6.1: Sole Proprietorships

6.1.1: A Brief Definition of Sole Proprietorships

A sole proprietorship is owned and run by one individual who receives all profits and has unlimited responsibility for all losses and debts.

Learning Objective

Define a sole proprietorship

Key Points

- In a sole proprietorship, there is no legal distinction between the individual and the business. Thus, every asset is owned by the proprietor, and they have unlimited liability.

- Examples include writers and consultants, local restaurants and shops, and home-based businesses.

- A sole proprietor may use a trade name or business name other than his or her legal name.

Key Term

- Sole Proprietorship

-

a business that is wholly owned by a single person, who has unlimited liability

Example

- An example of a sole proprietorship is an individual who runs a local food truck and would be listed as such with the city.

A sole proprietorship, also known as the sole trader or simply a proprietorship, is a type of business entity that is owned and run by one individual and in which there is no legal distinction between the owner and the business. Some formal definitions of a sole proprietorship are “a business owned by one person who is entitled to all of its profits” (Glos & Baker) and “a business owned and controlled by one man even though he may have many other persons working for him” (Reed & Conover).

The individual entrepreneur owns the business and is fully responsible for all its debts and legal liabilities. The owner receives all profits (subject to taxation specific to the business) and has unlimited responsibility for all losses and debts. Every asset of the business is owned by the proprietor, and all debts of the business are the proprietor’s. This means that the owner has no less liability than if they were acting as an individual instead of as a business. It is a “sole” proprietorship in contrast with partnerships. More than 75% of all United States businesses are sole proprietorships. Examples include writers and consultants, local restaurants and shops, and home-based businesses.

Mom and pop store

This is a small proprietor with a small shop.

A sole proprietor may use a trade name or business name other than his or her legal name. In many jurisdictions, there are rules to enable the true owner of a business name to be ascertained. In the United States, there is generally a requirement to file a doing business as statement with the local authorities. In the United Kingdom, the proprietor’s name must be displayed on business stationery, in business emails, and at business premises, and there are other requirements.

6.1.2: Advantages of Sole Proprietorships

The advantages of a sole proprietorship versus other forms of organizations is the relative ease of set-up and the lower start-up costs.

Learning Objective

Discuss the advantages of running a sole proprietorship

Key Points

- Filing taxes as a sole proprietorship is relatively easier than that of a corporation.

- Sole proprietorships typically require less capital to set up and have easier payroll requirements.

- Sole proprietorships are not as heavily regulated as other forms of organizations.

Key Term

- corporate

-

An incorporated entity is a separate legal entity that has been incorporated through a legislative or registration process established through legislation.

Example

- A man starting his own consulting firm as a sole proprietor would require very little capital to set up a home office to operate until sufficient funds are earned to open a larger office.

Advantages of Sole Proprietorship

The sole proprietor form of business ownership is the most common form in the United States and also the simplest. In this form of business ownership, an individual proprietor owns the business, manages the business, and is responsible for all of the business’ transactions and financial liabilities. This means that any debts incurred must be paid by the owner. This form of business has several advantages .

A Writer’s Office

A write enjoying the advantages of being a sole proprietor.

Quicker Tax Preparation

As a sole proprietor, filing your taxes is generally easier than a corporation. Simply file an individual income tax return (IRS Form 1040), including your business losses and profits. Your individual and business income are considered the same and self-employed tax implications will apply.

Lower Start-up Costs

Limited capital is a reality for many start-ups and small businesses. The costs of setting up and operating a corporation involves higher set-up fees and special forms. It’s also not uncommon for a lawyer to be involved in forming a corporation.

Ease of Money Handling

Handling money for the business is easier than other legal business structures. No payroll set-up is required to pay yourself. To make it even easier, set up a separate bank account to keep your business funds separate and avoid co-mingling personal and business activities.

Government Regulation

Sole proprietorships also have the least government rules and regulations affecting it. They do need to comply with licensing requirements within the states in which they do business and they do need to pay attention to local regulations. However, the paperwork required is much less than large corporations. Thus, they can operate quite easily. Sole proprietorships also do not pay corporate taxes.

Sale and Inheritance

The sole proprietor can own the business for as long as he or she decides, and can cash in and sell the business when they decide to get out. The sole proprietor can even pass the business down to their heir, a common practice.

6.1.3: Disadvantages of Sole Proprietorships

Sole proprietorships face a number of difficulties in the longer terms compared to limited liability companies.

Learning Objective

List the disadvantages of sole proprietorships

Key Points

- The owner of a sole proprietorship is solely liable for all debts and actions of the company. All personal wealth is linked to the business.

- Financial statements are not required in a sole proprietorship as are typically required of a corporation, meaning a lack of financial control is very probable.

- It is difficult to find outside investors to fund sole proprietorships, meaning growth potential is very limited beyond a certain point.

Key Term

- unlimited liability

-

The liability of an owner of a small proprietorship for all costs and debts of the business.

Example

- An individual who wishes to open a sandwich shop must put their own money into the business, knowing that, should it fail, they will be responsible for all costs and debts that will be incurred.

Sole proprietorships are the smallest form of business organization, and also the most common in the United States. However, while there are certain advantages (it is easier to set up a sole proprietorship than a limited liability company, for instance), there are a number of big disadvantages, particularly in the long term, that make the sole proprietorship model quite unattractive to business owners.

The main disadvantages to being a sole proprietorship are:

Unlimited liability: Your small business, in the form of a sole proprietorship, is personally liable for all debts and actions of the company. Unlike a corporation or an LLC, your business doesn’t exist as a separate legal entity. Therefore, all of your personal wealth and assets are linked to the business. For instance, if you go bankrupt and owe your debtors $100,000, then that money will have to come out of your own wallet even if there is no money left in the business. If you operate in a higher risk business, such as manufacturing or consumables, the cost to benefit ratio is favorable toward a corporate structure.

Sole proprietorships have unlimited liability

A sole proprietor will be responsible for all the costs and debts of their company.

Lack of financial controls: The looser structure of a proprietorship won’t require financial statements and maintaining company minutes as a corporation. The lack of accounting controls can result in the owner being lax about financial matters, perhaps falling behind in payments or not getting paid on time. It can be a serious issue if financial controls are not strictly managed.

Difficulty in raising capital: Imagine your business in five years. Will it still be a business of one? Growing your small business will require cash to take advantage of new markets and more opportunities. An unrelated investor has less peace of mind concerning the use and security of his or her investment, and the investment is more difficult to formalize; other types of business entities have more documentation. Outside investors will take your company more serious if you are a corporation.

6.2: Partnerships

6.2.1: Types of Partnerships

Various partnership types enable partners to determine the ideal distribution of profits and liabilities among business owners.

Learning Objective

Differentiate between partnership types, and recognize the key role liabilities play in these partnerships

Key Points

- Starting an unincorporated organization, complete with one or more partners, is generally referred to as a partnership. Balancing the risks and returns of this relationship is accomplished through types of partnerships.

- Common types of partnerships include general partnerships, limited partnerships, joint liability partnerships, several liability partnerships, and limited liability partnerships.

- The primary points of differentiation between all of these models revolves around liability, and how it is distributed among partners.

- Having limited liability in a given partnership agreement offers protection from legal and financial claims, while simultaneously resulting in some loss of control and potential returns.

- Coming to complete agreement regarding the type of partnership, and the division of liability and profit, is the first step to building an organization from the ownership point of view.

Key Terms

- stipulate

-

To require something as a condition for a contract or agreement.

- liabilities

-

Obligations, responsibilities, or debts owed to somebody.

Starting an unincorporated company with one or more partners via an agreement is generally referred to as a partnership, in which each of the owners assume personal liability for the legal actions and debts of the entity (unless otherwise stated by law or within the agreement). Under this model, there are a few different formats that new business owners should consider before finalizing the agreement. Each format has implications, primarily revolving around the concept of liability, and choosing the right format for the needs of the partners is a critical starting point.

Types of Partnerships

For the purpose of this discussion, the most important types of partnerships to consider are general partnerships, limited partnerships, joint liability partnerships, several liability partnerships, and limited liability partnerships.

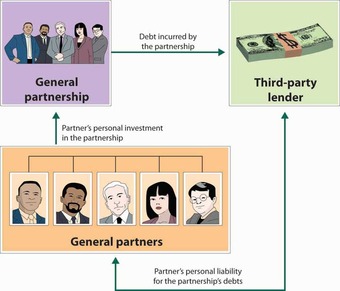

General Partnerships (GP)

This represents a default version of a partnership, which governs the relationships between the individual partners as well as between the partnership and the outside world. Each partner in the organization is considered an agent of the partnership, which means each partner represents the organization when dealing with external parties. Similarly, each partner has equal right to participate in the management, decision-making, and control (unless otherwise stated). Under most formats, adding a new partner requires the complete support and consent of all existing partners.

In terms of risks and returns (or liabilities and profits), the default assumption is that profits are distributed equally, and that liability is shared jointly and severally. Any debt or liability impacting the organization can be distributed equally (or via allocated responsibility) across the partners’ personal assets.

Limited Partnerships (LP)

In a limited partnership, a general partner may collaborate with a limited partner. A limited partner has no managerial authority, nor in most situations would they earn equal returns. However, the limited partner is protected by limited liability in legal situations regarding debt or other costs that may impact the general partner’s personal assets. Along similar lines, limited partners are not considered agents of the organization from a legal perspective. It is also important to understand that this is not the same as a limited liability partnership (LLP), in which all partners have limited liability.

Joint Liability Partnerships

Exactly as it sounds, a joint liability partnerships holds all partners equally liable for any financial and legal issues. As opposed to a several liability concept, in which liability may be distributed based on certain proportionate responsibility, joint liability partnerships are equal across the board. Picture a married couple purchasing a home. A joint liability on that loan would stipulate that both parties are equally responsible for repayment as well as equally in possession of the asset (i.e. the home).

Several Liability Partnerships

Several liability is the converse to joint liability, in which the involved parties will settle liability disputes based on respective obligations. This is easiest to demonstrate via an example. Assume two partners create a business, let’s say exporting wine. Partner A is in charge of sourcing, getting great wine from around the world. Partner B is responsible for the buyer side, and ensuring legality with the countries they are selling too. While selling to a more conservative country, it turns out Partner B accidentally overlooked some legal steps in the importing process.

As alcohol can be legally complex with costly mistakes, and it was partner B’s responsibility, it could be argued in a several liability case that partner B owes 80% of the cost for that mistake. To say 100% would likely be a little unfair, considering Partner A should be aware of the full channel. But how much liability does each party deserve? These are difficult questions, making this type of partnership slightly more complex.

Limited Liability Partnerships

Finally, there are limited liability partnerships (LLPs). In this situation, some or all partners have limited liability, which grants it some similarity with a corporation. LLPs do not hold each partner responsible for the financial and legal mistakes of the other partners. In some countries, LLPs must have a central GP with unlimited liability to put this risk somewhere (see limited partnerships). This format is quite popular among certain high-end services, such as law and accounting. It allows collaborative work while maintaining independence in regards to liability.

Like most legally complex concepts, in the United States in particular, LLP rulings can vary significantly from area to area. Understanding which liabilities are limited and which are not is important information to have before entering into a partnership.

Conclusion

When considering the appropriate type of partnership, liability is the key word. Prior to any formalized arrangement, each party should put forward their expectations concerning profit sharing and liability in clear terms. Aligning on the risk and return is the first step to moving forward in any professional business relationships at the ownership level.

6.2.2: Partnership Agreements

Partnership agreements govern the relationship between the various individuals who are collaborating on a given venture.

Learning Objective

Recall the more common components of partnership agreements, and recognize why these agreements are valuable

Key Points

- Partnerships are not limited liability models, and as a result incur a great deal of individual risk for each partner.

- Partnership agreements are designed to mitigate such risks, and ensure that each partner is in complete agreement as to the terms of the overall business arrangement.

- Common clauses within a partnership agreement revolve around how decisions are made, how compensation is decided, how to mediate disagreements and disputes, and when it may be appropriate to remove a partner.

Key Terms

- partnership

-

An agreement between individuals to collaborate towards mutually determined objectives.

- Expulsion

-

The forced removal of an individual from a group, usually due to poor behavior.

Why Create An Agreement?

Similar to a sole proprietor, a partnership shoulders the majority of the risk when opening a new venture (unlike limited liability models). As a result of this, partners entering an agreement will want to consider creating a partnership agreement, which governs the nature of their relationship relative to the venture they are collaborating on.

For example, let’s assume that a startup company decides to formulate their business as a partnership between four people. They estimate that $100,000 will be required to get the business off the ground over the next two years. They agree to invest equally, and write in the contract that each individual will contribute $25,000. However, after the first two years, one member fails to contribute. This voids the contract with that partner, and the overall ownership of the business now rests with the individuals who fulfilled the contract.

Common Partnership Agreement Components

The above example is fairly simple. However, businesses encounter a wide variety of challenges in which contractual agreements can be useful. Here are a few common components of partnership agreements:

- Majority Management – This indicates that business decisions will be made through the authorization of the majority of partners, protecting partners from one individual partner controlling the entire organization.

- Annual Account – This obligates each partner to collaboratively settle organizational accounts and debts each year.

- Consistent Interest – As partnerships are often side projects, this obligates each partner to a certain amount of interest and/or time commitment in the venture.

- Resolution of Dispute – It is often a good idea to anticipate which types of disputes may arise, and denote standard practices for how these disagreements will be handled.

- Causes Income Losses – If the company is not achieving the expected profitability, this will scale down the compensation received by each partner relative to the business’s overall success.

- Misconduct Expulsion – At times, it may be necessary to remove one partner due to poor behavior. An example of this may be one partner spending far too much on business expenses, such as flying first class and abusing shared resources.

While there may be many more aspects of a partnership agreement depending on the specific type of business, and the needs of each partner, this list is a good tool in understanding the general logic behind such agreements. When entering a collaboration, it is important to consider what could go wrong before it goes wrong, and plan for how to handle that contractually.

6.2.3: Advantages and Disadvantages of Partnerships

Partnerships are easy to establish and carry many advantages, however there are risks due to the concentrated ownership structure.

Learning Objective

Discuss the characteristics and advantages of partnerships

Key Points

- The profits from the business flow directly through to the partners’ personal tax returns.

- The most obvious advantages to a partnership are the ease in which they may be established, the combination of a wider pool of skills and knowledge, and the increased ability to raise more funds with more partners.

- The business usually will benefit from partners who have complementary skills.

Key Term

- tortious

-

Of, pertaining to, or characteristic of torts.

A partnership is formed between two or more professionals where the partners work together to achieve and share profits and losses.

Partnerships have certain default characteristics relating to both the relationship between the individual partners and the relationship between the partnership and the outside world. The former can generally be overridden by agreement between the partners, whereas the latter generally cannot be done. The assets of the business are owned on behalf of the other partners, and they are each personally liable, jointly and severally, for business debts, taxes or tortious liability . For example, if a partnership defaults on a payment to a creditor, the partners’ personal assets are subject to attachment and liquidation to pay the creditor.

General Partnership and Unlimited Liability

As in sole proprietorships, partnerships have unlimited liability. There are different kinds of partnerships, each with its own benefits and shortcomings.

By default, profits are shared equally among the partners. However, a partnership agreement will almost invariably expressly provide for the manner in which profits and losses are to be shared. Each general partner is deemed the agent of the partnership. Therefore, if that partner is apparently carrying on partnership business, all general partners can be held liable for his dealings with third persons. By default, a partnership will terminate upon the death, disability, or even withdrawal of any one partner. However, most partnership agreements provide for these types of events, with the share of the departed partner usually being purchased by the remaining partners. By default, each general partner has an equal right to participate in the management and control of the business. Disagreements in the ordinary course of partnership business are decided by a majority of the partners, and disagreements of extraordinary matters and amendments to the partnership agreement require the consent of all partners. However, in a partnership of any size, the partnership agreement will provide for certain electees to manage the partnership along the lines of a company board. Unless otherwise provided in the partnership agreement, no one can become a member of the partnership without the consent of all partners, though a partner may assign his share of the profits and losses and right to receive distributions. A partner’s judgment creditor may obtain an order charging the partner’s “transferable interest” to satisfy a judgment.

Advantages of Partnerships

- Partnerships are relatively easy to establish; however time should be invested in developing the partnership agreement

- With more than one owner, the ability to raise funds may be increased

- The profits from the business flow directly through to the partners’ personal tax returns

- Prospective employees may be attracted to the business if given the incentive to become a partner

- Usually the business will benefit from partners who have complementary skills

6.2.4: Partnerships and Taxes

Various partnerships need to file different tax forms; it is important to understand the IRS codes before embarking on a partnership.

Learning Objective

Discuss the general tax requirements for subchapter S corporations and limited liability companies

Key Points

- An S corporation, for United States federal income tax purposes, is a corporation that makes a valid election to be taxed under Subchapter S of Chapter 1 of the Internal Revenue Code.

- In general, S corporations do not pay any federal income taxes. Instead, the corporation’s income or losses are divided among, and passed through, to its shareholders.

- The shareholders must report the income or loss from the S-corp on their own individual income tax returns.

Key Term

- limited liability

-

The liability of an owner or a partner of a company for no more capital than they have invested.

Partnerships and Taxes

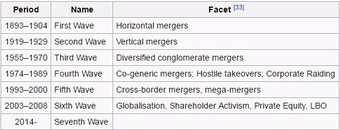

Different types of partnerships have different tax requirements, and partners will need to fill out different forms depending on the type. Below, we discuss Subchapter S Corporations, and LLCs.

Subchapter S Corporations

Subchapter S Corporations have a tax election only; this election enables the shareholder to treat the earnings and profits as distributions and have them pass through directly to their personal tax return. The catch here is that the shareholder, if working for the company (and if there is a profit), must pay him/herself wages, and must meet standards of “reasonable compensation”. This can vary by geographical region as well as occupation, but the basic rule is to pay yourself what you would have to pay someone else to do your job, as long as there is enough profit. If you do not do this, the IRS can reclassify all of the earnings and profit as wages, and you will be liable for all of the payroll taxes on the total amount.

Limited Liability Company (LLC)

The LLC is a relatively new type of hybrid business structure that is now permissible in most states. It is designed to provide the limited liability features of a corporation and the tax efficiencies and operational flexibility of a partnership. Formation is more complex and formal than that of a general partnership. The owners are members, and the duration of the LLC is usually determined when the organization papers are filed. The time limit can be continued, if desired, by a vote of the members at the time of expiration. LLCs must not have more than two of the four characteristics that define corporations: Limited liability to the extent of assets, continuity of life, centralization of management, and free transferability of ownership interests.

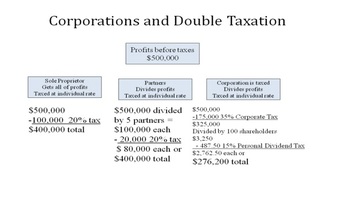

Corporations and Double Taxation

This figure shows how corporations are taxed twice.

6.3: Corporations

6.3.1: Types of Corporations

Four main types of corporations are designated as C, S, limited liability companies, and nonprofit organizations.

Learning Objective

Distinguish between a C corporation, S corporation, LLC and non-profit

Key Points

- C corporation refers to any corporation that, under United States federal income tax law, is taxed separately from its owners.

- S corporations are corporations that elect to pass corporate income, losses, deductions, and credit through to their shareholders for federal tax purposes.

- An LLC is a flexible form of enterprise that blends elements of partnership and corporate structures.

- A nonprofit organization is an organization that uses surplus revenues to achieve its goals rather than distributing them as profit or dividends.

Key Terms

- corporation

-

A group of individuals, created by law or under authority of law, having a continuous existence independent of the existences of its members, and powers and liabilities distinct from those of its members.

- shareholder

-

One who owns shares of stock.

Four main types of corporations exist in the United States:

- C corporations

- S corporations

- Limited Liability Companies (LLCs)

- Nonprofit Organizations

C Corporations

C corporation refers to any corporation that, under United States federal income tax law, is taxed separately from its owners . A C corporation is distinguished from an S corporation, which generally is not taxed separately. Most major companies (and many smaller companies) are treated as C corporations for U.S. federal income tax purposes. A C corporation has no limit on the number of shareholders, foreign or domestic. Any distribution from the earnings and profits of a C corporation is treated as a dividend for U.S. income tax purposes. Exceptions apply to treat certain distributions as made in exchange for stock rather than as dividends. Such exceptions include distributions in complete termination of a shareholder’s interest and distributions in liquidation of the corporation.

Coca-Cola Company

Coca-Cola is a famous C corporation.

S Corporations

S corporations are merely corporations that elect to pass corporate income, losses, deductions, and credit through to their shareholders for federal tax purposes. Like a C corporation, an S corporation is generally a corporation under the law of the state in which the entity is organized. For federal income tax purposes, however, taxation of S corporations resembles that of partnerships. Thus, income is taxed at the shareholder level and not at the corporate level. Payments to S shareholders by the corporation are distributed tax-free to the extent that the distributed earnings were not previously taxed. Also, certain corporate penalty taxes (e.g., accumulated earnings tax, personal holding company tax) and the alternative minimum tax do not apply to an S corporation. In order to make an election to be treated as an S corporation, the following requirements must be met:

- Must be an eligible entity (a domestic corporation, or a limited liability company which has elected to be taxed as a corporation).

- Must have only one class of stock.

- Must not have more than 100 shareholders.

Limited Liability Company (LLC)

An LLC is a flexible form of enterprise that blends elements of partnership and corporate structures. It is a legal form of company that provides limited liability to its owners in the vast majority of United States jurisdictions. The primary characteristic an LLC shares with a corporation is limited liability, and the primary characteristic it shares with a partnership is the availability of pass-through income taxation. It is often more flexible than a corporation, and it is well-suited for companies with a single owner.

Nonprofit Organization

A nonprofit organization is an organization that uses surplus revenues to achieve its goals rather than distributing them as profit or dividends. While not-for-profit organizations are permitted to generate surplus revenues, they must be retained by the organization for its self-preservation, expansion, or plans.

6.3.2: The Process of Incorporation

Incorporating a business is the formation of a new corporation.

Learning Objective

Outline the process of incorporation

Key Points

- Corporations can raise capital from investors through the issuance of capital stock.

- Corporations are perpetual or durable.

- The process of incorporation in the United States varies from state to state.

Key Term

- incorporation

-

The act of incorporating, forming a corporation or the state of being incorporated.

Examples

- Suppose you decide to form a corporation to import and distribute shoes. For this, you will have to go to your state’s office to file the papers called a charter. This document should mention that it will import shoes from other countries and distribute them throughout the U.S. (place of business). To abide by the bylaws, you might decide to hold shareholder meetings every October 15 (after the fiscal year has ended).

- The papers should clearly state the distinct name of your business. For example you might want to name your business Dynamic Shoe Exporters Inc.

Incorporation is the formation of a new corporation. The corporation may be a business, a nonprofit organization, a sports club, or a government of a new city or town. Even though corporations are not people, they are recognized by the law to have rights and responsibilities like natural persons under the law. The articles of incorporation (also called a charter, certificate of incorporation or letters patent) are filed with the appropriate state office, listing the purpose of the corporation, its principal place of business and the number and type of shares of stock. A registration fee is due, which is usually between $25 and $1,000 depending on the state.

Usually, there are also corporate bylaws which must be filed with the state. Bylaws outline a number of important administrative details such as when annual shareholder meetings will be held, who can vote, and the manner in which shareholders will be notified if there is a need for an additional “special” meeting.

A corporation has a distinct name and it is generally made up of three parts: “distinctive element,” “descriptive element,” and a legal ending. All corporations must have a distinctive element, and in most filing jurisdictions, a legal ending to their names. Some corporations choose not to have a descriptive element. In the name “Tiger Computers, Inc.”, the word “Tiger” is the distinctive element; the word “Computers” is the descriptive element; and the “Inc.” is the legal ending. The legal ending indicates that it is, in fact, a legal corporation and not just a business registration or partnership. Incorporated, limited, and corporation, or their respective abbreviations (Inc., Ltd., Corp. ) are the possible legal endings in the U.S.

Legal Benefits

- Protection of personal assets: One of the most important legal benefits is the safeguarding of personal assets against the claims of creditors and lawsuits. Sole proprietors and general partners in a partnership are personally and jointly responsible for all the liabilities of a business such as loans, accounts payable, and legal judgments. In a corporation, however, stockholders, directors and officers typically are not liable for the company’s debts and obligations. They are limited in liability to the amount they have invested in the corporation. For example, if a shareholder purchased $100 in stock, no more than $100 can be lost. Corporations and limited liability companies (LLCs) may hold assets such as real estate, cars or boats. If a shareholder of a corporation is personally involved in a lawsuit or bankruptcy, these assets may be protected. A creditor of a shareholder of a corporation or LLC cannot seize the assets of the company. However, the creditor can seize ownership shares in the corporation, as they are considered a personal asset .

- Transferable ownership: Ownership in a corporation or LLC is easily transferable to others, either in whole or in part. Some state laws are particularly corporate-friendly. For example, the transfer of ownership in a corporation incorporated in Delaware is not required to be filed or recorded.

- Retirement funds: Retirement funds and qualified retirements plans, such as a 401(k), may be established more easily.

- Taxation: In the United States, corporations are taxed at a lower rate than individuals are. Also, they can own shares in other corporations and receive corporate dividends 80 percent tax-free. There are no limits on the amount of losses a corporation may carry forward to subsequent tax years. A sole proprietorship, on the other hand, cannot claim a capital loss greater than $3,000 unless the owner has offsetting capital gains.

- Raising funds through sale of stock: A corporation can easily raise capital from investors through the sale of stock.

- Durability: A corporation is capable of continuing indefinitely. Its existence is not affected by the death of shareholders, directors, or officers of the corporation.

- Credit rating: Regardless of an owner’s personal credit scores, a corporation can acquire its own credit rating, and build a separate credit history by applying for and using corporate credit.

6.3.3: Ownership of Corporations

A corporation is typically owned and controlled by its shareholders.

Learning Objective

Outline the structure of the ownership in corporations

Key Points

- In a joint-stock company the members are known as shareholders and their share in the ownership, control, and profits of the corporation is determined by their portion of shares.

- In some corporations, the legal document establishing the corporation or containing its rules determines the corporation’s membership.

- The day-to-day activities of a corporation are typically controlled by individuals appointed by the members.

Key Terms

- shareholder

-

One who owns shares of stock.

- committee

-

a group of persons convened for the accomplishment of some specific purpose, typically with formal protocols

Example

- A person can decide to become an owner in a company by investing in the company’s stock. For example, someone might choose to buy shares of Apple stock in the stock market. If that person bought a majority of shares in Apple (a company worth billions of dollars), he/she could even influence Apple’s business by voting in annual general meetings or becoming a board member. By acquiring a controlling interest in the company, a person could suggest product changes in board of directors committee meetings, and the company’s executives could choose to make those changes. If they did not, they could be fired by board members with the majority of votes.

A corporation is typically owned and controlled by its members. In a joint-stock company, the members are known as shareholders and their share in the ownership, control, and profits of the corporation is determined by their portion of shares. Thus, a person who owns a quarter of the shares of a joint-stock company owns a quarter of the company, is entitled to a quarter of the profit (or at least a quarter of the profit given to shareholders as dividends), and has a quarter of the votes that may be cast at general meetings.

In some corporations, the legal document establishing the corporation or containing its rules determines the corporation’s membership. Membership in this case depends on the corporation type. For instance, in a worker cooperative, people who work for the cooperative are members, while in a credit union, people who have credit union accounts are members.

The day-to-day activities of a corporation are typically controlled by individuals appointed by the members. In some cases, this will be a single individual, but more commonly, corporations are controlled by a committee or by committees. Broadly speaking, two kinds of committee structures exist.

A single committee or board of directors is the method favored in most common law countries. The board of directors is composed of both executive and non-executive directors. The latter are responsible for supervising the formers’ management of the company.

A two-tiered committee structure with a supervisory board and a managing board is common in civil law countries. Under this model, the executive directors sit on one committee while the non-executive directors sit on the other.

A Famous Investor

Warren Buffet is perhaps the world’s most famous investor. He owns many companies through his investment firm Berkshire Hathaway.

6.3.4: Structure of Corporations

Corporate structure consists of various departments and divisions that contribute to the company’s overall mission and goals.

Learning Objective

Break down a corporation in to its structural parts

Key Points

- Segments of corporate structure may consist of the marketing department, finance department, accounting department, human resource department, IT department, and the operational aspect of the particular company.

- A division of a business is a distinct part of the firm, however the company is legally responsible for all of the obligations and debts of each division.

- In a large organization, various parts of the business may be run by different subsidiaries, and a business division may include one or many subsidiaries.

Key Terms

- subsidiary

-

A company owned by the parent company or holding company

- IT

-

Information Technology: the use of computers and telecommunications equipment to store, retrieve, transmit, and manipulate data.

Corporate structure consists of various departments that contribute to the company’s overall mission and goals. The Marketing department is considered by some business professionals as the most important entity in the corporate structure. Without this department, sales or new customers cannot be realized. The Finance department is also vitally important, as it is responsible for acquiring capital used in running an organization. Other segments of corporate structure may consist of the Accounting department, HumanResources department, IT department, and the Operational aspect of the particular company. These main six corporate departments represent the major managing resources within a publicly traded company; though there are often smaller departments either within the major segments or in autonomous form.

Another way a corporate structure can be defined is by business divisions. A division of a business is a distinct part of the firm, however the company is legally responsible for all of the obligations and debts of each division. In a large organization, various parts of the business may be run by different subsidiaries, and a business division may include one or many subsidiaries. Each subsidiary is a separate legal entity owned by the primary business or by another subsidiary in the hierarchy. Often a division operates under a separate name and is the equivalent of a corporation or limited liability company that obtains a fictitious name or a “doing business as” certificate.

Hewlett Packard (HP) is a good example of a corporate structure including multiple divisions. The divisions of HP — e.g., the Printing & Multifunction division, the Handheld Devices division, the Servers division (mini and mainframe computers), et cetera — all use the HP brand name. However, Compaq (a part of HP since 2002) operates as a subsidiary, using the Compaq brand name.

Corporate Structure

Hewlett Packard is an example of a corporation with multiple divisions and subsidiaries.

Another example is Google. Google Video is a division of Google, and is part of the same corporate entity. However, the YouTube video service is a subsidiary of Google because it remains operated as YouTube, LLC — a separate business entity even though it is owned by Google.

6.3.5: Advantages of Corporations

Shareholders of a modern business corporation have limited liability for the corporation’s debts and obligations.

Learning Objective

List the advantages of corporations

Key Points

- Unlike a partnership or sole proprietorship, shareholders of a modern business corporation have limited liability for the corporation’s debts and obligations.

- Limited liability reduces the amount that a shareholder can lose in a company so it allows corporations to raise large amounts of finance for their enterprises by combining funds from many owners of stock.

- Another advantage is that the assets and structure of the corporation may continue beyond the lifetimes of its shareholders and bondholders.

Key Term

- shareholders

-

A shareholder or stockholder is an individual or institution (including a corporation) that legally owns a share of stock in a public or private corporation.

Examples

- When a person owns shares in a corporation, the losses cannot exceed the amount invested in the shares, which is called limited liability. For example, if you decide to invest $100,000 in a tech start up, but it goes bankrupt in a year and has debts of $1,000,000, you will only lose your $100,000 and the creditors cannot sue you for the $900,000 that they have lost.

- Also if there are other major shareholders in the company, and one of them dies, the business will still continue. The shares are likely to be inherited by relatives or other persons (according to the dead person’s will) and the company will continue its business.

Advantages of Corporations

Unlike a partnership or sole proprietorship, shareholders of a modern business corporation have limited liability for the corporation’s debts and obligations. As a result, their losses cannot exceed the amount which they contributed to the corporation as dues or payment for shares. This enables corporations to socialize their costs. Socializing a cost is to spread it to society in general. The economic rationale for this is that it allows anonymous trading in the shares of the corporation by eliminating the corporation’s creditors as a stakeholder in such a transaction. Without limited liability, a creditor would probably not allow any share to be sold to a buyer at least as creditworthy as the seller.

Limited liability reduces the amount that a shareholder can lose in a company so it allows corporations to raise large amounts of finance for their enterprises by combining funds from many stock owners. This increases the attraction to potential shareholders and increases both the number of willing shareholders and the amount they are likely to invest.

However, some jurisdictions also permit another type of corporation, in which shareholders’ liability is unlimited, for example the unlimited liability corporation in two provinces of Canada, and the unlimited company in the United Kingdom.

Another advantage is that the assets and structure of the corporation may continue beyond the lifetimes of its shareholders and bondholders. This allows stability and the accumulation of capital, which is then available for investment in larger and longer-lasting projects than if the corporate assets were subject to dissolution and distribution. This was also important in medieval times, when land donated to the Church (a corporation) would not generate the feudal fees that a lord could claim upon a landholder’s death. However, a corporation can be dissolved by a government authority, putting an end to its existence as a legal entity. But this usually only happens if the company breaks the law. For example, it it fails to meet annual filing requirements or, in certain circumstances, if the company requests dissolution.

Welcoming Facebook

Facebook was able to raise $16 billion when it decided to offer shares to the public.

6.3.6: Disadvantages of Corporations

In many countries, corporate profits are taxed at a corporate tax rate, and dividends paid to shareholders are taxed at a separate rate — double taxation.

Learning Objective

List the disadvantages of corporations

Key Points

- In other systems, dividends are taxed at a lower rate than other income (for example, in the US) or shareholders are taxed directly on the corporation’s profits and dividends are not taxed.

- Another disadvantage of corporations is that, as Adam Smith pointed out in the Wealth of Nations, when ownership is separated from management, the latter will inevitably begin to neglect the interests of the former, creating dysfunction within the company.

- The fees and legal costs required to form a corporation may be substantial, especially if the business is just being started and the corporation is low on financial resources.

Key Term

- double taxation

-

Double taxation is the levying of tax by two or more jurisdictions on the same declared income (in the case of income taxes), asset (in the case of capital taxes), or financial transaction (in the case of sales taxes). This double liability is often mitigated by tax treaties between countries.

Examples

- You decide to set up a corporation and have a profit of $1,000,000 in the first year. Suppose the government taxes corporate profits at 30%, then the corporation has to pay $300,000 in taxes. It is decided that $500,000 will be distributed as dividends and the dividend tax is 10%, so you will lose a further $50,000 to the government when you file your personal taxes. This is the concept of double taxation: first the company was taxed for its profits, and later shareholders were taxed for their dividends.

- Also when you hire managers to run your company, they might decide to give themselves bonuses of $200,000 supposedly to increase performance. It will be very hard for you to determine if these bonuses were justified or not and if it was in the best interests of the company. This is the disadvantage of separated ownership.

In many countries, corporate profits are taxed at a corporate tax rate, and dividends paid to shareholders are taxed at a separate rate. Such a system is sometimes referred to as “double taxation”, because any profits distributed to shareholders will eventually be taxed twice.

One solution to this (as in the case of the Australian and UK tax systems) is for the recipient of the dividend to be entitled to a tax credit, which addresses the fact that the profits represented by the dividend have already been taxed. The company profit being passed on is therefore effectively only taxed at the rate of tax paid by the eventual recipient of the dividend.

In other systems, dividends are taxed at a lower rate than other income (for example, in the US) or shareholders are taxed directly on the corporation’s profits and dividends are not taxed. For example, S corporations in the US do not pay any federal income taxes. Instead, the corporation’s income or losses are divided among and passed through to its shareholders. The shareholders must then report the income or loss on their own individual income tax returns.

Another disadvantage of corporations is that, as Adam Smith pointed out in the Wealth of Nations, when ownership is separated from management (i.e. the actual production process required to obtain the capital), the latter will inevitably begin to neglect the interests of the former, creating dysfunction within the company. Some maintain that recent events in corporate America may serve to reinforce Smith’s warnings about the dangers of legally-protected, collectivist hierarchies.

The fees and legal costs required to form a corporation may be substantial, especially if the business is just being started and the corporation is low on financial resources.

Leeman Brothers’ Collapse

The management of Leeman Brothers was involved in presenting a misleading picture of the company which collapsed in 2008.

6.4: Special Forms of Ownership

6.4.1: S-Corporations (S-Corps)

S corporations elect to pass corporate income, losses, deductions, and credit through to their shareholders for federal tax purposes.

Learning Objective

Describe the characteristics of an S corporation

Key Points

- In terms of federal income taxation, S corporations resemble partnerships in that income, deductions, and tax credits flow through annually to shareholders, regardless of whether distributions are made.

- Payments are distributed to S shareholders tax-free to the extent that the distributed earnings were not previously taxed.

- Unlike a C corporation, an S corporation is not eligible for a dividends received deduction, nor is it subject to the ten percent of taxable income limitation applicable to charitable contribution deductions.

Key Terms

- S corporation

-

a legal designation of companies that elect to pass income, losses, deductions, and credit through to their shareholders for federal tax purposes

- shareholder

-

One who owns shares of stock.

- C Corporations

-

any corporation that, under United States federal income tax law, is taxed separately from its owners

- dividends

-

Dividends are payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders.

Examples

- Example (from Wikipedia)

- Widgets Inc, an S-Corp, makes $10,000,000 in net income (before payroll) in 2006 and is owned 51% by Bob and 49% by John. Keeping it simple, Bob and John both draw salaries of $94,200 (which is the Social Security Wage Base for 2006, after which no further Social Security tax is owed).

- Employee salaries are subject to FICA tax (Social Security & Medicare tax) –currently 13.3 percent–(4.2% Social Security paid by the employee; 6.2% Social Security paid by the employer; 1.45% employee medicare and 1.45% employer medicare). The distribution of the additional profits from the S corporation will be done without any further FICA tax liability.

- If for some reason, Bob (as the majority owner) was to decide not to distribute the money, both Bob and John would still owe taxes on their pro-rata allocation of business income, even though neither received any cash distribution. To avoid this “phantom income” scenario, S corporations commonly use shareholder agreements that stipulate at least enough distribution must be made for shareholders to pay the taxes on their distributive shares.

- Quarterly estimated taxes must be paid by the individual to avoid tax penalties, even if this income is “phantom income”.

S corporations elect to pass corporate income, losses, deductions, and credit through to their shareholders for federal tax purposes. S status combines the legal environment of C corporations with partnership-like federal income taxation.

Like a C corporation, an S corporation is generally subject to the laws of the state in which it is organized. However, in the manner of a partnership, an S corporation’s income, deductions, and tax credits flow through annually to shareholders, regardless of whether distributions are made. Thus, income is taxed at the shareholder level and not at the corporate level, and payments are distributed to S shareholders tax-free to the extent that the distributed earnings were not previously taxed.

Certain corporate penalty taxes (e.g., accumulated earnings tax, personal holding company tax) and the alternative minimum tax do not apply to an S corporation. Unlike a C corporation, an S corporation is not eligible for a dividends received deduction, nor is it subject to the ten percent of taxable income limitation applicable to charitable contribution deductions.

In order to be eligible for S corporation status, a corporation must meet certain requirements:

- Be an eligible entity (a domestic corporation, or a limited liability company which has elected to be taxed as a corporation)

- Have only one class of stock

- Have no more than 100 shareholders

- Spouses are automatically treated as a single shareholder. Families, defined as individuals descended from a common ancestor, plus spouses and former spouses of either the common ancestor or anyone lineally descended from that person, are considered a single shareholder as long as any family member elects such treatment.

- Shareholders must be U.S. citizens or residents and natural persons, so corporate shareholders and partnerships are generally excluded. However, certain trusts, estates, and tax-exempt corporations, notably 501(c)(3) corporations, are permitted to be shareholders.

- Profits and losses must be allocated to shareholders proportionately to each one’s interest in the business.

Pieter Brueghel the Younger, Paying the Tax (The Tax Collector)

S corporations are not burdened with double taxation.

6.4.2: Limited Liability Companies (LLCs)

An LLC is a hybrid business entity which has characteristics of both a corporation and a partnership, or sole proprietorship in some cases.

Learning Objective

Discuss the advantages and disadvantages of limited liability companies

Key Points

- The primary characteristic an LLC shares with a corporation is limited liability, and the primary characteristic it shares with a partnership is the availability of pass-through income taxation (i.e. no double taxation).

- An LLC is often more flexible than a corporation, and it is well-suited for companies with a single owner.

- There are a number of advantages and disadvantages associated with LLCs, and many of the specific advantages and disadvantages relate to certain states and districts.

Key Term

- double taxation

-

Double taxation is the levying of tax by two or more jurisdictions on the same declared income (in the case of income taxes), asset (in the case of capital taxes), or financial transaction (in the case of sales taxes). This double liability is often mitigated by tax treaties between countries.

Example

- If you decide to set up an LLC, your liability depends on the amount you have invested. For example, you invest $100,000 into your business but it goes through tough times after a year and you decide to close. Before you close the business you may have to pay your creditors. But they can only make claims up to $100,000 (your original investment). If this amount does not satisfy the creditors, they cannot take away your personal property to settle the debt. This could happen if your liabilities were unlimited. Alternately, if you make profits after some time, they have the provision of not being taxed twice. For tax purposes, an LLC can be registered as a partnership or sole proprietorship (and a corporation even though it is not a corporation for other purposes). If you register your LLC as a sole proprietorship or a partnership, you will not have to pay federal taxes on your income.

Limited Liability Companies (LLCs)

A limited liability company (LLC) is a hybrid business entity that has characteristics of both a corporation and a partnership (or sole proprietorship depending on how many owners). An LLC, although a business entity, is a type of unincorporated association and is not a corporation (calling it a limited liability corporation is incorrect). The primary characteristic an LLC shares with a corporation is limited liability, and the primary characteristic it shares with a partnership is the availability of pass-through income taxation (i.e. no double taxation). It is often more flexible than a corporation, and it is well-suited for companies with a single owner.

Membership interests in LLCs and partnership interests are also afforded a significant level of protection through the charging order mechanism. The charging order limits the creditor of a debtor-partner or a debtor-member to the debtor’s share of distributions, without conferring any voting or management rights on the creditor. Limited liability company members may, in certain circumstances, also incur a personal liability in cases where distributions to members render the LLC insolvent.

Advantages

Some advantages of LLCs include the following:

- choice of tax regime: an LLC can choose to be taxed as a sole proprietor, partnership, S or C corporation;

- much less administrative paperwork and record keeping than a corporation;

- pass-through taxation (i.e., no double taxation), unless the LLC elects to be taxed as a C corporation;

- less risk to be stolen by fire-sale acquisitions (more protection against hungry investors).

Disadvantages

Some disadvantages of LLCs are listed below.

State laws regarding stock corporations are very well developed and provide for a variety of governance and protective provisions for the corporation and its shareholders. However, most states do not dictate detailed governance and protective provisions for the members of a limited liability company. Thus, in the absence of such statutory provisions, the members of an LLC must establish governance and protective provisions pursuant to an operating agreement or similar governing document.

It may be more difficult to raise financial capital for an LLC as investors may be more comfortable investing funds in the better-understood corporate form with a view toward an eventual IPO.

Many jurisdictions levy a franchise tax or capital values tax on LLCs. In essence, this franchise or business privilege tax is the fee the LLC pays the state for the benefit of limited liability. The amount of the franchise tax can be based on the following:

- revenue,

- profits,

- number of owners,

- amount of capital employed in the state.

There can also be some combination of the above factors, or simply a flat fee.

YouTube Headquarters

A famous company that started out as an LLC is YouTube.

6.4.3: Publicly Held Corporations

Government-owned companies are either partially or fully owned by a government and have both a distinct legal form and commercial presence.

Learning Objective

Distinguish between a state-owned enterprise, government-linked company, and quasi-governmental organization

Key Points

- There are many possible levels of government involvement in publicly-owned companies. Governments can fully or partially own a company as well as own regular stock.

- While they may also have public policy objectives, publicly-owned companies are differentiated from other forms of government agencies or state entities established to pursue purely non-financial objectives.

- Government-linked companies and quasi-governmental organizations also provide ways for government to be involved in corporations, either through a holding company or through government funding.

Key Terms

- quasi-governmental organization

-

A corporation, business or agency that is regarded by national laws and regulations as being under the guidance of the government, but also separate from the government.

- state-owned enterprise

-

A legal entity created by a government to undertake commercial activities on behalf of an owner government.

- government-linked company

-

A private or public corporate entity in which an existing government owns a stake through a holding company.

Example

- Amtrack is an example of a publicly owned corporation that was started in 1971 to provide inter-city rail transport in the US. It is partially owned by the government because all its preferred stock is under government ownership while its common stock is held by the public. Its board of directors is appointed by the government.

There is no standard definition of a publicly-owned corporation or state-owned enterprise (SOE), although the two terms can be used interchangeably. Their defining characteristics are their distinct legal form, and their operation in commercial affairs. While they may also have public policy objectives, SOEs are different from other government entities established to pursue purely non-financial objectives.

State-owned enterprises can be fully or partially owned by the government. However, the line beyond which a corporation must be considered “state-owned” is unclear, as governments can also own regular stock and have no special influence over business. For example, in 2007 the Chinese Investment Corporation agreed to acquire a 10% interest in the global investment bank Morgan Stanley, but it is unlikely that this would qualify the latter as a government-owned corporation. SOEs are often the result of corporatization, a process in which government agencies are re-organized as semi-autonomous corporate entities.

The term government-linked company (GLC) is sometimes used to refer to private or public corporate entities in which an existing government owns a stake through a holding company. There are multiple ways of defining GLCs, depending on the proportion of the corporate entity a government owns. One rationale for calling a company a GLC is whether or not a government owns an effective controlling interest (>50%); another possible definition defines as a GLC any corporate entity that has a government as a shareholder.

Fannie Mae Headquarters

Fannie Mae was created by the US government to expand the secondary mortgage market.

A quasi-governmental organization is a corporation, business or agency that is regarded by national laws and regulations as being under the guidance of the government, but also separate from the government. While they may receive some revenue from charging customers for services, these organizations are often at least partially funded by the government. Sometimes they are even propped up with cash infusions in times of crisis to help offset situations that would bankrupt a normal privately owned business.

A notable example of an SOE is the Saudi national oil company, Saudi Aramco, which the Saudi government bought in 1988. The Saudi government also owns and operates Saudi Arabian Airlines, as well as many other companies.

6.4.4: Nonprofit Organizations (NPOs)

A nonprofit organization is an organization that uses surplus revenues to achieve goals rather than to distribute them as profit or dividends.

Learning Objective

Describe the types of nonprofit organizations, as well as their legal aspects and organizational goals

Key Points

- While not-for-profit organizations are permitted to generate surplus revenues, they must be retained by the organization for its self-preservation, expansion, or for other plans.

- The two major types of nonprofit organizations are membership and board-only. A membership organization elects the board, has regular meetings, and the power to amend the bylaws. A board-only organization typically has a self-selected board.

- Some NPOs may also be a charity or service organization; they may be organized as a not-for-profit corporation or as a trust, a cooperative, or they exist informally.

Key Terms

- nonprofit corporation

-

a company that uses surplus revenues to achieve its goals rather than distributing them as profit or dividends

- revenues

-

In business, revenue or turnover is income that a company receives from its normal business activities, usually from the sale of goods and services to customers.

Examples

- Feed The Children is an international, nonprofit relief organization with headquarters in Oklahoma City, Oklahoma. They deliver food, medicine, clothing and other necessities to individuals, children, and families who lack these essentials due to famine, war, poverty, or natural disasters (official web site description). In FY 2011, Feed The Children distributed more than 104 million pounds of food and other essentials to children and their families in all 50 states and internationally (official web site).

- It gets its revenues from pledges of cash and gifts-in kind from corporate and individual donors, according to its annual report in 2011. Its web site lists 5 members in its board of directors to direct its activities. Its surplus revenue is used to help needy children, as mentioned in the above paragraph.

Nonprofit Organizations

A nonprofit organization (NPO) is an organization that uses surplus revenues to achieve its goals rather than to distribute them as profit or dividends. While not-for-profit organizations are permitted to generate surplus revenues, they must be retained by the organization for its self-preservation, expansion, or for other plans. NPOs have controlling members or boards. Many have paid staff, including management, while others employ unpaid volunteers and even executives who work with or without compensation (occasionally nominal). Where there is a token fee, in general, it is used to meet legal requirements for establishing a contract between the executive and the organization. The extent to which an NPO can generate surplus revenues may be constrained, or use of surplus revenues may be restricted.

The two major types of nonprofit organizations are membership and board-only. A membership organization elects the board and has regular meetings and power to amend the bylaws. A board-only organization typically has a self-selected board, and a membership whose powers are limited to those delegated to it by the board. A board-only organization’s bylaws may even state that the organization does not have any membership, although the organization’s literature may refer to its donors as members; examples of such organizations are Fairvote and the National Organization for the Reform of Marijuana Laws.

Nature and Goals

Some NPOs may also be a charity or service organization; they may be organized as a not-for-profit corporation or as a trust, a cooperative, or they exist informally. A very similar type of organization termed a supporting organization operates like a foundation, but they are more complicated to administer, hold a more favorable tax status, and are restricted in the public charities they support.

Legal Aspects

NPOs have a wide diversity of structures and purposes. For legal classification, there are some elements of importance:

- Economic activity,

- Supervision and management provisions,

- Representation,

- Accountability and auditing provisions,

- Provisions for the amendment of the statutes or articles of incorporation,

- Provisions for the dissolution of the entity,

- Tax status of corporate and private donors,

- Tax status of the foundation.

Some of the above must be, in most jurisdictions, expressed in the charter of establishment. Others may be provided by the supervising authority at each particular jurisdiction.

While affiliations will not affect a legal status, they may be taken into consideration by legal proceedings as an indication of purpose.

Most countries have laws which regulate the establishment and management of NPOs and require compliance with corporate governance regimes. Most larger organizations are required to publish their financial reports detailing their income and expenditure publicly. In many aspects, they are similar to corporate business entities though there are often significant differences. Both not-for-profit and for-profit corporate entities must have board members, steering committee members, or trustees who owe the organization a fiduciary duty of loyalty and trust. A notable exception to this involves churches, which are often not required to disclose finances to anyone, including church members.

American Cancer Society Offices in Washington D.C.

The American Cancer Society (ACS) is a nationwide voluntary health organization dedicated to eliminating cancer.

6.5: Franchising

6.5.1: Types of Franchises

There are three major types of franchises – business format, product, and manufacturing – and each operates in a different way.

Learning Objective

List the different types of franchises

Key Points

- A business format franchise is a franchising arrangement where the franchisor provides the franchisee with an established business, including name and trademark, for the franchisee to run independently.

- A product franchise is a franchising agreement where manufacturers allow retailers to distribute products and use names and trademarks.

- A manufacturing franchise is a franchising agreement where the franchisor allows a manufacturer to produce and sell products using its name and trademark.

Key Term

- franchise

-

The authorization granted by a company to sell or distribute its goods or services in a certain area.

Example

- Generally, The Coca Cola Company only produces syrup concentrate. This is then sold to bottlers around the world, who finish the product by adding water and distributing it to retail stores, restaurants, and food service distributors.

Types of Franchises

While there are many ways to differentiate between different types of franchises (size, geographic location, etc), we will be looking at how different franchisors allow franchisees to use their name. On this basis, there are three different types of franchise:

- Business format franchises

- Product franchises

- Manufacturing franchises

Business Format Franchises

In business format franchises (which are the most common type), a company expands by supplying independent business owners with an established business, including its name and trademark. The franchiser company generally assists the independent owners considerably in launching and running their businesses. In return, the business owners pay fees and royalties. In most cases, the franchisee also buys supplies from the franchiser. Fast food restaurants are good examples of this type of franchise. Prominent examples include McDonalds , Burger King, and Pizza Hut.

McDonalds

McDonalds is perhaps the most famous franchise in the world.

Product Franchises

With product franchises, manufactures control how retail stores distribute their products. Through this kind of agreement, manufacturers allow retailers to distribute their products and to use their names and trademarks. To obtain these rights, store owners must pay fees or buy a minimum amount of products. Tire stores, for example, operate under this kind of franchise agreement.

Manufacturing Franchises

Through manufacturing franchises, a franchiser grants a manufacturer the right to produce and sell goods using its name and trademark. This type of franchise is common among food and beverage companies. For example, soft drink bottlers often obtain franchise rights from soft drink companies to produce, bottle, and distribute soft drinks. The major soft drink companies also sell the supplies to the regional manufacturing franchises. In the case of Coca Cola, for example, Coca Cola sells the syrup concentrate to a bottling company, who mixes these ingredients with water and bottles the product, and sells it on.

6.5.2: Advantages of Franchises

A franchise agreement can have many benefits for both the franchisor and the franchisee.

Learning Objective

Discuss the advantages of participating in a franchise

Key Points

- Benefits to the franchisor include regular royalty payments, expansion with reduced financial risk, and a greater geographical presence.

- Franchisee benefits include lower risk, lower startup costs, existing brand recognition, and parent company marketing support.

- Potential franchisees can select a franchise based on their location, interests, resources, and needs, which means that entering into a franchising arrangement can be a flexible process.

- – Royalty payments

- Franchisee benefits include:

- – Higher chance of success due to tried and tested business model

- – Franchisor support, training and expertise

- – Brand recognition and national marketing

Key Terms

- franchisor

-

a company or person that authorizes another to sell or distribute its goods or services in a certain area

- royalty

-

Regular payment made from the franchisee to the franchisor for the right to be a franchisee.

Example

- In the United States, the McDonalds Corporation owns only approximately 15% of McDonalds restaurants nationwide. The rest are operated through franchise and joint venture agreements, with profits being made through franchise fees and marketing fees, and at times through rent, as often the franchisee does not own the location of the restaurant.

Benefits for the Franchisor

Franchisors benefit from franchise agreements because they allow companies to expand much more quickly than they could otherwise. A lack of funds and workers can cause a company to grow slowly. Through franchising, a company invests very little capital or labor because the franchisee supplies both. The parent company experiences rapid growth with little financial risk.

A company can also ensure it has competent and highly motivated owners and managers at each outlet through franchising. Since the owners are largely responsible for the success of their outlets, they will put in a strong and constant effort to make sure their businesses run smoothly and prosper. In addition, companies are able to provide franchising rights to only qualified people.

Other benefits include:

- Franchising allows a business to have an international presence.

- Franchisors can experience economies of scale.

- Franchisors can benefit from growth without worrying about running costs.

- Franchisors receive royalty payments that are set as a percentage of profits.

Benefits for the Franchisee

The franchisee also has numerous advantages that come from entering a franchising agreement, including:

– There is a low risk due to the tried and tested formula. Buying a franchise business provides a higher chance for success. They get the benefit of owning a proven business formula that has been tested and shown to work well in other locations. In addition, they receive the support from the main company toward establishing the business, and the training to operate it successfully.

– There are lower start-up costs since the business idea was already developed.

– They are buying a name and brand that is recognized by the public. So they have a big advantage over starting a business from scratch, as they already have an established customer base.

– A franchise gives more security from the beginning. New independent businesses are known to have as high as a 90% failure rate, often causing the business owner heavy losses and at times bankruptcy.

– When you start a business from scratch, you spend huge amounts of time trying to operate the business without being successful because you may not have the necessary skills for that particular area. When you purchase a franchise, all the necessary groundwork has been done already. In addition, the franchisee gets training and head office support from the franchisor; this may be essential if the franchisee is new to running a business and has no experience or business knowledge.

– The franchisee gets the support of national marketing which a small business would not normally be able to afford. In some cases of larger brands, they may have customers waiting for their doors to open (for example in a new McDonalds).

– Since all the product selection and the marketing have been already developed, you simply have to take care of the daily operations of the business. Your goal will be to grow from an established foundation and expand from there.

– The new franchise owner gains many benefits from the association with the main franchise company. The franchisor offers a great deal of business experience that would take years for the average business person to acquire .

Pizza Hut Franchise

Franchisees gain many benefits from being a franchisee rather than starting their own business from scratch.

– There are a lot of part-time franchising opportunities, which are perfect if someone has a small amount to invest and wants to support themselves and maintain their investment. They may be able to sell the franchise to someone else once they no longer wish to run it.

6.5.3: Disadvantages of Franchises