12.1: Understanding the Corporation

12.1.1: Characteristics of a Corporation

Corporations are separate legal entities with a wide variety of legal, organizational, and operational characteristics.

Learning Objective

Recognize the various facets of organizational requirements and characteristics

Key Points

- Organizations are legally recognized individual entities operating within the legal confines of a given economy.

- Organizations can be privately held or publicly traded, as well as for profit or nonprofit. Organizations have liabilities, profits, taxes, and other legal reporting requirements.

- Ownership of an organization is generally determined via holding a certain percentage of existing corporate shares.

- A board of directors is often elected to oversee the organization’s practices and operations and to act as a voice for shareholders.

- The incorporation process has a number of steps that individuals must take in order to legally create a new organization.

Key Term

- insolvency

-

When debts exceed existing assets (i.e. the ability to pay them).

Defining the Corporation

A corporation is legally recognized as a person and singular legal entity within the confines of the law, independent of any specific individual who may have started it. Corporations are started and maintained through legal registration and periodic upkeep, and have tax reporting responsibilities within the region in which they are registered.

Organizations can be publicly traded (and thus publicly owned) or privately held, as well as for profit or non profit. In the United States, a corporation is generally considered a larger business organization, though non-profits can still be similarly registered. Generally speaking, corporations interact with the broader economy through operations, profits, and taxes.

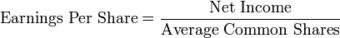

U.S. Corporate Profits

This chart illustrates the overall corporate profit over time in the U.S.

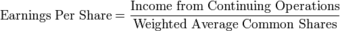

Corporate Tax Rate of Time (U.S.)

This chart illustrates the effective corporate tax rate in the U.S. over time.

Ownership

Corporations are, in theory, owned and controlled by members and shareholders. To simplify this logic a bit, if a company is owned equally by 5 different people, then each individual owns 20% of the value of the overall organization. As a result, ownership has a significant capital component. Organizations such as credit unions and cooperatives function in a slightly different manner, where each additional member of the project may own equal shares regardless of capital inputs.

While larger, publicly traded organizations may be owned by hundreds of thousands of shareholders, it is common practice for members to elect a board of directors to oversee the actual running of the organization (two boards are elected in some countries: a managerial board and a supervisory board). The respective boards will oversee typical operations of the firm, and ensure that the best interests of the community and the owners are being upheld.

Liabilities

Organizations are held accountable for their actions, just as individuals would be. As a result, organizations can be brought to court on various charges and convicted of criminal offenses. Organizations can also be dissolved for a wide variety of reasons including insolvency, bankruptcy, monopoly, and a wide variety of other failures to operate profitably and/or ethically.

The individuals within an organization, granted it is a limited liability organization, are somewhat insulated from the broader failings of the organization. This means that debts being taken out on behalf of the organization are not the liability of the individuals working there, but instead a liability of the legal entity that is called the corporation.

How to Incorporate

It’s worth noting what is traditionally required of an organization to become a corporation. In the United States, each state is different, but the following are common denominators:

- Business purpose (general and, sometimes, specific)

- Corporate name

- Registered agent

- Incorporator

- Share par value

- Number of authorized shares of stock

- Directors

- Preferred shares

- Officers

12.1.2: Formation of the Corporation

Registration is the main prerequisite to a corporation’s assumption of limited liability.

Learning Objective

Summarize the purpose of the articles of incorporation

Key Points

- Generally, a corporation files articles of incorporation with the government, laying out the general nature of the corporation, the amount of stock it is authorized to issue, and the names and addresses of directors.

- Nowadays, corporations in most jurisdictions have a distinct name that does not need to make reference to their membership.

- Some jurisdictions do not allow the use of the word “company” alone to denote corporate status, as it may refer to a partnership or some other form of collective ownership.

- In many jurisdictions, corporations whose shareholders benefit from limited liability are required to publish annual financial statements and other data, so that creditors who do business with the corporation are able to assess the creditworthiness of the corporation.

Key Terms

- privately held corporation

-

a business entity owned by a small number of people, and not having shares of ownership sold via a stock exchange or other public market

- publicly held corporation

-

a business entity owned by shareholders who may buy or sell their shares to anyone through a stock exchange

- corporation

-

A group of individuals, created by law or under authority of law, having a continuous existence independent of the existences of its members, and powers and liabilities distinct from those of its members.

- charter

-

A document issued by some authority, creating a public or private institution, and defining its purposes and privileges.

- limited liability

-

The liability of an owner or a partner of a company for no more capital than they have invested.

Formation

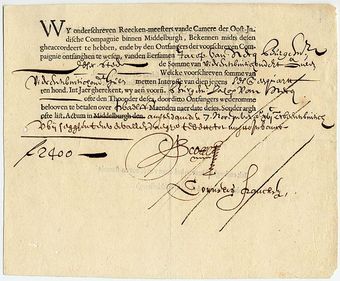

Historically, corporations were created by a charter granted by government . Today, corporations are usually registered with the state, province, or national government, and regulated by the laws enacted by that government.

Charter of Harvard College

In 1636, New England ministers founded Harvard College, America’s first institution of higher education.

Registration is the main prerequisite to a corporation’s assumption of limited liability. The law sometimes requires the corporation to designate its principal address, as well as a registered agent (a person or company designated to receive legal service of process). It may also be required to designate an agent or other legal representative of the corporation.

Generally, a corporation files articles of incorporation with the government, laying out the general nature of the corporation, the amount of stock it is authorized to issue, and the names and addresses of directors. Once the articles are approved, the corporation’s directors meet to create bylaws that govern the internal functions of the corporation, such as meeting procedures and officer positions.

The law of the jurisdiction in which a corporation operates will regulate most of its internal activities, as well as its finances. If a corporation operates outside its home state, it is often required to register with other governments as a foreign corporation, and is almost always subject to the laws of its host state pertaining to employment, crimes, contracts, civil actions, and the like.

Naming

Corporations generally have a distinct name. Historically, some corporations were named after their membership: for instance, “The President and Fellows of Harvard College. ” Nowadays, corporations in most jurisdictions have a distinct name that does not need to make reference to their membership. In Canada, this possibility is taken to its logical extreme: many smaller Canadian corporations have no names at all, merely numbers based on a registration number (for example, “12345678 Ontario Limited”), which is assigned by the provincial or territorial government where the corporation incorporates.

In most countries, corporate names include a term or an abbreviation that denotes the corporate status of the entity (for example, “Incorporated” or “Inc.” in the United States) or the limited liability of its members (for example, “Limited” or “Ltd.”). These terms vary by jurisdiction and language. In some jurisdictions they are mandatory, and in others they are not. Their use puts everybody on constructive notice that they are dealing with an entity whose liability is limited, and does not reach back to the persons who own the entity: one can only collect from whatever assets the entity still controls when one obtains a judgment against it.

Some jurisdictions do not allow the use of the word “company” alone to denote corporate status, as it may refer to a partnership or some other form of collective ownership (in the United States it can be used by a sole proprietorship but this is not generally the case elsewhere).

Financial disclosure

In many jurisdictions, corporations whose shareholders benefit from limited liability are required to publish annual financial statements and other data, so that creditors who do business with the corporation are able to assess the creditworthiness of the corporation and cannot enforce claims against shareholders. Shareholders, therefore, experience some loss of privacy in return for limited liability. This requirement generally applies in Europe, but not in Anglo-American jurisdictions, except for publicly traded corporations where financial disclosure is required for investor protection.

Steps required for incorporation

- The articles of incorporation (also called a charter, certificate of incorporation or letters patent) are filed with the appropriate state office, listing the purpose of the corporation, its principal place of business and the number and type of shares of stock. A registration fee is due, which is usually between $25 and $1,000, depending on the state.

- A corporate name is generally made up of three parts: “distinctive element”, “descriptive element”, and a “legal ending”. All corporations must have a distinctive element, and in most filing jurisdictions, a legal ending to their names. Some corporations choose not to have a descriptive element. In the name “Tiger Computers, Inc.”, the word “Tiger” is the distinctive element; the word “Computers” is the descriptive element; and the “Inc.” is the legal ending. The legal ending indicates that it is, in fact, a legal corporation and not just a business registration or partnership. Incorporated, limited, and corporation, or their respective abbreviations (Inc., Ltd., Corp. ) are the possible legal endings in the U.S.

- Usually, there are also corporate bylaws which must be filed with the state. Bylaws outline a number of important administrative details such as when annual shareholder meetings will be held, who can vote and the manner in which shareholders will be notified if there is need for an additional “special” meeting.

12.2: Stock Transactions

12.2.1: Issuing Stock

The amount of issued stock is based on a company’s authorized shares, or the maximum number of shares authorized for issue to shareholders.

Learning Objective

Differentiate between common and preferred stock

Key Points

- Issued shares are the sum of outstanding shares and treasury stock, or stock reacquired by the company. Most public companies issue two major types of shares: common and preferred.

- Common shareholders may possess “voting” shares and have the ability to influence company decisions through their vote. Owning common stock tends to be riskier than owning preferred stock.

- Preferred stock is considered a hybrid financial instrument because the shares have properties of both equity and debt.

- When reporting common or preferred stock in stockholder’s equity, the value of shares is divided between the stock’s par, or stated, value, and the amount in excess of par is recorded to additional paid in capital.

Key Terms

- creditor

-

A person to whom a debt is owed.

- capital

-

Money and wealth. The means to acquire goods and services, especially in a non-barter system.

- authorized stock

-

shares created by the company

- liquidation

-

The selling of the assets of a business as part of the process of dissolving it.

Issuing Company Stock

The process of issuing stock– or shares– of a publicly traded company involves several steps. The amount of issued stock is dependent on the authorized capital of a company, or the maximum number of shares authorized by a company’s corporate documents to issue to shareholders. A portion of authorized capital tends to remain unissued, but the number can be changed by shareholder approval. When shares are issued, they are transferred to a subscriber, an action referred to as an allotment. After the allotment, a subscriber becomes a shareholder. Issued shares are the sum of outstanding shares and treasury stock, or stock reacquired by the company. Most public companies issue two major types of shares: common and preferred.

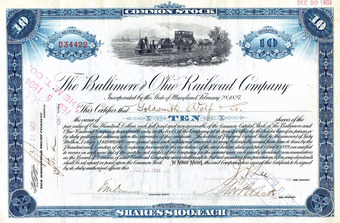

General Motors Common Stock Certificate

Public companies issue common stock to raise business capital.

Common Stock

Shares of common stock are primarily issued in the United States. Common shareholders may possess “voting” shares and have the ability to influence company decisions through their vote. Owning common stock tends to be riskier than owning preferred stock; yet over time, common shares on average perform better than preferred shares or bonds. The greater amount of risk is due to the fact that shares receive dividends only after preferred shareholders are paid and, in the event of a business liquidation, common stock shareholders are paid last, after creditors and preferred shareholders.

Preferred Stock

Preferred stock is considered a hybrid financial instrument because the shares have properties of both equity and debt. Preferred shares tend to pay dividends to shareholders, which can accumulate from one period to the next, and have priority over common shareholders when dividends are paid or assets liquidated. Similar to bonds, preferred shares are rated by credit-rating companies and are also callable by the company. Some other features associated with preferred stock include convertibility to common stock, non-voting rights, and the potential of shares to be either cumulative or non-cumulative of company dividends.

Stock Issuance and Stockholder’s Equity

Both common and preferred stock issued are reported in the stockholder’s equity section of the balance sheet. Each share type is reported at market value at the time the shares are purchased by investors, which is also the point in time when shares become outstanding. This value is divided between the stock’s par, or stated value and additional paid in capital.

12.2.2: Employee Stock Compensation

An employee stock option (ESO) is a call (buy) option on a firm’s common stock, granted to an employee as part of his compensation.

Learning Objective

Explain how employee stock options work and how a company would record their issue

Key Points

- Options, as their name implies, do not have to be exercised. The holder of the option should ideally exercise it when the stock’s market price rises higher than the option’s exercise price. When this occurs, the option holder profits by acquiring the company stock at a below market price.

- An ESO has features that are unlike exchange-traded options, such as a non-standardized exercise price and quantity of shares, a vesting period for the employee, and the required realization of performance goals.

- An option’s fair value at the grant date should be estimated using an option pricing model, such as the Black–Scholes model or a binomial model. A periodic compensation expense is reported on the income statement and also in additional paid in capital account in the stockholder’s equity section.

Key Terms

- exercise price

-

The fixed price at which the owner of an option can purchase (in the case of a call) or sell (in the case of a put) the underlying security or commodity.

- remuneration

-

A payment for work done; wages, salary, emolument.

- vesting period

-

A period of time an investor or other person holding a right to something must wait until they are capable of fully exercising their rights and until those rights may not be taken away.

Example

- A company offers stock options due in three years. The stock options have a total value of $150,000, and is for 50,000 shares of stock at a purchase price of $10. The stock’s par value is $1. The journal entry to expense the options each period would be: Compensation Expense $50,000 Additional Paid-In Capital, Stock Options $50,000. This expense would be repeated for each period during the option plan. When the options are exercised, the firm will receive cash of $500,000 (50,000 shares at $10). Paid-In capital will have to be reduced by the amount credited over the three year period. Common stock will increase by $50,000 (50,000 shares at $1 par value). And paid-in capital in excess of par must be credited to balance out the transaction. The journal entry would be:Cash $500,000 Additional Paid-In Capital, Stock Options $150,000 Common Stock $50,000 Additional Paid-In Capital, Excess of Par $600,000

Definition of Employee Stock Options

An employee stock option (ESO) is a call (buy) option on the common stock of a company, granted by the company to an employee as part of the employee’s remuneration package. The objective is to give employees an incentive to behave in ways that will boost the company’s stock price. ESOs are mostly offered to management as part of their executive compensation package. They may also be offered to non-executive level staff, especially by businesses that are not yet profitable and have few other means of compensation. Options, as their name implies, do not have to be exercised. The holder of the option should ideally exercise it when the stock’s market price rises higher than the option’s exercise price. When this occurs, the option holder profits by acquiring the company stock at a below market price .

General Foods Common Stock Certificate

Publicly traded companies may offer stock options to their employees as part of their compensation.

Features of ESOs

ESOs have several different features that distinguish them from exchange-traded call options:

- There is no standardized exercise price and it is usually the current price of the company stock at the time of issue. Sometimes a formula is used, such as the average price for the next 60 days after the grant date. An employee may have stock options that can be exercised at different times of the year and for different exercise prices.

- The quantity of shares offered by ESOs is also non-standardized and can vary.

- A vesting period usually needs to be met before options can be sold or transferred (e.g., 20% of the options vest each year for five years).

- Performance or profit goals may need to be met before an employee exercises her options.

- Expiration date is usually a maximum of 10 years from date of issue.

- ESOs are generally not transferable and must either be exercised or allowed to expire worthless on expiration day. This should encourage the holder to sell her options early if it is profitable to do so, since there’s substantial risk that ESOs, almost 50%, reach their expiration date with a worthless value.

- Since ESOs are considered a private contract between an employer and his employee, issues such as corporate credit risk, the arrangement of the clearing, and settlement of the transactions should be addressed. An employee may have limited recourse if the company can’t deliver the stock upon the exercise of the option.

- ESOs tend to have tax advantages not available to their exchange-traded counterparts.

Accounting and Valuation of ESOs

Employee stock options have to be expensed under US GAAP in the US. As of 2006, the International Accounting Standards Board (IASB) and the Financial Accounting Standards Board (FASB) agree that an option’s fair value at the grant date should be estimated using an option pricing model. The majority of public and private companies apply the Black–Scholes model. However, through September 2006, over 350 companies have publicly disclosed the use of a binomial model in Securities and Exchange Commission (SEC) filings. Three criteria must be met when selecting a valuation model:

- The model is applied in a manner consistent with the fair value measurement objective and other requirements of FAS123R;

- is based on established financial economic theory and generally applied in the field;

- and reflects all substantive characteristics of the instrument (i.e. assumptions on volatility, interest rate, dividend yield, etc.).

A periodic compensation expense is recorded for the value of the option divided by the employee’s vesting period. The compensation expense is debited and reported on the income statement. It is also credited to an additional paid-in capital account in the equity section of the balance sheet.

12.2.3: Repurchasing Stock

A stock repurchase is the reacquisition by a company of its own stock for the purpose of retirement or re-issuance.

Learning Objective

Explain why a company would repurchase their stock and how they would record it on their financial statements

Key Points

- Shares kept for the purpose of re-issuance are referred to as treasury stock.

- Buying back shares reduces the number of shares a company has outstanding without altering earnings. This can improve a company’s price/earnings ratio and earnings per share.

- In an inefficient market that has underpriced a company’s stock, a repurchase of shares can benefit current shareholders by providing support to the stock price. If the stock is overpriced, the opposite is true.

- On the balance sheet, treasury stock is listed under shareholders’ equity as a negative number. The accounts may be called “Treasury stock” or “equity reduction”.

Key Terms

- Earnings Per Share

-

The amount of earnings per each outstanding share of a company’s stock.

- price earnings ratio

-

The market price of that share divided by the annual earnings per share.

- treasury stock

-

A treasury or “reacquired” stock is one which is bought back by the issuing company, reducing the amount of outstanding stock on the open market (“open market” including insiders’ holdings).

Reasons to Repurchase Stock

The reasons to repurchase stock can vary from company to company. Reasons can include: (1) to cancel and retire the stock; (2) to reissue the stock later at a higher price; (3) to reduce the number of shares outstanding and increase earnings per share (EPS); or (4) to issue the stock to employees. The company either retires the repurchased shares or keeps them as treasury stock, available for re-issuance. If the intent of stock reacquisition is cancellation and retirement, the treasury shares exist only until they are retired and cancelled by a formal reduction of corporate capital. For accounting purposes, treasury shares are included in calculations to determine legal capital, but are excluded from calculations for EPS amounts.

.

Wall Street circa 1910

Public companies sometimes repurchase their own stock. The reacquired stock is referred to as treasury stock.

Benefits to Repurchasing Stock

Stock repurchases are often used as a tax-efficient method to put cash into shareholders’ hands, rather than paying dividends. Sometimes, companies do this when they feel that their stock is undervalued on the open market. Another motive for stock repurchase is to protect the company against a takeover threat.

In an efficient market, the net effect of a stock repurchase does not change the value of each share. For example, if the market fairly prices a company’s shares at $50 a share, and the company buys back 100 shares for $5,000, it now has $5,000 less cash but there are also 100 fewer shares outstanding. So, the net effect of the repurchase would be zero. Buying back shares can improve a company’s price earnings ratio due to the reduced number of shares (and unchanged earnings). It can improve EPS due to the fewer number of shares outstanding as well as unchanged earnings. In an inefficient market that has underpriced a company’s stock, a repurchase of shares can benefit current shareholders by providing support to the stock price. If the stock is overpriced, the opposite is true.

Accounting for Repurchased Shares

On the balance sheet, treasury stock is listed under shareholders’ equity as a negative number. The accounts may be called “Treasury stock” or “equity reduction”.

One way of accounting for treasury stock is with the cost method. In this method, the paid-in capital account is reduced in the balance sheet when the treasury stock is bought. When the treasury stock is sold back on the open market, the paid-in capital is either debited or credited if it is sold for more or less than the initial cost respectively.

Another common way for accounting for treasury stock is the par value method. In the par value method, when the stock is purchased back from the market, the books will reflect the action as a retirement of the shares. Therefore, common stock is debited and treasury stock is credited. However, when the treasury stock is resold back to the market, the entry in the books will be the same as the cost method.

In either method, any transaction involving treasury stock cannot increase the amount of retained earnings. If the treasury stock is sold for more than cost, then the paid-in capital treasury stock is the account that is increased, not retained earnings. In auditing financial statements, it is a common practice to check for this error to detect possible attempts to “cook the books. “

Example

Consider a company that repurchases 15,000 shares of its $1 par value stock for $25 per share. In this transaction:

- Treasury stock is debited $375,000

- Cash is credited $375,000

The firm then resells 7,500 shares of treasury stock for $28. In this transaction:

- Cash is debited $210,000

- Treasure Stock is credited $187,500

- Additional Paid-In Capital is credited $22,500

If the remaining 7,500 shares of stock are resold for less than the original $25 purchase price, and if the adjustment to treasury stock minus the proceeds from the sale is more than the balance of additional paid-in capital, an adjustment to retained earnings must be made. Consider the shares are sold for $21. The accounting for the transaction would be:

- Cash is debited $157,500

- Additional Paid-In Capital is debited $22,500

- Retained Earnings debited $7,500

- Treasury Stock is credited $187,500

12.2.4: Treasury Stock

Treasury stock is a company’s issued and reacquired capital stock; the stock has not been retired and is legally available for reissuance.

Learning Objective

Distinguish between the cost method and the par value method of recording treasury stock

Key Points

- Treasury stock can be accounted for using the cost or par value methods.

- Using the cost method, a treasury stock account is debited in the equity section of the balance sheet for the stock purchase price and cash is credited.

- When using the par value method, the company’s reacquisition of its own stock is treated as a retirement of the shares reacquired; treasury stock is debited for the par value of the stock and paid-in capital is debited or credited by the difference between the par value and repurchase price.

Key Terms

- paid-in capital

-

refers to capital contributed to a corporation by investors through purchase of stock from the corporation (primary market) (not through purchase of stock in the open market from other stockholders (secondary market)

- preemptive right

-

The right of shareholders to maintain a constant percentage of a company’s shares by receiving a proportionate fraction of any new shares issued, thus preempting any dilution

Treasury Stock

Definition of Treasury Stock

Treasury stock is the corporation’s own capital stock it has issued and then reacquired. Because this stock has not been canceled, it is legally available for reissuance and cannot be classified as unissued stock. When a corporation has additional authorized shares of stock that are to be issued after the date of original issue, in most states the preemptive right requires offering these additional shares first to existing stockholders on a pro rata basis. However, firms may reissue treasury stock without violating the preemptive right provisions of state laws; that is, treasury stock does not have to be offered to current stockholders on a pro rata basis. Treasury stock can be accounted for using the cost or par value methods.

Gerber Products Common Stock Certificate

Companies that issue common stock and reacquire it in the future, reclassify it as treasury stock.

Cost Method

Using the cost method, a treasury stock account is increased (debited) in the equity section of the balance sheet for the stock purchase price and cash is reduced (credited). The treasury stock amount is subtracted from the other stockholders’ equity amount, therefore it is considered a contra account. When the treasury stock is sold back on the open market, the treasury stock account is reduced (credited) for the original cost and the difference between original cost and sales price is debited or credited to a treasury stock paid in capital account, which is also disclosed in the equity section of the balance sheet. Cash is debited for the proceeds of the sale.

Par Value Method

When using the par value method, the company’s reacquisition of its own stock is treated as a retirement of the shares reacquired. On the purchase date, treasury stock is increased (debited) for the par value of stock reacquired and paid in capital is reduced (debited) or increased (credited) by the amount of the purchase price in excess of par. Cash is also credited for the purchase price. When the stock is resold, treasury stock is credited for the par value of the stock sold. Differences between the sales price and repurchase price are debited or credited to paid in capital, along with a debit to cash for proceeds from the sale.

12.3: Rules and Rights of Common and Preferred Stock

12.3.1: Claim to Income

In the cases of bankruptcy and dividend distribution, preferred stock shareholders will receive assets before common stock shareholders.

Learning Objective

Describe the rights preferred stock has to a company’s income

Key Points

- Common stock and preferred stock are both forms of equity ownership but carry different rights and claims to income.

- Preferred stock shareholders will have claim to assets over common stock shareholders in the case of company liquidation.

- Preferred stock also has first right to dividends.

Key Terms

- Common stock

-

Common stock is a form of equity and type of security. Common stock shareholders are at the bottom of the line when it comes to dividends and receiving compensation in the case of bankruptcy.

- Preferred Stock

-

Preferred stock is an equity security that has the properties of both an equity and debt instrument and is higher ranking than common stock.

Preferred and common stock have varying claims to income which will change from one equity issuer to another. In general, preferred stock will be given some preference in assets to common assets in the case of company liquidation, but both will fall behind bondholders when asset distribution takes place. In the event of bankruptcy, common stock investors receive any remaining funds after bondholders, creditors (including employees), and preferred stock holders are paid. As such, these investors often receive nothing after a bankruptcy. Preferred stock also has the first right to receive dividends. In general, common stock shareholders will not receive dividends until it is paid out to preferred shareholders. Access to dividends and other rights vary from firm to firm.

1903 stock certificate of the Baltimore and Ohio Railroad

Preferred and common stock both carry rights of ownership, but represent different classes of equity ownership.

Preferred stock may or may not have a fixed liquidation value (or par value) associated with it. This represents the amount of capital that was contributed to the corporation when the shares were first issued. Preferred stock has a claim on liquidation proceeds of a stock corporation equal to its par (or liquidation) value, unless otherwise negotiated. This claim is senior to that of common stock, which has only a residual claim.

Both types of stock can have a claim to income in the form of capital appreciation as well. As company value increases based on market determinants, the value of equity held in this company also will increase. This translates to a return on investment to shareholders. This will be different to common stock shareholders and preferred stock shareholders because of the different prices and rewards based on holding these different kinds of shares. In turn, should market forces decrease, the value of equity held will decrease as well, reflecting a loss on investment and, therefore, a decrease on the value of any claims to income for shareholders.

12.3.2: Voting Right

Common stock generally carries voting rights, while preferred stock does not; however, this will vary from company to company.

Learning Objective

Summarize the voting rights associated with common and preferred stock

Key Points

- Common stock shareholders can generally vote on issues, such as members of the board of directors, stock splits, and the establishment of corporate objectives and policy.

- While having superior rights to dividends and assets over common stock, generally preferred stock does not carry voting rights.

- Many of the voting rights of a shareholder can be exercised at annual general body meetings of companies. An annual general meeting is a meeting that official bodies, and associations involving the general public, are often required by law to hold.

Key Terms

- Voting rights

-

Rights which are generally associated with common stock shareholders in regards to business entity matters ( such as electing the board of directors or establishing corporate policy)

- Preferred Stock

-

Preferred stock is an equity security that has the properties of both an equity and debt instrument and is higher ranking than common stock.

- Common stock

-

Common stock is a form of equity and type of security. Common stock shareholders are at the bottom of the line when it comes to dividends and receiving compensation in the case of bankruptcy.

Voting Rights

Common stock can also be referred to as a “voting share. ” Common stock usually carries with it the right to vote on business entity matters, such as electing the board of directors, establishing corporate objectives and policy, and stock splits. However, common stock can be broken into voting and non-voting classes. While having superior rights to dividends and assets over common stock, generally preferred stock does not carry voting rights.

The matters that a stockholder gets to vote on vary from company to company. In many cases, the shareholder will be able to vote for members of a company board of directors and, in general, each share gets a vote as opposed to each shareholder. Therefore, a single investor who owns 300 shares will have more say in a voting matter than a single shareholder that owns 30.

Exercising Voting Rights

Many of the voting rights of a shareholder can be exercised at annual general body meetings of companies. An annual general meeting is a meeting that official bodies and associations involving the general public (including companies with shareholders) are often required by law (or the constitution, charter, by-laws, etc., governing the body) to hold. An AGM is held every year to elect the board of directors and inform their members of previous and future activities. It is an opportunity for the shareholders and partners to receive copies of the company’s accounts, as well as reviewing fiscal information for the past year and asking any questions regarding the directions the business will take in the future. Shareholders also have the option to mail their votes in if they cannot attend the shareholder meetings. In 2007, the Securities and Exchange Commission voted to require all public companies to make their annual meeting materials available online. Shareholders with the right to vote will have numerous options in how to make their voice heard with regards to voting matters should they choose to.

Shareholder Meeting

This scene from “The Office” humorously illustrates a shareholder meeting, where the shareholder can exercise their right to vote on company issues or question company directors.

12.3.3: Provisions of Preferred Stock

Preferred shares have numerous rights which can be attached to them, such as cumulative dividends, convertibility, and participation.

Learning Objective

Describe in detail the different types of provisions for preferred stock

Key Points

- If a preferred share has cumulative dividends, then it contains the provision that should a company fail to pay out dividends at any time at the stated rate, then the issuer will have to make up for it as time goes on.

- Convertible preferred stock can be exchanged for a predetermined number of company common stock shares.

- Often times companies will keep the right to call or buy back preferred shares at a predetermined price.

- Participating preferred issues offer holders the opportunity to receive extra dividends if the company achieves predetermined financial goals.

- Sometimes, dividends on preferred shares may be negotiated as floating; they may change according to a benchmark interest-rate index.

Key Terms

- Callable shares

-

Shares which can be bought back by the issuer at a predetermined price.

- Convertible preferred stock

-

Convertible preferred stock can be exchanged for a predetermined number of company common stock shares.

- Cumulative Dividends

-

Condition where owners of certain shares will receive accumulated dividends in the case a company cannot pay out dividends at the stated rate at the stated time.

Preferred stock may be entitled to numerous rights, depending on what is designated by the issuer. One of these rights may be the right to cumulative dividends. Preferred stock shareholders already have rights to dividends before common stock shareholders, but cumulative preferred shares contain the provision that should a company fail to pay out dividends at any time at the stated rate, then the issuer will have to make up for it as time goes on.

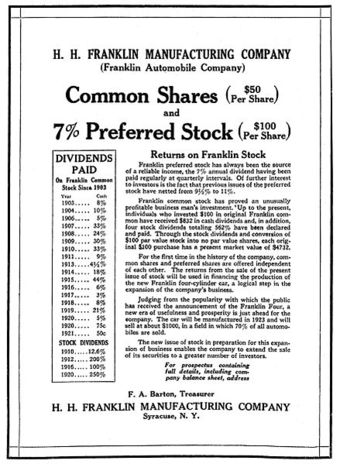

Historical dividend information for Franklin Automobile Company

Dividends are one of the privileges of stock ownership, and preferred shares get more rights to them than common shares do.

Convertible preferred stock can be exchanged for a predetermined number of company common stock shares. Generally, this can occur at the discretion of the investor, and he or she may pick any time to do so and, therefore, take advantage of fluctuations in the price of common stock. Once converted, the common stock cannot be converted back to preferred status.

Often times companies will keep the right to call or buy back preferred shares at a predetermined price. These shares are callable shares.

There is a class of preferred shares known as “participating preferred stock. ” These preferred issues offer holders the opportunity to receive extra dividends if the company achieves predetermined financial goals. Investors who purchased these stocks receive their regular dividend regardless of company performance (assuming the company does well enough to make its annual dividend payments). If the company achieves predetermined sales, earnings, or profitability goals, the investors receive an additional dividend.

Almost all preferred shares have a negotiated, fixed-dividend amount. The dividend is usually specified as a percentage of the par value, or as a fixed amount. Sometimes, dividends on preferred shares may be negotiated as floating; they may change according to a benchmark interest-rate index or floating rate. An example of this would be tying the dividend rate to LIBOR.

12.3.4: Purchasing New Shares

New shares can be purchased on exchanges and current shareholders will usually have preemptive rights to newly issued shares.

Learning Objective

Discuss the process and implication of purchasing new shares by a shareholder that already holds shares in a company

Key Points

- New share purchase is an important indicator of current shareholder belief in the health of the company and long term prospects for growth.

- Current Shareholders will often have preemptive rights that give them the right to purchase newly issued company shares before they go on sale to the general public.

- New shares can be purchased on exchanges, which offer a platform for the financial marketplace.

Key Terms

- Stock Exchange

-

A form of exchange that provides services for stock brokers and traders to trade stocks, bonds and other securities.

- Preemption

-

The right of a shareholder to purchase newly issued shares of a business entity before they are available to the general public so as to protect individual ownership from dilution.

New share purchases are an important action by share shareholders, since it requires a further investment in a business entity and is a reflection of a shareholder’s decision to maintain an ownership position in a company, or a potential investor’s belief that purchasing equity in a company will be an investment that grows in value.

Current shareholders may have preemptive rights over new shares offered by the company. In practice, the most common form of preemption right is the right of existing shareholders to acquire new shares issued by a company in a rights issue, a usually but not always public offering. In this context, the pre-emptive right is also called “subscription right” or “subscription privilege. ” This is the right, but not the obligation, of existing shareholders to buy the new shares before they are offered to the public. In this way, existing shareholders can maintain their proportional ownership of the company, preventing stock dilution.

New shares may be purchased over the same exchange mechanisms that previous stock was acquired. A stock exchange is a form of exchange which provides services for stock brokers and traders to trade stocks, bonds, and other securities. Stock exchanges also provide facilities for issue and redemption of securities and other financial instruments, and capital events, including the payment of income and dividends. The initial offering of stocks and bonds to investors is by definition done in the primary market and subsequent trading is done in the secondary market. A stock exchange is often the most important component of a stock market. Supply and demand in stock markets are driven by various factors that, as in all free markets, affect the price of stocks.

Exchanges

New shares can be traded on exchanges such as the Nasdaq, but will usually be offered to current shareholders before being put on sale to the general public.

12.3.5: Preferred Stock Rules and Rights

Preferred stock can include rights such as preemption, convertibility, callability, and dividend and liquidation preference.

Learning Objective

List the rights that preferred stock generally has

Key Points

- Preferred stock generally does not carry voting rights, but this may vary from company to company.

- Preferred stock can gain cumulative dividends, convertibility to common stock, and callability.

- The rights that come with ownership of preferred stock are detailed in a “Certificate of Designation”.

Key Terms

- liquidation

-

liquidation is the process by which a company (or part of a company) is brought to an end, and the assets and property of the company redistributed

- Preferred Stock

-

Preferred stock is an equity security that has the properties of both an equity and debt instrument and is higher ranking than common stock.

Preferred stock usually carries no voting rights, but may carry a dividend and may have priority over common stock in the payment of dividends and upon liquidation. Terms of the preferred stock are stated in a “Certificate of Designation. “

VOC stock

Preferred stock is a security ( a little more modern that this stock from the VOC or Dutch East India Company) that carries certain rights which designate it from common stock or debt.

Preferred stock is a special class of shares that may have any combination of features not possessed by common stock. The following features are usually associated with preferred stock: Preference in dividends preference in assets, in the event of liquidation, convertibility to common stock, callability, and at the option of the corporation. Some preferred shares have special voting rights to approve extraordinary events (such as the issuance of new shares or approval of the acquisition of a company) or to elect directors, but, once again, most preferred shares have no voting rights associated with them. Some preferred shares gain voting rights when the preferred dividends are in arrears for a substantial time.

Preferred stock may or may not have a fixed liquidation value (or par value) associated with it. This represents the amount of capital which was contributed to the corporation when the shares were first issued. Preferred stock has a claim on liquidation proceeds of a stock corporation equal to its par (or liquidation) value, unless otherwise negotiated. This claim is senior to that of common stock, which has only a residual claim.Almost all preferred shares have a negotiated, fixed-dividend amount. The dividend is usually specified as a percentage of the par value, or as a fixed amount. Sometimes, dividends on preferred shares may be negotiated as floating; they may change according to a benchmark interest-rate index. Preferred stock may also have rights to cumulative dividends.

12.3.6: Comparing Common Stock, Preferred Stock, and Debt

Common stock, preferred stock, and debt are all securities that a company may offer; each of these securities carries different rights.

Learning Objective

Differentiate between the rights of common shareholders, preferred shareholders, and bond holders

Key Points

- Common stock and preferred stock fall behind debt holders as creditors that would receive assets in the case of company liquidation.

- Common stock and preferred stock are both types of equity ownership. They receive rights of ownership in the company, such as voting and dividends.

- Debt holders often receive a bond for lending and while this does not give the ownership rights of being a stockholder, it does create a superior claim to a company’s assets in the case of liquidation.

Key Terms

- Common stock

-

Common stock is a form of corporate equity ownership, a type of security.

- bond

-

A bond is an instrument of indebtness of the bond issuers toward the bond holders.

- Preferred Stock

-

Preferred stock is an equity security that has the properties of both an equity and debt instrument and is higher ranking than common stock.

Equity

Common Stock and Preferred Stock are both methods of purchasing equity in a business entity.

Common stock generally carries voting rights along with it, while preferred shares generally do not.

Preferred shares act like a hybrid security, in between common stock and holding debt. Preferred stock can (depending on the issue) be converted to common stock and have access to accumulated dividends and multiple other rights. Preferred stock also has access to dividends and assets in the case of liquidation before common stock does.

However, both common and preferred stock fall behind debt holders when it comes to claims to assets of a business entity should bankruptcy occur. Common shareholders often do not receive any assets after bankruptcy as a result of this principle. However, common stock shareholders can theoretically use their votes to affect company decision making and direction in a way they believe will help the company avoid liquidation in the first place.

Debt

Debt can be “purchased” from a company in the form of a bond.

A bond from the Dutch East India Company

A bond is a financial security that represents a promise by a company or government to repay a certain amount, with interest, to the bondholder.

In finance, a bond is an instrument of indebtedness of the bond issuer to the holders. It is a debt security, under which the issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay them interest and/or to repay the principal at a later date, termed the maturity. Therefore, a bond is a form of loan or IOU: the holder of the bond is the lender (creditor), the issuer of the bond is the borrower (debtor), and the coupon is the interest. Bonds provide the borrower with external funds to finance long-term investments, or, in the case of government bonds, to finance current expenditure.

Bonds and stocks are both securities, but the major difference between the two is that (capital) stockholders have an equity stake in the company (i.e., they are owners), whereas, bondholders have a creditor stake in the company (i.e., they are lenders). Another difference is that bonds usually have a defined term, or maturity, after which the bond is redeemed, whereas stocks may be outstanding indefinitely.

12.4: Additional Detail on Preferred Stock

12.4.1: Dividend Preference

A corporation may issue two basic classes or types of capital stock, common and preferred, both of which can receive dividends.

Learning Objective

Explain the difference between common stock and preferred stock dividends

Key Points

- A corporation may issue two basic classes or types of capital stock, common and preferred. If a corporation issues only one class of stock, this stock is common stock. All of the stockholders enjoy equal rights.

- Common stock is a form of corporate equity ownership. Common stock holders cannot be paid dividends until all preferred stock dividends are paid in full. On the other hand, common shares on average perform better than preferred shares or bonds over time.

- Preferred stock is an equity security with properties of both an equity and a debt instrument, and is generally considered a hybrid instrument. Preferreds are senior (higher ranking) to common stock, but subordinate to bonds in terms of claim.

Key Terms

- dividend in arrears

-

an omitted dividend on cumulative preferred stock

- Preferred Stock

-

Stock with a dividend, usually fixed, that is paid out of profits before any dividend can be paid on common stock, and that has priority to common stock in liquidation.

- dividend

-

A pro rata payment of money by a company to its shareholders, usually made periodically (eg, quarterly or annually).

- Common stock

-

Shares of an ownership interest in the equity of a corporation or other entity with limited liability entitled to dividends, with financial rights junior to preferred stock and liabilities.

Dividends

A corporation may issue two basic classes or types of capital stock—common and preferred. If a corporation issues only one class of stock, this stock is common stock. All of the stockholders enjoy equal rights. Common stock is usually the residual equity in the corporation, meaning that all other claims against the corporation rank ahead of the claims of the common stockholder. Preferred stock is a class of capital stock that carries certain features or rights not carried by common stock. Within the basic class of preferred stock, a company may have several specific classes of preferred stock, each with different dividend rates or other features.

Companies issue preferred stock in order to avoid the following:

- Using bonds with fixed interest charges that must be paid regardless of the amount of net income.

- Issuing so many additional shares of common stock that earnings per share are less in the current year than in prior years.

- Diluting the common stockholders’ control of the corporation, since preferred stockholders usually have no voting rights.

Unlike common stock, which has no set maximum or minimum dividend, the dividend return on preferred stock is usually stated at an amount per share or as a percentage of par value. Therefore, the firm fixes the dividend per share.

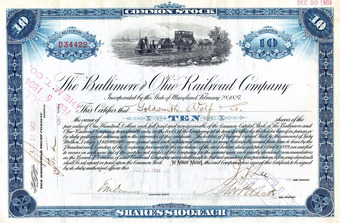

1903 stock certificate of the Baltimore and Ohio Railroad

Ownership of shares is documented by the issuance of a stock certificate and represents the shareholder’s rights with regards to the business entity.

Details on Common Stock

Common stock is a form of corporate equity ownership, a type of security. The terms “voting share” or “ordinary share” are also used in other parts of the world; common stock is primarily used in the United States. It is called “common” to distinguish it from preferred stock. If both types of stock exist, common stock holders cannot be paid dividends until all preferred stock dividends (including payments in arrears) are paid in full. In the event of bankruptcy, common stock investors receive any remaining funds after bondholders, creditors (including employees), and preferred stock holders are paid. As such, such investors often receive nothing after a bankruptcy. On the other hand, common shares on average perform better than preferred shares over time.

Common stock usually carries with it the right to vote on certain matters, such as electing the board of directors. However, a company can have both a “voting” and “non-voting” class of common stock. Holders of common stock are able to influence the corporation through votes on establishing corporate objectives and policy, stock splits, and electing the company’s board of directors. Some holders of common stock also receive preemptive rights, which enable them to retain their proportional ownership in a company should it issue another stock offering. There is no fixed dividend paid out to common stock holders and so their returns are uncertain, contingent on earnings, company reinvestment, and efficiency of the market to value and sell stock. Additional benefits from common stock include earning dividends and capital appreciation.

Details on Preferred Stocks

Preferred stock (also called preferred shares, preference shares or simply preferreds) is an equity security with properties of both an equity and a debt instrument, and is generally considered a hybrid instrument. Preferreds are senior (higher ranking) to common stock, but subordinate to bonds in terms of claim (or rights to stock holders’ share of company assets). Preferred stock usually carries no voting rights, but may carry a dividend and may have priority over common stock upon liquidation, and in the payment of dividends. Terms of the preferred stock are stated in a “Certificate of Designation. “

Similar to bonds, preferred stocks are rated by the major credit-rating companies. The rating for preferreds is generally lower, since preferred dividends do not carry the same guarantees as interest payments from bonds, and because they are junior to all creditors.

12.4.2: Liquidation Preference

The main purpose of a liquidation where the company is insolvent is to satisfy claims in the manner and order prescribed by law.

Learning Objective

Summarize how the liquidation preference determines which claims will be paid if a company becomes insolvent

Key Points

- The main purpose of a liquidation where the company is insolvent is to collect in the company’s assets, determine the outstanding claims against the company, and satisfy those claims in the manner and order prescribed by law.

- Before the claims are met, secured creditors are entitled to enforce their claims against the assets of the company to the extent that they are subject to a valid security interest. In most legal systems, only fixed security takes precedence over all claims.

- Claimants with non-monetary claims against the company may be able to enforce their rights against the company. For example, a party who had a valid contract for the purchase of land against the company may be able to obtain an order for specific performance.

- Most preferred stocks are preferred as to assets in the event of liquidation of the corporation.

Key Terms

- creditor

-

A person to whom a debt is owed.

- Preferred Stock

-

Stock with a dividend, usually fixed, that is paid out of profits before any dividend can be paid on common stock, and that has priority to common stock in liquidation.

- liquidation

-

The selling of the assets of a business as part of the process of dissolving it.

Example

- A party who had a valid contract for the purchase of land against the company may be able to obtain an order for specific performance and compel the liquidator to transfer title to the land to them, upon tender of the purchase price. After the removal of all assets which are subject to retention of title arrangements, fixed security, or are otherwise subject to proprietary claims of others, the liquidator will pay the claims against the company’s assets.

Liquidation Preference

The main purpose of a liquidation where the company is insolvent is to collect in the company’s assets, determine the outstanding claims against the company, and satisfy those claims in the manner and order prescribed by law. The liquidator must determine the company’s title to property in its possession. Property which is in the possession of the company, but which was supplied under a valid retention of title clause will generally have to be returned to the supplier. Property which is held by the company on trust for third parties will not form part of the company’s assets available to pay creditors.

Before the claims are met, secured creditors are entitled to enforce their claims against the assets of the company to the extent that they are subject to a valid security interest. In most legal systems, only fixed security takes precedence over all claims. Security by way of floating charge may be postponed to the preferential creditors.

Claimants with non-monetary claims against the company may be able to enforce their rights against the company. For example, a party who had a valid contract for the purchase of land against the company may be able to obtain an order for specific performance and compel the liquidator to transfer title to the land to them, upon tender of the purchase price. After the removal of all assets which are subject to retention of title arrangements, fixed security, or are otherwise subject to proprietary claims of others, the liquidator will pay the claims against the company’s assets.

Plane Liquidation

Planes are an example of liquidated items when companies “go under. ” They are generally auctioned off to the highest bidder.

Priority of Claims

Generally, the priority of claims on the company’s assets will be determined in the following order:

- Liquidators costs

- Creditors with fixed charge over assets

- Costs incurred by an administrator

- Amounts owed to employees for wages/superannuation (director limit $2,000)

- Payments owed in respect of workers’ injuries

- Amounts owed to employees for leave (director limit $1,500)

- Retrenchment payments owing to employees

- Creditors with floating charge over assets

- Creditors without security over assets

- Shareholders (Liquidating distribution) – Most preferred stocks are preferred as to assets in the event of liquidation of the corporation. Stock preferred as to assets is preferred stock that receives special treatment in liquidation. Preferred stockholders receive the par value (or a larger stipulated liquidation value) per share before any assets are distributed to common stockholders. A corporation’s cumulative preferred dividends in arrears at liquidation are payable even if there are not enough accumulated earnings to cover the dividends. Also, the cumulative dividend for the current year is payable. Stock may be preferred as to assets, dividends, or both.

- Unclaimed assets will usually vest in the state as bona vacantia.

12.4.3: Accounting for Preferred Stock

All preferred stock is reported on the balance sheet in the stockholders’ equity section and it appears first before any other stock.

Learning Objective

Differentiate between preferred to dividends, noncumulative, cumulative and convertible preferred stock

Key Points

- Stock preferred as to dividends means that the preferred stockholders receive a specified dividend per share before common stockholders receive any dividends. A dividend on preferred stock is the amount paid to preferred stockholders as a return for the use of their money.

- Noncumulative preferred stock is preferred stock on which the right to receive a dividend expires whenever the dividend is not declared. When noncumulative preferred stock is outstanding, a dividend omitted or not paid in any one year need not be paid in any future year.

- Cumulative preferred stock is preferred stock for which the right to receive a basic dividend, usually each quarter, accumulates if the dividend is not paid. Companies must pay unpaid cumulative preferred dividends before paying any dividends on the common stock.

- All preferred stock is reported on the balance sheet in the stockholders’ equity section and it appears first before any other stock. The par value, authorized shares, issued shares, and outstanding shares is disclosed for each type of stock.

Key Terms

- Common stock

-

Shares of an ownership interest in the equity of a corporation or other entity with limited liability entitled to dividends, with financial rights junior to preferred stock and liabilities.

- dividend

-

A pro rata payment of money by a company to its shareholders, usually made periodically (eg, quarterly or annually).

- Preferred Stock

-

Stock with a dividend, usually fixed, that is paid out of profits before any dividend can be paid on common stock, and that has priority to common stock in liquidation.

- cumulative dividend

-

a payments by the company to shareholders that accumulate if a previous payment was missed

Preferred Stock

Preferred stock is a class of capital stock that carries certain features or rights not carried by common stock. Within the basic class of preferred stock, a company may have several specific classes of preferred stock, each with different dividend rates or other features. Companies issue preferred stock to avoid:

1903 stock certificate of the Baltimore and Ohio Railroad

Ownership of shares is documented by the issuance of a stock certificate and represents the shareholder’s rights with regards to the business entity.

- using bonds with fixed interest charges that must be paid regardless of the amount of net income;

- issuing so many additional shares of common stock that earnings per share are less in the current year than in prior years; and

- diluting the common stockholders’ control of the corporation, since preferred stockholders usually have no voting rights.

Unlike common stock, which has no set maximum or minimum dividend, the dividend return on preferred stock is usually stated at an amount per share or as a percentage of par value. Therefore, the firm fixes the dividend per share.

Types of Preferred Stock

When a corporation issues both preferred and common stock, the preferred stock may be:

- Preferred as to dividends. It may be noncumulative or cumulative.

- Preferred as to assets in the event of liquidation.

- Convertible or nonconvertible.

- Callable.

Preferred as to Dividends

Stock preferred as to dividends means that the preferred stockholders receive a specified dividend per share before common stockholders receive any dividends. A dividend is the amount paid to preferred stockholders as a return for the use of their money.

For no-par preferred stock, the dividend is a specific dollar amount per share per year, such as USD 4.40. For par value preferred stock, the dividend is usually stated as a percentage of the par value, such as 8% of par value; occasionally, it is a specific dollar amount per share. Most preferred stock has a par value.

Usually, stockholders receive dividends on preferred stock quarterly. Such dividends—in full or in part—must be declared by the board of directors before paid. In some states, corporations can declare preferred stock dividends only if they have retained earnings (income that has been retained in the business) at least equal to the dividend declared.

Noncumulative Preferred Stock

Noncumulative preferred stock is preferred stock in which a dividend expires whenever the dividend is not declared. When noncumulative preferred stock is outstanding, a dividend omitted or not paid in any one year need not be paid in any future year. Because omitted dividends are lost forever, noncumulative preferred stocks are not attractive to investors and are rarely issued.

Cumulative Preferred Stock

Cumulative preferred stock is preferred stock for which the right to receive a basic dividend, usually each quarter, accumulates if the dividend is not paid. Companies must pay unpaid cumulative preferred dividends before paying any dividends on the common stock. For example, assume a company has cumulative, USD 10 par value, 10% preferred stock outstanding of USD 100,000, common stock outstanding of USD 100,000, and retained earnings of USD 30,000. It has paid no dividends for two years. The company would pay the preferred stockholders dividends of USD 20,000 (USD 10,000 per year times two years) before paying any dividends to the common stockholders.

Dividends in arrears are cumulative unpaid dividends, including the quarterly dividends not declared for the current year. Dividends in arrears never appear as a liability of the corporation because they are not a legal liability until declared by the board of directors. However, since the amount of dividends in arrears may influence the decisions of users of a corporation’s financial statements, firms disclose such dividends in a footnote.

Most preferred stocks are preferred as to assets in the event of liquidation of the corporation. Stock preferred as to assets is preferred stock that receives special treatment in liquidation. Preferred stockholders receive the par value (or a larger stipulated liquidation value) per share before any assets are distributed to common stockholders. A corporation’s cumulative preferred dividends in arrears at liquidation are payable even if there are not enough accumulated earnings to cover the dividends. Also, the cumulative dividend for the current year is payable. Stock may be preferred as to assets, dividends, or both.

Convertible Preferred Stock

Convertible preferred stock is preferred stock that is convertible into common stock of the issuing corporation. Convertible preferred stock is uncommon, most preferred stock is nonconvertible. Holders of convertible preferred stock shares may exchange them, at their option, for a certain number of shares of common stock of the same corporation.

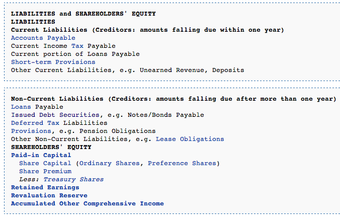

Preferred Stock and the Balance Sheet

All preferred stock is reported on the balance sheet in the stockholders’ equity section and it appears first before any other stock. The par value, authorized shares, issued shares, and outstanding shares is disclosed for each type of stock.

12.5: Dividend Policy

12.5.1: Impact of Dividend Policy on Clientele

Change in a firm’s dividend policy may cause loss of old clientele and gain of new clientele, based on their different dividend preferences.

Learning Objective

Describe how the clientele effect can influence stock price

Key Points

- The clientele effect is the idea that the type of investors attracted to a particular kind of security will affect the price of the security when policies or circumstances change.

- Current clientele might choose to sell their stock if a firm changes their dividend policy and deviates considerably from the investor’s preferences. Changes in policy can also lead to new clientele, whose preferences align with the firm’s new dividend policy.

- In equilibrium, the changes in clientele sets will not lead to any change in stock price.

- The real world implication of the clientele effect lies in the importance of dividend policy stability, rather than the content of the policy itself.

Key Terms

- clientele effect

-

The theory that changes in a firm’s dividend policy will cause loss of some clientele who will choose to sell their stock, and attract new clientele who will buy stock based on dividend preferences.

- clientele

-

The body or class of people who frequent an establishment or purchase a service, especially when considered as forming a more-or-less homogeneous group of clients in terms of values or habits.

- dividend clientele

-

Sets of investors who are attracted to certain types of dividend policy.

Example

- Suppose Firm A had been in a growth stage and did not offer dividends to its shareholders, but their policy changed to paying low cash dividends. Clientele interested in long term capital gains might be alarmed, interpreting this decision as a sign of slowing growth, which would mean less stock price appreciation in the future. This set of clientele could choose to sell the stock. On the other hand, dividend payments could appeal to investors who are interested in regular additional income from the investment, and they would buy Firm A’s stock.

The Clientele Effect

The clientele effect is the idea that the type of investors attracted to a particular kind of security will affect the price of the security when policies or circumstances change. These investors are known as dividend clientele. For instance, some clientele would prefer a company that doesn’t pay dividends at all, but instead invests their retained earnings toward growing the business. Some would instead prefer the regular income from dividends over capital gains. Of those who prefer dividends over capital gains, there are further subsets of clientele; for example, investors might prefer a stock that pays a high dividend, while another subset might look for a balance between dividend payout and reinvestment in the company.

Clientele Type Example

Retirees are more likely to prefer high dividend payouts over capital gains since this provides them with cash income. Therefore, if a company discontinued paying dividends, the clientele effect may cause retiree shareholders to sell the stock in favor of other income generating investments.

Clientele may choose to sell their stock if a firm changes its dividend policy, and deviates considerably from its preferences. On the other hand, the firm may attract a new clientele group if its new dividend policy appeals to the group’s dividend preferences. These changes in demographics related to a stock’s ownership due to a change of dividend policy are examples of the “clientele effect. “

This theory is related to the dividend irrelevance theory presented by Modigliani and Miller, which states that, under particular assumption, an investor’s required return and the value of the firm are unrelated to the firm’s dividend policy. After all, clientele can just choose to sell off their holdings if they dislike a firm’s policy change, and the firm may simultaneously attract a new subset of clientele who like the policy change. Therefore, stock value is unaffected. This is true as long as the “market” for dividend policy is in equilibrium, where demand for such a policy meets the supply.

The clientele effect’s real world implication is that what matters is not the content of the dividend policy, but rather the stability of the policy. While investors can always choose to sell shares of firms with undesirable dividend policy, and buy shares of firms with attractive dividend policy, there are brokerage costs and tax considerations associated with this. As a result, an investor may stick with a stock that has a sub-optimal dividend policy because the cost of switching investments outweighs the benefit the investor would receive by investing in a stock with a better dividend policy.

Although commonly used in reference to dividend or coupon (interest) rates, the clientele effect can also be used in the context of leverage (debt levels), changes in line of business, taxes, and other management decisions.

12.5.2: Stock Dividends vs. Cash Dividends

Investors’ preference for stock or cash depends on their inclinations toward factors such as liquidity, tax situation, and flexibility.

Learning Objective

Assess whether a particular shareholder would prefer stock or cash dividends

Key Points

- Cash dividends provide steady payments of cash that can be used to reinvest in a company, if the shareholder desires.

- Holders of stock dividends can sell their stock for (hopefully) high capital gains in the future, or they can sell it off immediately to get cash, much like a cash dividend. This flexibility is seen by some as a benefit of stock dividend.

- Cash dividends are immediately taxable as income, while stock dividends are only taxed when they are actually sold by the shareholder.

- If an investor is interested in long-term capital gains, he or she will likely prefer stock dividends. If an investor needs a regular source of income, cash dividends will provide liquidity.

- Firms can choose to issue stock dividends if they would like to direct their earnings toward the development of the firm but would still like to appease stockholders with some form of payment.

- Established firms with little more room to grow do not have pressing needs for all their cash earnings, so they are more likely to give cash dividends.

Key Terms

- cash dividend

-

a payment by the company to shareholders paid out in currency, usually via electronic funds transfer or a printed paper check

- stock dividends

-

Stock or scrip dividends are those paid out in the form of additional stock shares of either the issuing corporation or another corporation.

- cash dividends

-

Cash dividends are those paid out in currency, usually via electronic funds transfer or by paper check.

If a firm decides to parcel out dividends to shareholders, they have a choice in the form of payment: cash or stock. Cash dividends are those paid out in currency, usually via electronic funds transfer or by paper check. This is the most common method of sharing corporate profits with the shareholders of a company. Stock or scrip dividends are those paid out in the form of additional stock shares of either the issuing corporation or another corporation.Cash dividends provide investors with a regular stream of income. Stock dividends, unlike cash dividends, do not provide liquidity to the investors; however, they do ensure capital gains to the stockholders. Therefore, if investors are not interested in a long-term investment, they will prefer regular cash payments over payments of additional stock.

Income from Dividends

When choosing between cash or stock dividends, the trade-off is between liquidity in the short-term or income from capital gains in the long-term.

Costs of taxes can also play a role in choosing between cash or stock dividends. Cash dividends are immediately taxable under most countries’ tax codes as income, while stock dividends are not taxable until sold for capital gains (if stock was the only choice for receiving dividends). This can be seen as a huge benefit of stock dividends, particularly for investors of a high income tax bracket. A further benefit of the stock dividend is its perceived flexibility. Shareholders have the choice of either keeping their shares in hopes of high capital gains, or selling some of the new shares for cash, which is somewhat like receiving a cash dividend.

If the payment of stock dividends involves the issuing of new shares, it increases the total number of shares while lowering the price of each share without changing the market capitalization of the shares held. It has the same effect as a stock split: the total value of the firm is not affected. If the payment involves the issuing of new shares, it increases the total number of shares while lowering the price of each share without changing the market capitalization, or total value, of the shares held. As such, receiving stock dividends does not increase a shareholder’s stake in the firm; by contrast, a shareholder receiving cash dividends could use that income to reinvest in the firm and increase their stake.