5.1: Understanding Inventory

5.1.1: Nature of Inventory

Inventory represents finished and unfinished goods which have not yet been sold by a company.

Learning Objective

Explain the purpose of inventory and how a company controls and reports it

Key Points

- Inventories are maintained because time lags in moving goods to customers could put sales at risk.

- Inventories are maintained as buffers to meet uncertainties in demand, supply and movements of goods.

- There are four stages of inventory: raw material, work in progress, finished goods, and goods for resale.

- Raw materials – materials and components scheduled for use in making a product. Work in process, WIP – materials and components that have began their transformation to finished goods. Finished goods – goods ready for sale to customers. Goods for resale – returned goods that are salable.

- When a merchant buys goods from inventory, the value of the inventory account is reduced by the cost of goods sold. For commodity items that one cannot track individually, accountants must choose a method that fits the nature of the sale.

- FIFO (first in-first out) regards the first unit that arrived in inventory as the first sold. LIFO (last in-first out) considers the last unit arriving in inventory as the first sold. Using LIFO accounting for inventory a company reports lower net income and book value, resulting in lower taxation.

Key Terms

- raw material

-

A material in its unprocessed, natural state considered usable for manufacture.

- inventory

-

A detailed list of all of the items on hand.

- supply chain

-

A system of organizations, people, technology, activities, information and resources involved in moving a product or service from supplier to customer.

Example

- A canned food manufacturer’s materials inventory includes the ingredients to form the foods to be canned, empty cans and their lids (or coils of steel or aluminum for constructing those components), labels, and anything else (solder, glue, etc.) that will form part of a finished can. The firm’s work in process includes those materials from the time of release to the work floor until they become complete and ready for sale to wholesale or retail customers. This may be vats of prepared food, filled cans not yet labeled or sub-assemblies of food components. It may also include finished cans that are not yet packaged into cartons or pallets. Its finished good inventory consists of all the filled and labeled cans of food in its warehouse that it has manufactured and wishes to sell to food distributors (wholesalers), to grocery stores (retailers), and even perhaps to consumers through arrangements like factory stores and outlet centers.

Definition of Inventory

Inventory represents finished and unfinished goods which have not yet been sold by a company. . Inventories are maintained as buffers to meet uncertainties in demand, supply, and movements of goods. These holdings are recorded in an accounting system .

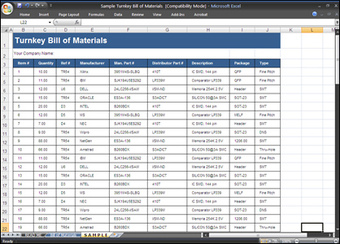

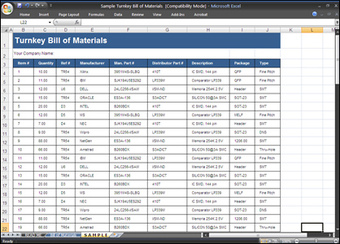

Inventory Template

Example of inventory template.

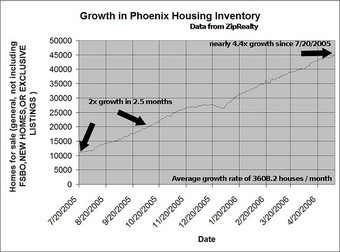

Housing inventory growth in Phoenix

There was an interesting comment on the housing bubble blog listing “available inventory”, otherwise known as the number of houses currently for sale, in Phoenix. It listed the available inventory on a daily basis from 7/20/2006 to 5/9/2006 (up to the day it was posted! )Phoenix is one of the “hot” markets of the housing bubble, but certainly isn’t the top of the list. Inventory run ups like this are being seen nation wide, and are leading to price reductions (if the seller is smart) and long waits to sell as bubble flippers all try to cash out at once.

Basic Inventory Accounting

An organization’s inventory counts as a current asset on an organization’s balance sheet because the organization can, in principle, turn it into cash by selling it. However, it ties up money that could serve for other purposes and requires additional expense for its protection. Inventory may also cause significant tax expenses, depending on particular countries’ laws regarding depreciation of inventory, as in the case of Thor Power Tool Company v. Commissioner.

Inventory Systems

There are two principal systems for determining inventory quantities on hand: periodic and perpetual system.

The Periodic System

This system requires a physical count of goods on hand at the end of a period. A cost basis (i.e., FIFO, LIFO) is then applied to derive an inventory value. Because it is simple and requires records and adjustments mostly at the end of a period, it is widely used. It does lack some of the planning and control benefits of the perpetual system.

The Perpetual System

The perpetual system requires continuous recording of receipt and disbursement for every item of inventory. Most large manufacturing and merchandising companies use this system to ensure adequate supplies are on hand for production or sale, and to minimize costly machine shut-downs and customer complaints.

Inventory Costing

Inventory cost includes all expenditures relating to inventory acquisition, preparation, and readiness for sale, minus purchase discounts.

Rationale for Keeping Inventory:

- Time – The time lags present in the supply chain, from supplier to user at every stage, requires that you maintain certain amounts of inventory to use in this lead time. However, in practice, inventory is to be maintained for consumption during ‘variations in lead time’. Lead time itself can be addressed by ordering that many days in advance.

- Uncertainty – Inventories are maintained as buffers to meet uncertainties in demand, supply and movements of goods.

- Economies of scale – Ideal condition of “one unit at a time at a place where a user needs it, when he needs it” principle tends to incur lots of costs in terms of logistics. So bulk buying, movement and storing brings in economies of scale, thus inventory.

Stages of Inventory:

- Raw materials – materials and components scheduled for use in making a product.

- Work in process, WIP – materials and components that have began their transformation to finished goods.

- Finished goods – goods ready for sale to customers.

- Goods for resale – returned goods that are salable.

5.1.2: Categories of Goods Included in Inventory

Most manufacturing organizations usually divide their “goods for sale” inventory into raw materials, work in process, and finished goods.

Learning Objective

Distinguish between the raw materials, work in process, finished goods and goods for resale

Key Points

- Raw materials – Materials and components scheduled for use in making a product.

- Work in process/progress (WIP) – Materials and components that have began their transformation to finished goods.

- Finished goods – Goods ready for sale to customers.

- Goods for resale – Returned goods that are salable.

- Distressed inventory is inventory for which the potential to be sold at a normal cost has passed or will soon pass.

- Inventory credit refers to the use of stock, or inventory, as collateral to raise finance.

Key Terms

- raw materials

-

A raw material is the basic material from which a product is manufactured or made.

- finished goods inventory

-

the amount of completed products not yet sold or distributed to the end-user

- Finished goods

-

Goods that are completed, from a manufacturing standpoint, but not yet sold or distributed to the end-user.

- work in progress

-

A portion of inventory that represents goods which are no longer salable as raw materials, but not yet salable as finished goods.

- Work in process

-

a company’s partially finished goods waiting for completion and eventual sale or the value of these items

Example

- A canned food manufacturer’s materials inventory includes the ingredients to form the foods to be canned, empty cans and their lids (or coils of steel or aluminum for constructing those components), labels, and anything else (solder, glue, etc.) that will form part of a finished can. The firm’s work in process includes those materials from the time of release to the work floor until they become complete and ready for sale to wholesale or retail customers. This may be vats of prepared food, filled cans not yet labeled or sub-assemblies of food components. It may also include finished cans that are not yet packaged into cartons or pallets. Its finished good inventory consists of all the filled and labeled cans of food in its warehouse that it has manufactured and wishes to sell to food distributors (wholesalers), to grocery stores (retailers), and even perhaps to consumers through arrangements like factory stores and outlet centers.

Categories of Goods

While the reasons for holding stock were covered earlier, most manufacturing organizations usually divide their “goods for sale” inventory into several categories:

- Raw materials – Materials and components scheduled for use in making a product.

- Work in process or work in progress (WIP) – Materials and components that have began their transformation to finished goods.

- Finished goods – Goods ready for sale to customers.

- Goods for resale – Returned goods that are salable .

Raw Materials

A raw material is the basic material from which a product is manufactured or made. For example, the term is used to denote material that came from nature and is in an unprocessed or minimally processed state. Latex, iron ore, logs, crude oil, and salt water are examples of raw materials.

Work in Process (WIP)

WIP, or in-process inventory, includes unfinished items for products in a production process. These items are not yet completed, and are just being fabricated, waiting in a queue for further processing, or in a buffer storage. The term is used in production and supply chain management.

Optimal production management aims to minimize work in process. Work in process requires storage space, represents bound capital not available for investment, and carries an inherent risk of earlier expiration of the shelf life of the products. A queue leading to a production step shows that the step is well buffered for shortage in supplies from preceding steps, but may also indicate insufficient capacity to process the output from these preceding steps.

Finished Goods

Goods that are completed (manufactured) but not yet sold or distributed to the end-user.

Goods for resale

Returned goods that are salable. This is not always included in the “goods for sale” inventory; that depends on the preference of the company.

Example

A canned food manufacturer’s materials inventory includes the ingredients needed to form the foods to be canned, empty cans and their lids (or coils of steel or aluminum for constructing those components), labels, and anything else (solder, glue, etc.) that will form part of a finished can. The firm’s work in process includes those materials from the time of release to the work floor until they become complete and ready for sale to wholesale or retail customers. This may be vats of prepared food, filled cans not yet labeled, or sub-assemblies of food components. It may also include finished cans that are not yet packaged into cartons or pallets. The manufacturer’s finished good inventory consists of all the filled and labeled cans of food in its warehouse that it has manufactured and wishes to sell to food distributors (wholesalers), to grocery stores (retailers), and even perhaps to consumers through arrangements like factory stores and outlet centers.

5.1.3: Components of Inventory Cost

The cost of goods produced in the business should include all costs of production: parts, labor, and overhead.

Learning Objective

Identify the components used to calculate the cost of goods sold

Key Points

- Labor costs include direct labor and indirect labor. Direct labor costs are the wages paid to those employees who spend all their time working directly on the product being manufactured. Indirect labor costs are the wages paid to other factory employees involved in production.

- Overhead costs (costs incurred at the plant or organization level) are often allocated to sets of produced goods based on the ratio of labor hours or costs or the ratio of materials used for producing the set of goods.

- Most businesses make more than one of a particular item. Thus, costs are incurred for multiple items rather than a particular item sold. Parts and raw materials are often tracked to particular sets (e.g., batches or production runs) of goods, then allocated to each item.

Key Terms

- raw materials

-

A raw material is the basic material from which a product is manufactured or made.

- labor

-

Effort expended on a particular task; toil, work.

- overhead

-

Any cost or expenditure (monetary, time, effort or otherwise) incurred in a project or activity, that does not directly contribute to the progress or outcome of the project or activity.

Cost of Goods

The cost of goods produced in the business should include all costs of production. The key components of cost generally include:

- Parts, raw materials and supplies used,

- Labor, including associated costs such as payroll taxes and benefits, and

- Overhead of the business allocable to production.

Most businesses make more than one of a particular item. Thus, costs are incurred for multiple items rather than a particular item sold. Determining how much of each of these components to allocate to particular goods requires either tracking the particular costs or making some allocations of costs.

Parts and Raw Materials

Parts and raw materials are often tracked to particular sets (e.g., batches or production runs) of goods, then allocated to each item.

Labor

Labor costs include direct labor and indirect labor. Direct labor costs are the wages paid to those employees who spend all their time working directly on the product being manufactured. Indirect labor costs are the wages paid to other factory employees involved in production. Costs of payroll taxes and fringe benefits are generally included in labor costs, but may be treated as overhead costs. Labor costs may be allocated to an item or set of items based on timekeeping records.

Overhead Costs

Determining overhead costs often involves making assumptions about what costs should be associated with production activities and what costs should be associated with other activities. Traditional cost accounting methods attempt to make these assumptions based on past experience and management judgment as to factual relationships. Activity based costing attempts to allocate costs based on those factors that drive the business to incur the costs.

Accounting cycle

Image of the accounting cycle

Overhead costs are often allocated to sets of produced goods based on the ratio of labor hours or costs or the ratio of materials used for producing the set of goods. Overhead costs may be referred to as factory overhead or factory burden for those costs incurred at the plant level or overall burden for those costs incurred at the organization level. Where labor hours are used, a burden rate or overhead cost per hour of labor may be added along with labor costs. Other methods may be used to associate overhead costs with particular goods produced. Overhead rates may be standard rates, in which case there may be variances, or may be adjusted for each set of goods produced.

Variable Production Overheads

Variable production overheads are allocated to units produced based on actual use of production facilities. Fixed production overheads are often allocated based on normal capacities or expected production. More or fewer goods may be produced than expected when developing cost assumptions (like burden rates). These differences in production levels often result in too much or too little cost being assigned to the goods produced. This also gives rise to variances.

Example

Jane owns a business that resells machines. At the start of 2009, she has no machines or parts on hand. She buys machines

and

for $10 each, and later buys machines

and

for $12 each. All the machines are the same, but they have serial numbers. Jane sells machines

and

for $20 each. Her cost of goods sold depends on her inventory method. Under specific identification, the cost of goods sold is:

which is the particular costs of machines

and

. If she uses FIFO, her costs are:

If she uses average cost, her costs are:

If she uses LIFO, her costs are:

Thus, her profit for accounting and tax purposes may be $20, $18, or $16, depending on her inventory method.

5.1.4: Flow of Inventory Costs

Accounting techniques are used to manage assumptions of cost flows related to inventory and stock repurchases.

Learning Objective

Discuss how a company uses LIFO or FIFO to calculate the cost of inventory

Key Points

- Accounting techniques are used to manage inventory and financial matters – how much money a company has tied up within inventory of produced goods, raw materials, parts, components, etc. These techniques manage assumptions of cost flows related to inventory and stock repurchases .

- FIFO stands for first-in, first-out, meaning that the oldest inventory items are recorded as sold first, but do not necessarily mean that the exact oldest physical object has been tracked and sold.

- LIFO stands for last-in first-out. The most recently produced items are recorded as sold first. Since the 1970’s, companies shifted towards the use of LIFO, which reduces their income taxes. The International Financial Reporting Standards banned using LIFO, so companies returned to FIFO.

Key Terms

- accounting

-

The development and use of a system for recording and analyzing the financial transactions and financial status of a business or other organization.

- FIFO

-

First in, first out (accounting).

- LIFO

-

Last-in, first-out (accounting).

Example

- A canned food manufacturer’s materials inventory includes the ingredients to form the foods to be canned, empty cans and their lids (or coils of steel or aluminum for constructing those components), labels, and anything else (solder, glue, etc.) that will form part of a finished can. The firm’s work in process includes those materials from the time of release to the work floor until they become complete and ready for sale to wholesale or retail customers. This may be vats of prepared food, filled cans not yet labeled or sub-assemblies of food components. It may also include finished cans that are not yet packaged into cartons or pallets. Its finished goods inventory consists of all the filled and labeled cans of food in its warehouse that it has manufactured and wishes to sell to food distributors (wholesalers), to grocery stores (retailers), and even perhaps to consumers through arrangements like factory stores and outlet centers.

FIFO and LIFO methods are accounting techniques used in managing inventory and financial matters involving the amount of money a company has tied up within inventory of produced goods, raw materials, parts, components, or feed stocks. These methods are used to manage assumptions of cost flows related to inventory, stock repurchases (if purchased at different prices), and various other accounting purposes.

Accounting Cycle

The accounting cycle (flows).

FIFO stands for first-in, first-out, meaning that the oldest inventory items recorded first are sold first, but does not necessarily mean that the exact oldest physical object has been tracked and sold.

- An example of how to calculate the ending inventory balance of the period using FIFO — assume the following inventory is on hand and purchased on the following dates:

- Inventory of Product X –

- Purchase date: 10/1/12 — 10 units at a cost of USD 5

- Purchase date: 10/5/12 — 5 units at a cost of USD 6

- On 12/30/12, a sale of Product X is made for 11 units

- When the sale is made, it is assumed that the 10 units purchased on 10/1/12 (the sale eliminates this inventory layer) and 1 unit purchased on 10/5/12 were sold

- The ending inventory balance on 12/31/12, is 4 units at a cost of USD 6

LIFO stands for last-in, first-out, meaning that the most recently produced items are recorded as sold first. Since the 1970’s, some U.S. companies shifted towards the use of LIFO, which reduces their income taxes in times of inflation. However, with International Financial Reporting Standards banning the use of LIFO, more companies have gone back to FIFO. LIFO is only used in Japan and the United States.

- An example of how to calculate the ending inventory balance of the period using LIFO — assume the following inventory is on hand and purchased on the following dates:

- Inventory of Product X –

- Purchase date: 10/1/12 — 10 units at a cost of USD 5

- Purchase date: 10/5/12 — 5 units at a cost of USD 6

- On 12/30/12, a sale of Product X is made for 11 units

- When the sale is made, it is assumed that the 5 units purchased on 10/5/12 (the sale eliminates this inventory layer) and 6 units purchased on 10/1/12 were sold

- The ending inventory balance on 12/31/12, is 4 units at a cost of USD 5

Differences between Inventory Costing Methods

The difference between the cost of an inventory calculated under the FIFO and LIFO methods is called the LIFO reserve. This reserve is essentially the amount by which an entity’s taxable income has been deferred by using the LIFO method.

Differences in Periods of Rising Prices (Inflation)

- FIFO (+) Higher value of inventory (-) Lower cost of goods sold

- LIFO (-) Lower value of inventory (+) Higher cost of goods sold

Differences in Periods of Falling Prices (Deflation)

- FIFO (-) Lower value of inventory (+) Higher cost of goods sold

- LIFO (+) Higher value on inventory (-) Lower cost on goods sold

Methods of Preparing Cash Flow Statements

- The direct method of preparing a cash flow statement results in report that is easier to understand. It creates a cash flow statement report using major classes of gross cash receipts and payments.

- The indirect method is almost universally used because FAS 95 requires a supplementary report similar to the indirect method if a company chooses to use the direct method. It uses net-income as a starting point, makes adjustments for all transactions for non-cash items, then adjusts from all cash-based transactions. An increase in an asset account is subtracted from net income. An increase in a liability account is added back to net income. This method converts accrual-basis net income (or loss) into cash flow by using a series of additions and deductions.

5.2: Controlling Inventory

5.2.1: Internal Controls

Inventory internal controls ensure that a company has sufficient resources to meet its customers’ needs without having too much goods.

Learning Objective

Explain how a company would use storage, inventory management systems and inventory counts to control inventory

Key Points

- Companies should store inventory in secure spacious warehouses so that inventory is not stolen or damaged. Goods and resources of the same or similar type should be kept in the same general area of the warehouse to minimize confusion and to ensure accurate counts.

- An inventory management system is a series of procedures, often aided by computer software, that tracks assets progression through inventory. A properly used and maintained inventory management system allows management to be able to know how much inventory it has at any given time.

- Detailed physical inventory counts are a way of ensuring that a company’s inventory management system is accurate and as a check to make sure goods are not being lost or stolen. A physical count of a company’s entire inventory is generally taken prior to the issuance of a company’s balance sheet.

- To conduct a cycle count, an auditor will select a small subset of inventory, in a specific location, and count it on a specified day. The auditor will then compare the count to the related information in the inventory management system to ensure the information in the system is correct.

Key Terms

- internal auditor

-

one who conducts an independent, objective assurance and consulting activity designed to add value and improve an organization’s operations

- physical inventory count

-

Physical inventory is a process where a business physically counts its entire inventory. A physical inventory may be mandated by financial accounting rules or the tax regulations to place an accurate value on the inventory, or the business may need to count inventory so component parts or raw materials can be restocked. Businesses may use several different tactics to minimize the disruption caused by physical inventory.

- cycle counts

-

Process by which an auditor selects a small subset of inventory and counts it to ensure that it matches the information in the company’s inventory management system. Meant to test the accuracy of inventory system.

Internal controls over a company’s inventory are meant to ensure that management has an accurate count of what materials and goods it has available for sale and to protect those goods from being spoiled, stolen or otherwise made unavailable for sale. In short, inventory internal controls are meant to ensure that a company always has sufficient resources to produce and sell goods to meet its customers’ needs without having oversupply.

This process is affected by the company’s structure, its employees, and its informational systems. Since a company’s inventory is directly tied to the business’s ability to generate profit, the internal controls must be comprehensive and require significant thought when being designed.

Storage

Companies should store inventory in secure, spacious warehouses so that inventory is not stolen or damaged. Goods and resources of the same or similar type should be kept in the same general area of the warehouse to minimize confusion and to ensure accurate counts.

Inventory Management Systems

An inventory management system is a series of procedures, often aided by computer software, that tracks assets progression through inventory. For example, assume a set amount of raw material is acquired by the company. When the company receives that material, the amount should be noted in the inventory management system. As the material is processed into the goods for resale, the amount of raw material used should be deducted from the “raw material inventory” and the amount of goods that result from the process should be added to the “finished goods inventory. ” As each finished item is sold, the “finished goods inventory” should be decreased by that amount.

The benefit of a properly used and maintained inventory management system is that it allows management to be able to know how much inventory it has at any given time.

Physical Inventory Count

Physical inventory counts are a way of ensuring that a company’s inventory management system is accurate and as a check to make sure goods are not being lost or stolen. A detailed physical count of a company’s entire inventory is generally taken prior to the issuance of a company’s balance sheet, to ensure that the company accurately report its inventory levels.

Keeping track of Inventory

Clerk conducting physical inventory count using a handheld computer in a Tesco Lotus supermarket in Sakon Nakhon, Thailand

Cycle Counts

Companies usually conduct cycle counts periodically throughout an accounting period as a means to ensure that the information in its inventory management system is correct. To conduct a cycle count, an auditor will select a small subset of inventory, in a specific location, and count it on a specified day. The auditor will then compare the count to the related information in the inventory management system. If the counts match, no further action is taken. If the numbers differ, the auditor will take additional steps to determine why the counts do not match.

Cycle counts contrast with traditional physical inventory in that a full physical inventory may stop operation at a facility while all items are counted at one time. Cycle counts are less disruptive to daily operations, provide an ongoing measure of inventory accuracy and procedure execution, and can be tailored to focus on items with higher value, higher movement volume, or that are critical to business processes. Cycle counting should only be performed in facilities with a high degree of inventory accuracy.

5.2.2: Perpetual vs. Periodic Counting

Perpetual inventory updates the quantities continuously and periodic inventory updates the amount only at specific times, such as year end.

Learning Objective

Explain the differences between perpetual inventory and periodic inventory

Key Points

- Perpetual inventory, also called continuous inventory, is when information about amount and availability of the product is updated continuously, usually via computer.

- Periodic inventory is a system of inventory in which updates are made on a periodic basis.

- Theft, breakage, or untracked movement can cause the perpetual inventory to be inaccurate.

Key Terms

- periodic inventory system

-

accounting for goods and materials held for eventual sale that is not continually updated

- perpetual

-

Continuing uninterrupted

- breakage

-

Something that has been broken.

Perpetual Inventory

Perpetual inventory, also called continuous inventory, is when information about amount and availability of a product is updated continuously. Generally, this is accomplished by connecting the inventory system either with the order entry system or for a retail establishment the point of sale system.

A company using the perpetual inventory system would have a book inventory that is exactly (within a small margin of error) the same as the physical (real) inventory.

Periodic Inventory

Periodic inventory is when information about amount and availability of a product is updated only periodically. Physical inventories are conducted at set time intervals; both cost of goods sold and the inventory are adjusted at the time of the physical inventory. Most companies who use periodic inventory perform this at year-end.

Periodic vs. Perpetual

In earlier periods, non-continuous or periodic inventory systems were more prevalent. Many small businesses still only have a periodic system of inventory.

Perpetual inventory systems can still be vulnerable to errors due to overstatements (phantom inventory) or understatements (missing inventory) that occurs as a result of theft, breakage, scanning errors, or untracked inventory movements. These errors lead to systematic errors in replenishment.

Periodic inventory is performed once a year.

Physically counting inventory ensures that book value and physical value are the same.

While the perpetual inventory method provides a close picture of the true inventory information, it is a good idea for companies using a perpetual inventory system to do a physical inventory periodically.

5.2.3: Conducting a Physical Inventory

There are three phases of a physical inventory: planning and preparation, execution, and analysis of results.

Learning Objective

Identify the three phases of a physical inventory

Key Points

- Physical inventory is a process where a business physically counts its entire inventory.

- In the planning and preparation period, a list of stocks which is supposed to be counted are set up. Different teams are then assigned to count the stock.

- Each team counts a specific inventory. The results are recorded on the inventory listing sheet.

- The physicial count is compared to the computer count. The company must note any discrepancies between the actual number and the computer system, recount these inventory items to determine the correct quantity, and adjust the computer inventory quantity if needed.

- Any discrepancies between the actual number and the computer system must be fixed.

Key Terms

- perpetual inventory system

-

Perpetual inventory or continuous inventory updates information on inventory quantity and availability on a continuous basis as a function of doing business. Generally this is accomplished by connecting the inventory system with order entry and in retail the point of sale system.

- cycle counting

-

A cycle count is an inventory auditing procedure, which falls under inventory management, where a small subset of inventory, in a specific location, is counted on a specified day. Cycle counts contrast with traditional physical inventory in that a full physical inventory may stop operation at a facility while all items are counted at one time. Cycle counts are less disruptive to daily operations, provide an ongoing measure of inventory accuracy and procedure execution, and can be tailored to focus on items with higher value, higher movement volume, or that are critical to business processes.

Conducting a Physical Inventory

Physical inventory is a process where a business physically counts its entire inventory. Companies perform a physical inventory for several reasons including to satisfy financial accounting rules or tax regulations, or to compile a list of items for restocking.

Most companies choose to do a physical inventory at year-end.

Businesses may use several different tactics to minimize the disruption caused by physical inventory. For instance, inventory services provide labor and automation to quickly count inventory and minimize shutdown time.

In addition, inventory control system software can speed the physical inventory process . A perpetual inventory system tracks the receipt and use of inventory, and calculates the quantity on hand. Cycle counting, an alternative to physical inventory, may be less disruptive.

A company’s inventory is a valuable asset.

An inventory control system ensures that the company’s books reflect the actual inventory on hand.

The Phases Of Physical Inventory

There are three phases of a physical inventory:

- Planning and preparation

- Execution

- Analysis of results

Planning and Preparation

In the planning and preparation period, a list of stocks that need to be counted is set up. Teams are then assigned and sent to count the stock.

Execution

The teams count the inventory items and record the results on an inventory-listing sheet.

Analysis Of Results

When analyzing the results, a company must compare the inventory counts submitted by each team with the inventory count from the computer system. If any discrepancies occur between the actual number and the computer system, it may be necessary to recount the disputed inventory items to determine the correct quantity. After the final amounts are determined, the company must make an adjusting entry to the computer inventory.

5.2.4: Impact of Measurement Error

Measurement error leads to systematic errors in replenishment and inaccurate financial statements.

Learning Objective

Explain how a measurement error affects a company’s inventory value

Key Points

- In inventory controlling, measurement error is the difference between the actual number of stocks and the value obtained by measurement.

- Inventory systems can be vulnerable to errors due to overstatements (phantom inventory) or understatements (missing inventory). Overstatements and understatements can occur as a result of theft, breakage, scanning errors or untracked inventory movements.

- Based on inaccurate measurement data, the company will make either excessive orders or late orders which then may cause production disruption. In sum, systematic measurement error can lead to errors in replenishment.

- An incorrect inventory balance causes an error in the calculation of cost of goods sold and, therefore, an error in the calculation of gross profit and net income.

Key Term

- phantom inventory

-

Phantom inventory is a common expression for goods that an inventory accounting system considers to be on-hand at a storage location, but are not actually available. This could be due to the items being moved without recording the change in the inventory accounting system, breakage, theft data entry errors or deliberate fraud. The resulting discrepancy between the online inventory balance and physical availability can delay automated reordering and lead to out-of-stock incidents. If not addressed, phantom inventory can also result in broader accounting issues and restatements.

Measurement Error Impacts

Measurement error is the difference between the true value of a quantity and the value obtained by measurement. The two main types of error are random errors and systematic errors. In inventory controlling, measurement error is the difference between the actual number of stocks and the value obtained by measurement.

Inventory systems can be vulnerable to errors due to overstatements (phantom inventory) when the actual inventory is lower than the measurement or understatements (missing inventory) when the actual stocks are higher than the measurement. Overstatements and understatements can occur as a result of theft, breakage, scanning errors or untracked inventory movements. It is quite easy to overlook goods on hand, count goods twice, or simply make mathematical mistakes.

Physical inventory

Female clerk doing inventory work using a handheld computer in a Tesco Lotus supermarket in Sakon Nakhon, Thailand

Based on inaccurate measurement data, the company will make either excessive orders or late orders which then may cause production disruption. In sum, systematic measurement error can lead to errors in replenishment.

Inventory controlling helps revenue and expenses be recognized. As a result, an incorrect inventory balance causes an error in the calculation of cost of goods sold and, therefore, an error in the calculation of gross profit and net income. A general rule is that overstatements of ending inventory cause overstatements of income, while understatements of ending inventory cause understatements of income. Since financial statement users depend upon accurate statements, care must be taken to ensure that the inventory balance at the end of each accounting period is correct. It is also vital that accountants and business owners fully understand the effects of inventory errors and grasp the need to be careful to get these numbers as correct as possible.

5.3: Valuing Inventory

5.3.1: Costing Methods Overview

There are four accepted methods of costing items: specific identification; first-in, first-out; last-in, first-out; and weighted-average.

Learning Objective

Review the differences between the four cost accounting methods and demonstrate how to calculate the cost of goods sold

Key Points

- Cost accounting is regarded as the process of collecting, analyzing, summarizing, and evaluating various alternative courses of action involving costs and advising the management on the most appropriate course of action based on the cost efficiency and capability of the management.

- The specific identification method of inventory costing attaches the actual cost to an identifiable unit of product. Firms find this method easy to apply when purchasing and selling large inventory items such as cars.

- The FIFO (first-in, first-out) method of inventory costing assumes that the costs of the first goods purchased are those charged to cost of goods sold when the company actually sells goods.

- The LIFO (last-in, first-out) method of inventory costing assumes that the costs of the most recent purchases are the first costs charged to cost of goods sold when the company actually sells the goods.

- The weighted-average method of inventory costing is a means of costing ending inventory using a weighted-average unit cost. Companies most often use the weighted-average method to determine a cost for units that are basically the same.

- Beginning Inventory + Purchases = Available for Sale – Ending Inventory = Cost of Good Sold.

Key Terms

- inventory

-

A detailed list of all of the items on hand.

- costing

-

The estimation of the cost of a process or product.

- raw materials

-

A raw material is the basic material from which a product is manufactured or made.

Costing Methods Overview

Cost accounting information is designed for managers. Since managers are making decisions only for their own organization, there is no need for the information to be comparable to similar information from other organizations. Instead, the important criterion is that the information must be relevant for decisions that managers, operating in a particular environment of business including strategy, make. Cost accounting information is commonly used in financial accounting information, but first we are concentrating on its use by managers to take decisions. The accountants who handle the cost accounting information add value by providing good information to managers who are making decisions. Among the better decisions, is the better performance of one’s organization, regardless if it is a manufacturing company, a bank, a non-profit organization, a government agency, a school club or even a business school. The cost-accounting system is the result of decisions made by managers of an organization and the environment in which they make them .

Efficient use of inventory is critical for businesses.

Inventory at a business.

Cost accounting is regarded as the process of collecting, analyzing, summarizing, and evaluating various alternative courses of action involving costs and advising the management on the most appropriate course of action based on the cost efficiency and capability of the management.

The following are different cost accounting approaches:

- standardized or standard cost accounting

- lean accounting

- activity-based costing

- resource consumption accounting

- throughput accounting

- marginal costing/cost-volume-profit analysis

Classical cost elements for a manufacturing business are:

-

Raw materials

- Labor

- Indirect expenses/overhead

Accepted Financial Costing Methods

There are four accepted methods of costing inventory items:

- specific identification;

- first-in, first-out (FIFO);

- last-in, first-out (LIFO); and

- weighted-average.

Each method has advantages and disadvantages. Note that a manufacturing business’s inventory will consist of work in process, or unfinished goods, and finished inventory; the costs of unfinished and finished inventory contain a combination of costs related to raw materials, labor, and overhead. On the other hand, a retailer’s inventory consists of all finished products purchased from a wholesaler or manufacturer; the costs of their units are based on their acquisition cost rather than the costs associated with manufacturing units.

Specific Identification

The specific identification method of inventory costing attaches the actual cost to an identifiable unit of product. Firms find this method easy to apply when purchasing and selling large inventory items such as cars. Under the specific identification method, the firm must identify each unit in inventory, unless it is unique, with a serial number or identification tag.

FIFO (first-in, first-out)

The FIFO (first-in, first-out) method of inventory costing assumes that the costs of the first goods purchased are those charged to cost of goods sold when the company actually sells goods. This method assumes the first goods purchased are the first goods sold. In some companies, the first units in (bought) must be the first units out (sold) to avoid large losses from spoilage. Such items as fresh dairy products, fruits, and vegetables should be sold on a FIFO basis. In these cases, an assumed first-in, first-out flow corresponds with the actual physical flow of goods.

LIFO (last-in, first-out)

The LIFO (last-in, first-out) method of inventory costing assumes that the costs of the most recent purchases are the first costs charged to cost of goods sold when the company actually sells the goods.

Weighted-average

The weighted-average method of inventory costing is a means of costing ending inventory using a weighted-average unit cost. Companies most often use the weighted-average method to determine a cost for units that are basically the same, such as identical games in a toy store or identical electrical tools in a hardware store. Since the units are alike, firms can assign the same unit cost to them.

Calculating Cost of Goods Sold (periodic method)

Beginning Inventory + Purchases = Available for Sale

Available – Ending Inventory = Cost of Good Sold

5.3.2: Specific Identification Method

Specific identification is a method of finding out ending inventory cost that requires a detailed physical count.

Learning Objective

Describe how a company would use the specific identification method to value inventory

Key Points

- Specific identification is a method of finding out ending inventory cost. It requires a detailed physical count, so that the company knows exactly how many of each goods brought on specific dates remained at year end inventory.

- In theory, this method is the best method, since it relates the ending inventory goods directly to the specific price they were bought for. However, management can easily manipulate ending inventory cost, since they can choose to report that cheaper goods were sold first, ultimately raising income.

- Alternatively, management can choose to report lower income, to reduce the taxes they needed to pay.

Key Terms

- serial number

-

A unique number, assigned to a particular unit of some product, to identify it.

- inventory

-

A detailed list of all of the items on hand.

- accounting

-

The development and use of a system for recording and analyzing the financial transactions and financial status of a business or other organization.

- specific identification method

-

inventory measurement based on the exact number of goods in inventory and their purchase price

Example

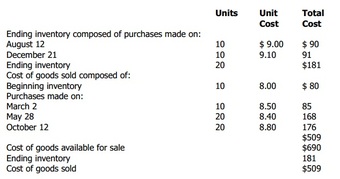

- Assume that the company in can identify the 20 units on hand at year-end as 10 units from the August 12 purchase and 10 units from the December 21 purchase. The company computes the ending inventory as shown in. It subtracts the USD 181 ending inventory cost from the USD 690 cost of goods available for sale to obtain the USD 509 cost of goods sold. Note that you can also determine the cost of goods sold for the year by recording the cost of each unit sold. The USD 509 cost of goods sold is an expense on the income statement, and the USD 181 ending inventory is a current asset on the balance sheet. The specific identification costing method attaches cost to an identifiable unit of inventory. The method does not involve any assumptions about the flow of the costs as in the other inventory costing methods. Conceptually, the method matches the cost to the physical flow of the inventory and eliminates the emphasis on the timing of the cost determination. Therefore, periodic and perpetual inventory procedures produce the same results for the specific identification method.

Types of Accounting Methods

The merchandise inventory figure used by accountants depends on the quantity of inventory items and the cost of the items. There are four accepted methods of costing the items: (1) specific identification; (2) first-in, first-out (FIFO); (3) last-in, first-out (LIFO); and (4) weighted-average. Each method has advantages and disadvantages.

General Information

Specific identification is a method of finding out ending inventory cost. It requires a detailed physical count, so that the company knows exactly how many of each goods brought on specific dates remained at year-end inventory. When this information is found, the amount of goods is multiplied by their purchase cost at their purchase date, to get a number for the ending inventory cost.

In theory, this method is the best method because it relates the ending inventory goods directly to the specific price they were bought for. However, this method allows management to easily manipulate ending inventory cost, since they can choose to report that the cheaper goods were sold first, therefore increasing ending inventory cost and lowering cost of goods sold. This will increase the income.

Alternatively, management can choose to report lower income, to reduce the taxes they needed to pay. This method is also a very hard to use on interchangeable goods. For example, it is hard to relate shipping and storage costs to a specific inventory item. These numbers will need to be estimated and reducing the specific identification’s benefit of being extremely specific.

Using Specific Identification

The specific identification method of inventory costing attaches the actual cost to an identifiable unit of product. Firms find this method easy to apply when purchasing and selling large inventory items such as cars. Under the specific identification method, the firm must identify each unit in inventory, unless it is unique, with a serial number or identification tag.

To illustrate, assume that the company in can identify the 20 units on hand at year-end as 10 units from the August 12 purchase and 10 units from the December 21 purchase. The company computes the ending inventory as shown in ; it subtracts the USD 181 ending inventory cost from the USD 690 cost of goods available for sale to obtain the USD 509 cost of goods sold. Note that you can also determine the cost of goods sold for the year by recording the cost of each unit sold. The USD 509 cost of goods sold is an expense on the income statement, and the USD 181 ending inventory is a current asset on the balance sheet. The specific identification costing method attaches cost to an identifiable unit of inventory. The method does not involve any assumptions about the flow of the costs as in the other inventory costing methods. Conceptually, the method matches the cost to the physical flow of the inventory and eliminates the emphasis on the timing of the cost determination. Therefore, periodic and perpetual inventory procedures produce the same results for the specific identification method.

Specific Identification

Determining ending inventory under specific identification

5.3.3: Cost Flow Assumptions

Inventory cost flow assumptions (e.g., FIFO) are necessary to determine the cost of goods sold and ending inventory.

Learning Objective

Explain how a company’s inventory cost flow assumptions dictate which method it will use for inventory valuation

Key Points

- Companies make certain assumptions about which goods are sold and which goods remain in inventory (resulting in different accounting methodologies).

- The only requirement, regardless of method is that: The total cost of goods sold plus the cost of the goods remaining in ending inventory for financial and tax purposes is equal to the actual cost of goods available.

- Cost flow assumptions are for financial reporting and tax purposes only and do not have to agree with the actual movement of goods.

Key Terms

- inventory

-

A detailed list of all of the items on hand.

- assumption

-

The thing supposed; a postulate, or proposition assumed; a supposition.

- COGS

-

COGS (cost of goods sold) is the inventory costs of those goods a business has sold during a particular period.

Example

- FIFO assigns first costs incurred to COGS (cost of goods sold) on the income statement. This disallows manipulation by management and cost flow agrees with ideal, physical flow of goods. Some may argue that the agreement of cost flow and ideal, physical flow of goods is not important. FIFO also uses the least relevant cost for the income statement and underestimates or overestimates the cost of goods sold if prices are rising or falling, respectively.

Cost Flow Assumptions

Inventory cost flow assumptions are necessary to determine the cost of goods sold and ending inventory. Companies make certain assumptions about which goods are sold and which goods remain in inventory (resulting in different accounting methodologies). This is for financial reporting and tax purposes only and does not have to agree with the actual movement of goods (companies typically choose a method because of its particular benefits, such as lower taxes) .

Efficient use of inventory is critical for businesses.

Picture of inventory at a business.

The only requirement, regardless of method is that: The total cost of goods sold plus the cost of the goods remaining in the ending inventory for financial and tax purposes is equal to the actual cost of goods available.

Specific Identification

Characteristics of the specific identification method include:

- Keeps track of the cost of each, specific good sold

- Perfect matching of costs of goods to goods sold

- Often impossible or too costly and allows manipulation by management

FIFO

Characteristics of the FIFO method include:

- Assigns first costs incurred to COGS (cost of goods sold) on the income statement

- Disallows manipulation by management and cost flow agrees with ideal, physical flow of goods, though the agreement of cost flow and ideal, physical flow of goods is arguably not important

- Uses the least relevant cost for the income statement and underestimates or overestimates the cost of goods sold if prices are rising or falling, respectively

LIFO

Characteristics of the LIFO method include:

- Assigns last costs incurred to COGS on the income statement

- Disallows manipulation by management and uses the most relevant cost for the income statement

- Underestimates or overestimates cost of goods sold if prices are falling or rising, respectively and cost flow disagrees with ideal, physical flow of goods, though the agreement of cost flow and ideal, physical flow of goods is arguably not important

Weighted Average

Characteristics of the weighted average method include:

- Assigns average cost incurred to COGS on the income statement

- Disallows manipulation by management and better estimation of the cost of goods sold than FIFO or LIFO if prices are rising or falling

- Tends to ignore extreme costs of inventory and there is no theoretical reasoning for using this method

Additional Notes

LIFO and weighted average cost flow assumptions may yield different end inventories and COGS in a perpetual inventory system than in a periodic inventory system due to the timing of the calculations. In the perpetual system, some of the oldest units calculated in the periodic units-on-hand ending inventory may get expended during a near inventory exhausting individual sale. In the LIFO system, the weighted average system, and the perpetual system, each sale moves the weighted average, so it is a moving weighted average for each sale. In contrast, in the periodic system, it is only the weighted average of the cost of the beginning inventory, the sum cost of all the purchases, less than the cost of the inventory, divided by the sum of the beginning units and the total units purchased.

5.3.4: Average Cost Method

Under the Average Cost Method, It is assumed that the cost of inventory is based on the average cost of the goods available for sale during the period.

Learning Objective

Explain how a company uses the average cost method to value their inventory

Key Points

- Under the average cost method, it is assumed that the cost of inventory is based on the average cost of the goods available for sale during the period.The average cost is computed by dividing the total cost of goods available for sale by the total units available for sale.

- The weighted-average method of inventory costing is a means of costing ending inventory using a weighted-average unit cost. Companies most often use the weighted-average method to determine a cost for units that are basically the same, such as identical games in a toy store.

- Moving-Average (Unit) Cost is a method of calculating Ending Inventory cost. Assume that both Beginning Inventory and beginning inventory cost are known. From them the Cost per Unit of Beginning Inventory can be calculated.

Key Terms

- COGS

-

COGS (cost of goods sold) is the inventory costs of those goods a business has sold during a particular period.

- weighted average

-

An arithmetic mean of values biased according to agreed weightings.

- average collection period

-

365 divided by the receivables turnover ratio

- inventory

-

A detailed list of all of the items on hand.

- depreciable cost

-

original cost minus salvage value

Example

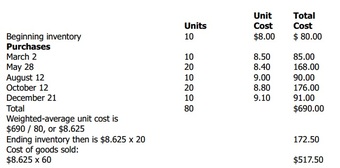

- To see how a company uses the weighted-average method to determine inventory costs using periodic inventory procedure, look at. Note that we compute weighted average cost per unit by dividing the cost of units available for sale, $690, by the total number of units available for sale, 80. Thus, the weighted-average cost per unit is $8.625, meaning that each unit sold or remaining in inventory is valued at $8.625.

Average Cost Method

Under the average cost method, it is assumed that the cost of inventory is based on the average cost of the goods available for sale during the period. The average cost is computed by dividing the total cost of goods available for sale by the total units available for sale. This gives a weighted-average unit cost that is applied to the units in the ending inventory. There are two commonly used average cost methods: Simple Weighted Average Cost method and Moving-Average Cost method.

The following is an example of the weighted average cost method:

- On 12/31/12, Furniture Palace has cost of goods available for sale (beginning inventory and purchases) of USD 5,000; 200 units available for sale; sales of 50 units; and an ending inventory of 150 units.

- The per unit cost of inventory is USD 25 (5,000 / 200 units). The value of the ending inventory on the balance sheet is USD 3,750 (150 units * USD 25). The cost of goods sold on the income statement is USD 1,250 (50 units * USD 25).

Moving Average Cost

Moving-Average (Unit) Cost is a method of calculating Ending Inventory cost. Assume that both Beginning Inventory and Beginning Inventory Cost are known. From them, the Cost per Unit of Beginning Inventory can be calculated. During the year, multiple purchases are made. Each time, purchase costs are added to Beginning Inventory Cost to get Cost of Current Inventory. Similarly, the number of units bought is added to Beginning Inventory to get Current Goods Available for Sale. After each purchase, Cost of Current Inventory is divided by Current Goods Available for Sale to get Current Cost per Unit on Goods.

Also during the year, multiple sales happen. The Current Goods Available for Sale is deducted by the amount of goods sold (COGS), and the Cost of Current Inventory is deducted by the amount of goods sold times the latest (before this sale) Current Cost per Unit on Goods. This deducted amount is added to Cost of Goods Sold. At the end of the year, the last Cost per Unit on Goods, along with a physical count, is used to determine ending inventory cost.

The following is an example of the moving-average cost method:

On 12/29/12, Furniture Palace has beginning inventory of $5,000 and 200 units available for sale. The current cost per unit is

.

On 12/30/12, a purchase of 50 units is made for $250. The new cost per unit after the purchase is

.

On 12/31/12, sales for the period were 50 units and ending inventory is 150 units. The value of the ending inventory on the balance sheet is

. The cost of goods sold on the income statement is

.

Weighted-Average under Periodic Inventory Procedure

The Weighted-Average Method of inventory costing is a means of costing ending inventory using a weighted-average unit cost. Companies most often use the Weighted-Average Method to determine a cost for units that are basically the same, such as identical games in a toy store or identical electrical tools in a hardware store. Since the units are alike, firms can assign the same unit cost to them. Under periodic inventory procedure, a company determines the average cost at the end of the accounting period by dividing the total units purchased plus those in beginning inventory into total cost of goods available for sale. The ending inventory is carried at this per unit cost.

Advantages and Disadvantages of Weighted-Average Method

When a company uses the Weighted-Average Method and prices are rising, its cost of goods sold is less than that obtained under LIFO, but more than that obtained under FIFO. Inventory is also not as badly understated as under LIFO, but it is not as up-to-date as under FIFO. Weighted-average costing takes a middle-of-the-road approach. A company can manipulate income under the weighted-average costing method by buying or failing to buy goods near year-end. However, the averaging process reduces the effects of buying or not buying.

Determining ending inventory

Determining ending inventory under weighted-average method using periodic inventory procedure

5.3.5: FIFO Method

FIFO stands for “first-in, first-out,” and assumes that the costs of the first goods purchased are charged to cost of goods sold.

Learning Objective

Describe how a company would value inventory under the FIFO method

Key Points

- This method assumes the first goods purchased are the first goods sold. In some companies, the first units in (bought) must be the first units out (sold) to avoid large losses from spoilage.

- In periods of rising prices (Inflation) FIFO has higher value of inventory and lower cost of goods sold; in periods of falling prices (deflation) it has lower value of inventory and higher cost of goods sold.

- Because a company using FIFO assumes the older units are sold first and the newer units are still on hand, the ending inventory consists of the most recent purchases.

Key Terms

- accounting

-

The development and use of a system for recording and analyzing the financial transactions and financial status of a business or other organization.

- inflation

-

An increase in the quantity of money, leading to a devaluation of existing money.

- FIFO

-

First in, first out (accounting).

Example

- An example of how to calculate the ending inventory balance and cost of goods sold of the period using FIFO — assume the following inventory is on hand and purchased on the following dates: Inventory of Product X -Purchase date: 10/1/12 — 10 units at a cost of USD 5 Purchase date: 10/5/12 — 5 units at a cost of USD 6 On 12/30/12, a sale is made of Product X for 11 units. Under FIFO, it is assumed that 10 units purchased on 10/1/12 (the sale also eliminates this inventory layer) and 1 unit purchased on 10/5/12 were sold The ending inventory balance on the 12/31/12 balance sheet is 4 units at a cost of USD 6, or USD 24 and cost of goods sold on the income statement is USD 56 (10 units * USD 5 + 1 unit * USD 6)

What Is FIFO

FIFO stands for “first-in, first-out”, and is a method of inventory costing which assumes that the costs of the first goods purchased are those charged to cost of goods sold when the company actually sells goods.

FIFO and LIFO methods are accounting techniques used in managing inventory and financial matters involving the amount of money a company has tied up within inventory of produced goods, raw materials, parts, components, or feed stocks. These methods are used to manage assumptions of cost flows related to inventory, stock repurchases (if purchased at different prices), and various other accounting purposes .

Inventory

Inventory in a warehouse

Assumptions of FIFO

This method assumes the first goods purchased are the first goods sold. In some companies, the first units in (bought) must be the first units out (sold) to avoid large losses from spoilage. Such items as fresh dairy products, fruits, and vegetables should be sold on a FIFO basis. In these cases, an assumed first-in, first-out flow corresponds with the actual physical flow of goods.

Because a company using FIFO assumes the older units are sold first and the newer units are still on hand, the ending inventory consists of the most recent purchases. When using periodic inventory procedure to determine the cost of the ending inventory at the end of the period under FIFO, you would begin by listing the cost of the most recent purchase. If the ending inventory contains more units than acquired in the most recent purchase, it also includes units from the next-to-the-latest purchase at the unit cost incurred, and so on. You would list these units from the latest purchases until that number agrees with the units in the ending inventory.

How is it different?

Different accounting methods produce different results, because their flow of costs are based upon different assumptions. The FIFO method bases its cost flow on the chronological order purchases are made, while the LIFO method bases it cost flow in a reverse chronological order. The average cost method produces a cost flow based on a weighted average of unit costs.

The difference between the cost of an inventory calculated under the FIFO and LIFO methods is called the “LIFO reserve. ” This reserve is essentially the amount by which an entity’s taxable income has been deferred by using the LIFO method.

How to Calculate Ending Inventory Using FIFO

Ending inventory = beginning inventory + net purchases – cost of goods sold

Keep in mind the FIFO assumption: Costs of the first goods purchased are those charged to cost of goods sold when the company actually sells goods.

When Using FIFO

- Periods of Rising Prices (Inflation)FIFO (+) Higher value of inventory (-) Lower cost of goods sold

- Periods of Falling Prices (Deflation)FIFO (-) Lower value of inventory (+) Higher cost of goods sold

5.3.6: LIFO Method

LIFO stands for last-in, first-out, meaning that the most recently produced items are recorded as sold first.

Learning Objective

Summarize how using the LIFO method affects a company’s financial statements

Key Points

- FIFO and LIFO Methods are accounting techniques used in managing inventory and financial matters involving the amount of money a company has tied up within inventory of produced goods, raw materials, parts, components, or feed stocks.

- LIFO stands for last-in, first-out, meaning that the most recently produced items are recorded as sold first.

- The difference between the cost of an inventory calculated under the FIFO and LIFO methods is called the “LIFO reserve. ” This reserve is essentially the amount by which an entity’s taxable income has been deferred by using the LIFO method.

Key Terms

- inventory

-

A detailed list of all of the items on hand.

- income statement

-

A calculation which shows the profit or loss of an accounting unit (company, municipality, foundation, etc.) during a specific period of time, providing a summary of how the profit or loss is calculated from gross revenue and expenses.

- LIFO

-

Last-in, first-out (accounting).

Example

- LIFO under perpetual inventory procedure: Under this procedure, the inventory composition and balance are updated with each purchase and sale. Each time a sale occurs, the items sold are assumed to be the most recent ones acquired. Despite numerous purchases and sales during the year, the ending inventory still includes the units from beginning inventory. Applying LIFO on a perpetual basis during the accounting period, results in different ending inventory and cost of goods sold figures than applying LIFO only at year-end using periodic inventory procedure. For this reason, if LIFO is applied on a perpetual basis during the period, special inventory adjustments are sometimes necessary at year-end to take full advantage of using LIFO for tax purposes.

Accounting Methods

A merchandising company can prepare an accurate income statement, statements of retained earnings, and balance sheets only if its inventory is correctly valued. On the income statement, a company using periodic inventory procedure takes a physical inventory to determine the cost of goods sold. Since the cost of goods sold figure affects the company’s net income, it also affects the balance of retained earnings on the statement of retained earnings. On the balance sheet, incorrect inventory amounts affect both the reported ending inventory and retained earnings. Inventories appear on the balance sheet under the heading “Current Assets,” which reports current assets in a descending order of liquidity. Because inventories are consumed or converted into cash within a year or one operating cycle, whichever is longer, inventories usually follow cash and receivables on the balance sheet.

FIFO and LIFO methods are accounting techniques used in managing inventory and financial matters involving the amount of money a company has tied up within inventory of produced goods, raw materials, parts, components, or feed stocks. These methods are used to manage assumptions of cost flows related to inventory, stock repurchases (if purchased at different prices), and various other accounting purposes.

LIFO

LIFO stands for last-in, first-out, meaning that the most recently produced items are recorded as sold first. Since the 1970s, some U.S. companies shifted towards the use of LIFO, which reduces their income taxes in times of inflation, but with International Financial Reporting Standards banning the use of LIFO, more companies have gone back to FIFO. LIFO is only used in Japan and the United States. The difference between the cost of an inventory calculated under the FIFO and LIFO methods is called the “LIFO reserve. ” This reserve is essentially the amount by which an entity’s taxable income has been deferred by using the LIFO method.

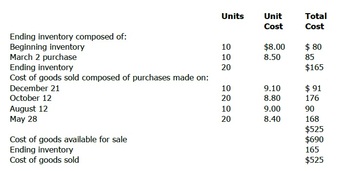

LIFO inventory method

Determining LIFO cost of ending inventory under periodic inventory procedure.

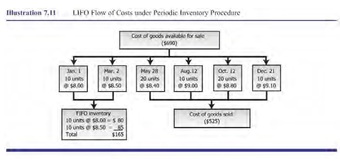

LIFO Flowchart

LIFO flow of costs under periodic inventory procedure

The following is an example of the LIFO inventory costing method (assume the following inventory of Product

is on hand and purchased on the following dates).

- Purchase date 10/1/12: 10 units at a cost of USD 5

- Purchase date 10/5/12: 5 units at a cost of USD 6

- On 12/30/12, 11 units of Product

are sold. When the sale is made, it is assumed that the 5 units purchased on 10/5/12 (the sale eliminates this inventory layer) and 6 units purchased on 10/1/12 were sold.

The ending inventory balance on 12/31/12 balance sheet is

, and the cost of goods sold on the income statement is

.

LIFO Under Perpetual Inventory Procedure

Under this procedure, the inventory composition and balance are updated with each purchase and sale. Each time a sale occurs, the items sold are assumed to be the most recent ones acquired. Despite numerous purchases and sales during the year, the ending inventory still includes the units from beginning inventory.

Applying LIFO on a perpetual basis during the accounting period, results in different ending inventory and cost of goods sold figures than applying LIFO only at year-end using periodic inventory procedure. For this reason, if LIFO is applied on a perpetual basis during the period, special inventory adjustments are sometimes necessary at year-end to take full advantage of using LIFO for tax purposes.

5.3.7: Gross Profit Method

The gross profit method uses the previous year’s average gross profit margin to calculate the value of the inventory.

Learning Objective

Explain how a company would use the Gross Profit Method to value inventory

Key Points

- There a two methods to estimate inventory cost the retail inventory method and the gross profit method.

- If taking a physical inventory is impossible or impractical, it is necessary to estimate the inventory cost.

- Keep in mind the gross profit method assumes that gross profit ratio remains stable during the period.

Key Terms

- monetary

-

Of, pertaining to, or consisting of money.

- gross profit

-

The difference between net sales and the cost of goods sold.

Valuing Inventory

An inventory valuation allows a company to provide a monetary value for items that make up their inventory. Inventories are usually the largest current asset of a business, and proper measurement of them is necessary to assure accurate financial statements. If inventory is not properly measured, expenses and revenues cannot be properly matched and a company could make poor business decisions.

A company will chose an inventory accounting system, either perpetual or periodic. In perpetual inventory the accounting records must show the amount of inventory on hand at all times. Periodic inventory is not updated on a regular basis.

Methods Used to Estimate Inventory Cost

While the best way to value inventory is to perform a physical inventory, in certain business operations, taking a physical inventory is impossible or impractical. In such a situation, it is necessary to estimate the inventory cost. There are two methods to estimate inventory cost, the retail inventory method and the gross profit method.

Both methods can be used to calculate the inventory amount for the monthly financial statements, or estimate the amount of missing inventory due to theft, fire or other disaster. Either of these methods should never be used as a substitute for performing an annual physical inventory.

Gross Profit Method

The gross profit (or gross margin) method uses the previous year’s average gross profit margin (i.e. sales minus cost of goods sold divided by sales) to calculate the value of the inventory. Keep in mind the gross profit method assumes that gross profit ratio remains stable during the period.

Inventory.

The gross profit (or gross margin) method uses the previous year’s average gross profit margin (i.e. sales minus cost of goods sold divided by sales) to calculate the value of the inventory.

To prepare the inventory value via the gross profit method:

- Calculate the cost of goods available for sale as the sum of the cost of beginning inventory and cost of net purchases.

- Determine the gross profit ratio. Gross profit ratio equals gross profit divided by sales. Use projected gross profit ratio or historical gross profit ratio whichever is more accurate and reliable.

- Multiply sales made during the period by gross profit ratio to obtain estimated cost of goods sold.

- Calculate the cost of ending inventory as the difference of cost of goods available for sale and estimated cost of goods sold.

Example

The following is an example on how to calculate ending inventory using the gross profit method.

Furniture Palace has cost of goods available for sale of $5000. Sales were $1000.

The company has projected a gross profit ratio of 25%.

The estimated cost of goods sold on the income statement for the period is

.

The ending inventory on the balance sheet is

.

5.3.8: Selecting an Inventory Method

When selecting an inventory method, managers should look at the advantages and disadvantages of each.

Learning Objective

Summarize the differences between LIFO, FIFO and Specific Identification and explain how a company would use that information to select an inventory method

Key Points

- Specific identification provides the most precise matching of costs and revenues and is, therefore, the most theoretically sound method.

- The FIFO method has four major advantages: (1) it is easy to apply, (2) the assumed flow of costs corresponds with the normal physical flow of goods, (3) no manipulation of income is possible, and (4) the balance sheet amount for inventory is likely to approximate the current market value.

- During periods of inflation, LIFO shows the largest cost of goods sold (COGS) of any of the costing methods because the newest costs charged to cost of goods sold are also the highest costs.

- When a company uses the weighted-average method and prices are rising, its cost of goods sold is less than that obtained under LIFO, but more than that obtained under FIFO.

Key Terms

- inventory

-

A detailed list of all of the items on hand.

- balance sheet

-

A summary of a person’s or organization’s assets, liabilities. and equity as of a specific date.

Example

- Specific Identification: Assume that a company bought three identical units of a given product at different prices. One unit cost USD 2,000, the second cost USD 2,100, and the third cost USD 2,200. The company sold one unit for USD 2,800. The units are alike, so the customer does not care which of the identical units the company ships. However, the gross margin on the sale could be either USD 800, USD 700, or USD 600, depending on which unit the company ships.

Advantages and Disadvantages of Specific Identification