2.1: The Basics of Accounting

2.1.1: Terminology of Accounting

Important terminology in accounting includes cash vs. accrual basis, assets, liabilities, and equity.

Learning Objective

Distinguish between the two primary accounting methods

Key Points

- The cash basis of accounting records revenue when cash is received and expenses when they are paid in cash.

- The accrual method records income items when they are earned and records deductions when expenses are incurred, regardless of the flow of cash.

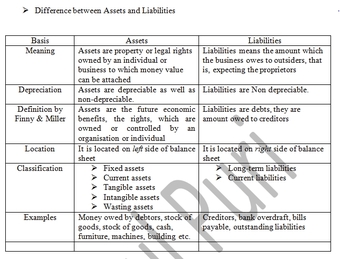

- Assets are economic resources. Anything capable of being owned or controlled to produce value is considered an asset.

- A liability is an obligation of an entity arising from past transactions, the settlement of which may result in the transfer of assets, provision of services, or other yielding of economic benefits in the future.

- Equity is the residual claim or interest of the most junior class of investors in assets after all liabilities are paid.

Key Term

- intangible assets

-

non-monetary assets that cannot be seen, touched or physically measured, are created through time and effort, and are identifiable as a separate asset

There are two primary accounting methods – cash basis and accrual basis. The cash basis of accounting, or cash receipts and disbursements method, records revenue when cash is received and expenses when they are paid in cash. In contrast, the accrual method records income items when they are earned and records deductions when expenses are incurred, regardless of the flow of cash. Accrual accounts include, among others, accounts payable, accounts receivable, goodwill, deferred tax liability and future interest expense.

The term accrual is also often used as an abbreviation for the terms accrued expense and accrued revenue. Accrued revenue (or accrued assets) is an asset, such as unpaid proceeds from a delivery of goods or services, when such income is earned and a related revenue item is recognized, while cash is to be received in a later period, when the amount is deducted from accrued revenues. An example of an accrued expense is a pending obligation to pay for goods or services received from a counterpart, while cash is to be paid out in a latter accounting period when the amount is deducted from accrued expenses.

In financial accounting, assets are economic resources. Anything capable of being owned or controlled to produce value is considered an asset. Simply stated, assets represent value of ownership that can be converted into cash. Two major asset classes are intangible assets and tangible assets. Intangible assets are identifiable non-monetary assets that cannot be seen, touched or physically measured, are created through time and effort, and are identifiable as a separate asset. Tangible assets contain current assets and fixed assets. Current assets include inventory, while fixed assets include such items as buildings and equipment.

Assets and liabilities

Differences between assets and liabilities

A liability is an obligation of an entity arising from past transactions, the settlement of which may result in the transfer of assets, provision of services, or other yielding of economic benefits in the future. A liability is defined by the following characteristics:

- Any type of borrowing from persons or banks for improving a business or personal income,

- A responsibility to others that entails settlement by future transfer of assets, provision of services, or other transactions,

- A responsibility that obligates the entity to another, leaving it little or no discretion to avoid settlement, or

- A transaction or event obligating the entity that has already occurred.

In accounting and finance, equity is the residual claim or interest of the most junior class of investors in assets after all liabilities are paid. If liability exceeds assets, negative equity exists. In an accounting context, shareholders’ equity represents the remaining interest in assets of a company, spread among individual shareholders in common or preferred stock.

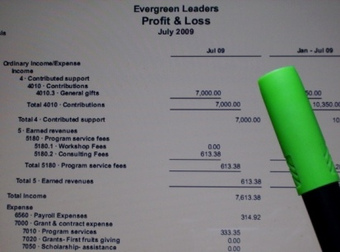

2.1.2: Debits and Credits

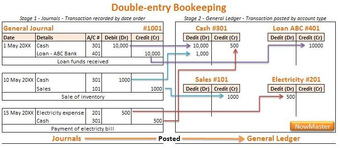

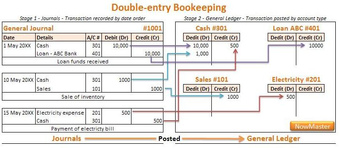

Credit and debit are the two fundamental aspects of every financial transaction in the double-entry bookkeeping system.

Learning Objective

Define how the terms debit and credit are used in accounting

Key Points

- The English words credit and debit come from the Latin words credre and debere, respectively. Credre means “to entrust,” and debere means “to owe”.

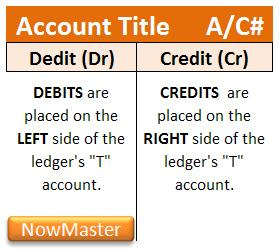

- In financial accounting or bookkeeping, “Dr” (Debit) indicates the left side of a ledger account and “Cr” (Credit) indicates the right.

- The rule that total debits equal total credits applies when all accounts are totaled.

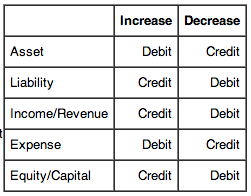

- An increase (+) to an asset account is a debit. An increase (+) to a liability account is a credit.

- Conversely, a decrease (-) to an asset account is a credit. A decrease (-) to a liability account is a debit.

- It is important for us to consider perspective when attempting to understand the concepts of debits and credits.

Key Terms

- double-entry bookkeeping system

-

A double-entry bookkeeping system is a set of rules for recording financial information in a financial accounting system in which every transaction or event changes at least two different nominal ledger accounts.

- debit

-

an entry in the left hand column of an account to record a debt; debits increase asset and expense accounts and decrease liability, income, and equity accounts

- credit

-

an entry in the right hand column of an account; credits increase liability, income, and equity accounts and decrease asset and expense accounts

The difficulty with accounting has less to do with the math as it does with its concepts. There is no more difficult yet vital concept to understand than that of debits and credits. Debits and credits are at the heart of the double-entry bookkeeping system that has been the foundation stone on which the financial world’s accounting system has been built for well over 500 years. Given the length of time, is it any wonder that confusion has surrounded the concept of debits and credits? The English language and its laws have morphed to bring new definitions for two words that, in the accounting world, have their own significance and meaning.

For a better conceptual understanding of debits and credits, let us look at the meaning of the original Latin words. The English translators took theirs word credit and debit from the Latin words credre and debere, respectively. Credre means “to entrust,” and debere means “to owe. ” When we look closely into these two concepts we see that they are actually two sides of the same coin. In a closed financial system, money cannot just materialize. If money is received by someone it must have come from someone. That is, if someone entrusts an amount of money to someone else, then that person receiving the entrusted money would owe the same amount of money in return (i.e., the credre must equal the debere).

The Accounting Definition

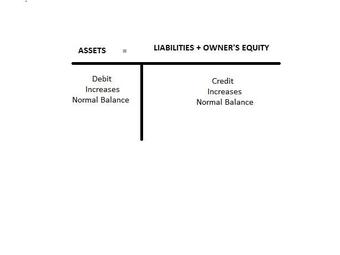

Debits and credits serve as the two balancing aspects of every financial transaction in double-entry bookkeeping. Debits are entered on the left side of a ledger, and credits are entered on the right side of a ledger. Whether a debit increases or decreases an account depends on what kind of account it is. In the accounting equation Assets = Liabilities + Equity, if an asset account increases (by a debit), then one must also either decrease (credit) another asset account or increase (credit) a liability or equity account.

Another way to help remember debit and

credit rules, is to think of the accounting equation as a tee (T),

the vertical line of the tee (T) goes between assets and liabilities.

Everything on the left side (debit side) increases with a debit and

has a normal debit balance; everything on the right side (credit

side) increases with a credit and has a normal credit balance. (Note:

a normal balance does not always mean the accounts balance will be on

that side, it’s simply a way of remembering which side increases it).

Accounting Equation

The extended accounting equation allows

for revenue and expenses as well.

Assets = Liabilities + Owner’s Equity +

Revenue – Expenses

As you already know the first part of

the equation, let’s focus on the new classifications, revenue and

expenses.

-

Revenue is treated like capital,

which is an owner’s equity account, and owner’s equity is increased

with a credit, and has a normal credit balance. -

Expenses reduce revenue, therefore they are just the opposite, increased

with a debit, and have a normal debit balance.

Each transaction (let’s say $100) is recorded by a debit entry of $100 in one account, and a credit entry of $100 in another account. When people say that “debits must equal credits” they do not mean that the two columns of any ledger account must be equal. If that were the case, every account would have a zero balance (no difference between the columns), which is often not the case. The rule that total debits equal the total credits applies when all accounts are totaled.

Perspective

It is important for us to consider perspective when attempting to understand the concepts of debits and credits. For example, one credit that confuses most newcomers to accounting is the one that appears on their own bank statement. We know that cash in the bank is an asset, and when we increase an asset we debit its account. Then how come the credit balance in our bank accounts goes up when we deposit money? The answer is one that is fundamental to the accounting system. Each firm records financial transactions from their own perspective.

Think about the bank’s perspective for a moment. How do they view the money we have just deposited? Whose money is it? It’s ours; therefore, from the bank’s perspective the deposit is viewed as a liability (money owed by the bank to others). When we deposit money into our accounts, the bank’s liability increases, which is why the bank credits our account.

In summary: An increase (+) to an asset account is a debit and an increase (+) to a liability account is a credit; conversely, a decrease (-) to an asset account is a credit and a decrease (-) to a liability account is a debit.

What is debited and credited is also a matter of transaction type. In accounting, these are divided into three types of accounts. The rule of debit and credit depends on the type of account you are talking about:

- Personal account: Debit the receiver and credit the giver

- Real account: Debit what comes in and credit what goes out

- Nominal account: Debit all expenses & losses and credit all incomes & gains

Debit and credit rules

Debit and credit rules

2.1.3: Fundamental Accounting Equation

To ensure that a company is “in balance,” its assets must always equal its liabilities plus its owners’ equity.

Learning Objective

State the fundamental accounting equation

Key Points

- The accounting equation displays that all assets are either financed by borrowing money or paying with the money of the company’s shareholders.

- The balance sheet is a complex display of this equation, showing that the total assets of a company are equal to the total of liabilities and shareholder equity. Any purchase or sale has an equal effect on both sides of the equation or offsetting effects on the same side of the equation.

- A mark in the credit column will increase a company’s liability, income, and capital accounts but decrease its asset and expense accounts. A mark in the debit column will increase a company’s asset and expense accounts, but decrease its liability, income, and capital account.

Key Terms

- debit

-

an entry in the left hand column of an account to record a debt; debits increase asset and expense accounts and decrease liability, income, and equity accounts

- credit

-

an entry in the right hand column of an account; credits increase liability, income, and equity accounts and decrease asset and expense accounts

- double-entry bookkeeping system

-

A double-entry bookkeeping system is a set of rules for recording financial information in a financial accounting system in which every transaction or event changes at least two different nominal ledger accounts.

The fundamental accounting equation can actually be expressed in two different ways. A double-entry bookkeeping system involves two different “columns;” debits on the left, credits on the right. Every transaction and all financial reports must have the total debits equal to the total credits. A mark in the credit column will increase a company’s liability, income and capital accounts, but decrease its asset and expense accounts. A mark in the debit column will increase a company’s asset and expense accounts, but decrease its liability, income and capital account.

For example, if a person buys a computer for $945. He borrows $500 from his best friend and pays for the rest using cash in his bank account. To record this transaction in his personal ledger, the person would make the following journal entry.

Computer (Increase in asset) $945

Cash (Decrease in an asset) $445

Loan from friend (Increase in debt) $500

As you can see, the total amount of the debits (the amount on the left) equal the credits (the total amount on the right). The transaction is in “balance. “

An extension of that basic rule involves the balance sheet. The total assets listed on a company’s balance sheet must equal the company’s total liabilities, plus its owners’ equity in the company. This identity reflects the assumption that all of a company’s assets are either financed through debt or through the contribution of funds by the company’s owners.

A simple balance sheet example:

Assets

Cash $100,000

PP&E $200,000

Liabilities & Equity

Mortgage $150,000

Equity $150,000

As you can see, the business’s total assets equal the company’s total liabilities and equity. This company is “balanced. “

2.1.4: An Expanded Equation

Preparing financial statements requires preparing an adjusted trial balance, translating that into financial reports, and having those reports audited.

Learning Objective

Demonstrate how to prepare the financial statements

Key Points

- The purpose of financial statements are to provide both business insiders and outsiders a concise, clear picture of the current financial status in the business. Therefore, the people who use the statements must be confident in its accuracy.

- Closing the books is simply a matter of ensuring that transactions that take place after the business’s financial period are not included in the financial statements.

- Adjusting entries are generally made in relation to prepaid expenses, prepayments, accruals, estimates and inventory.

- When an audit is completed, the auditor will issue a report regarding whether the statements are accurate. To ensure a positive reports, some companies try to participate in opinion shopping. This practice is generally prohibited..

Key Terms

- adjusting entry

-

Journal entries usually made at the end of an accounting period to allocate income and expenditure to the period in which they actually occurred.

- audit

-

An independent review and examination of records and activities to assess the adequacy of system controls, to ensure compliance with established policies and operational procedures, and to recommend necessary changes in controls, policies, or procedures

- opinion shopping

-

The process of contracting or rejecting auditors based on the type of opinion report they will issue on the auditee.

Example

- Financial statements for Highland Yoga for each period would appear as follows:

Preparing Financial Statements

When a business enterprise presents all the relevant financial information in a structured and easy to understand manner, it is called a financial statement. The purpose of financial statements are to provide both business insiders and outsiders a concise, clear picture of the current financial status in the business. Therefore, the people who use the statements must be confident in its accuracy.

Adjusted Trial Balance – Closing the Books

The process of preparing the financial statements begins with the adjusted trial balance. Preparing the adjusted trial balance requires “closing” the book and making the necessary adjusting entries to align the financial records with the true financial activity of the business.

Closing the books is simply a matter of ensuring that transactions that take place after the business’s financial period are not included in the financial statements. For example, assume a business is preparing its financial statements with a December 31st year end. It acquires some property on January 14th. If the books are properly closed, that property will not be included on the balance sheet that is being prepared for the period on December 31st.

Adjusted Trial Balance – Adjusting Entries

An adjusting entry is a journal entry made at the end of an accounting period that allocates income and expenditure to the appropriate years. Adjusting entries are generally made in relation to prepaid expenses, prepayments, accruals, estimates and inventory. Throughout the year, a business may spend funds or make assumptions that might not be accurate regarding the use of a good or service during the accounting period. Adjusting entries allow the company to go back and adjust those balances to reflect the actual financial activity during the accounting period.

For example, assume a company purchases 100 units of raw material that it expects to use up during the current accounting period. As a result, it immediately expenses the cost of the material. However, at the end of the year the company discovers it only used 50 units. The company must then make an adjusting entry to reflect that, and decrease the amount of the expense and increase the amount of inventory accordingly.

Translate the Adjusted Trial Balance to Financial Statements

Using the trial balance, the company then prepares the four financial statements. These statements are:

- The Balance Sheet: A summary of the company’s assets, liabilities and equity;

- The Income Statement: A summary of the business’s income, expenses, and profits

- The Statement of Cash Flows: A report on a company’s cash flow activities, particularly its operating, investing and financing activities; and

- The Statement of Changes in Equity: A report that explains the changes of the company’s equity throughout the reporting period

The company may also provide Notes to the Financial Statements, which are disclosures regarding key details about the company’s operations that may not be evident from the financial statements.

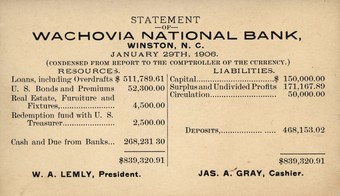

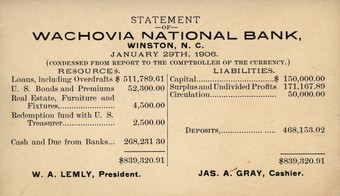

Financial statement

Financial statement from Wachovia National Bank, 1906.

Audit the Financial Statements

Once the company prepares its financial statements, it will contract an outside third party to audit it. An audit is an independent review and examination of records and activities to assess the adequacy of system controls, to ensure compliance with established policies and operational procedures, and to recommend necessary changes in controls, policies, or procedures. It is the audit that assures outside investors and interested parties that the content of the statements are correct.

When an audit is completed, the auditor will issue a report with the findings. The findings can state anything from the statements are accurate to statements are misleading. To ensure a positive reports, some companies try to participate in opinion shopping. This is the process that businesses use to ensure it gets a positive review. Since Enron and the accounting scandals of the early 2000s, this practice has been prohibited.

2.1.5: Types of Transactions

Transactions include sales, purchases, receipts, and payments made by an individual or organization.

Learning Objective

Distinguish between the four transactions that occur in the accounting cycle

Key Points

- Sales – A sale is a transfer of property for money or credit. Revenue is earned when goods are delivered or services are rendered. In double-entry bookkeeping, a sale of merchandise is recorded in the general journal as a debit to cash or accounts receivable and a credit to the sales account.

- Purchase transactions results in a decrease in the finances of the purchaser and an increase in the benefits of the sellers. Purchases can be made by cash or credit. As credit purchases are made, accounts payable will increase.

- Receipts refer to a business getting paid by another business for delivering goods or services. This transaction results in a decrease in accounts receivable and an increase in cash/ cash or equivalents.

- Payments refer to a business paying to another business for receiving goods or services. This transaction results in a decrease in accounts payable and an decrease in cash/ cash or equivalents.

Key Term

- double-entry bookkeeping

-

A double-entry bookkeeping system is a set of rules for recording financial information in a financial accounting system in which every transaction or event changes at least two different nominal ledger accounts.

Transactions include sales, purchases, receipts, and payments made by an individual or organizations.

Overview of Sales

A sale is a transfer of property for money or credit. Revenue is earned when goods are delivered or services are rendered. In double-entry bookkeeping, a sale of merchandise is recorded in the general journal as a debit to cash or accounts receivable and a credit to the sales account. The amount recorded is the actual monetary value of the transaction, not the list price of the merchandise. A discount from list price might be noted if it applies to the sale. Fees for services are recorded separately from sales of merchandise, but the bookkeeping transactions for recording sales of services are similar to those for recording sales of tangible goods .

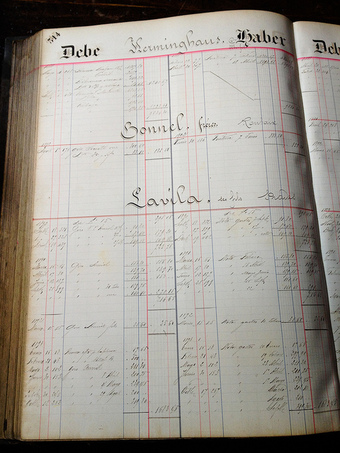

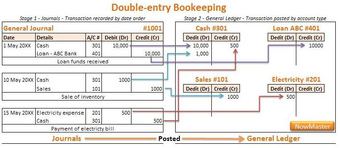

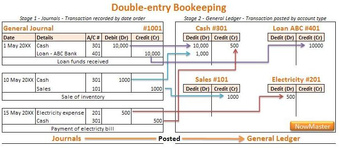

Bookkeeping

Purchases and sales in an old ledger

Overview of Purchases

Purchasing refers to a business or organization acquiring goods or services to accomplish the goals of its enterprise. This transaction results in a decrease in the finances of the purchaser and an increase in the benefits of the sellers. Purchases can be made by cash or credit. As credit purchases are made, accounts payable will increase.

Overview of Receipts

Receipts refer to a business getting paid by another business for delivering goods or services. This transaction results in a decrease in accounts receivable and an increase in cash or equivalents.

Overview of Payments

Payments refer to a business paying another business for receiving goods or services. The business that makes the payment will decrease its accounts payable as well as its cash or equivalents. On the other hand, the business that receives the payment will see a decrease in accounts receivable but an increase in cash or equivalents.

2.2: The Accounting Cycle

2.2.1: What Is the Accounting Cycle?

The accounting cycle is performed during the accounting period, to analyze, record, classify, summarize, and report financial information.

Learning Objective

Identify and complete the 8 steps in the Accounting Cycle

Key Points

- The accounting cycle has 8 Steps.

- Each transaction must be analyzed to determine whether it qualifies as a business transaction.

- The accounting cycle runs within the accounting period.

- The goal of the accounting cycle is to produce financial statements for the company.

Key Terms

- source

-

The person, place or thing from which something (information, goods, etc. ) comes or is acquired.

- bookkeeping

-

The skill or practice of keeping books or systematic records of financial transactions, e.g., income and expenses.

- summarize

-

To give a recapitulation of the salient facts; to recapitulate or review

Example

- As we walk through the steps of the accounting cycle, consider the following example. After a number of years as a successful CPA at a national firm, you decide to quit the rat race and pursue your true love — yoga. You decide that Atlanta’s Virginia-Highland neighborhood would be the perfect place to open an Ashtanga Yoga studio. Even better, your friend Solomon, a certified instructor, has just moved to town and is willing to teach at the studio. You hurriedly prepare to open the studio, Highland Yoga, by July 1.Pre-opening (before July 1)Prior to opening the business, you make the following transactions:1. You contribute $4,000 in cash to start the business.2. You purchase $500 worth of mats and other equipment for use during classes.3. You purchase an additional $400 worth of mats, equipment, and clothing for sale at the studio.4. You purchase liability insurance at a total cost of $1,200. The policy covers July 1 through December31.JulyThe following transactions take place during July.1. You receive cash totaling $800 for classes.2. Your instructor teaches classes for the month. You agree to pay $600 for the classes; $300 is paid on July 15, and $300 will be paid on August 3.3. You pay rent for July of $1,000 on July 1.4. You use utilities (electricity and water) totaling $200. This amount is payable on August 15.AugustThe following transactions take place during August.1. You receive $1,500 in cash for classes. Of this amount, $1,000 was for classes in August. The remainder is for 2-month passes allowing unlimited classes in August and September.2. Your instructor again earns $600 teaching classes; $300 due on August 16 and $300 on September 1.3. Utilities total $150, payable September 15.4. You pay rent of $1,000 on August 1.5. You sell inventory costing $150 for a revenue of $225.6. You are worried about money, so your Uncle Rafael makes you an offer. He agrees to loan you $2,000 in cash. You will need to repay him sometime later, but he doesn’t say when.7. A client is extremely dissatisfied with their class, and demands their money back. Reluctantly, you agree. The class cost $15.8. After borrowing money, you decide to withdraw some of your investment in the studio to pursue other opportunities. You decide to withdraw $1,000.

The Accounting Cycle

The accounting cycle is a series of steps performed during the accounting period (some throughout the period and some at the end) to analyze, record, classify, summarize, and report useful financial information for the purpose of preparing financial statements. In bookkeeping, the accounting period is the period for which the books are balanced and the financial statements are prepared. Generally, the accounting period consists of 12 months. However, the beginning of the accounting period differs according to the company. For example, one company may use the regular calendar year, January to December, as the accounting year, while another entity may follow April to March as the accounting period.

Eight Steps in the Accounting Cycle

There are eight steps in the accounting cycle and they are as follows:

- Analyze transactions by examining source documents.

- Journalize transactions in the journal.

- Post journal entries to the accounts in the ledger.

- Prepare a trial balance of the accounts and complete the worksheet (includes adjusting entries).

- Prepare financial statements.

- Journalize and post adjusting entries.

- Journalize and post closing entries.

- Prepare a post-closing trial balance.

Source Documents

To begin the accounting cycle, it is necessary to understand what constitutes a business transaction. Business transactions are measurable events that affect the financial condition of a business. Business transactions can be the exchange of goods for cash between the business and an external party, such as the sale of a book, or they can involve paying salaries to employees. These events have one fundamental thing in common: they have caused a measurable change in the amounts in the accounting equation, assets = liabilities + stockholders’ equity. The evidence that a business event has occurred is a source document. Sales tickets, checks, and invoices are common source documents. Source documents are important because they are the ultimate proof that a business transaction has taken place.

After determining, via the source documents, that an event is a business transaction, it is then entered into the company books via a journal entry. After all the transactions for the period have been entered into the appropriate journals, the journals are posted to the general ledger . The trial balance proves that the books are in balance or that the debits equal the credits. From the trial balance, a company can prepare their financial statements. After the financials are prepared, the month end adjusting and closing entries are recorded (journalized) and posted to the appropriate accounts. After those entries are made, a post-closing trial balance is run. The post-closing trial balance verifies the debits equal the credits and that all beginning balances for permanent accounts are in place.

The General Ledger

The General Ledger contains all entries from both the General Journal and the Special Journals.

Highland Yoga

As we walk through the steps of the accounting cycle, consider the following example. After a number of years as a successful CPA at a national firm, you decide to quit the rat race and pursue your true love — yoga. You decide that Atlanta’s Virginia-Highland neighborhood would be the perfect place to open an Ashtanga Yoga studio. Even better, your friend Solomon, a certified instructor, has just moved to town and is willing to teach at the studio. You hurriedly prepare to open the studio, Highland Yoga, by July 1.

Pre-opening (before July 1)

Prior to opening the business, you make the following transactions:

1. You contribute $4,000 in cash to start the business.

2. You purchase $500 worth of mats and other equipment for use during classes.

3. You purchase an additional $400 worth of mats, equipment, and clothing for sale at the studio.

4. You purchase liability insurance at a total cost of $1,200. The policy covers July 1 through December31.

July

The following transactions take place during July.

1. You receive cash totaling $800 for classes.

2. Your instructor teaches classes for the month. You agree to pay $600 for the classes; $300 is paid on July 15, and $300 will be paid on August 3.

3. You pay rent for July of $1,000 on July 1.

4. You use utilities (electricity and water) totaling $200. This amount is payable on August 15.

August

The following transactions take place during August.

1. You receive $1,500 in cash for classes. Of this amount, $1,000 was for classes in August. The remainder is for 2-month passes allowing unlimited classes in August and September.

2. Your instructor again earns $600 teaching classes; $300 due on August 16 and $300 on September 1.

3. Utilities total $150, payable September 15.

4. You pay rent of $1,000 on August 1.

5. You sell inventory costing $150 for a revenue of $225.

6. You are worried about money, so your Uncle Rafael makes you an offer. He agrees to loan you $2,000 in cash. You will need to repay him sometime later, but he doesn’t say when.

7. A client is extremely dissatisfied with their class, and demands their money back. Reluctantly, you agree. The class cost $15.

8. After borrowing money, you decide to withdraw some of your investment in the studio to pursue other opportunities. You decide to withdraw $1,000.

2.2.2: Recording Transactions

All business transactions must be recorded to the proper journal by double-entry book keeping.

Learning Objective

Explain why the double entry system is used in accounting and the proper use of a T-account

Key Points

- Source documents are important because they are the ultimate proof a business transaction has occurred.

- An account is a part of the accounting system used to classify and summarize the increases, decreases, and balances of each asset, liability, stockholders’ equity item, dividend, revenue, and expense.

- The accounting requirement that each transaction be recorded by an entry that has equal debits and credits is called double-entry procedure.

- This double-entry procedure keeps the accounting equation in balance.

Key Terms

- debit

-

an entry in the left hand column of an account to record a debt; debits increase asset and expense accounts and decrease liability, income, and equity accounts

- account

-

A registry of pecuniary transactions; a written or printed statement of business dealings or debts and credits, and also of other things subjected to a reckoning or review

- credit

-

an entry in the right hand column of an account; credits increase liability, income, and equity accounts and decrease asset and expense accounts

Example

- Continuing our example, how would we recognize and record the transactions involved in running our yoga studio? Pre-openingPrior to opening the business, you make the following transactions:1. You contribute $4,000 in cash to start the business.Cash 4,000, Contributed Capital 4,000; Assets(+)=Equity(+)2. You purchase $500 worth of mats and other equipment for use during classes.Cash -500, PPE 500; Assets(+), Assets(-)=03. You purchase an additional $400 worth of mats, equipment, and clothing for sale at the studio.Cash -400, Inventory 400; Assets(+), Assets(-)=04. You purchase liability insurance at a total cost of $1,200. The policy covers July 1 through December31.Cash -1,200, Prepaid Insurance 1,200; Assets(+), Assets(-)JulyThe following transactions take place during July.1. You receive cash totaling $800 for classes.Cash 800, Service Revenue 800; Assets(+)= Equity(+)2. Your instructor teaches classes for the month. You agree to pay $600 for the classes; $300 is paid on July 15, and $300 will be paid on August 3.Cash -300, Wage Payable 300, Instructor Expense 600; Assets(-300)=Liabilities(+300)+Equity(-600)3. You pay rent for July of $1,000 on July 1. Cash -1,000, Rent Expense 1,000; Assets(-)=Equity(-)4. You use utilities (electricity and water) totaling $200. This amount is payable on August 15.Utility Payable 200, Utility Expense 200; Liability(+)+Equity(-)=0. AugustThe following transactions take place during August.1. You receive $1,500 in cash for classes. Of this amount, $1,000 was for classes in August. The remainder is for 2-month passes allowing unlimited classes in August and September.Cash 1,500, Unearned Revenue 250, Service Revenue 1,250 Assets(+1,500)=Liability(+250)+Equity(+1,250)2. Your instructor again earns $600 teaching classes; $300 due on August 16 and $300 on September 1.Cash -300, Wage Payable 300, Instructor Expense 600; Assets(-300)=Liabilities(+300)+Equity(-600)3. Utilities total $150, payable September 15.Utility Payable 150, Utility Expense 150; Liability(+)+Equity(-)=04. You pay rent of $1,000 on August 1.Cash -1,000, Rent Expense 1,000; Assets(-)=Equity(-)5. You sell inventory costing $150 for a revenue of $225.a. Cash 225, Sales Revenue 225; Assets(+)=Equity(+)b. Inventory -150, Cost of Goods Sold 150; Assets(-)=Equity(-)6. You are worried about money, so your Uncle Rafael makes you an offer. He agrees to loan you $2,000 in cash. You will need to repay him sometime later, but he doesn’t say when.Cash 2,000, Loan Payable 2,000; Assets(+)=Liabilities(+)7. A client is extremely dissatisfied with their class, and demands their money back. Reluctantly, youagree. The class cost $15.Cash -15, Service Revenue -15; Assets(-)=Equity(-)8. After borrowing money, you decide to withdraw some of your investment in the studio to pursue otheropportunities. You decide to withdraw $1,000.Cash -1,000, Contributed Capital -1,000; Assets(-)=Equity(-)

Journal entries are business transactions that cause a measurable change in the accounting equation.

(Assets = Liabilities + Stockholders’ Equity)

Since business transactions always generate documentation, it is the accountant or bookkeeper’s job to analyze the source document to determine whether a journal entry is necessary. Source documents are important because they are the ultimate proof of business transactions. Some examples of source documents include bills received from suppliers for goods or services received, bills sent to customers for goods sold or services performed, and cash register tapes. Each source document is analyzed to determine whether the event caused a measurable change in the accounting equation. If it has, then it is necessary to prepare and record a journal entry in the proper account.

An account is the part of the accounting system used to classify and summarize the increases, decreases, and balances of each asset, liability, stockholders’ equity item, dividend, revenue, and expense. Firms set up accounts for each different business element, such as cash, accounts receivable, and accounts payable. Individual companies may label their accounts differently.

All accounts have corresponding contra accounts depending on what transaction has taken place; i.e., when a vehicle is purchased using cash, the asset account “Vehicles” is debited as the vehicle account increases, and simultaneously the asset account “Bank” is credited due to the payment of the vehicle using cash. Some balance sheet items have corresponding contra accounts, with negative balances, that offset them. Examples are accumulated depreciation against equipment, and allowance for bad debts against long-term notes receivable.

The General Ledger

The General Ledger contains all entries from both the General Journal and the Special Journals. Using a double entry system to record transactions keeps the accounts in balance.

The accounting requirement that each transaction be recorded by an entry that has equal debits and credits is called double-entry procedure. This double-entry procedure keeps the accounting equation in balance. For each business transaction recorded, the total dollar amount of debits must equal the total dollar amount of credits. If one account (or accounts) is debited for $100, then another account (or accounts) must be credited for the same amount.

T-accounts

The general ledger of all accounts is, simply, a comprehensive collection of T-accounts — so called because there is a vertical line in the middle of each ledger page and a horizontal line at the top of each ledger page, like a large letter T. The account title will appear above the horizontal line, and debits and credits will appear to the left and right of the vertical line, respectively.

Some typical accounts and their normal balances:

Assets Debit

Contra Asset Credit

Liability Credit

Contra Liability Debit

Owner’s Equity Credit

Stockholder’s Equity Credit

Revenue Credit

Contra Revenue Debit

Expenses Debit

Gains Credit

Losses Debit

T-Account

T-accounts are so named because of their “T” shape, with the name of the account on top, and debits and credits on the left and right, respectively.

An account’s normal balance will be the side on which increases are recorded. For example, assets and expenses normally have debit balances, and liabilities and revenues normally have credit balances.

Continuing our example, how would we recognize and record the transactions involved in running our yoga studio?

Pre-opening

Prior to opening the business, you make the following transactions:

1. You contribute $4,000 in cash to start the business.

Cash 4,000, Contributed Capital 4,000; Assets(+)=Equity(+)

2. You purchase $500 worth of mats and other equipment for use during classes.

Cash -500, PPE 500; Assets(+), Assets(-)=0

3. You purchase an additional $400 worth of mats, equipment, and clothing for sale at the studio.

Cash -400, Inventory 400; Assets(+), Assets(-)=0

4. You purchase liability insurance at a total cost of $1,200. The policy covers July 1 through December31.

Cash -1,200, Prepaid Insurance 1,200; Assets(+), Assets(-)

July

The following transactions take place during July.

1. You receive cash totaling $800 for classes.

Cash 800, Service Revenue 800; Assets(+)= Equity(+)

2. Your instructor teaches classes for the month. You agree to pay $600 for the classes; $300 is paid on July 15, and $300 will be paid on August 3.

Cash -300, Wage Payable 300, Instructor Expense 600; Assets(-300)=Liabilities(+300)+Equity(-600)

3. You pay rent for July of $1,000 on July 1.

Cash -1,000, Rent Expense 1,000; Assets(-)=Equity(-)

4. You use utilities (electricity and water) totaling $200. This amount is payable on August 15.

Utility Payable 200, Utility Expense 200; Liability(+)+Equity(-)=0.

August

The following transactions take place during August.

1. You receive $1,500 in cash for classes on August 1. Of this amount, $1,000 is for an initiation fee. The remainder is for 2-month passes allowing unlimited classes in August and September.

Cash 1,500, Unearned Revenue 500, Service Revenue 1,000; Assets(+1,500)=Liability(+500)+Equity(+1,000)

2. Your instructor again earns $600 teaching classes; $300 due on August 16 and $300 on September 1.

Cash -300, Wage Payable 300, Instructor Expense 600; Assets(-300)=Liabilities(+300)+Equity(-600)

3. Utilities total $150, payable September 15.

Utility Payable 150, Utility Expense 150; Liability(+)+Equity(-)=0

4. You pay rent of $1,000 on August 1.

Cash -1,000, Rent Expense 1,000; Assets(-)=Equity(-)

5. You sell inventory costing $150 for a revenue of $225.

a. Cash 225, Sales Revenue 225; Assets(+)=Equity(+)

b. Inventory -150, Cost of Goods Sold 150; Assets(-)=Equity(-)

6. You are worried about money, so your Uncle Rafael makes you an offer. He agrees to loan you $2,000 in cash. You will need to repay him sometime later, but he doesn’t say when.

Cash 2,000, Loan Payable 2,000; Assets(+)=Liabilities(+)

7. A client is extremely dissatisfied with their class, and demands their money back. Reluctantly, you agree. The class cost $15.

Cash -15, Service Revenue -15; Assets(-)=Equity(-)

8. After borrowing money, you decide to withdraw some of your investment in the studio to pursue other opportunities. You decide to withdraw $1,000.

Cash -1,000, Contributed Capital -1,000; Assets(-)=Equity(-)

2.2.3: Journalizing

Items are entered into the general journal or the special journals via journal entries, also called journalizing.

Learning Objective

Explain the correct procedure for making a journal entry in the General or Special Journal.

Key Points

- Special journals are designed to facilitate the process of journalizing and posting transactions. They are used for the most frequent transactions in a business.

- Journal entries are prepared after examining the source document to see if a business transaction has taken place.

- The total amount debited and the total amount credited should always be equal, thereby ensuring the accounting equation is maintained.

Key Terms

- debit

-

an entry in the left hand column of an account to record a debt; debits increase asset and expense accounts and decrease liability, income, and equity accounts

- journalizing

-

the act of recording bookkeeping entries

- Facilitate

-

To make easy or easier.

- credit

-

an entry in the right hand column of an account; credits increase liability, income, and equity accounts and decrease asset and expense accounts

Example

- Consider our example for the yoga studio. How would we record journal entries for each transaction? Pre-openingPrior to opening the business, you make the following transactions:1. You contribute $4,000 in cash to start the business.Cash 4,000 Contributed capital 4,0002. You purchase $500 worth of mats and other equipment for use during classes.PPE 500 Cash 5003. You purchase an additional $400 worth of mats, equipment, and clothing for sale at the studio.Inventory 400 Cash 4004. You purchase liability insurance at a total cost of $1,200. The policy covers July 1 through December31.Prepaid insurance 1,200 Cash 1,200JulyThe following transactions take place during July.1. You receive cash totaling $800 for classes.Cash 800 Revenue 8002. Your instructor teaches classes for the month. You agree to pay $600 for the classes; $300 is paid on July 15, and $300 will be paid on August 3.Wage expense 600 Cash 300 Wage payable 3003. You pay rent for July of $1,000 on July 1.Rent expense 1,000 Cash 1,0004. You use utilities (electricity and water) totaling $200. This amount is payable on August 15.Utility expense 200 Utility payable 200AugustThe following transactions take place during August.1. You receive $1,500 in cash for classes. Of this amount, $1,000 was for classes in August. The remainder is for 2-month passes allowing unlimited classes in August and September.Cash 1,500 Revenue 1,250 Unearned revenue 2502. Your instructor again earns $600 teaching classes; $300 due on August 16 and $300 on September 1.Wage expense 600 Cash 300 Wage payable 3003. Utilities total $150, payable September 15.Utility expense 150 Utility payable 1504. You pay rent of $1,000 on August 1.Rent expense 1,000 Cash 1,0005. You sell inventory costing $150 for a $225.Cash 225 Revenue 225Cost of goods sold 150 Inventory 150(these can be combined into a single entry if you choose.)6. You are worried about money, so your Uncle Rafael makes you an offer. He agrees to loan you $2,000 in cash. You will need to repay him sometime later, but he doesn’t say when.Cash 2,000 Loan Payable 2,0007. A client is extremely dissatisfied with their class, and demands their money back. Reluctantly, you agree. The class cost $15.Revenue 15 Cash 15or Refund expense 15 Cash 158. After borrowing money, you decide to withdraw some of your investment in the studio to pursue other opportunities. You decide to withdraw $1,000.Contributed capital 1,000 Cash 1,000(this cannot be a dividend, because your balance of retained earnings is negative. )

The General Journal

The general journal is where double entry bookkeeping entries are recorded by debiting one or more accounts and crediting another one or more accounts with the same total amount. The total amount debited and the total amount credited should always be equal, thereby ensuring the accounting equation is maintained.

Depending on the business’s accounting information system, specialized journals may be used in conjunction with the general journal for record-keeping. In such case, use of the general journal may be limited to non-routine and adjusting entries

Special Journals

Special journals are designed to facilitate the process of journalizing and posting transactions. They are used for the most frequent transactions in a business. For example, in merchandising businesses, companies acquire merchandise from vendors and then in turn sell the merchandise to individuals or other businesses. Sales and purchases are the most common transactions for merchandising businesses. A business like a retail store will record the following transactions many times a day for sales on account and cash sales.

Journalizing

Items are entered the general journal or the special journals via journal entries, or journalizing. Journal entries are prepared after examining the source document to see if a business transaction has taken place. If a business transaction has taken place, that is a transaction that causes a measurable change in the accounting equation then a journal entry is necessary . Each journal entry must have a debit and a credit. Journal entries also include the date of the transaction, titles of the accounts debited and credited (credited account is indented several spaces), the amount of each debit and credit; and an explanation of the transaction also known as a Narration.

The company’s income statement

Closing the accounts prepares the ledger for the next accounting period.

Consider our example for the yoga studio. How would we record journal entries for each transaction?

Pre-opening

Prior to opening the business, you make the following transactions:

1. You contribute $4,000 in cash to start the business.

Cash 4,000

Contributed capital 4,000

2. You purchase $500 worth of mats and other equipment for use during classes.

PPE 500

Cash 500

3. You purchase an additional $400 worth of mats, equipment, and clothing for sale at the studio.

Inventory 400

Cash 400

4. You purchase liability insurance at a total cost of $1,200. The policy covers July 1 through December31.

Prepaid insurance 1,200

Cash 1,200

July

The following transactions take place during July.

1. You receive cash totaling $800 for classes.

Cash 800

Revenue 800

2. Your instructor teaches classes for the month. You agree to pay $600 for the classes; $300 is paid on July 15, and $300 will be paid on August 3.

Wage expense 600

Cash 300

Wage payable 300

3. You pay rent for July of $1,000 on July 1.

Rent expense 1,000

Cash 1,000

4. You use utilities (electricity and water) totaling $200. This amount is payable on August 15.

Utility expense 200

Utility payable 200

August

The following transactions take place during August.

1. You receive $1,500 in cash for classes. Of this amount, $1,000 was for classes in August. The remainder is for 2-month passes allowing unlimited classes in August and September.

Cash 1,500

Revenue 1,250

Unearned revenue 250

2. Your instructor again earns $600 teaching classes; $300 due on August 16 and $300 on September 1.

Wage expense 600

Cash 300

Wage payable 300

3. Utilities total $150, payable September 15.

Utility expense 150

Utility payable 150

4. You pay rent of $1,000 on August 1.

Rent expense 1,000

Cash 1,000

5. You sell inventory costing $150 for a $225.

Cash 225

Revenue 225

Cost of goods sold 150

Inventory 150

(these can be combined into a single entry if you choose. )

6. You are worried about money, so your Uncle Rafael makes you an offer. He agrees to loan you $2,000 in cash. You will need to repay him sometime later, but he doesn’t say when.

Cash 2,000

Loan Payable 2,000

7. A client is extremely dissatisfied with their class, and demands their money back. Reluctantly, you agree. The class cost $15.

Revenue 15

Cash 15

or

Refund expense 15

Cash 15

8. After borrowing money, you decide to withdraw some of your investment in the studio to pursue other opportunities. You decide to withdraw $1,000.

Contributed capital 1,000

Cash 1,000

(this cannot be a dividend, because your balance of retained earnings is negative. )

Journal Entry

Journal entries record business transactions so they may later be used to create financial statements.

2.2.4: Posting

Posting is recording in the ledger accounts the information contained in the journal.

Learning Objective

Describe how posting affects the General Journal, Special Journal and General Ledger

Key Points

- Posting is always from the journal to the ledger accounts.

- Postings can be made at the time the transaction is journalized; at the end of the day, week, or month; or as each journal page is filled.

- Cross-indexing is the placing of the account number of the ledger account in the general journal and the general journal page number in the ledger account.

Key Terms

- general journal

-

where double entry bookkeeping entries are recorded by debiting one or more accounts and crediting another one or more accounts with the same total amount

- posting

-

an item inserted into a register, ledger or diary

- ledger

-

A book for keeping notes, especially one for keeping accounting records. (accounting) A collection of accounting entries consisting of credits and debits.

Example

- Continuing with our yoga studio example, posting journalized entires into T-accounts would look something like this:

In accounting, each journal entry is like a set of instructions. Carrying out of these instructions is known as posting, a procedure that takes information recorded via journal entries (or journalizing) in the General or Special Journals and transfers it to the General Ledger. Each individual journal entry directs the input of a certain dollar amount as a debit in a specific ledger account, and directs the input of a certain dollar amount as a credit in a specific ledger account. Posting is always from the journal to the ledger accounts, and can be done two ways: the journal entries can be posted at the time the transaction is journalized; or the posting can be done at a set time like the end of the day, week, or month. Journal entries may also be posted as the journal page is filled if using a manual accounting system as a matter of personal taste. When posting the general journal, the date used in the ledger accounts is the date the transaction was recorded in the journal, not the date the journal entry was posted to the ledger accounts.

The General Ledger

All transactions made by the company in relation to the bond must be recorded in its general ledger. The general ledger contains all entries from both the General Journal and the Special Journals.

Since accountants and bookkeepers often need to trace the origin of a ledger entry, they use cross-indexing. In cross-indexing a notation is made for each entry that indicates which general or special journal account the general ledger entry came from. This practice makes it easy to trace an entry back to the original transaction. The account number appears in the Posting Reference column of the General Journal.

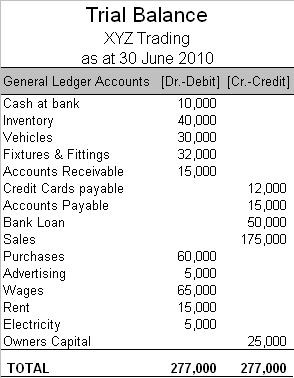

2.2.5: The Trial Balance

A trial balance is run during the accounting cycle to test whether the debits equal the credits.

Learning Objective

Identify when the trial balance is performed and its purpose

Key Points

- A trial balance is prepared after all the journal entries for the period have been recorded.

- The trial balance lists all of the ledger, both general journal and special, accounts and their debit or credit balances.

- A trial balance only checks the sum of debits against the sum of credits. If debits do not equal credits then the accountant or bookkeeper must determine why.

Key Terms

- equality

-

The fact of being equal; of having the same value.

- credit

-

an entry in the right hand column of an account; credits increase liability, income, and equity accounts and decrease asset and expense accounts

- debit

-

an entry in the left hand column of an account to record a debt; debits increase asset and expense accounts and decrease liability, income, and equity accounts

Example

- In the example of Highland Yoga, the pre-opening trial balance would be calculated as follows:1. You contribute $4,000 in cash to start the business.Cash 4,000, Contributed Capital 4,000; Assets(+)=Equity(+)2. You purchase $500 worth of mats and other equipment for use during classes.Cash -500, PPE 500; Assets(+), Assets(-)=03. You purchase an additional $400 worth of mats, equipment, and clothing for sale at the studio.Cash -400, Inventory 400; Assets(+), Assets(-)=04. You purchase liability insurance at a total cost of $1,200. The policy covers July 1 through December 31.Cash -1,200, Prepaid Insurance 1,200; Assets(+), Assets(-)The trial balance for debits will be:4,000 (cash) + 500 (PPE) + 400 (inventory) + 1,200 (prepaid insurance) = 6,100The trial balance for credits will be:4,000 (contributed capital) + 500 (cash) + 400 (cash) + 1,200 (cash) = 6,100The calculation will be the same for the next two periods in the example, including any necessary adjustments.

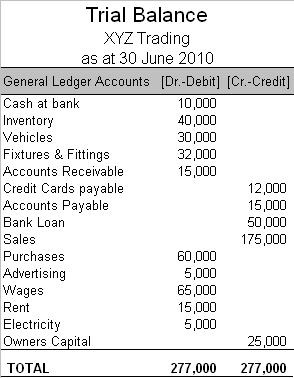

The Trial Balance

During the accounting cycle, a trial balance is prepared. It is usually prepared after all the journal entries for the period have been recorded.

The trial balance tests the equality of a company’s debits and credits. It lists all of the ledger, both general journal and special, accounts and their debit or credit balances to determine that debits equal credits in the recording process .

The Trial Balance

The post-closing trial balance proves debits still equal credits after the closing entries have been made.

The accounts appear in this order: assets, liabilities, stockholders’ equity, dividends, revenues, and expenses. Within the assets category, the most liquid (closest to becoming cash) asset appears first and the least liquid appears last. Within the liabilities, those liabilities with the shortest maturities appear first.

If the total of the debit column does not equal the total value of the credit column then this would show that there is an error in the nominal ledger accounts. This error must be found before a profit and loss statement and balance sheet can be produced.

Preparing the Trial Balance

The trial balance is usually prepared by a bookkeeper or accountant. The bookkeeper/accountant used journals to record business transactions. The journal entries were then posted to the general ledger. The trial balance is a part of the double-entry bookkeeping system and uses the classic ‘T’ account format for presenting values. A trial balance only checks the sum of debits against the sum of credits. If debits do not equal credits then the accountant or bookkeeper must determine why.

In the example of Highland Yoga, the pre-opening trial balance would be calculated as follows:

1. You contribute $4,000 in cash to start the business.

Cash 4,000, Contributed Capital 4,000; Assets(+)=Equity(+)

2. You purchase $500 worth of mats and other equipment for use during classes.

Cash -500, PPE 500; Assets(+), Assets(-)=0

3. You purchase an additional $400 worth of mats, equipment, and clothing for sale at the studio.

Cash -400, Inventory 400; Assets(+), Assets(-)=0

4. You purchase liability insurance at a total cost of $1,200. The policy covers July 1 through December 31.

Cash -1,200, Prepaid Insurance 1,200; Assets(+), Assets(-)

The trial balance for debits will be:

4,000 (cash) + 500 (PPE) + 400 (inventory) + 1,200 (prepaid insurance) = 6,100

The trial balance for credits will be:

4,000 (contributed capital) + 500 (cash) + 400 (cash) + 1,200 (cash) = 6,100

The calculation will be the same for the next two periods in the example, including any necessary adjustments.

Finding Errors in the Trial Balance

Some reasons why the general ledger may be out of balance:

- Failing to post part of a journal entry.

- Posting a debit as a credit, or vice versa.

- Incorrectly determining the balance of an account.

- Recording the balance of an account incorrectly in the trial balance.

- Omitting an account from the trial balance.

- Making a transposition or slide error in the accounts or the journal.

When the error is found, a correcting entry must be made. Then another trial balance is run.

2.2.6: Adjustments

Adjusting entries are journal entries made at the end of an accounting period that allocate income and expenses to their proper period.

Learning Objective

Identify the types of adjusting entries and when and why they are made

Key Points

- The matching principle of accrual accounting demands that revenues and associated costs are recognized in the same accounting period.

- The types of adjusting entries are prepayments, accrual, estimates, and inventory.

- Depreciation is an example of an estimated adjusting entry.

- In a periodic inventory system, an adjusting entry is used to determine the cost of goods sold expense. However, an adjusting entry is not necessary for a company using perpetual inventory.

- Adjusting entries for expenses such as interest, taxes, rent, and salaries are the most common accrual entries.

Key Terms

- revenue

-

Income that a company receives from its normal business activities, usually from the sale of goods and services to customers.

- accrue

-

(intransitive, accounting) To be incurred as a result of the passage of time.The monthly financial statements show all the actual but only some of the accrued expenses.

Example

- Consider our yoga studio example. Some of our previously recognized transactions need to be adjusted in later periods:Julya. Recognize insurance expensePrepaid Insurance -100, Insurance Expense 100; Assets(-)=Equity(-)b. Depreciation @ $20/monthAccumulated Depreciation 20, Depreciation Expense 20; Assets(-)=Equity(-)Augusta. Recognize insurance expensePrepaid Insurance -100, Insurance Expense 100; Assets(-)=Equity(-)b. Depreciation @ $20/monthAccumulated Depreciation 20, Depreciation Expense 20; Assets(-)=Equity(-)c. Pay wages from JulyCash -300, Wage Payable -300; Assets(-), Liabilities(-)d. Pay utilities from JulyCash -200, Utility Payable -200; Assets(-), Liabilities(-) The journal entries to record these transactions would be as follows:Julya. Expiration of insuranceInsurance expense 200 Prepaid insurance 200b. Depreciation on studio equipment (500 for 25 months = 20/month)Depreciation expense 20 Accumulated Depreciation 20Augusta. Expiration of insuranceInsurance expense 200 Prepaid insurance 200b. Depreciation on studio equipment (500 for 25 months = 20/month)Depreciation expense 20 Accumulated Depreciation 20c. Pay wage from JulyWage payable 300 Cash 300d. Pay utility bill from JulyUtility payable 200 Cash 200

What are Adjusting Entries

For accounting purposes, adjusting entries are journal entries made at the end of an accounting period. Adjusting entries allocate income and/or expenses to the period in which they actually occurred . The revenue recognition principle states that income and expenses must match. This is why adjusting entries need to be made under an accrual based accounting system. Based on this, revenues and associated costs are recognized in the same accounting period. However, the actual cash may be received or paid at a different time.

The General Ledger

The General Ledger contains all entries from both the General Journal and the Special Journals.

The Types of Adjusting Entries

There are several different types of adjusting entries. Each one accounts for a different situation.

- Prepayments – adjusting entries for prepayments are necessary to account for cash that has been paid prior to delivery of goods or completion of services. When this cash is paid, it is first recorded in a prepaid expense asset account; the account is to be expensed either with the passage of time (e.g. rent, insurance) or through use and consumption (e.g. supplies). The adjusting entry would credit the asset (e.g. supplies) account and debit a related expense account (e.g. supplies expense)

- Accruals – accrued revenues are revenues that have been recognized (that is, services have been performed or goods have been delivered), but their cash payment have not yet been recorded or received. When the revenue is recognized, it is recorded as a receivable. Accrued expenses have not yet been paid for, so they are recorded in a payable account. Expenses for interest, taxes, rent, and salaries are commonly accrued for reporting purposes.

- Estimates – An adjusting entry for an estimate occurs when the exact amount of an expense cannot easily be determined. For example, the depreciation of fixed assets is an expense that has to be estimated. The entry for bad debt expense can also be classified as an estimate.

- Inventory – in a periodic inventory system, an adjusting entry is used to determine the cost of goods sold expense. This entry is not necessary for a company using perpetual inventory.

Consider our yoga studio example. Some of our previously recognized transactions need to be adjusted in later periods:

July

a. Recognize insurance expense

Prepaid Insurance -100, Insurance Expense 100; Assets(-)=Equity(-)

b. Depreciation @ $20/month

Accumulated Depreciation 20, Depreciation Expense 20; Assets(-)=Equity(-)

August

a. Recognize insurance expense

Prepaid Insurance -100, Insurance Expense 100; Assets(-)=Equity(-)

b. Depreciation @ $20/month

Accumulated Depreciation 20, Depreciation Expense 20; Assets(-)=Equity(-)

c. Pay wages from July

Cash -300, Wage Payable -300; Assets(-), Liabilities(-)

d. Pay utilities from July

Cash -200, Utility Payable -200; Assets(-), Liabilities(-)

The journal entries to record these transactions would be as follows:

July

a. Expiration of insurance

Insurance expense……………………………….200

—–Prepaid insurance……………………………………200

b. Depreciation on studio equipment (500 for 25 months = 20/month)

Depreciation expense……………………………20

—–Accumulated Depreciation……………………………20

August

a. Expiration of insurance

Insurance expense……………………………200

—–Prepaid insurance ……………………………200

b. Depreciation on studio equipment (500 for 25 months = 20/month)

Depreciation expense……………………………20

—–Accumulated Depreciation……………………20

c. Pay wage from July

Wage payable……………………………300

—–Cash…………………………………………300

d. Pay utility bill from July

Utility payable……………………………200

—–Cash………………………………………….200

2.2.7: Preparing Financial Statements

Preparing financial statements requires preparing an adjusted trial balance, translating it into financial reports, and auditing them.

Learning Objective

Explain the necessary steps to take before preparing the financial statements and the purpose of the statements

Key Points

- The purpose of financial statements are to provide both business insiders and outsiders a concise, clear picture of the current financial status in the business. Therefore, the people who use the statements must be confident in its accuracy.

- Closing the books is simply a matter of ensuring that transactions that take place after the business’s financial period are not included in the financial statements.

- Adjusting entries are generally made in relation to prepaid expenses, prepayments, accruals, estimates and inventory.

- When an audit is completed, the auditor will issue a report regarding whether the statements are accurate. To ensure a positive reports, some companies try to participate in opinion shopping. This practice is generally prohibited..

Key Terms

- audit

-

An independent review and examination of records and activities to assess the adequacy of system controls, to ensure compliance with established policies and operational procedures, and to recommend necessary changes in controls, policies, or procedures

- adjusting entry

-

Journal entries usually made at the end of an accounting period to allocate income and expenditure to the period in which they actually occurred.

- opinion shopping

-

The process of contracting or rejecting auditors based on the type of opinion report they will issue on the auditee.

Example

- Financial statements for Highland Yoga for each period would appear as follows:

Preparing Financial Statements

When a business enterprise presents all the relevant financial information in a structured and easy to understand manner, it is called a financial statement. The purpose of financial statements are to provide both business insiders and outsiders a concise, clear picture of the current financial status in the business. Therefore, the people who use the statements must be confident in its accuracy.

Adjusted Trial Balance – Closing the Books

The process of preparing the financial statements begins with the adjusted trial balance. Preparing the adjusted trial balance requires “closing” the book and making the necessary adjusting entries to align the financial records with the true financial activity of the business.

Closing the books is simply a matter of ensuring that transactions that take place after the business’s financial period are not included in the financial statements. For example, assume a business is preparing its financial statements with a December 31st year end. It acquires some property on January 14th. If the books are properly closed, that property will not be included on the balance sheet that is being prepared for the period on December 31st.

Adjusted Trial Balance – Adjusting Entries

An adjusting entry is a journal entry made at the end of an accounting period that allocates income and expenditure to the appropriate years. Adjusting entries are generally made in relation to prepaid expenses, prepayments, accruals, estimates and inventory. Throughout the year, a business may spend funds or make assumptions that might not be accurate regarding the use of a good or service during the accounting period. Adjusting entries allow the company to go back and adjust those balances to reflect the actual financial activity during the accounting period. Failure to record the adjusting entries can result in understatement of expenses and overstatement of income, which ultimately can affect the amount of taxes paid.

For example, assume a company purchases 100 units of raw material that it expects to use up during the current accounting period. As a result, it immediately expenses the cost of the material. However, at the end of the year the company discovers it only used 50 units. The company must then make an adjusting entry to reflect that, and decrease the amount of the expense and increase the amount of inventory accordingly.

Translate the Adjusted Trial Balance to Financial Statements

Using the trial balance, the company then prepares the four financial statements. These statements are:

- The Balance Sheet: A summary of the company’s assets, liabilities and equity;

- The Income Statement: A summary of the business’s income, expenses, and profits

- The Statement of Cash Flows: A report on a company’s cash flow activities, particularly its operating, investing and financing activities; and

- The Statement of Changes in Equity: A report that explains the changes of the company’s equity throughout the reporting period

Information flows from the unadjusted trial balance to the trial balance then to the income statement.

The company may also provide Notes to the Financial Statements, which are disclosures regarding key details about the company’s operations that may not be evident from the financial statements.

Wachovia National Bank 1906 financial statement

Audit the Financial Statements

Once the company prepares its financial statements, it will contract an outside third party to audit it. An audit is an independent review and examination of records and activities to assess the adequacy of system controls, to ensure compliance with established policies and operational procedures, and to recommend necessary changes in controls, policies, or procedures. It is the audit that assures outside investors and interested parties that the content of the statements are correct.

When an audit is completed, the auditor will issue a report with the findings. The findings can state anything from the statements are accurate to statements are misleading. To ensure a positive reports, some companies try to participate in opinion shopping. This is the process that businesses use to ensure it gets a positive review. Since Enron and the accounting scandals of the early 2000s, this practice has been prohibited.

2.2.8: Closing the Cycle

Transferring information from temporary accounts to permanent accounts is referred to as closing the books.

Learning Objective

Identify the steps in the closing process

Key Points

- Closing may be performed monthly or annually.

- There are four basic steps to closing the books.

- Closing the revenue accounts—transferring the balances in the revenue accounts to a clearing account called Income Summary.

- Closing the expense accounts—transferring the balances in the expense accounts to a clearing account called Income Summary.

- Closing the Income Summary account—transferring the balance of the Income Summary account to the Retained Earnings account (also known as the capital account).

- Closing the Dividends account—transferring the balance of the Dividends account to the Retained Earnings Account.

Key Terms

- temporary account

-

an account that is closed at the end of the period to be made a permanent account

- revenue

-

Income that a company receives from its normal business activities, usually from the sale of goods and services to customers.

- account

-

A registry of pecuniary transactions; a written or printed statement of business dealings or debts and credits, and also of other things subjected to a reckoning or review

Example

- Closing entries for our yoga studio example would be:

Closing the Accounting Cycle

The process of closing the temporary accounts is often referred to as closing the books. Accountants may perform the closing process monthly or annually. Only revenue, expense, and dividend accounts are closed—not asset, liability, Capital Stock, or Retained Earnings accounts. If the accounts are not closed correctly the beginning balances for the next month may be incorrect.

The Steps to Close the Accounts

There are four basic steps in the closing process:

- Closing the revenue accounts—transferring the balances in the revenue accounts to a clearing account called Income Summary.

- Closing the expense accounts—transferring the balances in the expense accounts to a clearing account called Income Summary.

- Closing the Income Summary account—transferring the balance of the Income Summary account to the Retained Earnings account (also known as the capital account).

- Closing the Dividends account—transferring the balance of the Dividends account to the Retained Earnings Account

The Income Summary account is a clearing account only used at the end of an accounting period to summarize revenues and expenses for the period. After transferring all revenue and expense account balances to Income Summary, the balance in the Income Summary account represents the net income or net loss for the period. Closing or transferring the balance in the Income Summary account to the Retained Earnings account results in a zero balance in the Income Summary. The Dividends account is also closed at the end of the accounting period. It contains the dividends declared by the board of directors to the stockholders. The dividends account is closed directly to the Retained Earnings account. It is not closed to the Income Summary because dividends have no effect on income or loss for the period.

2.2.9: The Post-Closing Trial Balance

A post-closing trial balance is a trial balance taken after the closing entries have been posted.

Learning Objective

Explain the post-closing trial balance and why it is necessary

Key Points

- A post-closing trial balance checks the accuracy of the closing process.

- A post-closing trial balance proves that the books are in balance at the start of the new accounting period.

- The post-closing trial balance differs from the adjusted trial balance.

Key Terms

- adjusted trial balance

-

a list of all the General ledger accounts (both revenue and capital) contained in the ledger of a business after adjusting entries are made

- trial balance

-

a statement of the balances of all nominal accounts in a double-entry ledger, made to test their equality

- credit

-

an entry in the right hand column of an account; credits increase liability, income, and equity accounts and decrease asset and expense accounts

- closing entry

-

a journal entry made at the end of an accounting period to transfer temporary accounts to permanent accounts

- debit

-

an entry in the left hand column of an account to record a debt; debits increase asset and expense accounts and decrease liability, income, and equity accounts

- post-closing trial balance

-

a check that closing entries were done correctly

The Post-closing Trial Balance

The post-closing trial balance is the last step in the accounting cycle. It is prepared after all of that period’s business transactions have been posted to the General Ledger via journal entries. The post-closing trial balance can only be prepared after each closing entry has been posted to the General Ledger. The purpose of closing entries is to transfer the balances of the temporary accounts (expenses, revenues, gains, etc.) to the retained earnings account. After the closing entries are posted, these temporary accounts will have a zero balance. The permanent balance sheet accounts will appear on the post-closing trial balance with their balances. When the post-closing trial balance is run, the zero balance temporary accounts will not appear. However, all the other accounts having non-negative balances are listed, including the retained earnings account. As with the trial balance, the purpose of the post-closing trial balance is to ensure that debits equal credits.

The Trial Balance

The post-closing trial balance proves debits still equal credits after the closing entries have been made.

Why the Post-Closing Trial Balance Is Necessary