business operations can require the use of credit, or the transfer of money or property on promise of repayment, to meet operating needs.

Learning Objective

Outline the types of credit used for financing business operations

Key Points

- Credit is sometimes not granted to a person or business with financial instability or difficulty. Companies frequently offer credit to their customers as part of the terms of a purchase agreement.

- A line of credit is any credit source extended to a business or individual by a bank or other financial institution and may take several forms.

- A revolving credit line provides a borrower with a maximum aggregate amount of capital, available over a specified period of time; it allows the borrower to draw down, repay, and re-draw credit amounts advanced to her by the available capital during the term of the debt.

- In a loan, the borrower initially receives or borrows an amount of money, called the “principal,”, from the lender and is obligated to pay back or repay an amount with interest to the lender at a later time.

Key Terms

- debtor

-

A person or firm that owes money; one in debt; one who owes a debt

- creditor

-

A person to whom a debt is owed.

Use of Credit and Financing for Operations

Business operations can require the use of credit and financing to meet operating needs. Credit, in commerce and finance, is a term used to denote transactions involving the transfer of money or other property on promise of repayment, usually at a fixed future date and at a specific interest rate . The transferor thereby becomes a creditor, and the transferee (the recipient of the funds or property) becomes a debtor. Credit is sometimes not granted to a person or business with financial instability or difficulty. Companies frequently offer credit to their customers as part of the terms of a purchase agreement. Organizations that offer credit to their customers frequently employ a credit manager .

Loans can weigh a business down.

The use of credit is a necessity in business and should be managed wisely.

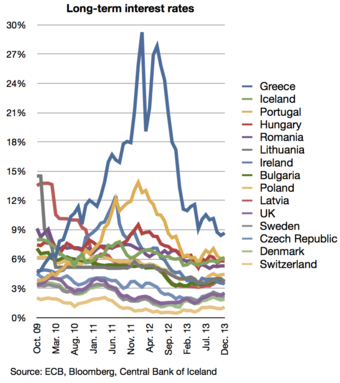

Interest Rates

Long-term interest rate statistics for non-Euro countries plus Greece, Portugal, and Ireland.

Types of Credit

A line of credit is any credit source extended to a business or individual by a bank or other financial institution. A line of credit may take several forms, such as overdraft protection, demand loan, special purpose, export packing credit, term loan, discounting, purchase of commercial bills, traditional revolving credit card account, etc. It is effectively a source of funds that can readily be used at the borrower’s discretion. Interest is paid only on money actually withdrawn. Lines of credit can be secured by collateral or may be unsecured.

A revolving credit line provides a borrower with a maximum aggregate amount of capital, available over a specified period of time. However, unlike a term loan, revolving debt allows the borrower to draw down, repa,y and re-draw credit amounts advanced to her by the available capital during the term of the debt. Each credit line is borrowed for a set period of time, usually one, three, or six months, after which time it is technically repayable. Repayment of revolving credit is achieved either by scheduled payments on the total amount of the debt over time, or by all outstanding loans being repaid on the date of termination.

In a loan, the borrower initially receives or borrows an amount of money, called the “principal,” from the lender and is obligated to pay back or repay an equal amount of money to the lender at a later time. Typically, the money is paid back in regular installments, or partial repayments; in an annuity, each installment is the same amount. The loan is generally provided at a cost, referred to as interest on the debt, which provides an incentive for the lender to engage in the loan.

19.3.5: Purchasing Inventory

Inventory management is primarily about specifying the quantity and placement of stocked goods.

Learning Objective

Explain how an organization makes purchasing decisions

Key Points

- The scope of inventory management includes items such as: stock replenishment lead time, carrying costs of inventory, asset management, and inventory forecasting.

- There are four basic reasons for keeping an inventory: time lags present in the supply chain, the maintenance of inventory for consumption during variations in lead time, inventories maintained to meet uncertainties in demand and supply, and economies of scale.

- Purchasing refers to a business or organization acquiring goods or services to accomplish the goals of its enterprise. Companies generally use operating funds to finance their purchasing program.

- One of the goals of purchasing inventory is to acquire goods at the most advantageous terms for the buying entity (the “Buyer”).

Key Terms

- lead time

-

The amount of time between the initiation of some process and its completion, e.g. the time required to manufacture or procure a product; the time required before something can be provided or delivered.

- economies of scale

-

The characteristics of a production process in which an increase in the scale of the firm causes a decrease in the long-run average cost of each unit.

Inventory Management

Inventory management is primarily about specifying the quantity and placement of stocked goods. Inventory management is required at different locations within a facility or within multiple locations of a supply network to maintain the regular and planned course of production and to manage the risk of running out of materials or goods for sale. The scope of inventory management also involves stock replenishment lead time, carrying costs of inventory, asset management, inventory forecasting, inventory valuation, inventory visibility, future inventory price forecasting, physical inventory, available physical space for inventory, quality management, returns and defective goods, and demand forecasting .

Clothing Retailers Should Have Sufficient Inventory On Hand

Inventory purchases should be carefully managed to prevent overstocking merchandise or having inventory shortages.

There are four basic reasons for keeping an inventory:

- Time: The time lags present in the supply chain, from supplier to user at every stage, require that businesses maintain certain amounts of inventory to use in this lead time.

- Consumption: Inventory is to be maintained for consumption during variations in lead time. Lead time itself can be addressed by ordering a specified number of days in advance.

- Uncertainty: Inventories are maintained as buffers to meet uncertainties in demand, supply, and movements of goods.

- Economies of scale: The idea of “one unit at a time, at a place where a user needs it, when they need it” tends to incur lots of costs in terms of logistics. So bulk buying, movement, and storing brings in economies of scale and creates inventory.

Purchasing

Purchasing refers to a business or organization acquiring goods or services to accomplish the goals of its enterprise. Companies generally use operating funds to finance their purchasing program. Most organizations use a three-way check as the foundation of their purchasing programs. This involves three departments in the organization completing separate parts of the acquisition process. These departments can be purchasing, receiving, and accounts payable; or engineering, purchasing, and accounts payable; or a plant manager, purchasing, and accounts payable. Combinations can vary significantly, but a purchasing department and accounts payable are usually two of the three departments involved.

Historically, the purchasing department issued purchase orders for supplies, services, equipment, and raw materials. Then, in an effort to decrease the administrative costs associated with the repetitive ordering of basic consumable items, “blanket” or “master” agreements were put into place. These types of agreements typically have a longer duration and increased scope to maximize the quantities of scale concept. When additional supplies were required, a simple release would be issued to the supplier to provide the goods or services.

From time to time, an organization will “shop” for suppliers through the process of bidding. When selecting bidders, an organization identifies potential suppliers for specified supplies, services, or equipment. These suppliers’ credentials and history are analyzed, together with the products or services they offer. The bidder selection process varies from organization to organization, but can include running credit reports, interviewing management, testing products, and touring facilities. Organizational goals will dictate the criteria for the selection process of bidders. It is also possible that the product or service being procured is so specialized that the number of bidders are limited and the criteria must be very wide to permit competition.

Negotiating is a key skill in purchasing. One of the goals of purchasing inventory is to acquire goods at the most advantageous terms for the buying entity (the “Buyer”). Purchasing agents typically attempt to decrease costs while meeting the Buyer’s other requirements, such as an on-time delivery and compliance to the commercial terms and conditions (including the warranty, the transfer of risk, assignment, auditing rights, confidentiality, remedies, etc.).

19.4: Short-Term Financing

19.4.1: Commercial Paper

Commercial paper is a money-market security issued (sold) by large corporations to get money to meet short term debt obligations.

Learning Objective

Analyze the commercial paper market

Key Points

- There are two methods of issuing paper. The issuer can market the securities directly to a buy and hold investor such as most money market funds. Alternatively, it can sell the paper to a dealer, who then sells the paper in the market.

- Commercial paper is a lower cost alternative to a line of credit with a bank. Once a business becomes established, and builds a high credit rating, it is often cheaper to draw on a commercial paper than on a bank line of credit.

- Asset-Backed Commercial Paper (ABCP) is a form of commercial paper that is collateralized by other financial assets.

Key Term

- money market

-

A market for trading short-term debt instruments, such as treasury bills, commercial paper, bankers’ acceptances, and certificates of deposit.

Commercial Paper

In the global money market, commercial paper is an unsecured promissory note with a fixed maturity of one to 364 days. Commercial paper is a money-market security issued (sold) by large corporations to get money to meet short term debt obligations (for example, payroll), and is only backed by an issuing bank or a corporation’s promise to pay the face amount on the maturity date specified on the note. Since it is not backed by collateral, only firms with excellent credit ratings from a recognized rating agency will be able to sell their commercial paper at a reasonable price. Commercial paper is usually sold at a discount from face value, and carries higher interest repayment rates than bonds. Typically, the longer the maturity on a note, the higher the interest rate the issuing institution must pay. Interest rates fluctuate with market conditions, but are typically lower than banks’ rates.

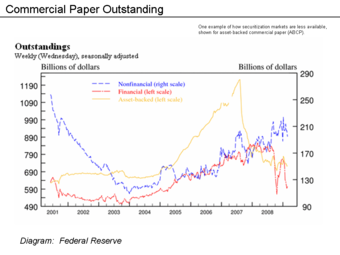

There are two methods of issuing paper. The issuer can market the securities directly to a buy and hold investor such as most money market funds. Alternatively, it can sell the paper to a dealer, who then sells the paper in the market . The dealer market for commercial paper involves large securities firms and subsidiaries of bank holding companies. Most of these firms are also dealers in US Treasury securities. Direct issuers of commercial paper are usually financial companies that have frequent and sizable borrowing needs, and find it more economical to sell paper without the use of an intermediary. In the United States, direct issuers save a dealer fee of approximately five basis points, or 0.05% annualized, which translates to $50,000 on every $100 million outstanding. This saving compensates for the cost of maintaining a permanent sales staff to market the paper. Dealer fees tend to be lower outside the United States .

US Commercial Paper Weekly 2001-2008

United States Commercial Paper outstanding at end of each week from 3 January 2001 to 29 October 2008. Vertical scale shows debt in billions (thousands of millions) of dollars, horizontal scale shows years. Each blue marker indicates commercial paper outstanding at that date which matures after one week.

US Commercial Paper 2001-2007

United States Commercial Paper outstanding at end of each year 2001 to 2007. Vertical scale shows debt in millions of dollars, horizontal scale shows years. All markers indicate commercial paper outstanding, maturing after December 31. Circles on blue line indicate Total commercial paper; triangles diamonds on pink line indicate SEC rule 2a-7 tier-1 commercial paper; triangles on blue line indicate Asset-backed commercial paper; squares on yellow line indicate SEC rule 2a-7 tier-2 commercial paper.

Weekly Commercial Paper Outstandings

Commercial paper is a lower cost alternative to a line of credit with a bank. Once a business becomes established and builds a high credit rating, it is often cheaper to draw on a commercial paper than on a bank line of credit. Nevertheless, many companies still maintain bank lines of credit as a backup. Banks often charge fees for the amount of the line of the credit that does not have a balance.

Advantages and Disadvantages

Advantages of commercial paper include lower borrowing costs; term flexibility; and more liquidity options for creditors due to its trade-ability.

Disadvantages of commercial paper include its limited eligibility; reduced credit limits with banks; and reduced reliability due to its strict oversight.

Asset-Backed Commercial Paper (ABCP)

Asset-Backed Commercial Paper (ABCP) is a form of commercial paper that is collateralized by other financial assets. ABCP is typically a short-term instrument that matures between one and 180 days from issuance and is typically issued by a bank or other financial institution. The firm wishing to finance its assets through the issuance of ABCP sells the assets to a Special Purpose Vehicle (SPV) or Structured Investment Vehicle (SIV), created by a financial services company. The SPV/SIV issues the ABCP to raise funds to purchase the assets. This creates a legal separation between the entity issuing and the institution financing its assets.

19.4.2: Factoring Accounts Receivable

Factoring makes it possible for a business to readily convert a substantial portion of its accounts receivable into cash.

Learning Objective

Explain the business of factoring and assess the risks of the involved parties

Key Points

- Debt factoring is also used as a financial instrument to provide better cash flow control especially if a company currently has a lot of accounts receivables with different credit terms to manage.

- The three parties directly involved in factoring are: the one who sells the receivable, the debtor (the account debtor, or customer of the seller), and the factor.

- There are two principal methods of factoring: recourse and non-recourse. Under recourse factoring, the client is not protected against the risk of bad debts. Under non-recourse factoring, the factor assumes the entire credit risk.

Key Term

- factoring

-

A financial transaction whereby a business sells its accounts receivable to a third party (called a factor) at a discount.

Factoring

Factoring is a financial transaction whereby a business sells its accounts receivable to a third party (called a “factor”) at a discount. Factoring makes it possible for a business to convert a readily substantial portion of its accounts receivable into cash. This provides the funds needed to pay suppliers and improves cash flow by accelerating the receipt of funds.

Money

Factoring makes it possible for a business to readily convert a substantial portion of its accounts receivable into cash.

Companies factor accounts when the available cash balance held by the firm is insufficient to meet current obligations and accommodate its other cash needs, such as new orders or contracts. In other industries, however, such as textiles or apparel, for example, financially sound companies factor their accounts simply because this is the historic method of finance. The use of factoring to obtain the cash needed to accommodate a firm’s immediate cash needs will allow the firm to maintain a smaller ongoing cash balance. By reducing the size of its cash balances, more money is made available for investment in the firm’s growth. Debt factoring is also used as a financial instrument to provide better cash flow control, especially if a company currently has a lot of accounts receivables with different credit terms to manage. A company sells its invoices at a discount to their face value when it calculates that it will be better off using the proceeds to bolster its own growth than it would be by effectively functioning as its “customer’s bank. “

Types of Factoring

There are two principal methods of factoring: recourse and non-recourse. Under recourse factoring, the client is not protected against the risk of bad debts. On the other hand, the factor assumes the entire credit risk under non-recourse factoring (i.e., the full amount of invoice is paid to the client in the event of the debt becoming bad). Other variations include partial non-recourse, where the factor’s assumption of credit risk is limited by time, and partial recourse, where the factor and its client (the seller of the accounts) share credit risk. Factors never assume “quality” risk, and even a non-recourse factor can charge back a purchased account which does not collect for reasons other than credit risk assumed by the factor, (e.g., the account debtor disputes the quality or quantity of the goods or services delivered by the factor’s client).

In “advance” factoring, the factor provides financing to the seller of the accounts in the form of a cash “advance,” often 70-85% of the purchase price of the accounts, with the balance of the purchase price being paid, net of the factor’s discount fee (commission) and other charges, upon collection. In “maturity” factoring, the factor makes no advance on the purchased accounts; rather, the purchase price is paid on or about the average maturity date of the accounts being purchased in the batch.

There are three principal parts to “advance” factoring transaction:

- The advance, a percentage of the invoice’s face value that is paid to the seller at the time of sale.

- The reserve, the remainder of the purchase price held until the payment by the account debtor is made.

- The discount fee, the cost associated with the transaction which is deducted from the reserve, along with other expenses, upon collection, before the reserve is disbursed to the factor’s client.

Parties Involved in the Factoring Process

The three parties directly involved are the one who sells the receivable, the debtor (the account debtor, or customer of the seller), and the factor. The receivable is essentially an asset associated with the debtor’s liability to pay money owed to the seller (usually for work performed or goods sold). The seller then sells one or more of its invoices (the receivables) at a discount to the third party, the specialized financial organization (aka the factor), often, in advance factoring, to obtain cash. The sale of the receivables essentially transfers ownership of the receivables to the factor, indicating the factor obtains all of the rights associated with the receivables. Accordingly, the factor obtains the right to receive the payments made by the debtor for the invoice amount and, in non-recourse factoring, must bear the loss if the account debtor does not pay the invoice amount due solely to his or its financial inability to pay.

Risks in Factoring

The most important risks of a factor are:

- Counter party credit risk: risk covered debtors can be re-insured, which limit the risks of a factor. Trade receivables are a fairly low risk asset due to their short duration.

- External fraud by clients: fake invoicing, mis-directed payments, pre-invoicing, unassigned credit notes, etc. A fraud insurance policy and subjecting the client to audit could limit the risks.

- Legal, compliance, and tax risks: a large number and variety of applicable laws and regulations depending on the country.

- Operational: operational risks such as contractual disputes.

19.4.3: Credit Cards

Credit cards allow users to pay for goods and services based on the promise to pay for them later and the immediate provision of cash by the card provider.

Learning Objective

Evaluate the costs and benefits of a credit card

Key Points

- The issuer of the card creates a revolving account and grants a line of credit to the consumer (or the user) from which the user can borrow money for payment to a merchant or as a cash advance to the user.

- The main benefit to each customer is convenience. Credit cards allow small short-term loans to be quickly made to a customer who need not calculate a balance remaining before every transaction, provided the total charges do not exceed the maximum credit line for the card.

- Costs to users include high interest rates and complex fee structures.

Key Term

- credit card

-

A plastic card with a magnetic strip or an embedded microchip connected to a credit account and used to buy goods or services. It’s like a debit card, but money comes not from your personal bank account, but the bank lends money for the purchase based on the credit limit. Credit limit is determined by the income and credit history. Bank charge APR (annual percentage rate) for using of money.

Example

- For example, if a user has a $1,000 transaction and repaid it in full within this grace period, there would be no interest charged. If, however, even $1 of the total amount remained unpaid, interest would be charged on the $1,000 from the date of purchase until the payment is received.

Credit Cards

A credit card is a payment card issued to users as a system of payment. It allows the cardholder to pay for goods and services based on the promise to pay for them later and the immediate provision of cash by the card provider. The issuer of the card creates a revolving account and grants a line of credit to the consumer (or the user) from which the user can borrow money for payment to a merchant or as a cash advance to the user. Credit cards allow the consumers a continuing balance of debt, subject to interest being charged. A credit card also differs from a cash card, which can be used like currency by the owner of the card .

Credit card

A credit card is a payment card issued to users as a system of payment.

Credit cards are issued by an issuer like a bank or credit union after an account has been approved by the credit provider, after which cardholders can use it to make purchases at merchants accepting that card.

Benefits to Users

The main benefit to each customer is convenience. Compared to debit cards and checks, a credit card allows small short-term loans to be quickly made to a customer who need not calculate a balance remaining before every transaction, provided the total charges do not exceed the maximum credit line for the card.

Many credit cards offer rewards and benefits packages like enhanced product warranties at no cost, free loss/damage coverage on new purchases and various insurance protections. Credit cards can also offer reward points which may be redeemed for cash, products or airline tickets.

Costs to Users

High interest rates: Low introductory credit card rates are limited to a fixed term, usually between six and 12 months, after which a higher rate is charged. As all credit cards charge fees and interest, some customers become so indebted to their credit card provider that they are driven to bankruptcy. Some credit cards often levy a rate of 20 to 30 percent after a payment is missed. In other cases a fixed charge is levied without change to the interest rate. In some cases universal default may apply – the high default rate is applied to a card in good standing by missing a payment on an unrelated account from the same provider. This can lead to a snowball effect in which the consumer is drowned by unexpectedly high interest rates.

Complex fee structures in the credit card industry limit customers’ ability to comparison shop, help ensure that the industry is not price-competitive and help maximize industry profits.

Benefits to Merchants

For merchants, a credit card transaction is often more secure than other forms of payment, because the issuing bank commits to pay the merchant the moment the transaction is authorized regardless of whether the consumer defaults on the credit card payment. In most cases, cards are even more secure than cash, because they discourage theft by the merchant’s employees and reduce the amount of cash on the premises. Finally, credit cards reduce the back office expense of processing checks/cash and transporting them to the bank.

Costs to Merchants

Merchants are charged several fees for accepting credit cards. The merchant is usually charged a commission of around one to three percent of the value of each transaction paid for by credit card. The merchant may also pay a variable charge, called an interchange rate, for each transaction. In some instances of very low-value transactions, use of credit cards will significantly reduce the profit margin or cause the merchant to lose money on the transaction. Merchants with very low average transaction prices or very high average transaction prices are more averse to accepting credit cards. Merchants may charge users a “credit card supplement,” either a fixed amount or a percentage, for payment by credit card. This practice is prohibited by the credit card contracts in the United States, although the contracts allow the merchants to give discounts for cash payment.

Merchants are also required to lease processing terminals, meaning merchants with low sales volumes may have to commit to long lease terms. For some terminals, merchants may need to subscribe to a separate telephone line. Merchants must also satisfy data security compliance standards which are highly technical and complicated. In many cases, there is a delay of several days before funds are deposited into a merchant’s bank account. As credit card fee structures are very complicated, smaller merchants are at a disadvantage to analyze and predict fees. Finally, merchants assume the risk of chargebacks by consumers.

19.4.4: Commercial Banks

A commercial bank lends money, accepts time deposits, and provides transactional, savings, and money market accounts.

Learning Objective

Sketch out the role of commercial banks in money lending

Key Points

- Commercial banks may provide a secured loan, which are monetary loans that have borrower collateral pledged against their repayment.

- Commercial banks may also provide unsecured loans, which are monetary loans that are not secured against the borrower’s assets (i.e., no collateral is involved).

- Accessing funds through a commercial bank is a very common way of accessing funds when in need, particularly in the case of small or entrepreneurial businesses.

Key Term

- collateral

-

A security or guarantee (usually an asset) pledged for the repayment of a loan if one cannot procure enough funds to repay. (Originally supplied as “accompanying” security. )

A commercial or business bank , is a type of financial institution and intermediary that lends money, accepts time deposits, and provides transactional, savings, and money market accounts.

Commercial banks

A commercial bank (or business bank) is a type of financial institution and intermediary.

Commercial banks engage in the following activities: the processing of payments; accepting money on term deposit; lending money by overdraft, installment loan, or other means; providing documentary and standby letters of credit guarantees, performance bonds, securities underwriting commitments and other forms of off- balance sheet exposures; and the safekeeping of documents and other items in safe deposit boxes.

Commercial banks provide a number of loans. A secured loan is when a borrower pledges some asset (e.g., a car or property) as collateral for it, which then becomes a secured debt owed to the creditor who gives the loan. The debt is thus secured against the collateral. In the event that the borrower defaults, the creditor takes possession of the asset used as collateral and may sell it to regain some or all of the amount originally lent to the borrower.

Commercial banks may also provide unsecured loans, which are monetary loans that are not secured against the borrower’s assets (i.e., no collateral is involved). Some examples of unsecured loans include credit cards and credit lines.

An overdraft is an example of an unsecured loan. An overdraft occurs when money is withdrawn from a bank account and the available balance goes below zero. In this situation, the account is said to be “overdrawn”. If there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. If the positive balance exceeds the agreed terms, then additional fees may be charged and higher interest rates may apply.

Accessing funds through a commercial bank is very typical, and a common way of accessing funds when in need, particularly in the case of small or entrepreneurial businesses.

19.4.5: Trade Credit or Accounts Payable

Trade credit is the largest use of capital for a majority of B2B sellers; Accounts Payable is money owed by a firm to its suppliers.

Learning Objective

Explain the process of using and recording accounts payable

Key Points

- There are many forms of trade credit in common use; often industry-specific. They all benefit from their collaboration to make efficient use of capital to accomplish various business objectives.

- An accounts payable is recorded in the Account Payable sub-ledger at the time an invoice is vouchered for payment.

- Commonly, a supplier will ship a product, issue an invoice, and collect payment later, which describes a cash conversion cycle, or a period of time during which the supplier has already paid for raw materials but hasn’t been paid in return by the final customer.

Key Term

- supplier

-

One who supplies; a provider.

Trade Credit

Trade credit is the largest use of capital for a majority of business to business (B2B) sellers in the United States and is a critical source of capital for a majority of all businesses. For example, Wal-Mart, the largest retailer in the world, has used trade credit as a larger source of capital than bank borrowings. Trade credit for Wal-Mart is eight times the amount of capital invested by shareholders.

For many borrowers in the developing world, trade credit serves as a valuable source of alternative data for personal and small business loans.

There are many forms of trade credit in common use; often industry-specific. They all benefit from their collaboration to make efficient use of capital to accomplish various business objectives.

Accounts Payable (A/P)

Accounts Payable (A/P and also known as creditors) is money owed by a business to its suppliers. An accounts payable is recorded in the A/P sub-ledger at the time an invoice is vouchered for payment. Payables are often categorized as Trade Payables, payables for the purchase of physical goods that are recorded in Inventory, and Expense Payables, payables for the purchase of goods or services that are expensed. Common examples of Expense Payables are advertising, travel, entertainment, office supplies, and utilities. A/P is a form of credit that suppliers offer to their customers by allowing them to pay for a product or service after it has already been received .

Credit

Accounts Payable (also known as Creditors) is money owed by a business to its suppliers.

In households, these payables are ordinarily bills such as utility, rent, etc. Households usually track and pay on a monthly basis manually by using checks, credit cards, or online banking. In a business, there is usually a much broader range of suppliers to pay, and accountants or bookkeepers usually use accounting software to track the flow of money into this liability account when they receive invoices and out of it when they make payments. Increasingly, large firms often use specialized automation solutions (commonly called ePayables) to automate the paper and manual elements of processing an organization’s invoices.

Commonly, a supplier will ship a product, issue an invoice, and collect payment later, which describes a cash conversion cycle, a period of time during which the supplier has already paid for raw materials but hasn’t been paid in return by the final customer. When the invoice is received by the purchaser, it is matched to the packing slip and purchase order, and if all is in order, the invoice is paid. This is referred to as the three-way match. The three-way match can slow down the payment process, so the method may be modified. For example, three-way matching may be limited solely to large-value invoices, or the matching is automatically approved if the received quantity is within a certain percentage of the amount authorized in the purchase order.

19.4.6: Family and Friends

Asking friends and families to invest is one way that start-ups are funded.

Learning Objective

Analyze person to person (P2P) lending

Key Points

- Somewhat similar to raising money from family and friends is person-to-person lending. Person-to-person lending is a certain breed of financial transaction which occurs directly between individuals or “peers” without the intermediation of a traditional financial institution.

- Lending money and supplies to friends, family, and community members predates formalized financial institutions, but in its modern form, peer-to-peer lending is a by-product of Internet technologies, especially Web 2.0.

- In a particular model of P2P lending known as “family and friend lending”, the lender lends money to a borrower based on their pre-existing personal, family, or business relationship.

Key Term

- financial institution

-

In financial economics, a financial institution is an institution that provides financial services for its clients or members.

Investments from Family and Friends

Asking friends and families to invest is another common way that start-ups are funded. Often the potential entrepreneur is young, energetic, and has a good idea for a start-up, but does not have much in the way of personal savings. Friends and family may be older and have some money set aside. While your parents, or other family members should not risk all of their retirement savings on your start-up, they may be willing to risk a small percentage of it to help you out .

Family

Asking friends and families to invest is another common way that start-ups are funded.

Sometimes friends your own age are willing to work for little or no wages until your cash flow turns positive. The term “sweat equity” is often used for this type of contribution as the owner will often reward such loyalty with a small percentage ownership of the organization in lieu of cash. A variation on this is barter or trade. This is a method by which you could provide a needed service such as consulting or management advice in return for the resources needed for your start up. This needs to be accounted for in your accounting records also.

Person-to-Person Lending

Somewhat similar to raising money from family and friends is person-to-person lending. Person-to-person lending (also known as peer-to-peer lending, peer-to-peer investing, and social lending; abbreviated frequently as P2P lending) is a certain breed of financial transaction (primarily lending and borrowing, though other more complicated transactions can be facilitated) which occurs directly between individuals or “peers” without the intermediation of a traditional financial institution. However, person-to-person lending is for the most part a for-profit activity, which distinguishes it from person-to-person charities, person-to-person philanthropy, and crowdfunding.

Lending money and supplies to friends, family, and community members predates formalized financial institutions, but in its modern form, peer-to-peer lending is a by-product of Internet technologies, especially Web 2.0. The development of the market niche was further boosted by the global economic crisis in 2007 to 2010 when person-to-person lending platforms promised to provide credit at the time when banks and other traditional financial institutions were having fiscal difficulties.

Many peer-to-peer lending companies leverage existing communities and pre-existing interpersonal relationships with the idea that borrowers are less likely to default to the members of their own communities. The risk associated with lending is minimized either through mutual (community) support of the borrower or, as occurs in some instances, through forms of social pressure. The peer-to-peer lending firms either act as middlemen between friends and family to assist with calculating repayment terms, or connect anonymous borrowers and lenders based on similarities in their geographic location, educational and professional background, and connectedness within a given social network.

In a particular model of P2P lending known as “family and friend lending”, the lender lends money to a borrower based on their pre-existing personal, family, or business relationship. The model forgoes an auction-like process and concentrates on formalizing and servicing a personal loan. Lenders can charge below market rates to assist the borrower and mitigate risk. Loans can be made to pay for homes, personal needs, school, travel, or any other needs.

Advantages and Criticisms

One of the main advantages of person-to-person lending for borrowers has been better rates than traditional bank rates can offer (often below 10%). The advantages for lenders are higher returns that would be unobtainable from a savings account or other investments.

As person-to-person lending companies and their customer base continue to grow, marketing expenses and administrative costs associated with customer service and arbitration, maintaining product information, and developing quality websites to service customers and stand out among competitors will rise. In addition, compliance to legal regulations becomes more complicated. This causes many of the original benefits from disintermediation to fade away and turns person-to-person companies into new intermediaries, much like the banks that they originally differentiated from. This process of reintroducing intermediaries is known as reintermediation.

Person-to-person lending also attracts borrowers who, because of their past credit status or the lack of thereof, are unqualified for traditional bank loans. The unfortunate situation of these borrowers is well-known for the people issuing the loans and results in very high interest rates that verge on predatory lending and loan sharking.

19.4.7: Secured vs. Unsecured Funding

A secured loan is a loan in which the borrower pledges an asset (e.g. a car or property) as collateral, while an unsecured loan is not secured by an asset.

Learning Objective

Differentiate between a secured loan vs. an unsecured loan

Key Points

- A loan constitutes temporarily lending money in exchange for future repayment with specific stipulations such as interest, finance charges, and fees.

- Secured loans are secured by assets such as real estate, an automobile, boat, or jewelry. The secured asset is known as collateral. In the event the borrower does not pay the loan as agreed, he/she may forfeit the asset used as collateral to the lender.

- Unsecured loans are monetary loans that are not secured against collateral. Interest rates for unsecured loans are often higher than for secured loans because the risk to the lender is greater.

Key Term

- Assets

-

An asset is something of economic value. Examples of assets include money, real estate, and automobiles.

Examples

- A mortgage loan is a secured loan in which the collateral is real estate. If the borrower does not pay back the mortgage within the agreed upon terms, the lender may seize the property. Seizure of real estate for non-payment is also known as foreclosure. A foreclosure is a legal process in which mortgaged property is sold to pay the debt of the defaulting borrower.

- A car loan is a secured loan in which the collateral is an automobile, If the borrower does not pay back the car loan within the agreed upon terns, the lender may seize the automobile. Seizure of an automobile for non-payment is also known as repossession. Repossession is a legal process in which property, such as a car, is taken back by the creditor.

Loans

Debt refers to an obligation. A loan is a monetary form of debt. A loan constitutes temporarily lending money in exchange for future repayment with specific stipulations such as interest, finance charges, and/or fees. A loan is considered a contract between the lender and the borrower. Loans may either be secured or unsecured.

Secured Loans

A secured loan is a loan in which the borrower pledges some asset (e.g., a car or property) as collateral. A mortgage loan is a very common type of debt instrument, used by many individuals to purchase housing. In this arrangement, the money is used to purchase the property. The financial institution, however, is given security — a lien on the title to the house — until the mortgage is paid off in full. If the borrower defaults on the loan, the bank has the legal right to repossess the house and sell it, to recover sums owed to it.

If the sale of the collateral does not raise enough money to pay off the debt, the creditor can often obtain a deficiency judgment against the borrower for the remaining amount. Generally speaking, secured debt may attract lower interest rates than unsecured debt due to the added security for the lender. However, credit history, ability to repay, and expected returns for the lender are also factors affecting rates.

There are two purposes for a loan secured by debt. By extending the loan through secured debt, the creditor is relieved of most of the financial risks involved because it allows the creditor to take the property in the event that the debt is not properly repaid. For the debtor, a secured debt may receive more favorable terms than that available for unsecured debt, or to be extended credit under circumstances when credit under terms of unsecured debt would not be extended at all. The creditor may offer a loan with attractive interest rates and repayment periods for the secured debt.

Unsecured Loans

Unsecured loans are monetary loans that are not secured against the borrower’s assets. The interest rates applicable to these different forms may vary depending on the lender and the borrower. These may or may not be regulated by law.

Interest rates on unsecured loans are nearly always higher than for secured loans, because an unsecured lender’s options for recourse against the borrower in the event of default are severely limited. An unsecured lender must sue the borrower, obtain a money judgment for breach of contract, and then pursue execution of the judgment against the borrower’s unencumbered assets (that is, the ones not already pledged to secured lenders). In insolvency proceedings, secured lenders traditionally have priority over unsecured lenders when a court divides up the borrower’s assets. Thus, a higher interest rate reflects the additional risk that in the event of insolvency, the debt may be difficult or impossible to collect.

Unsecured loans are often used by borrowers for small purchases such as computers, home improvements, vacations, or unexpected expenses. An unsecured loan means the lender relies on the borrower’s promise to pay it back. Due to the increased risk involved, interest rates for unsecured loans tend to be higher. Typically, the balance of the loan is distributed evenly across a fixed number of payments; penalties may be assessed if the loan is paid off early. Unsecured loans are often more expensive and less flexible than secured loans, but suitable if the lender wants a short-term loan (one to five years).

In the event of the bankruptcy of the borrower, the unsecured creditors will have a general claim on the assets of the borrower after the specific pledged assets have been assigned to the secured creditors, although the unsecured creditors will usually realize a smaller proportion of their claims than the secured creditors.

In some legal systems, unsecured creditors who are also indebted to the insolvent debtor are able (and in some jurisdictions, required) to set-off the debts, which actually puts the unsecured creditor with a matured liability to the debtor in a pre-preferential position.

19.4.8: Short-Term Loans

Short-term loans offer individuals and businesses borrowing options to meet financial obligations.

Learning Objective

Classify different types of short term loans

Key Points

- Longer term funding is supplied by bonds and equity.

- Convenience is main benefit of a credit card to a business or entrepreneur .

- Venture capitalists use bridge loans to “bridge” cash flow gaps between successive major private equity financing terms.

Key Terms

- London Interbank Offered Rate

-

the average interest rate estimated by leading financial instiutions in London that they would be charged if borrowing from others

- collateral

-

A security or guarantee (usually an asset) pledged for the repayment of a loan if one cannot procure enough funds to repay. (Originally supplied as “accompanying” security. )

- benchmark

-

A standard by which something is evaluated or measured.

- venture capital

-

money invested in an innovative enterprise in which both the potential for profit and the risk of loss are considerable.

Example

- In December 2010, Kohlberg Kravis Roberts (KKR) and partners marketed a bridge loan for its upcoming acquisition of Del Monte Foods. As is common in such cases, KKR planned for the newly private company to borrow money by issuing corporate bonds. To ensure the money would be available, KKR sought $1.6 billion in bridge loan guarantees, for which it promised to pay 8.75 percent interest for 60 days and 11.75 percent thereafter. At KKR’s option, these loans could then be replaced with eight-year corporate bonds (in effect, a put option) paying 11.75 percent. In return for the loans and guarantees, KKR was offering roughly 2 percent in fees.

Short Term Loans

Short term loans are borrowed funds used to meet obligations within a few days up to a year. The borrower receives cash from the lender more quickly than with medium- and long-term loans, and must repay it in a shorter time frame.

Examples of short-term loans include:

Overdraft